Wires and Cables Market Outlook:

Wires and Cables Market size was valued at USD 219.24 billion in 2025 and is set to exceed USD 374.49 billion by 2035, registering over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wires and cables is estimated at USD 230.09 billion.

This market growth is assessed to be encouraged by the growing need for energy globally. As a result, the demand for cutting-edge wires and cables to ensure effective transmission is increasing, an essential infrastructure component for producing, moving, and storing power.

According to the EIA projections, by 2050, the world's need for power may have increased by roughly one-third to three-quarters.

Key Wire And Cable Market Insights Summary:

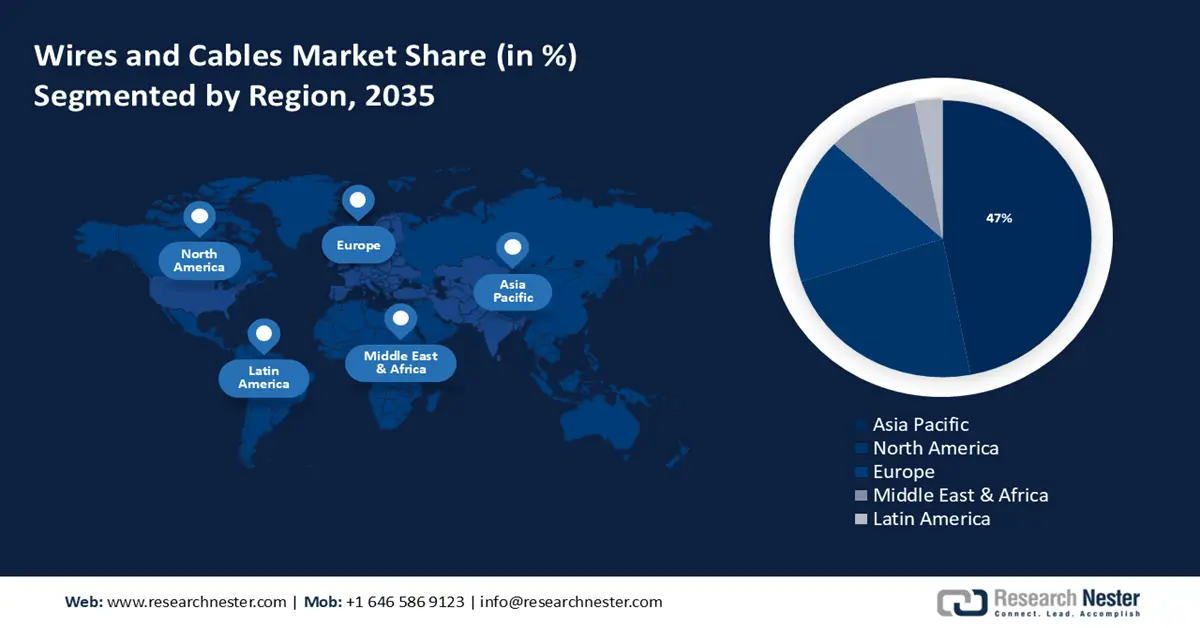

Regional Highlights:

- Asia Pacific wires and cables market will secure over 47% share by 2035, driven by rapid urbanization and industrialization, increasing energy demands and the need for wires and cables.

- North America market will register massive growth from 2026 to 2035, driven by increasing infrastructure initiatives and rising demand in the consumer electronics and energy sectors.

Segment Insights:

- The low segment in the wires and cables market is anticipated to hold a 57% share by 2035, attributed to the increasing demand for telecommunication services and the need for digitization.

- The overhead segment in the wires and cables market is expected to achieve robust growth till 2035, driven by the rising prevalence of natural disasters, which drive the demand for overhead cables.

Key Growth Trends:

- Expanding aerospace and defense industry

- Surging adoption of renewable energy

Major Challenges:

- Varying prices of raw materials such as copper, and aluminum

Key Players: Leoni AG, LS Cables & System Ltd., Nexans, NKT A/S, Prysmian S.p.A, KEI Industries Ltd., Finolex Cables Ltd., Habia Cable.

Global Wire And Cable Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 219.24 billion

- 2026 Market Size: USD 230.09 billion

- Projected Market Size: USD 374.49 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Wires and Cables Market Growth Drivers and Challenges:

Growth Drivers

- Expanding aerospace and defense industry - The continuous expansion of the aviation sector is likely to augment market demand for aerospace wiress and cables that are utilized in the sector for signal communication, data transfer, and power supply, and are made to endure high temperatures, high pressures, and challenging climatic circumstances, guaranteeing dependable operation and security in applications involving airplanes and spacecraft.

The scale of the aerospace and defense sector worldwide is currently over USD 850 billion. - Surging adoption of renewable energy - For green technology to function better and be more reliable, premium wiress and cables are needed, which will be essential in transporting electricity from scattered wind and solar farms to the homes and businesses that utilize it.

As per the International Energy Agency, throughout the next five years, over 90% of the increase in global electricity production will come from renewable sources. - Growing spending in the construction sector - This has caused the number of construction-related activities to rise, leading to a higher demand for electrical cables and wiress which are utilized in practically every residential, commercial, and industrial building construction for various power transmissions, including those of data, electricity, and security.

