Wax Emulsion Market Outlook:

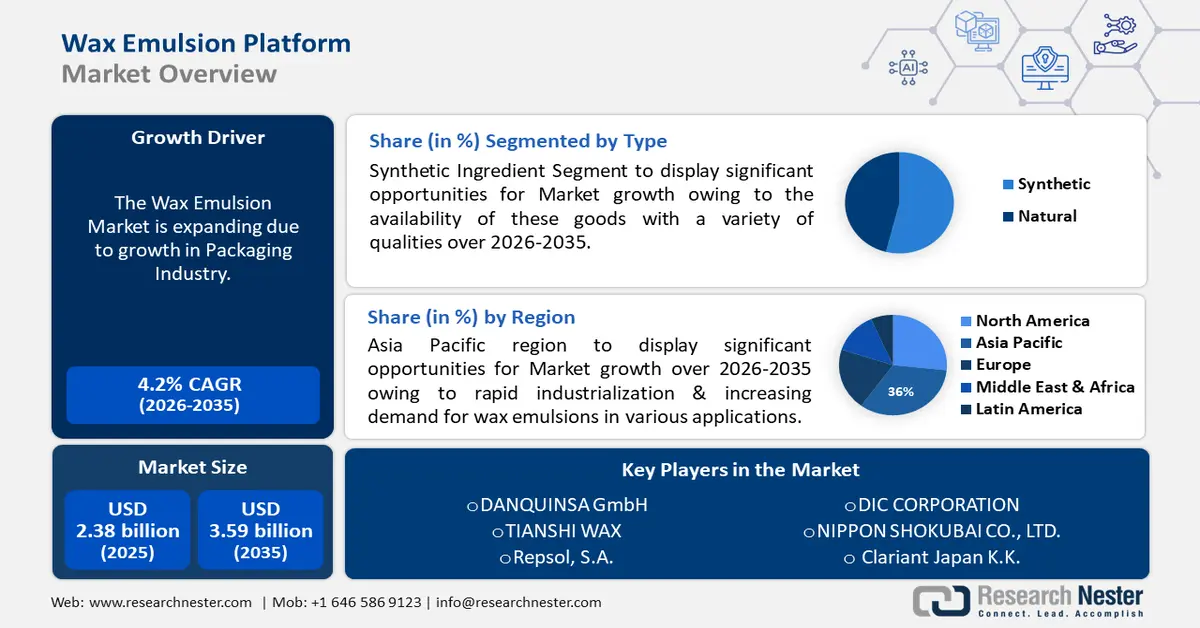

Wax Emulsion Market size was over USD 2.38 billion in 2025 and is projected to reach USD 3.59 billion by 2035, growing at around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wax emulsion is evaluated at USD 2.47 billion.

The market for wax emulsions is being driven primarily by factors including, the food & beverage industry's growing need for effective and environmentally friendly packaging solutions, as well as end-user industries' rising demand to enhance product quality and performance. In a survey conducted in 2022, it was noted that around 82% of respondents were willing to pay more for sustainable packaging.

Abrasion resistance and ease of use are two of the exceptional qualities of wax emulsions that are drawing in industries like adhesives & sealants, paints & coatings, textiles, and cosmetics. Also, the rising usage of paraffin wax emulsions in food and packaging applications is propelling the wax emulsion market expansion.

Furthermore, producers of wax emulsions are concentrating on creating novel goods and looking into ways to make money in developing nations. Prominent petrochemical firms and OMCs are actively creating goods in response to consumer needs and market demands.

Key Wax Emulsion Market Insights Summary:

Regional Highlights:

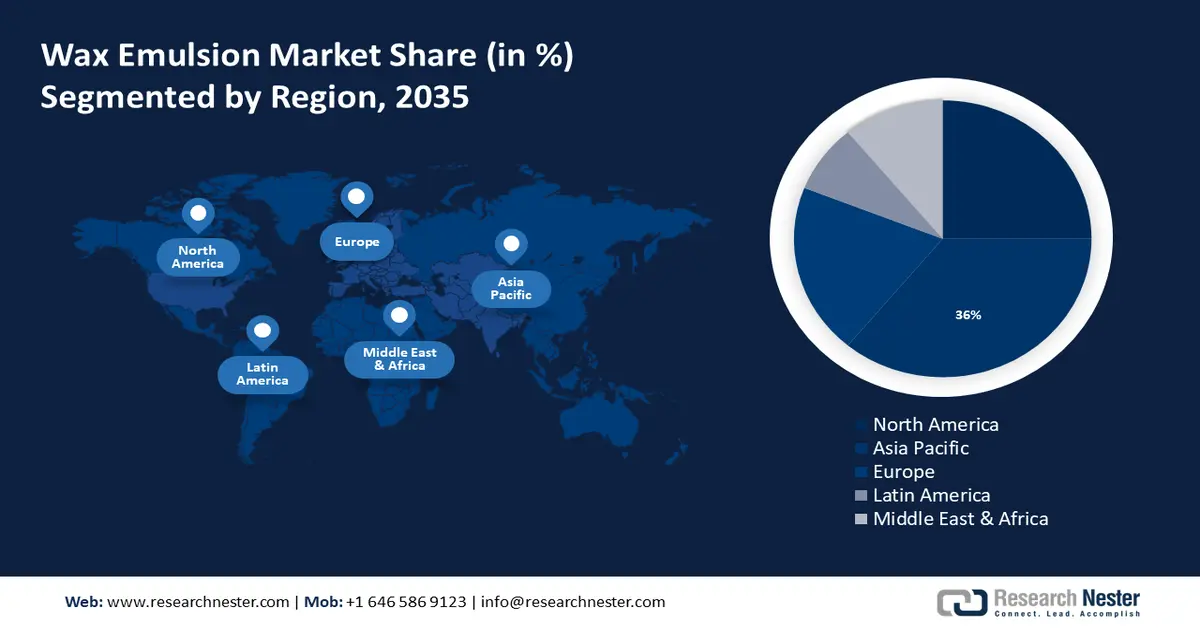

- Asia Pacific wax emulsion market will dominate around 36% share by 2035, fueled by rapid industrialization and growth in automotive and packaging industries.

- North America market will achieve significant revenue share by 2035, driven by demand for eco-friendly products in the construction and automotive sectors.

Segment Insights:

- The synthetic segment in the wax emulsion market is anticipated to experience robust growth till 2035, driven by the versatile application of synthetic wax in various industries.

- The acrylic polymer segment in the wax emulsion market is expected to achieve significant share by 2035, influenced by strong adhesion, durability, and water resistance of acrylic polymer waxes.

Key Growth Trends:

- Growing automotive sector

- Rising demand from construction sector

Major Challenges:

- Volatility in raw materials prices

- The limited shelf life of wax emulsion restricts the market’s growth.

Key Players: BASF SE, ALTANA AG, Sasol Limited, Exxon Mobil Corporation, Hexion, Michelman, Inc., Lubrizol Corporation, DANQUINSA GmbH, TIANSHI WAX, Repsol, S.A.

Global Wax Emulsion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.38 billion

- 2026 Market Size: USD 2.47 billion

- Projected Market Size: USD 3.59 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Wax Emulsion Market Growth Drivers and Challenges:

Growth Drivers

- Growing automotive sector - The automotive industry’s growth, particularly in emerging economies, drives demand for wax emulsions used in polishes, adhesives & sealants, and protective coatings. These coatings enhance the appearance and durability of automotive finishes. Further with the rise in automotive production, for instance, a total of 94 million vehicles were manufactured worldwide by 2023, propelling the wax emulsion market’s growth.

- Rising demand from construction sector - Rapid urbanization and infrastructure development projects worldwide require materials with protective and decorative properties. Due to growing urbanisation, world is witnessing significant surge in construction activities. For instance, as per Indian Government, the construction industry in the nation is estimated to reach approximately $1.4 trillion by 2025. Wax emulsions find applications in construction materials like paints, coatings, and sealants. In light of this rise in construction activities, demand for paints & coatings is also increasing. This eventually offer growth prospects for wax emulsion market.

- Technological advancements - Ongoing research and development efforts are leading to the development of advanced wax emulsions with improved properties such as better water resistance, enhanced durability, and compatibility with various substrates. These innovations drive market revenue by expanding the application scope.

- Rising environmental concerns - With growing environmental awareness, there’s a shift towards eco-friendly products. Wax emulsions, being water-based and low in volatile organic compounds (VOCs), are preferred over solvent-based alternatives, propelling the wax emulsion market growth. As observed by Research Nester analysts, in the United States approximately 12.5 million tons of volatile organic compounds (VOC) in 2023, which is estimated to be low in comparison to previous years, signifying the adoption of wax emulsions.

Challenges

- Volatility in raw materials prices - Fluctuations in the prices of raw materials used in wax emulsion production, such as waxes and emulsifiers, can pose challenges for manufacturers. This volatility impacts production costs and profit margins, making it challenging to maintain competitiveness in the market.

- Wax emulsions face competition from substitute products, such as solvent-based coatings and alternative additives, posing a challenge to the wax emulsion market.

- The limited shelf life of wax emulsion restricts the market’s growth.

