Window Film Market Outlook:

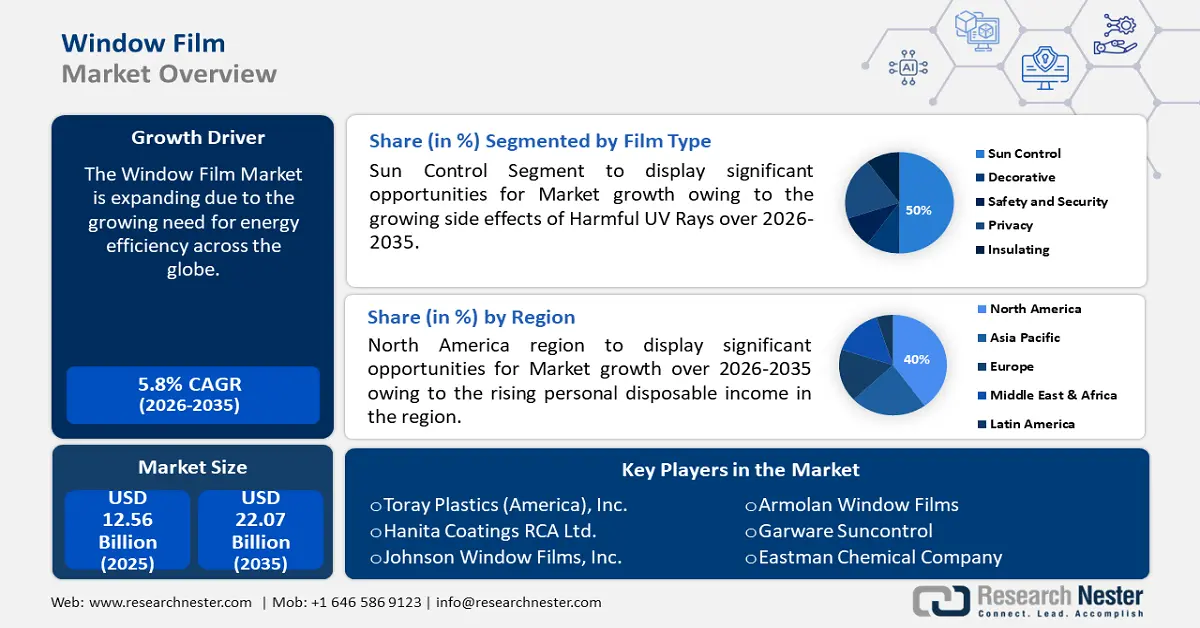

Window Film Market size was valued at USD 12.56 billion in 2025 and is likely to cross USD 22.07 billion by 2035, expanding at more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of window film is assessed at USD 13.22 billion.

The growing need for energy efficiency globally is said to be driving window film market growth. The world's efforts to increase energy efficiency have escalated in 2022, leading to higher adoption of window films, which are made to increase energy efficiency and are intended to retain heat in the winter and cool air in the summer, saving money on heating and cooling. According to the International Energy Agency, the world economy utilized energy 2% more effectively in 2022 than it did in 2021.

Additionally, growing technological advancements are believed to augment window film market demand. The window film industry is facing a shift in competition as cutting-edge films with better color and tones are being introduced which have found novel and inventive uses in a variety of industries, in addition to their conventional uses in energy efficiency and UV protection.

For instance, the creation of ceramic films has been one of the most important developments in window film technology which provides more robust protection against the sun's rays.

Key Window Film Market Insights Summary:

Regional Highlights:

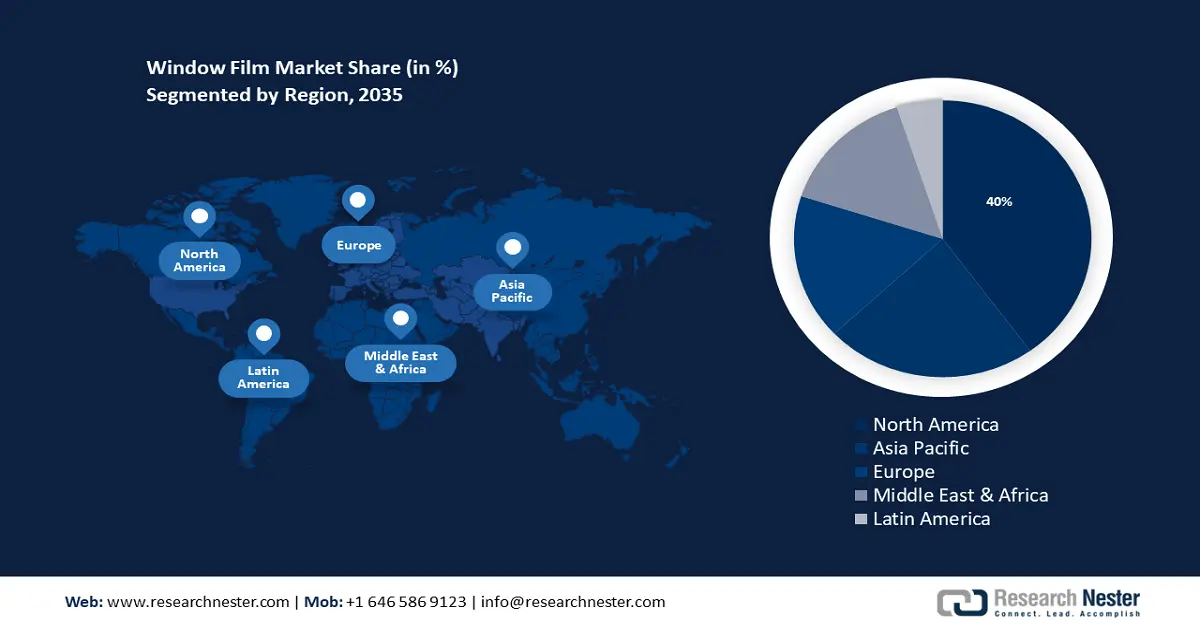

- North America window film market will dominate around 40% share by 2035, driven by increasing personal disposable income and rising demand for automotive tinting films.

- Asia Pacific market will capture the second largest share by 2035, driven by rapid expansion in the marine sector supported by government maritime programs and increased seaborne commerce.

Segment Insights:

- The sun control segment in the window film market is projected to achieve a 50% share by 2035, influenced by increasing awareness of UV damage to health and furnishings.

- The automotive segment in the window film market is expected to experience substantial growth till 2035, driven by the need to reduce glare and prevent road accidents.

Key Growth Trends:

- Rising construction industry

- Growing applications in the marine industry

Major Challenges:

- Stringent regulations

Key Players: Toray Plastics (America), Inc., AVERY DENNISON CORPORATION, Johnson Window Films, Inc., Armolan Window Films, Garware Suncontrol, Eastman Chemical Company, American Standard Window Film.

Global Window Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.56 billion

- 2026 Market Size: USD 13.22 billion

- Projected Market Size: USD 22.07 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 17 September, 2025

Window Film Market Growth Drivers and Challenges:

Growth Drivers

- Rising construction industry - A window film, often known as a tint, helps maintain more consistent, moderate temperatures in rooms by letting in visible light while reflecting solar heat, and they are known to work very well at reducing the energy used for building cooling to offer superior glare reduction and make building occupants feel safer.

For instance, more than 90% of UV rays are blocked from entering windows by window film, which effectively blocks out the sun and lowers solar heat. - Growing applications in the marine industry - Window films act as a permanent shield to protect the boat's automotive glass from the sun's harmful rays, which assist in saving money on cooling the vessel by efficiently reducing the quantity of heat that the sun emits. The growth rate of the maritime sector is approximately 1.2 times faster than that of the whole economy.

- Increasing focus on sustainability - Window films are more environmentally friendly since they minimize "light trespassing," or light pollution, and reject the heat that usually follows and actively decreases. Moreover, owing to its ability to reduce heat transfer through windows, it is one of the finest investments for energy conservation.

A 2022 poll found that more than 55% of C-level executives from large global corporations reported that their organizations are using more sustainable materials as part of their efforts to combat climate change. - Growing sales of automobiles - Over the past ten years, there has been a notable increase in global car sales, which may fuel the demand for window films often known as tints, which will enhance the driving experience, and provide privacy and comfort when driving.

According to estimates, global auto sales increased from around 67 million units in 2022 to over 75 million vehicles in 2023.

Challenges

- Stringent regulations - Strict guidelines prohibiting the use of tinted glass in automobiles have been established by the regional transport office; these guidelines differ between states and provinces. Adhering to these regulations may be time-consuming and can increase the overall cost. For instance, only RTO-approved glass film with more than 65% visibility is permitted for the front and rear windows of the car, whereas windows with around 49% vision are permitted for a clear view.

- There is a lack of awareness among consumers and companies regarding window tint film solutions, which might impede market growth since the advantages of vehicle window coatings, such as UV protection, heat reduction, and glare reduction, may not be well known to many prospective customers.

Window Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 12.56 billion |

|

Forecast Year Market Size (2035) |

USD 22.07 billion |

|

Regional Scope |

|

Window Film Market Segmentation:

Film Type Segment Analysis

Sun control segment is set to hold more than 50% window film market share by 2035 owing to the growing side effects of harmful UV rays. UV radiation can be harmful since it can result in actinic keratosis, wrinkles, leathery skin, cancer, liver spots, and other early symptoms of sun damage.

