Zeolites Market Outlook:

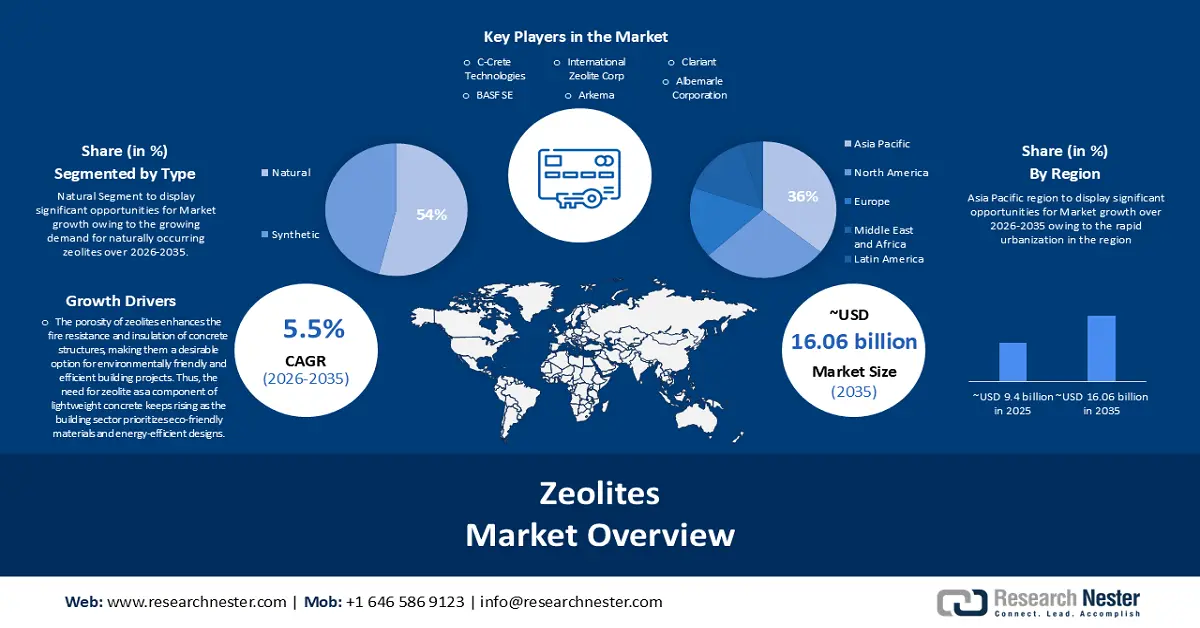

Zeolites Market size was over USD 9.4 billion in 2025 and is anticipated to cross USD 16.06 billion by 2035, witnessing more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zeolites is assessed at USD 9.87 billion.

Because of its special qualities, natural zeolite is becoming more and more popular as a lightweight concrete material. The porosity of zeolites enhances the fire resistance and insulation of concrete structures, making them a desirable option for environmentally friendly and efficient building projects. Thus, the need for zeolite as a component of lightweight concrete keeps rising as the building sector prioritizes eco-friendly materials and energy-efficient designs. As per a study, it has been demonstrated that substitutes made of plastic, recyclable materials, and sustainable concrete can save CO2 emissions by up to 50%.

Moreover, its expansion is being driven by the expanding use of several end-use industries. Zeolites are multipurpose minerals possessing ion exchange, molecular sieving, catalysis, and absorption capabilities. Zeolites, for example, are employed in gas separation procedures to filter out pollutants and divide gases according to the polarity and size of their molecules. Therefore, the growing use of zeolites in various industries is accelerating its zeolites market growth.

Key Zeolites Market Insights Summary:

Regional Highlights:

