Washing Machine Cleaner Market Outlook:

Washing Machine Cleaner Market size was over USD 1.38 billion in 2025 and is poised to exceed USD 2.59 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of washing machine cleaner is estimated at USD 1.46 billion.

Washing machine maintenance is a cost-effective solution compared to purchasing new appliances regularly and investing in robust washing machine cleaners is paramount in effective washing machine care. The rapid washing machine cleaner market growth is primarily attributed to rising awareness of maintaining appliance longevity.

The United Nations Human Settlements Program considers access to washing machines as a key indicator of success in three global agendas i.e., gender equality, sustainable development goals, and new urban agenda. The UN Habitat estimated 2 million people globally have access to washing machines and the number is poised to increase exponentially during the forecast period owing to a rise in access to electricity and growing disposable incomes in families. As awareness improves, more families are implementing appliance solutions to households to minimize work and push for gender equality norms. For instance, access to washing machine is correlated with reduced burden on women as per UN Habitat.

The positive trends of adopting washing machines globally are enabling the swift growth of the washing machine cleaner market. The demand for effective washing machine cleaners increases as the number of households with washing machines grows. Washing machine cleaners help erase odors, detergent buildups, dirt accumulation, and improve the longevity of the appliance. The market is geared towards convenience and key market players are investing in products that can offer short-cycle washing machine cleaning. Additionally, artificial intelligence (AI) integration is set to usher in the next generation of washing machine cleaning solutions. For instance, in August 2024, Samsung teased an India-specific AI integrated washing machine with a self-clean cycle that can eliminate residue and odor.

Key Washing Machine Cleaner Market Insights Summary:

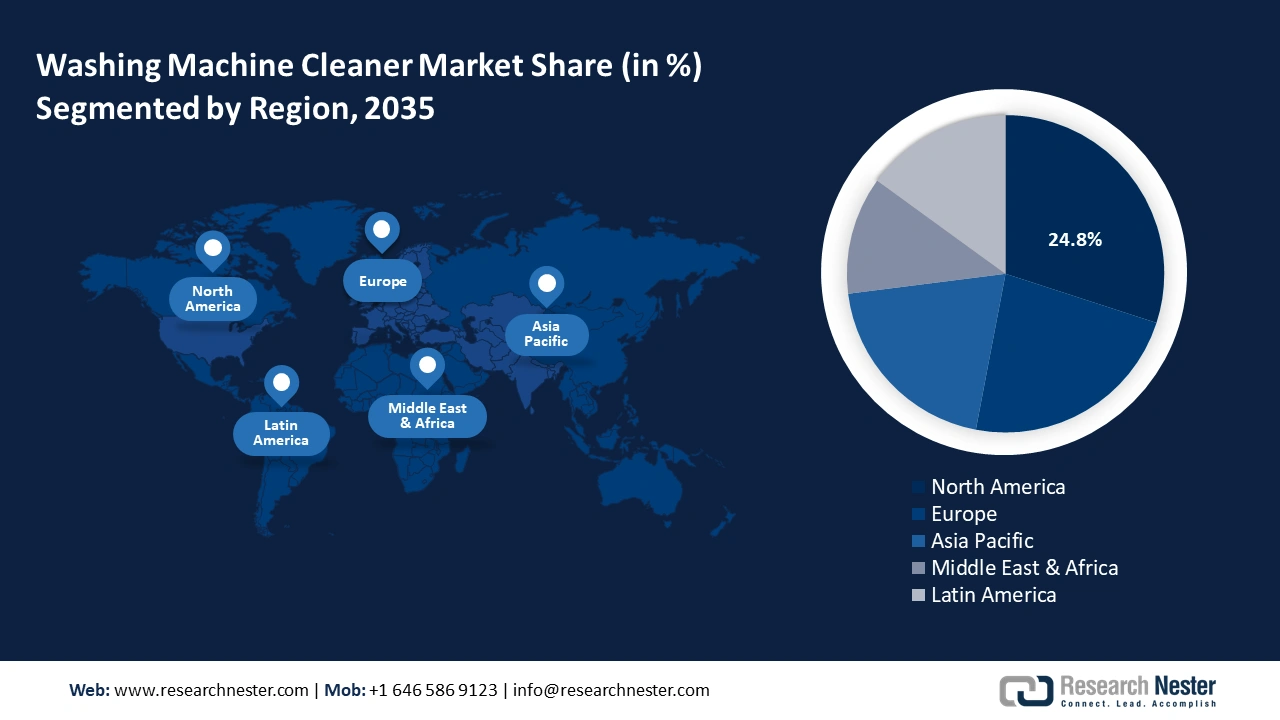

Regional Highlights:

- North America washing machine cleaner market will account for 24.80% share by 2035, driven by high appliance usage and disposable income in the U.S. and Canada.