According to the United States Environmental Protection Agency, melanoma is the primary cause of over 75% of skin cancer deaths, despite representing only 3% of skin cancer occurrences, caused by sunburns and UV exposure, especially in youth.

Numerous advantages come with solar control window film for skylights, such as the ability to regulate indoor temperature, minimize glare, and lessen the amount of heat that enters the home through the windows. Additionally, it blocks damaging UV rays, as the purpose of the film is to reflect sunlight.

Not only can UV radiation harm skin, but it can also fade paint and destroy furnishings; therefore, the use of sun control window film has increased since it provides UV protection for furnishings and skin, lowers interior temperatures, and saves energy. sun protection film for windows in homes and offices. Moreover, by installing a UV protection window film, over 76% of fading damage can be avoided. Besides this, window film solutions are over 90% effect. For instance, more than 75% of these rays are blocked out by ive at blocking dangerous UV rays.

Application Segment Analysis

The automotive segment in the window film market is set to garner a substantial CAGR shortly. The major factor in the expansion of the segment is the rising number of road accidents. The cases with glare are greater than the number of pedestrians who died in crashes without glare since it can cause momentary blindness and put one's life in danger. This has increased the usage of automotive window films, which can reduce glare and improve visibility on the road.

As per the World Health Organization (WHO), approximately 1.19 million people lose their lives in automobile accidents each year.

The most well-known use of window film is undoubtedly for automotive tinting, which provides privacy while shielding the driver from heat, glare, and UV radiation to enhance the driving experience. Most drivers want to keep the interior of their car from fading and minimize glare while driving.

Moreover, for a variety of reasons, people frequently tint their automobiles, such as to prevent the glass from breaking when something strikes it, to prolong the appearance of newness in the car by preventing interior cracking and warping, and to reduce fuel consumption from excessive air conditioning use while maintaining a comfortable environment for all.

Material (Vinyl, Polyester, Plastic, Ceramic)

The polyester segment in the window film market is poised to grow at a rapid rate through 2035. The growth can be accredited to the benefits provided by this type of material. Window film is made of polyester, which can block UV radiation, therefore shielding interiors from their damaging effects.

For instance, globally, the amount of polyester produced in 2022 climbed to around 62 million metric tons from 60 million metric tons in 2021.

Our in-depth analysis of the global window film market includes the following segments:

|

Film Type |

|

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Window Film Market Regional Analysis:

North American Market Insights

North America region in window film market is estimated to capture revenue share of over 40% by 2035. The industry growth in the region is expected on account of growing personal disposable income. This may lead to a rise in demand for automotive tinting film as higher income increases the ability to buy a personal automobile, leading to the growth of the automotive industry.

In addition to being a major contributor to economic growth in the United States for a considerable amount of time, the construction industry has grown even more important in recent years, which is expected to drive window film market growth. Particularly, the United States' construction industry expanded by over 6% in 2023.

In Canada, the UV index is higher, which may propel the need for window films.

APAC Market Insights

The Asia Pacific region will also encounter a huge revenue share for the window film market during the forecast period and will hold the second position owing to the rapid growth in the marine sector. In the next five years, the marine and boating industry in the region is expected to grow significantly, driven by the government's programs to support the nation's maritime industry, more seaborne commerce, and the use of more environmentally friendly fuels.

The Japanese government's net zero targets for new construction will eventually become the norm in Japan to encourage energy-efficient and green building practices.

More than 130 nations have committed to achieving net zero emissions by 2050, including Japan, which has pledged to achieve net zero emissions and a minimum 45% reduction in greenhouse gas emissions by 2030.

The market for car window films in China is expanding, led by increasing urbanization and industrialization.

The presence of quality-controlled manufacturers of premium window tinting films for vehicles in Korea is likely to fuel window film market demand.

Window Film Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toray Plastics (America), Inc.

- AVERY DENNISON CORPORATION

- Johnson Window Films, Inc.

- Armolan Window Films

- Garware Suncontrol

- Eastman Chemical Company

- American Standard Window Film

- Saint-Gobain Performance Plastics Corporation (Solar Gard)

- Madico, Inc.

- Reflectiv Window Films

The window film market consists of several key players. These key players are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Toray Plastics (America), Inc. a leading manufacturer of polyester, polypropylene, and metallized films and polypropylene and polyethylene foams announced the launch of a New, 8.7-meter Polypropylene Film Line to produce highly engineered next-generation laminations and mono-material films, and further lessens Toray's carbon impact, supporting the company's sustainability initiative.

- Johnson Window Films, Inc. announced a partnership with Automotive Glass Experts (AGE) to offer "a comprehensive range of window film applications, as a complementary service in AGE workstations, and for representing a substantial growth for Johnson Window Films.

- Report ID: 6066

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Window Film Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.