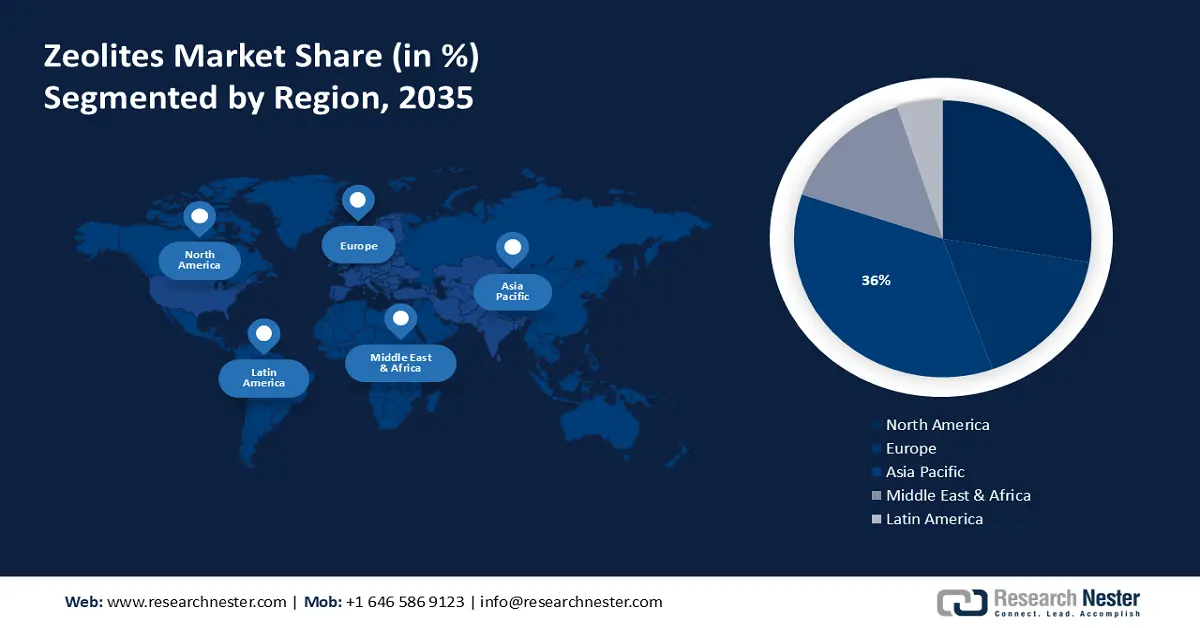

- Asia Pacific zeolites market will hold more than 36% share, driven by rapid urbanization and lifestyle changes in the region, forecast period 2026–2035.

- North America market will capture a 28% share, fueled by increased manufacture of petrochemicals and animal feed, forecast period 2026–2035.

Segment Insights:

- The natural zeolite (type) segment in the zeolites market is projected to secure a 54% share by 2035, driven by demand for environmentally friendly and sustainable materials in various applications.

- The catalyst segment in the zeolites market is anticipated to hold a 44% share by 2035, attributed to demand for zeolites as catalysts in petrochemical and oil refining industries.

Key Growth Trends:

- Increased Demand for Synthetic Zeolites from the Detergent Industry

- Surge in the Demand for Absorbents for the Removal of VOCs

Major Challenges:

- Toxic Nature of Synthetic Zeolites

- Environmental Degradation Caused by Zeolites may Hinder Market Growth

Key Players: C-Crete Technologies, International Zeolite Corp., Albemarle Corporation, BASF SE, Honeywell International Inc., Arkema, Clariant, Zeochem AG, KNT Group, Zeolyst International.

Global Zeolites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.4 billion

- 2026 Market Size: USD 9.87 billion

- Projected Market Size: USD 16.06 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 16 September, 2025

Zeolites Market Growth Drivers and Challenges:

Growth Drivers

- Increased Demand for Synthetic Zeolites from the Detergent Industry – Synthetic materials have excellent ionizing properties, making them ideal for use as water exchangers to remove magnesium, calcium, and other ions. However, zeolite 4A was substituted for other phosphate builders in some detergent industries because of the various environmental regulations. The increasing awareness of the harmful effect of phosphate construction on detergents is the major reason for the expanding use of zeolite. Also, manufacturers are shifting toward the use of zeolite 4A which is accelerating the market growth. For instance, Huiying Chemical Industry (Xiamen) Co., Ltd. introduced ADVAN Synthetic detergent grade zeolites, which are the main substitute for phosphate-type builders in domestic detergents and softening washing water through calcium ion exchange. Zeolite is used as a builder in most phosphate-free household detergent formulations.

- Surge in the Demand for Absorbents for the Removal of VOCs - By-products of petrochemical operations, volatile organic compounds (VOCs) pose a risk to human health and the environment. These are mostly released by the petrochemical and chemical industries and can be found in solvent-based paints, adhesives & sealants, printing inks, and various consumer goods. Breathing becomes difficult and the central nervous system is harmed by VOC emissions. As a result, there is a growing need for materials with minimal volatile organic compounds. Zeolites are effective adsorbents for the removal of volatile organic compounds (VOCs) because of their range of characteristics, which include hydrophobicity, thermal stability, and nonflammability.

- Increased Adoption in the Agriculture Sector - There is an increased need for soil restoration and agriculture. According to a report in 2022, up to 40% of all soils globally are moderately or severely degraded; if deforestation, overgrazing, intensive cultivation, urbanization, and other detrimental practices continue, this percentage might increase to 90% by 2050. Synthetic zeolites are generally used in fertilizers because of their ability to retain nutrients in the soil and release them progressively over time. Because of their great porosity, synthetic zeolites can hold more water. Synthetic zeolites can thus control soil water levels by hydrating and dehydrating the soil, reducing soil drying during dry spells and times of water shortage. Synthetic zeolites have superior hydrothermal stability and the ability to be synthesized using pore diameters and chemical properties. Therefore, these properties of the zeolite are escalating the market growth.

