Wound Care Biologics Market Outlook:

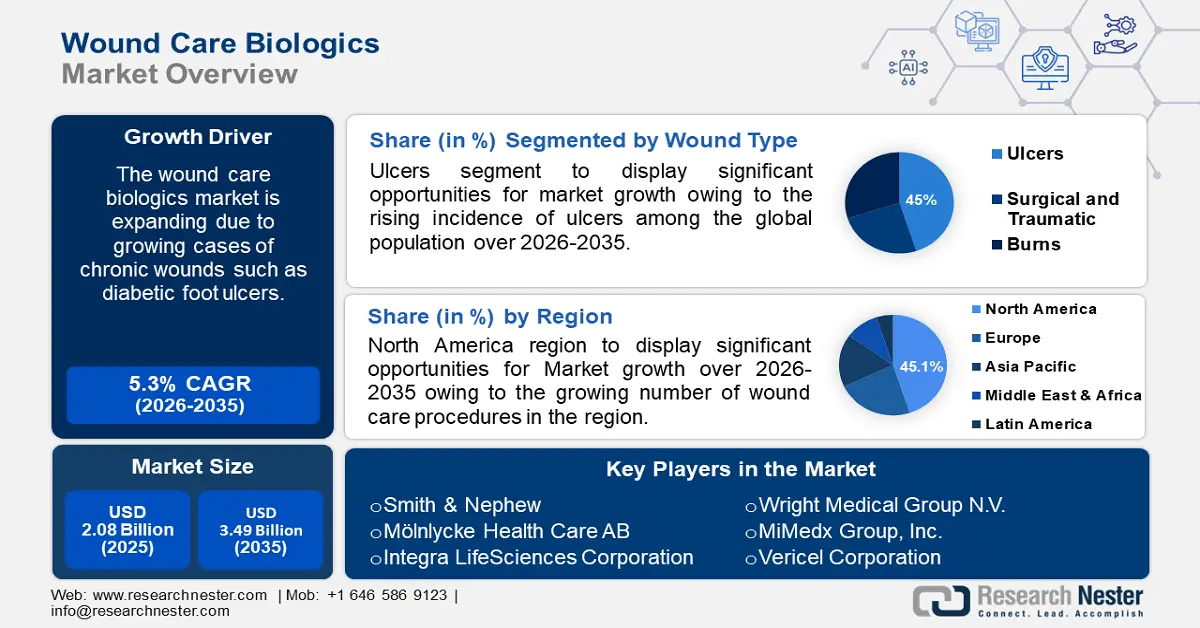

Wound Care Biologics Market size was valued at USD 2.08 billion in 2025 and is set to exceed USD 3.49 billion by 2035, registering over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wound care biologics is estimated at USD 2.18 billion.

The rising cases of chronic wounds such as ischemic ulcers and foot ulcers among diabetic patients are driving the market growth. According to a 2023 report by the Journal of the American Medical Association (JAMA), annually 18.6 million people worldwide suffer from foot ulcers with 1.6 million cases reported in the United States.

Significant advancements in clinical wound management and their pathophysiology, coupled with ongoing biomedical innovations have resulted in a shift from invasive skin grafting techniques to dermal fibroblasts. Several pharmaceutical companies are focused on the research and development of cutting-edge biologics to diversify their product offerings. For instance, in June 2021 Mallinckrodt launched StrataGraft, a FDA-approved allogeneic cellularized scaffold. It consists of dermal fibroblasts in murine collagen and allogeneic cultured keratinocytes that eliminate the need for autografting in chronic burn patients.

Key Wound Care Biologics Market Insights Summary:

Regional Highlights:

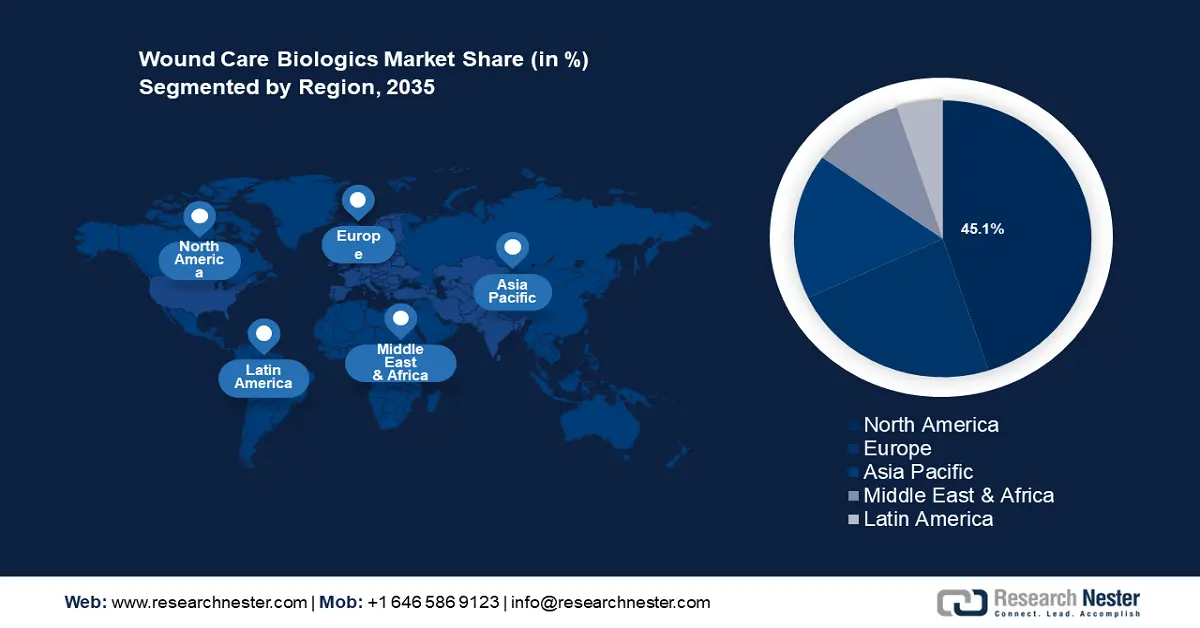

- The North America wound care biologics market is anticipated to capture 45% share by 2035, driven by a high number of wound care procedures.

- The Europe market will hold the second largest share by 2035, driven by universal healthcare and innovation in wound care.

Segment Insights:

- The ulcers segment in the wound care biologics market is projected to capture a 45% share by 2035, driven by rising chronic venous ulceration among varicose vein sufferers.

- The hospitals segment in the wound care biologics market is expected to achieve notable growth till 2035, fueled by high patient footfall and use of biologics for chronic wound treatment.

Key Growth Trends:

- Recent advances in wound care management

- Rising aging population

Major Challenges:

- Limited accessibility and affordability

- Stringent regulatory framework

Key Players: Smith & Nephew, Molnlycke Health Care AB, Integra LifeSciences Corporation, Wright Medical Group N.V., MiMedx Group, Inc., Vericel Corporation, Anika Therapeutics, Osiris Therapeutics, Inc., Solsys Medical, LLC, Lavior Pharma Inc..

Global Wound Care Biologics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.08 billion

- 2026 Market Size: USD 2.18 billion

- Projected Market Size: USD 3.49 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 17 September, 2025

Wound Care Biologics Market Growth Drivers and Challenges:

Growth Drivers

- Recent advances in wound care management - Recent developments in advanced wound care technology include stem cell therapy, bioengineered skin grafts, nanotherapeutics, and 3D bioprinting-based solutions. They reduce recovery time and post-operative contracture, to facilitate rapid re-epithelialization, revascularization, and healing of wound beds. Bioprinting, often referred as ‘Healthcare’s next revolution’ has a widespread application in drug development, regenerative medicine, artificial organs, and wound healing. Similar to 3D printing, bioprinting uses biomaterials, which usually contain living cells.

- Rising aging population - Older people are more prone to chronic wounds due to compromised immune systems, reduced mobility, and comorbidities. Mature skin is susceptible to deep cuts and bruises due to intrinsic factors such as poor collagen synthesis and rapid protein degeneration. According to the World Health Organization (WHO) 2022 report, by 2030 1 in 6 people will be 60 years and older. Moreover, it has been estimated that the elderly population in the United States accounts for nearly 80% of all chronic wound cases. The rising geriatric population is projected to drive market growth in the forecast period.

- Increasing number of road accidents - Road traffic accidents (RTA) are one of the leading causes of life-threatening injuries and mortality. It has factored in the need for trauma care and rehabilitation for treating open wounds, which is projected to fuel the global wound care biologics market. A 2023 World Health Organization (WHO) report suggests that every year, traffic accidents claim the lives of almost 1.19 million individuals.

Challenges

- Limited accessibility and affordability - One of the major restraining factors for the wound care biologics market growth is the high cost of the products, making them unaffordable for many patients. This limits their penetration into new markets, particularly in low-income regions.

- Stringent regulatory framework - Wound care products, including topical ointments and dressings, are mandated to comply with the regulations set by regulatory bodies and agencies. This restricts the ability of new players to enter the market due to lack of financial resources and research and development capabilities. The stringent regulations may delay their commercial release, thereby adding to development costs and creating barriers to market expansion.

