Waterproofing Admixtures Market Outlook:

Waterproofing Admixtures Market size was valued at USD 6.49 billion in 2025 and is set to exceed USD 13.88 billion by 2035, registering over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of waterproofing admixtures is evaluated at USD 6.95 billion.

The expansion of the construction industry is driving the demand for effective waterproofing solutions. According to the AGC 2024 report, the total number of construction establishments in the U.S. accounted for more than 91,9000 in early 2023. The surge in new construction each year requires a large amount of building materials including concrete admixtures.

The liability of waterproofing applications has propelled growth in the waterproofing admixtures market. Its wide usage in residential, commercial, and industrial construction prolongs the lifespan of buildings. Their pore-blocking and hydrophobic properties help the concrete to bind faster and act as an insulator for external moisture. Further, encourages construction companies to invest in waterproofing solutions. The production houses are now focusing on availing sustainable options for admixtures. The innovative formulations are successfully complying with environmental safety. For instance, in July 2023, Chryso launched EnviroMix, which can reduce the carbon footprint by 50%.

Key Waterproofing Admixtures Market Insights Summary:

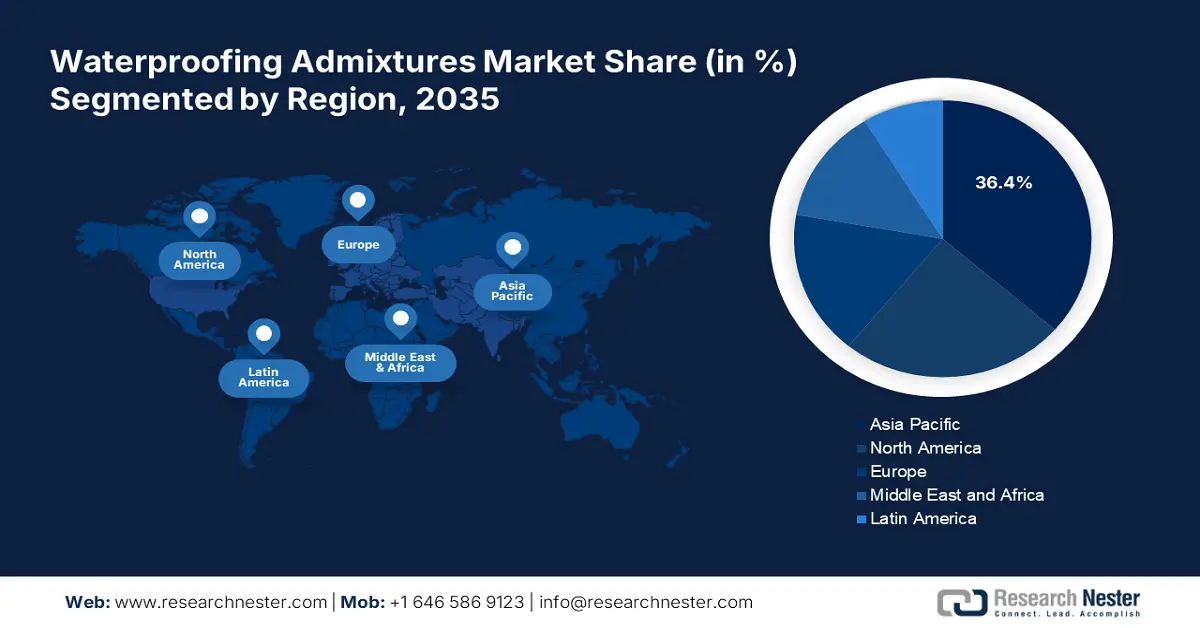

Regional Highlights:

- Asia Pacific holds a 36.4% share of the Waterproofing Admixtures Market, driven by rapid urbanization and initiatives for premium-quality construction materials, positioning it as a key growth hub through 2026–2035.

- The Waterproofing Admixtures Market in North America is expected to see substantial growth from 2026–2035, driven by the established real estate industry and demand for advanced waterproofing solutions.

Segment Insights:

- The crystalline admixtures segment is anticipated to achieve a 45.6% share by 2035, propelled by its self-healing, durable, and waterproof nature for large construction use.