Segment Insights:

- The foam segment in the washing machine cleaner market is projected to hold a 31.40% share by 2035, fueled by demand for targeted and water-efficient washing machine cleaning.

- The liquid segment in the washing machine cleaner market is expected to hold a significant share by 2035, influenced by liquid cleaners' versatility and compatibility with different washing cycles.

Key Growth Trends:

- Rising calls for quick solutions

- Increasing percentage of appliance ownership

Major Challenges:

- Rising calls for quick solutions

- Increasing percentage of appliance ownership

Key Players: Procter & Gamble Company, Reckitt Benckiser Group plc, The Clorox Company, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., S.C. Johnson & Son, Inc., OxiClean (Church & Dwight), Affresh (Whirlpool Corporation), Durgol (Düring AG), Ecozone Ltd.

Global Washing Machine Cleaner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.38 billion

- 2026 Market Size: USD 1.46 billion

- Projected Market Size: USD 2.59 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (24.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Washing Machine Cleaner Market Growth Drivers and Challenges:

Growth Drivers

- Rising calls for quick solutions: As the percentage of smart appliances increase and living standards improve, there is a growing call for quick solutions in washing machine cleaning. The busy lifestyle of consumers drives demands for time-saving solutions for household chores. As innovations increase, the launch of washing machine cleaners that are easy to use and require minimal effort have high demand. Additionally, washing machine filters should be cleaned every three months to maintain their life expectancy. For instance, in March 2023, True Fresh launched easy-to-use washing machine cleaner tablets that can be used in front loading, top loading, and heavy-duty commercial machines.

- Increasing percentage of appliance ownership: The percentage of appliance ownership has significantly grown. Emerging economies have seen a significant rise in appliance ownership, which results in greater demand for washing machine cleaners. For instance, the Indian Brand and Equity Foundation valued the washing machine market in India at USD 8.4 million. The increase in machine ownership globally leads to greater demands for convenient machine cleaning solutions. Additionally, the disposable income in middle-class families has been increasing. The Organization for Economic Cooperation and Development released a report for 2023 indicating disposable income in households increasing by USD 40 thousand in Germany, USD 33 thousand in Italy, and USD 31 thousand in Denmark and rising disposable income leads to greater investment in household solutions products such as washing machine cleaners.

- Growing demands for sustainable cleaning products: As call for sustainable, chemical free products intensifies, there is a shift in consumer purchasing trends towards eco-friendly household supplies. In May 2021, the World Economic Forum stated google searches pertaining to sustainable goods had increased a whooping 71% since 2016 and the increase in demand for sustainable products is seen in both emerged and emerging economies. Sustainable washing machine cleaners are devoid of phosphates and chloride, and contain plant-based enzymes for cleaning. For instance, in September 2020, Unilever announced that it plans to eliminate the use of fossil fuels in its cleaning products by 2030.

Challenges

-

Challenges from DIY cleaning: The growing popularity of do it yourself (DIY) cleaning solutions derails the sale of specialized washing machine cleaners. Social media platforms such as YouTube have played a vital role in disseminating DIY washing machine cleaning solutions and consumers adopt it owing to the cost-effective nature. DIY cleaning solutions do not have specialized cleaning materials that can effectively engage in deep cleaning of washing machines. Brands are investing in quality marketing of their washing machine cleaning products as competition from DIY cleaning solutions intensify.

- Limitations in consumer perception: The consumer perception on specialized washing machine cleaners has remained limited. Consumers can skip investing on quality washing machine cleaners as pre-conceived notions such as cleaning with hot water or standard detergents prevail. Brands have to invest in marketing campaigns to raise awareness in consumers which can increase operational costs for smaller brands. To effectively combat this challenge, it is pertinent to educate consumers on the benefits of washing machine cleaners in improving life expectancy of the appliance and greater energy efficiency.

Washing Machine Cleaner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.38 billion |

|

Forecast Year Market Size (2035) |

USD 2.59 billion |

|

Regional Scope |

|

Washing Machine Cleaner Market Segmentation:

Type Segment Analysis

Foam segment is likely to capture washing machine cleaner market share of around 31.4% by the end of 2035 due to the advantages foam-based cleaners provide over traditional liquid formulations. Foam cleaners are ideal for targeted cleaning such as for rubber seals or the detergent dispenser, and often require less water to use which makes it an efficient cleaning solution. Foam cleaning solutions are rising in demand due to their cost-effective nature. In September 2023, LanzaTech announced a collaboration with Dow to introduce bio degradable foam cleaning solution.