Wound Care Biologics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.08 billion |

|

Forecast Year Market Size (2035) |

USD 3.49 billion |

|

Regional Scope |

|

Wound Care Biologics Market Segmentation:

Wound Type Segment Analysis

Ulcers segment is expected to capture wound care biologics market share of over 45% by 2035 owing to the rising incidence of chronic venous leg ulceration among people suffering from varicose veins. According to a study published by the Journal of Vascular Surgery in 2023, around 40% of the population globally has varicose veins, one of the most common chronic venous illnesses. Venous leg ulcers impact approximately 1% to 2% of the population, with the prevalence rising to 4% in individuals over 65.

Chronic ulcers, such as diabetic foot ulcers and venous ulcers, are a major health concern worldwide. Advanced therapeutics such as negative pressure wound therapy (NPWT) promotes the healing of these complicated and resistant wounds. Such treatments reduce hospital time and facilitates quicker transitions to outpatient care settings. The efficacy of wound care biologics in accelerating ulcer closure, lowering infection risks, and improving overall patient outcomes caters to market expansion.

Product Segment Analysis

The biologic skin substitutes segment is estimated to expand at a staggering CAGR through 2035. The major factor in the expansion of the segment is the rising number of burn and trauma cases worldwide.

Burns due to fire, heat, or hot substances are the fourth most common form of civilian trauma worldwide, after road traffic accidents, falls, and interpersonal violence. It is estimated that between 7 and 12 million people sustain burn injuries for which medical attention is required. Biologic skin substitutes are therefore, in huge demand due to their ability to accelerate wound closure, reduce scarring and improve overall wound healing.

End-user Segment Analysis

In wound care biologics market, hospitals segment is projected to hold revenue share of over 32% by the end of 2035. Hospitals remain the foremost sites for patients seeking wound treatment, particularly those that are severe or chronic. Hospitals have wound-care units with qualified health professionals who are skilled at using biologics to aid in proper wound healing and improve patient outcomes. High patient football and the expanding demand for improved wound care treatments in hospital settings add to the segment growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Wound Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wound Care Biologics Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 45% by 2035. This rise is poised to be encouraged by a growing number of wound care procedures. As a consequence, wound care biologics are expected to be a growing business, which encompasses topical treatments and skin grafts composed of bioengineered cells. Particularly, in 2022, more than 12,880,540 wound dressing procedures were carried out over North America.

One of the main causes of unintended death in the United States is burns, which is likely to augment market demand for wound care biologics. According to the American Burn Association’s Healthcare Cost and Utilization Project (HCUP) National Inpatient Sample (NIS), there are approximately 30,000 burn admissions per year (weighted estimates), representing 88.5 admissions per million lives per year.

In Canada, the market for wound care biologics is anticipated to expand since the prioritization of wound treatment is becoming more widely recognized among Canadian healthcare institutions.

European Market Insights

The Europe region is estimated to account for the second-largest revenue share in the wound care biologics market through 2035. Majority of European nations now have universal health coverage, making the health care industry one of the fast-growing regions in the world. More than 55% of prescription drug expenditures in the EU are paid for by mandatory or governmental insurance programs.

In Germany, a new wound dressing called Epicite Balance was introduced by JeNaCell in June 2023, an Evonik business, using hydro polymer called biosynthetic cellulose for creative uses in medical devices. he dressing is especially well-suited and adapted for the management of chronic wounds which impact around 1% of people in developed nations, particularly elderly patients.

Also, more than 20% of Italians out of the country's total population are said to suffer from chronic ulcers, leading to market expansion.

Wound Care Biologics Market Players:

- Marine Polymer Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smith & Nephew

- Molnlycke Health Care AB

- Integra LifeSciences Corporation

- Wright Medical Group N.V.

- MiMedx Group, Inc.

- Vericel Corporation

- Anika Therapeutics

- Osiris Therapeutics, Inc.

- Solsys Medical, LLC

- Lavior Pharma Inc.

Numerous important companies in the wound care biologics sector are implementing several tactical measures and are constantly collaborating, expanding, making agreements, and taking part in joint ventures to fortify their positions in the industry.

Recent Developments

- Smith & Nephew announced the introduction of Renasys Edge negative pressure wound therapy system to covertly care for people suffering from long-term injuries including ulcers.

- Molnlycke Health Care AB a world-leading MedTech company specialised in wound care and wound management acquired P.G.F. Industry Solutions GmbH to permit Mölnlycke to rapidly grow their Granudacyn business to enhance the quality of life for further patients.

- Report ID: 6256

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wound Care Biologics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.