Used Car Market Outlook:

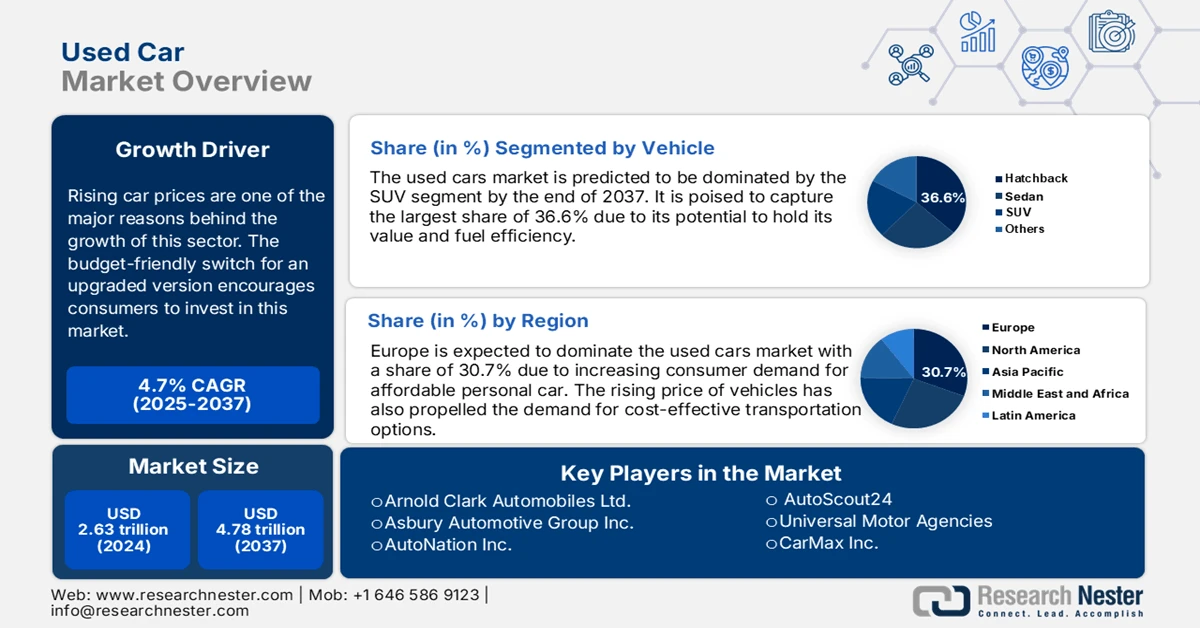

Used Car Market in 2025 is assessed at USD 2.73 trillion. The global market size was valued at over USD 2.63 trillion in 2024 and is expected to expand at a CAGR of around 4.7%, surpassing USD 4.78 trillion revenue by 2037. Europe is expected to generate USD 1.47 trillion, driven by increasing consumer demand for affordable personal cars.

Rising car prices are one of the major reasons behind the growth of this sector. According to a CFPB report published in February 2022, the CPI of new cars increased by 12% in 2022. The report further stated that the chip shortage decreased new production compared to the previous year. Thus, consumers are opting for more alternative options, including used vehicles.

The limited inventory due to ongoing challenges has severely disrupted the supply chain of new cars. In addition, the budget-friendly switch for an upgraded version encourages consumers to invest in the used car market. Many companies are now offering attractive trade-in solutions to avail pre-owned models at an affordable price. For instance, in June 2022, BCA launched a regular sales program, Forecourt Ready to offer the highest-conditioned vehicles. The ready-to-retail models can support customers with uplifted auction standards. Such facilities can reduce the pre-sale refurbishing cost for dealers, gaining more retailer interest in this industry.