Wax Emulsion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 2.38 billion |

|

Forecast Year Market Size (2035) |

USD 3.59 billion |

|

Regional Scope |

|

Wax Emulsion Market Segmentation:

Source Segment Analysis

Synthetic segment in the wax emulsion market is estimated to hold 54% of the revenue share by 2035. The availability of these goods with a variety of qualities that make them appropriate for a wide range of applications, such as paints & coatings, cosmetics, and construction, is credited with the segment's growth. The expansion of these end-use sectors is anticipated to fuel the segment's growth as well.

Furthermore, food packaging frequently uses synthetic wax emulsions. These emulsions have protective properties against corrosion, improve abrasion and rubbing resistance, and keep surfaces from adhering to one another. Together, these attributes propel the segment's expansion within the wax emulsion market.

Application Segment Analysis

Paints & coatings segment is estimated to hold the majority market share. The segment is experiencing growth in the wax emulsion market due to several factors. Firstly, wax emulsions are utilized as additives in paints and coatings to enhance properties such as water repellency, scratch resistance, and gloss. Further, increasing construction activities, infrastructure development, and renovation projects worldwide are driving demand for decorative and protective coatings.

It is projected that by 2024, the US paints & coating industry will have produced over 1.34 billion gallons. Additionally, stringent environmental regulations are prompting the adoption of eco-friendly coatings, with water-based wax emulsions being preferred over solvent based alternatives. These factors collectively contribute to the expansion of the paints & coatings segment within the market.

Type Segment Analysis

Acrylic polymer segment in the wax emulsion market is projected to garner a significant revenue share in the upcoming years. The segment’s growth is attributed to its extensive properties. This type of wax provides strong adhesion, remarkable durability, and high-water resistance. These characteristics, in combination with their protective properties against abrasion and environmental conditions, make them the preferred option for applications covering a wide range of products including coating, adhesives, and finishes.

Not only does acrylic polymer emulsion wax enhance the performance of products, but it also delivers a balance between protection and aesthetic appeal. Its key role in the field of emulsion wax is reinforced by its ability to adapt to changing demands from various applications, thus supplementing the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Source |

|

|

End User |

|

|

Type |

|

|

Appearance |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wax Emulsion Market Regional Analysis:

APAC Market Insights

Asia Pacific wax emulsion market is set to hold 36% of the revenue share by 2035. The region is experiencing rapid industrialization, particularly in countries like China, India, and Southeast Asian Nations. As industries expand, there is an increasing demand for wax emulsions in various applications such as coatings, adhesives, textiles, and construction materials.

Also, with the rising middle class and increasing disposable incomes, there is a growing demand for automobiles in the Asia Pacific region. About 37 million passenger cars were estimated to be on the road by 2022. Wax emulsions are used in automotive coatings, polishes, and sealants to enhance appearance, durability, and corrosion resistance, surging market demand.

Furthermore, the packaging industry in the Asia Pacific region is expanding rapidly, driven by e-commerce, urbanization, and changing consumer lifestyles. Wax emulsions are used in coatings for paper and cardboard packaging to provide moisture resistance, printability, and protection against grease, contributing to the market’s growth.

North America Market Insights

North America wax emulsion market is expected to garner significant revenue share during the foreseen period. The region’s construction industry is witnessing steady growth due to infrastructure development, residential construction, and renovation projects. In 2022, the industry size of the US construction sector was estimated to be around USD 1.8 trillion. Wax emulsions are used in various construction materials such as paints, coatings, sealants, and adhesives, driving the market growth.

There is an increasing focus on sustainability and environmental responsibility in North America, leading to the adoption of eco-friendly products. Water–based wax emulsions, which have lower VOC emissions and environmental impact compared to solvent-based alternatives, are witnessing increased demand.

Moreover, North America is a significant hub for automotive manufacturing, with a growing demand for automobiles. In the United States, about 8.6 million vehicles were manufactured in 2020. Wax emulsions are used in automotive coatings, polishes, and sealants to enhance appearance, durability, and corrosion resistance, driving wax emulsion market growth in the region.

Wax Emulsion Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ALTANA AG

- Sasol Limited

- Exxon Mobil Corporation

- Hexion

- Michelman, Inc.

- Lubrizol Corporation

- DANQUINSA GmbH

- TIANSHI WAX

- Repsol, S.A.

Recent Developments

- Exxon Mobil Corporation introduced a new product brand, ProwaxxTM which reaffirms its commitment to the wax industry. The new architecture, which took effect in April 2024, makes it possible to distinguish between waxes.

- Michelman, Inc. concluded an exclusive distribution contract with Omya, one of the world's largest producers of calcium carbonate and a distributor of specialty chemicals. Omya would exclusively distribute Michelman's surface modification and wax emulsion products in the Canadian paints and coating markets under this partnership.

- Report ID: 6027

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wax Emulsion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.