Key Growth Trends:

- Rising demand for weather-resistant infrastructure

- Increased awareness of structural integrity

Major Challenges:

- Uncertain availability of raw materials

- Competition in pricing strategies

- Key Players: Alchemco, BASF SE, Dow Inc, Evonik A G, Fosroc Inc., Kryton International Inc., Mapei S.p.A, Penetron, RPM International Inc, Sika AG, Wacker Chemie AG, Xypex Chemical Corporation.

Global Waterproofing Admixtures Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.49 billion

- 2026 Market Size: USD 6.95 billion

- Projected Market Size: USD 13.88 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Waterproofing Admixtures Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for weather-resistant infrastructure: The change in climate such as rainfall and flooding has become more frequent than ever. Such severity of weather has raised the need for buildings with the ability to withstand extreme conditions. Further, forces the developers to increase the usage of waterproof concrete in construction. Subsequently, this increases the demand for the waterproofing admixturess market. These infrastructures are also being preferred for their long-term durability and enhanced building performance. For instance, in January 2024, Evonik launched VISIOMER HEMA-P 100, a high-performance phosphate methacrylate. The versatile application of the substance includes waterproofing roofs to increase durability.

- Increased awareness of structural integrity: The rising tendency to consider and prevent potential structural damage during construction has boosted the waterproofing admixtures market. Both consumers and developers have become aware of the benefits of using waterproofing for construction works. Architectural firms are also taking the initiative to educate their clients about such concrete mixtures. They are also learning how waterproofing solutions can reduce maintenance costs while preventing the integrity of the building. The changing preference for using low-carbon materials is influencing innovation in this industry. In April 2024, Mapei launched the Cube System to produce low-carbon concrete during the inauguration of their new Speke plant.

Challenges

- Uncertain availability of raw materials: Disruptions such as geopolitical issues, and natural disasters can obstruct the global supply chain of raw materials. This may further lead to delays and a shortage in production. Many admixtures are made of specific materials, which have limited reservoirs. These can impact the manufacturing process severely. Strict regulations can also restrict the use of certain chemicals, complicating procurement strategies. Companies may need to make extensive investments to mitigate these issues by finding alternative materials. Sourcing such components may not be readily available or budget-friendly. Further, refrains manufacturers from participating in the waterproofing admixtures market.

- Competition in pricing strategies: Fluctuations in the cost of key raw materials may also result in price volatility. It can create difficulty in maintaining consistent pricing and profit margins. This may reduce the interest of consumers, forcing them to switch to other available options in the market. Besides making the waterproofing admixtures effective, leaders are also competing for affordability. Thus, inconsistency in availing products at the lowest price may be challenging. Additionally, lowering the price can lead to quality compromise. This further may exploit consumer trust in the reliability of the product. Higher investment costs for innovation may not pay off as expected, further restricting new developments.

Waterproofing Admixtures Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 6.49 billion |

|

Forecast Year Market Size (2035) |

USD 13.88 billion |

|

Regional Scope |

|

Waterproofing Admixtures Market Segmentation:

Type (Crystalline Admixtures, Pore Blocking Admixtures, Densifier)

The crystalline admixture segment is projected to hold over 45.6% waterproofing admixtures market share by the end of 2035. The multi-functional and cost-effective features of this product are driving the growth of this segment. The waterproofing ability of these admixtures encompasses self-healing and lasting properties. The water-resistant material can be used widely in large construction projects including basements, water tanks, and tunnels. These components fill the voids and cracks in the concrete to improve durability and extend the lifespan of the structures. For instance, in April 2020, Sika launched WT-240 P, which can reduce the concrete permeability of hydraulic structures.

Application (Residential, Commercial, Infrastructure, Industrial)

Based on the application, the residential segment is estimated to generate the highest revenue in the waterproofing admixtures market. The increasing number of projects to build housing complexes in highly populated regions is one of the major reasons for growth factors. A broad range of usage in residential construction demands specially formulated waterproofing solutions. This further engages greater investments from both real-estate developers. Maintenance and water retardance are crucial for houses in moisture-prone areas, which pushes homeowners to spend for these solutions. With the increment in consumer awareness and technological advancements, the diverse residential usage of waterproofing solutions is predicted to multiply.