Key Used Car Market Insights Summary:

Regional Highlights:

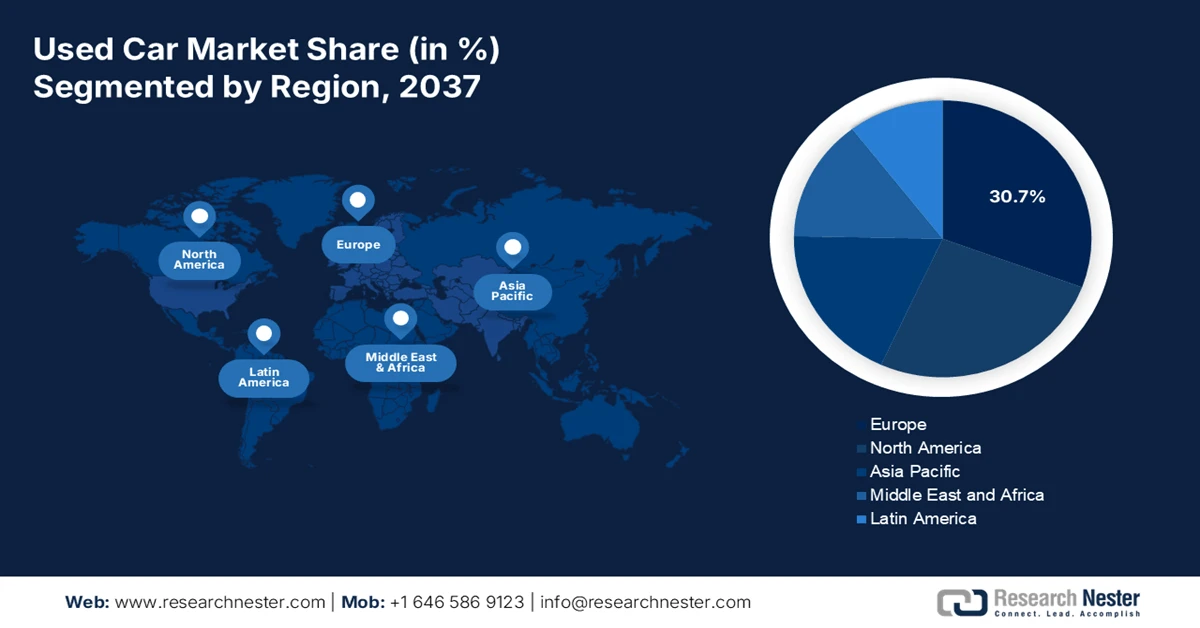

- In the used car market, Europe is expected to represent the largest revenue share of 30.7% by 2037, attributed to rising preference for affordable personal vehicles amid escalating new car prices.

- North America is projected to witness steady expansion over the forecast period, supported by advanced digital resale platforms and growing acceptance of pre-owned electric vehicles.

Segment Insights:

- In the used car market, the SUV segment is forecast to command a dominant 36.6% share by 2037, reinforced by fuel-efficient and value-retentive models enhancing family affordability and urban usability.

- Based on fuel type, the electric vehicle segment is anticipated to gain strong momentum during the forecast period, encouraged by rising environmental consciousness and expanding charging infrastructure investments.

Key Growth Trends:

- Widespread online platforms and operations

- Increased certification and financing options

Major Challenges:

- Fluctuating prices of used car

- Competition with other transportation

Key Players: Alphartis Deutschland, AMAG Schweiz, Autotorino Italien, AVAG Holding Deutschland, Avemo Deutschland, Bernard Frankreich, Bertel O. Steen Norwegen, Bilia Schweden.

Global Used Car Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 2.63 trillion

- 2025 Market Size: USD 2.73 trillion

- Projected Market Size: USD 4.78 trillion by 2037

- Growth Forecasts: 4.7% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Europe (30.7% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, France, Italy, Spain

Last updated on : 23 April, 2025

Used Car Market - Growth Drivers and Challenges

Growth Drivers

- Widespread online platforms and operations: Rapid digitalization of dealership networks has increased sales in the market. The advancement in online platforms for buying and selling pre-owned cars has accelerated the transition. Ease in digital payment methods has brought convenience to the process. Further, it supports the changing consumer preferences by offering detailed mechanical insights. Companies are also encouraging online transactions by integrating digital solutions. For instance, in September 2020, BCA launched its new digital sales channel, Retail Ready. This platform offers 24/7 availability and live online auctions for direct listing and selling cinch retail eCommerce platform.