Challenges

- Toxic Nature of Synthetic Zeolites - Because some zeolite dusts are poisonous, they are regarded as nuisance dusts. Concerns about zeolites' possible toxicity are being raised about their use in personal care products. There are safety and health risks even when these dust particles are accidentally inhaled. If inhaled, zeolites, a complex collection of silicates, can result in lung conditions. When utilized as catalysts, synthetic zeolites can clog easily and become hazardous. Therefore, one of the main drawbacks to using synthesized zeolites is their toxicity.

- Environmental Degradation Caused by Zeolites may Hinder Market Growth

- The growth of the zeolites market may be hampered by the inability to use their microporosity as a catalyst for the synthesis of large molecules.

Zeolites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 9.4 billion |

|

Forecast Year Market Size (2035) |

USD 16.06 billion |

|

Regional Scope |

|

Zeolites Market Segmentation:

Type Segment Analysis

Natural zeolite segment in the zeolites market is anticipated to hold a share of 54% during the forecast period. Growth can be attributed to the growing demand for naturally occurring zeolites in a wide range of applications, including construction and building materials, soil protection, animal feed, or water treatment. There is also a growing demand for environmentally friendly and sustainable materials, due to increased awareness about the environment. Natural zeolites are naturally occurring minerals with low environmental impact and various uses such as water purification, soil remediation, or air filtration which contribute to the sustainability of the environment.

Function Segment Analysis

The catalyst segment in the zeolites market is expected to hold the largest share of 44% during the forecast period. In the petrochemical and oil refining industries, zeolites are the most important organic material used for the production of oil and gas. For instance, in 2021, the global petrochemical production capacity was close to 2.3 billion metric tons. Therefore, the expansion of these industries is also bolstering the catalysts segment growth. Furthermore, the growth of this segment is driven by a growing demand for zeolites as catalysts in the fluid chromatographic tracking and hydrocarbon cracking applications. Zeolites' huge surface areas and clearly defined pore patterns make them extremely good catalysts as well. These properties allow for precise control of chemical reactions, leading to a higher yield and selectivity. In addition, zeolite is often used as a catalyst to facilitate cleaner and more sustainable production processes. They can reduce energy consumption and greenhouse gas emissions by facilitating reactions at lower temperatures and pressures.

Our in-depth analysis of the global market includes the following segments:

|

Pore Size |

|

|

Type |

|

|

Function |

|

|

Natural Zeolites Application |

|

|

Synthetic Zeolites Application |

|

|

Framework |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zeolites Market Regional Analysis:

APAC Market Insights

Zeolites market in Asia Pacific is anticipated to hold the largest revenue share of 36% during the forecast period. Rapid urbanization and ongoing lifestyle changes in the Asia Pacific region are responsible for the market expansion of zeolites. The region's growing need for automobiles has resulted in a high consumption of petroleum products like gasoline and diesel, which has raised the demand for fluid catalytic cracking (FCC) catalysts. For instance, with approximately 23 million passenger automobile sales in 2022, China emerged as the Asia-Pacific region's largest market. India, with sales of about 3.8 million units in 2022, was the second-largest market in the region. Moreover, a large portion of the economies in many Asian nations are based on agriculture. Zeolites are applied as fertilizers and soil amendments in agriculture to enhance plant uptake of nutrients, soil structure, and water retention.

North American Market Insights

North America zeolites market is poised to hold a share of 28% by the end of 2035. The main reason behind the region's rising product consumption is an increase in the manufacture of petrochemicals and animal feed. Two of the world's leading producers of feed are the United States and Mexico. In addition, the demand for zeolites to address these environmental challenges in North America is increasing as concerns grow about water and air pollution. In addition, the construction sector in this region is experiencing growth that has led to increased demand for building materials including zeolite-based products such as lightweight concrete or asphalt additives.

Zeolites Market Players:

- C-Crete Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- International Zeolite Corp.

- Albemarle Corporation

- BASF SE

- Honeywell International Inc.

- Arkema

- Clariant

- Zeochem AG

- KNT Group

- Zeolyst International

Recent Developments

- C-Crete Technologies, a leader in the development of cement-free concretes, is commemorating the pour of the first zeolite-based concrete in history, a significant milestone that indicates the product's readiness for commercialization. Zeolite was used as the binder instead of Portland cement on November 16 for the pouring of a 20-ton slab-on-grade outdoor concrete foundation and sidewalk stairs at 7200 Woodlawn in Seattle. This pour adds to earlier pours of about 100 tons of C-Crete cement-free concrete made with various feedstocks (all in the same building).

- The production plant located in Jordan, Ontario of International Zeolite Corp., a global provider of sustainable zeolite-infused products for agricultural use, is pleased to announce that it has achieved operational readiness and will start manufacturing IZ's exclusive zeolite nutrient delivery products in late March. By reducing greenhouse gas emissions and the requirement for conventional fertilizers, IZ's licensed unique technology transforms crop growth and assists farmers in lessening their ecological footprints.

- Report ID: 5811

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zeolites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.