Our in-depth analysis of the waterproofing admixtures market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Waterproofing Admixtures Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is likely to dominate majority revenue share of 36.4% by 2035. The rapid urbanization in developing countries such as China, Japan, India, and other Southeast Asia nations is driving the growth. Initiatives taken to elevate living standards are demanding premium-quality construction materials, including waterproofing solutions. Domestic leaders are pushing their R&D to develop more effective and appealing concrete for builders. For instance, in July 2023, Tremco Construction launched Flowscreed Micro for luxurious concrete floors. The durable micro-cement floor topping is designed to blend in with modern architecture. Manufactured in Malaysia, the Flowcrete technology can offer unmatched water resistance while retaining an aesthetic look.

India is presenting lucrative opportunities for the waterproofing admixtures market with its continuously developing construction industry. The new generation of developers is seeking high-quality concrete materials, propelling the growth of water-resistant products. Government initiatives are also playing a vital role in securing a good consumer base for this sector. Issued building safety codes to maintain proper waterproofing and damp restoration are also enhancing the sector. According to the National Building Code, IS 3067, it is necessary to obtain a series of standards for waterproofing and damp proofing on buildings.

Being one of the largest raw material suppliers in the world, China is expected to lead the waterproofing admixtures market. Wide application of water-resistant solutions in large-scale projects including highways and bridges is boosting the demand. The increased population is also forcing the government and individuals to invest in more construction projects. This further inspires international and local industries to offer a variety of waterproofing admixtures as per usage. In June 2024, Sika launched a new plant in Northeast China to produce a broad range of construction products including waterproofing solutions.

North America Market Analysis

The North America waterproofing admixtures market is expected to continue its upward trajectory due to its established real estate industry. The uplifted housing standards of this region surge for elevated designs with smart features. The advanced waterproofing solutions are manufactured to enhance the effectiveness and application methods. This further makes it an essential construction material. The government is now more focused on reducing industrial emissions through innovative admixture formulations. In July 2024, the U.S. Department of Energy established a Cement and Concrete Center of Excellence. Additionally, the plan outlays an investment of USD 9 million to support R&D in producing low-carbon concrete materials. Such initiatives are inflating future development in this market.

The U.S. is projected to experience remarkable growth in the waterproofing admixtures market during the forecast period. This is driven by the rapid expansion in demand for concrete additives. Many global leaders are now showing interest in consolidating their grip in this demanding landscape. In November 2023, Sika increased its production capacity for construction admixtures in this country. This huge manufacturing unit will help Sika to introduce innovative products such as ViscoCrete to console the surging demand.

The increased demand in Canada waterproofing admixtures market is creating greater business opportunities for construction material suppliers. Favorable regulatory strategies regarding construction and industrial developments are fueling the need. The competitive focus on quality and performance is helping companies comply with standards. They are partnering with building material suppliers to spread their products across the country. In November 2022, Dow partnered with ABS Specialty Silicones to distribute its elastomeric waterproof roof coating solutions in the U.S. and Canada.

Key Waterproofing Admixtures Market Players:

- Alchemco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Dow Inc

- Evonik A G

- Fosroc Inc.

- Kryton International Inc.

- Mapei S.p.A

- Penetron

- RPM International Inc

- Sika AG

- Wacker Chemie AG

- Xypex Chemical Corporation

Besides the pricing and quality, companies are now focusing on developing sustainable alternatives of raw material resources for admixtures. They are slowly but steadily accepting the transition towards bio-based manufacturing components. Many companies have achieved great success in producing such eco-friendly products. The new technology of formulating in the waterproofing admixtures market is evolving the landscape. For instance, in December 2023, Cemex launched a range of bio-based admixtures to reduce the carbon footprint in the concrete mix. The revolutionary formulation can enhance the sustainability attributes by reducing carbon and water usage by 20-30%. Such market dynamics changing key players include:

Recent Developments

- In August 2024, Saint Gobain acquired Ovniver Group to consolidate its leading position in the construction chemical industry. The agreement concludes with a transaction of USD 0.8 billion, which is a strategic investment to capture the Mexica and Central America markets.

- In May 2023, Sika acquired MBCC Group to establish sustainable eco-friendly chemicals, including waterproofing admixturess. With the combined force of expertise and success, the acquisition aims to reduce the CO2 footprint.

- Report ID: 6628

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Waterproofing Admixtures Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.