- Increased certification and financing options: Increasing demand for certified vehicles to obtain quality assurance is shaping the market. The CPO programs are helping to meet consumer expectations by conducting a thorough inspection of vehicle conditions. Financing facilities for buying pre-owned cars have also broadened the range of consumers with different economic backgrounds. Leasing and rental platforms are also feed-stocking the market with maturity-returned cars. For instance, in May 2024, Kia India partnered with ORIX Auto to launch its new ownership experience program, Kia Lease. This partnership will allow ORIX to access the returned or exchanged vehicles for reselling.

Challenges

- Fluctuating prices of used car: Price volatility is one of the major setbacks in the used car market. The uncertainty in pricing may complicate the negotiation process between sellers and buyers. Thus, consumers with financial limitations may refrain from the purchase or sale. The varying prices due to seasonality and changed supply-demand dynamics can create difficulty in determining fair market value. This can further result in extended holding periods, creating inconsistent demand.

- Competition with other transportation: The rise of shared rides and public transportation can reduce the demand in the market. This may hinder consumer interest in owning personal ownership experience. Sustainability concerns in the younger generation can also lead to a decline in personal vehicles, including used car. Rapid urbanization has increased the accessibility of public transport, diminishing the need for personal or pre-owned cars.

Used Car Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

4.7% |

|

Base Year Market Size (2024) |

USD 2.63 trillion |

|

Forecast Year Market Size (2037) |

USD 4.78 trillion |

|

Regional Scope |

|

Used Car Market Segmentation:

Vehicle (Hatchback, Sedan, SUV)

In terms of vehicle type, the used car market is predicted to be dominated by the SUV segment by the end of 2037. It is poised to capture the largest share of 36.6% during the forecast period. The fuel efficiency of these models makes them a budget-friendly option for families, thereby increasing their demand in the pre-owned industry. The potential of holding its value makes it a beneficial option for the reselling process. SUVs are preferred for urban areas due to their practicality and diverse driving capability. This further boosts the demand for this category. According to an article published by The Times of India, in October 2024, the sale of used SUVs spiked by 49% during the festive season.

Fuel (Gasoline, Diesel, Hybrid, Electric)

Based on fuel type, the used car market is predicted to register significant growth in the electric vehicle segment. The sale of used EVs gained traction due to growing awareness of environmental issues. The effectiveness of electric cars in reducing carbon emissions has inspired companies to invest in managing their footprint. In May 2023, Arnold invested USD 25.0 million to strengthen the EV charging network across the UK. The outlay of Arnold Clark Charge encompassed the installation of over 500 charging stations. Such investments are clear evidence of the company’s plan to expand its pre-owned portfolio. This further empowers the adoption of used EVs by contributing to infrastructure development.

Our in-depth analysis of the market includes the following segments:

|

Vehicle |

|

|

Fuel |

|

|

Sales Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Used Car Market - Regional Analysis

Europe Market Statistics

Europe industry is expected to account for largest revenue share of 30.7% by 2037, due to increasing consumer demand for affordable personal cars. The rising price of vehicles has propelled the demand for cost-effective transportation options. According to a report published by the European Central Bank, in February 2022, car prices in this region were accelerated to 8.7% by August. However, the decline in new car production is causing a scarcity in availability and an increment in used car prices. Companies are opting for strategic advertisements to resolve the issue by promoting them locally. For instance, in July 2024, Arnold, a leading supplier of used car, partnered with Scottish Rugby to provide vehicles for the sports community employees. This will further help Arnold to capture the grand audience of the Scotland Men’s team.