Before the coronavirus pandemic, the construction industry had grown to a spending value of more than USD 10 trillion, and it is predicted to expand by around 2% per year.

Challenges

- Varying prices of raw materials such as copper, and aluminum - In wiress and cables, copper is the most often utilized metal since it is an excellent electrical conductor. However, economic conditions around the world, supply chain reorganizations, and strict laws have a significant impact on copper prices, which may impede market growth.

Changes in the price of copper can diresctly affect the cost of production and profitability. - The performance, building, and design criteria for wiress and cables are outlined in several legislative and regulatory compliance standards. Adhering to these regulations can be complex and expensive.

Wires and Cables Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 219.24 billion |

|

Forecast Year Market Size (2035) |

USD 374.49 billion |

|

Regional Scope |

|

Wires and Cables Market Segmentation:

Voltage Segment Analysis

Low segment is poised to account for wires and cables market share of more than 57% by the end of 2035. The segment growth can be accredited to the growing telecommunication industry propelled by the increased need for digitization and high-speed connectivity. As a consequence, the market for wires and cables is anticipated to develop steadily over the coming years.

For instance, in 2023, the global telecommunications market is predicted to increase rapidly, with roughly USD 1 trillion estimated to be spent globally.

The wiring system known as low voltage cabling is made to withstand lower voltages and is also commonly utilized for telecommunications purposes as it serves as the foundation of contemporary communications, offering the networks, telephony, and data transmission infrastructure.

Additionally, low-voltage wiress and cables are utilized in many different applications, such as phone systems and internet access since they use less energy and produce less heat.

End-Use Segment Analysis

The energy & power segment is estimated to gather the highest CAGR during the forecast timeframe. The major factor for the expansion of the segment is the rising global population. Particularly, by 2024, the world's population will be expanding at a rate of over 0.90% per year. As a result, worldwide electricity demand is anticipated to increase, leading to a significant hike in the need for subterranean high- and extra-high-voltage (HV) cables.

Installation Segment Analysis

The overhead segment in wires and cables market is assessed to generate a robust revenue share by the end of 2035. The growing prevalence of natural disasters is the primary driver of the segment's growth. The most recent increases in flooding and severe storm occurrences have been caused by greenhouse gasses trapping more heat in the atmosphere.

Therefore, overhead cables are essential, since power lines that have been undergrounded may be more vulnerable to floods from rain, ice melting, and storm surges that are corrosive.

In a report published by Our World in Data, global deaths from natural disasters, such as floods, droughts, earthquakes, and storms, range from 40,000 to 50,000 annually.

Our in-depth analysis of the market includes the following segments:

|

Voltage |

|

|

Installation |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wires and Cables Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 47% by 2035. The market growth in the region is expected on account of rapid urbanization. Due to this, the region is witnessing rapid industrialization, which is accelerating the energy demands, leading to higher demand for wires and cables. As per the World Bank, with an average yearly urbanization rate of 3%, East Asia and the Pacific are the regions that are urbanizing the fastest in the world.

Over the past ten years, China's need for wires and cable has increased quickly driven by increased telecommunications investments and a notable rise in electric vehicle sales.

Japan now boasts one of the top electronics businesses in the world led by the growing use of smart devices and Internet of Things (IoT) technology, this has led to a significant increase in market demand. For instance, Japan's consumer electronics market is expected to increase by around 0.11% between 2024 and 2028.

South Korean cable manufacturers raise their output quickly in response to a significant spike in orders from data centers and battery producers worldwide.

North American Market Insights

The North America region will also encounter massive growth for the wires and cables market through 2035 and will hold the second position owing to the increasing infrastructure initiatives in this region. It is anticipated that the region's infrastructure will deploy more wiress and connections to update the current grid network.

It is estimated that the US consumer electronics market will expand by more than 2% between 2023 and 2024, which might lead to a significant rise in the need for wiress and cables.

Canada is fifth in the world for natural gas production and fourth in the world for oil production, thus there is a higher need for wires and cable products that must function well in challenging conditions.

Wires and Cables Market Players:

- Belden Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leoni AG

- Ravicab Cables Private Ltd.

- LS Cables & System Ltd.

- Nexans

- NKT A/S

- Prysmian S.p.A

- KEI Industries Ltd.

- Finolex Cables Ltd.

- Habia Cable

The wires and cables market consist of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Belden Inc. a leading global supplier of specialty networking solutions introduced six Q2 2022 products Hirschmann BXS Gigabit Switches, Hirschmann GREYHOUND 105/106 Ethernet Switches, Lumberg Automation LioN-X IO-Link Masters, Belden’s Digital Electricity (DE) Class 4 Cables, Belden OSP Dry Loose Tube Cables, and Belden RS-485 Cables to provide clients with improved integration possibilities, innovative means of safely transporting electricity over great distances, and quickly available items.

- Ravicab Cables Private Ltd. an Indian manufacturer of specialized cables with over 20 years of experience in the production, promotion, and distribution of wiress and cables announced the acquisition of Leoni Cable Solutions India Private Ltd.

- Report ID: 6077

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wire And Cable Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.