The liquid segment of the market continues to hold a significant washing machine cleaner market share due to its versatility. Liquid cleaners continue to be a staple in numerous households owing to their familiarity and affordability. Brands are vying to release liquid cleaners that are chemically free due to the consumer shift towards chemical free sustainable products. Additionally, liquid cleaners can be used in both hot and cold wash cycles and can work in low-temperature washes. The versatility is the most significant driver of this segment.

Function Segment Analysis

The anti-bacterial segment is poised to hold a significant washing machine cleaner market share during the forecast period. Washing machine appliances can accumulate bacterial growth over time, which can be hazardous to health. As health concerns of consumers increase, the demand for anti-bacterial solutions rises as these cleaning solutions are particularly effective in preventing the spread of diseases. The segment also benefits from innovations such as products that combine anti-bacterial properties with deodorizing and stain-removal properties due to greater demand for versatile solutions in washing machine cleaning.

Our in-depth analysis of the washing machine cleaner market includes the following segments:

|

Type |

|

|

Function |

|

| Price Range |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Washing Machine Cleaner Market Regional Analysis:

North America Market Insights

North America washing machine cleaner market is anticipated to capture revenue share of over 24.8% by 2035. The U.S. leads in North America in washing machine appliances per household. Due to high rate of disposable income in the two leading regions in North America, the U.S. and Canada, the rate of spending on washing machine cleaning solutions is high. Additionally, the U.S. has the second highest purchasing power parity globally as per the International Monetary Fund (IMF) which allows brands to put forth competitive pricing in the washing machine cleaner market.

The U.S. leads the washing machine cleaner market in North America owing to a high rate of appliance usage. For instance, a U.S. Census Bureau report in 2016 indicated that 85% of U.S. households have a washing machine, and with the advent of smart solutions and increasing income, the number is poised to rise significantly more by 2024. Due to the large-scale penetration of washing machine appliances in the country, the demand for premium washing machine cleaning solutions has risen. In January 2024, a report by Prosperous America stated that washing machine prices have risen less than the overall consumer inflation in the market. This trend bodes well for the sales of washing machine appliances which is poised to positively impact the washing machine cleaner market.

Canada is a key contributor in the North America market and is poised to grow its revenue share during the forecast period. The washing machine cleaner market is benefitting from the penetration of e-commerce which allows consumers to choose and buy from a variety of washing machine cleaning solutions. Additionally, the rise of urbanization in Canada has led to demands for greater convenience leading to demand for quick washing machine cleaning solutions. Additionally, brands in Canada are offering versatile cleaning solutions to include front-load and top-load washing machines.

Europe Market Insights

The Europe market has a large profit share in the washing machine cleaner market and is projected to increase its revenue share by the end of the forecast period. The washing machine cleaner market in Europe is experiencing growth owing to rising awareness on appliance hygiene in countries such as the UK, France, and Germany. A marker for the washing machine cleaner market growth in Europe is the shift to a hybrid work system after the COVID-19 pandemic, which has allowed consumers to focus more on home appliances and appliance care. Specialized appliance care products are gradually rising in popularity in the region as evident from the growing demands for specialized washing machine cleaning solutions that are multipurpose.

UK leads the washing machine cleaner market growth in Europe due to extremely high rate of appliance ownership in households. It is estimated that around 97% of households own a washing machine in the UK. Although the survey was more than a decade ago, the eventual increase in disposable income in UK households is expected to increase the number in current times. Additionally, global and local brands in the UK are launching easy-to-use washing machine cleaning solutions due to the growing demand for convenience in appliance care.

Germany is estimated to increase its revenue share during the forecast period owing to large-scale market penetration of household appliances and rising demands for appliance care. A Research Nester report indicates the sale of over 3 million washing machines in Germany in the year 2023. Germany requires stringent labeling of products and consumers have a higher demand for sustainable products. This has led to the growth of chemical-free anti-microbial and anti-bacterial washing machine cleaning solutions in the region.

Washing Machine Cleaner Market Players:

- Procter and Gamble

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oxiclean

- Glisten

- Unilever

- Affresh

- Clorox

- Tide

- Bosch

- Reckitt & Colman

The washing machine cleaner market has global, local, and regional players competing to retain and increase market share. Key market players are investing in cleaning solutions that consume less time and are chemical-free as per the current consumer behavior trends.

Recent Developments

- In April 2024, Henkel and Samsung introduced custom wash cycles that reduce energy consumption by 60% and will leverage Henkel’s deep clean enzyme technology.

- In April 2024, Unilever launched WonderWash for cold cycles and performs quick wash in 15 minutes. Unilever estimates this segment to be worth USD 2 million by 2026.

- In December 2021, Bosch Home Appliances launched a new range of made-in-India top load washing machines and aims to double its market share in the country.

- Report ID: 6501

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Washing Machine Cleaner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.