The UK is projected to show remarkable development in the used car market by the end of 2037. The country is highly influenced by environmental concerns, driving the need for sustainable alternatives in this sector. The increasing demand for hybrid and fully electric vehicles has encouraged companies to outstretch their dealership network. For instance, in March 2024, the GWM ORA appointed Richardson’s and Hartwell as their used car retailer in the UK. These new retail partners are expected to embellish the company network through their expertise in used electric vehicles across the country.

France is established as a reliable supplier for the market in this region. As the country focuses on reliability, fuel efficiency, and advanced technology, it is aspiring to invest in platforms to streamline pre-owned vehicles. This is further fueling the supply chain to introduce innovative solutions with more convenient features. For instance, in January 2023, ProovStation raised USD 11.34 million to deploy AI-powered testing stations for used car. The assistive facilities aim to deliver automated valuation and inspection results in just 3 seconds. Such technologies are inspiring more developments in this industry to secure quality.

North America Market Analysis

The ongoing technological advancements and shifting consumer preferences are shaping the used car market dynamics. Enhanced online platforms including Carvana, Vroom, and AutoTrader have been successfully increasing consumer engagement in this sector, by making the process more accessible and efficient through digital tools. The popularity of electric vehicles has also influenced the market to opt for environmentally friendly options. Many government subsidiary plans are supporting these initiatives through funding and incentives. For instance, in August 2024, the Washington State Department of Commerce released a new state rebate program. This will allocate a USD 2,500 rebate for each used EV purchase and lease to make it affordable for low-income drivers.

The U.S. encompasses advanced technology to boost its market. Growing demand for affordable alternatives to avoid highly-priced new vehicles is propelling the growth of this country. Environmental concerns and federal incentives are increasing interest in buying pre-owned EVs to promote sustainability. Online platforms are improving and expanding their services to offer seamless transactions. For instance, in February 2024, Carvana expanded its same-day delivery of used car in the Sacramento area. This further captivates more investment in this field.

Canada is encouraging consumers to invest in the market to cope with its current economic condition. The country is witnessing a robust demand for affordable used vehicles among first-time buyers. The drivers are opting for reliable brands such as Ford, Honda, and Toyota for SUVs and trucks to fit the country’s lifestyle. Many dealer points have enabled online sales and home delivery options, bringing virtual convenience. This further encourages more buyers and sellers to purchase or list their vehicles from these platforms.

Key Used Car Market Players:

- Alphartis Deutschland

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AMAG Schweiz

- Autotorino Italien

- AVAG Holding Deutschland

- Avemo Deutschland

- Bernard Frankreich

- Bertel O. Steen Norwegen

- Bilia Schweden

- BPM Frankreich

- Emil Frey Group

- Arnold Clark Automobiles Ltd.

- Caravana

- Asbury Automotive Group Inc.

- AutoNation Inc.

- AtoScout24

- Universal Motor Agencies

- CarMax Inc.

The transition of the dealership network toward digital platforms is a major influencing factor in the used car market. These online sales models are changing the landscape by offering virtual showrooms, detailed vehicle evaluations, and remote transactions. Thus, it enhances user experience and promotes more advancement in this industry. For instance, in March 2022, AutoScout acquired a majority stake in AUTOproff. This acquisition helped to connect retailers are wholesalers digitally to support fast-growing Europe used car businesses. Global leaders are now expanding their networks through subscription services. Such facilities enable access to insurance and maintenance in a single package. This further helps companies to differentiate themselves from other competitors. Such key players include:

Recent Developments

- In July 2024, Carvana launched an online shopping and checkout platform for used EV buyers. This is dedicated to catering a streamlined experience for consumers purchasing pre-owned electric and plug-in hybrid vehicles. Its automated system can determine eligibility and apply Clean Vehicle Tax Credit to encourage more buyers to invest.

- In May 2023, Arnold Clark inaugurated its new branch for used car in Ayr. This relocation was intended to expand the network of Kia by availing over 150 used car in the new showroom located in Heathfield.

- Report ID: 6271

- Published Date: Apr 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Used Car Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.