Ultrasound Market Outlook:

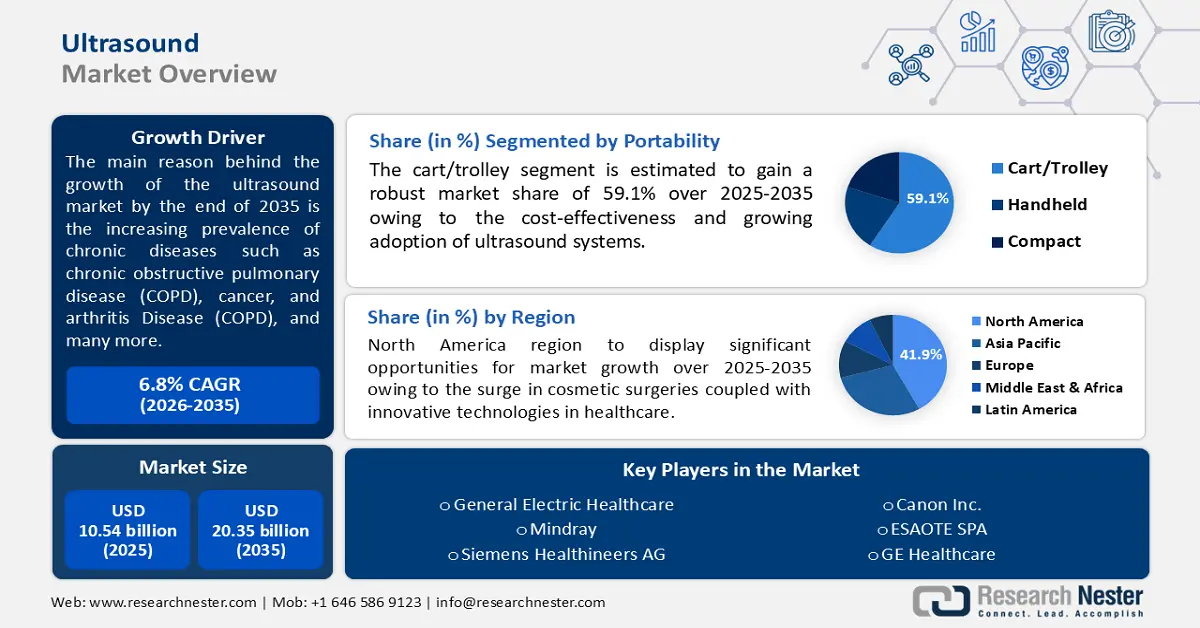

Ultrasound Market size was over USD 10.54 billion in 2025 and is projected to reach USD 20.35 billion by 2035, growing at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ultrasound is evaluated at USD 11.19 billion.

The globally increasing prevalence of chronic diseases such as chronic obstructive pulmonary disease (COPD), cancer, and arthritis are influencing the market growth. Ultrasound provides effective palliative and curative care to cancer patients and has fewer adverse effects than surgical or conventional pharmacological treatments. According to a World Health Organization (WHO) 2024 study, the global burden of new cancer cases will be 35 million in 2050, at a growth rate of 77% as compared to 20 new million cases in 2022. Furthermore, a 2023 report by the World Heart Federation mentioned 20.5 million deaths worldwide in 2021 due to cardiovascular diseases. Significant strides have been made to address the gaps in modern ultrasound technology. In September 2021, the Focused Ultrasound Foundation (FUS), Cancer Research Institute (CRI), and Parker Institute for Cancer Immunotherapy (PICI) collaborated to discuss the ongoing challenges in immuno-oncology and develop the FUS technology. It offers a targeted approach using histotripsy ablation for tumor diffusion and kills cancer cells at an early stage. The rising incidence of chronic diseases and the continuous technological advancements in non-invasive therapeutics are driving market expansion.

Key Ultrasound Market Insights Summary:

Regional Highlights:

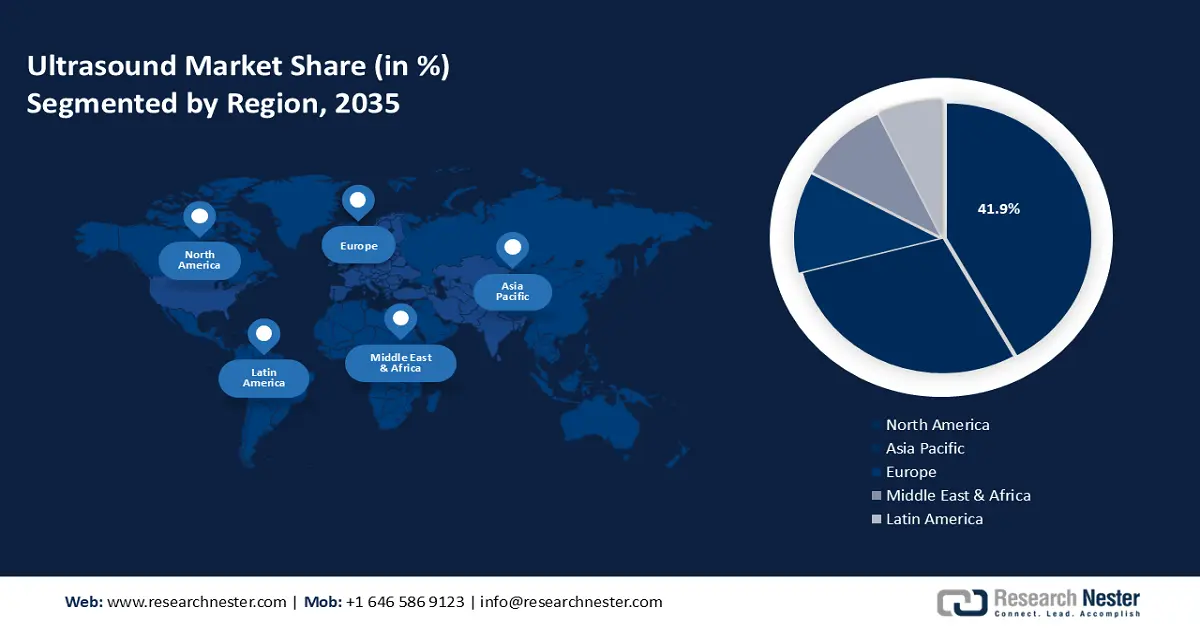

- The North America ultrasound market will dominate around 42% share by 2035, driven by the surge in cosmetic surgeries coupled with innovative healthcare technologies.

- The Asia Pacific market will exhibit huge growth during the forecast timeline, driven by increasing cardiovascular diseases and gastrointestinal disorders in the region.

Segment Insights:

- The cart/trolley segment in the ultrasound market is projected to hold a significant share by 2035, driven by cost-effectiveness and growing adoption of ultrasound systems with improved features.

- The radiology segment segment in the ultrasound market is projected to achieve a staggering CAGR through 2035, driven by the rising number of radiology centers and extensive use of ultrasound technology.

Key Growth Trends:

- Integration of artificial intelligence (AI) in medical devices

- Demand for therapeutic ultrasound

Major Challenges:

- Market entry barriers

- Shortage of skilled technicians

Key Players: Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd. , Zimmer MedizinSysteme GmbH, General Electric Healthcare, Mindray Medical International Limited., Siemens Healthineers AG, Canon Inc., ESAOTE SPA, GE Healthcare.

Global Ultrasound Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.54 billion

- 2026 Market Size: USD 11.19 billion

- Projected Market Size: USD 20.35 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Ultrasound Market Growth Drivers and Challenges:

Growth Drivers

-

Integration of artificial intelligence (AI) in medical devices - AI trained in Foundation Models (FMs) plays a pivotal role in addressing high variability and intrinsic noise in ultrasound imaging. FMs, large-scale neural networks, have emerged as an adaptable and reliable foundation for developing AI applications tailored to disease diagnosis. These models have risen to prominence due to their ability to operate as human-in-the-loop AI systems, garnering accurate results. This positions them as ready a contender to fulfill a diverse array of tasks and address challenges prevalent in conventional imaging technologies. In April 2024, GE HealthCare launched its AI-based Voluson Signature 20 and 18 ultrasound systems, which automatically annotate and reduce the time required to complete the standard ISUOG second-trimester exams by 40%. Moreover, to achieve the highest level of precision and accuracy, robotic surgeries are gradually replacing traditional surgeries. Better outcomes are expected from the adoption of AI into medical devices like blood pressure monitors, ultrasound systems, MRI scanners, and more. For instance, the "Acuson Maple" AI-enabled ultrasound system was introduced by Siemens Healthineers in 2023. The same hardware and software platforms are used by this system to digitize analysis and workflow for effective examination. As a result, companies and medical professionals are making large investments in AI-related research and development. Collectively, these advancements underline the potential of AI in redefining medical diagnostics and treatment.

-

Demand for therapeutic ultrasound - Diagnostic imaging systems, ultrasound is a cost-effective and efficient diagnostic tool in the medical imaging field. Additionally, compared to other imaging technologies, it is safer as it does not use magnetic fields or ionizing radiation. The ultrasonic medical device has many applications in both therapy and diagnosis. The use of ultrasound for certain medical conditions, such as cardiology and oncology, has become increasingly common. The ultrasound market revenue is anticipated to grow due to the creation of wireless transducers, app-based ultrasound technology, laparoscopic ultrasound, fusion with CT/MR, and an increase in the applications of ultrasound devices in shear wave elastography and 3D imaging. For instance, A division of Kronos Advanced Technologies Inc., KronosMD, INC., has announced that it has acquired all present and future rights to all patents and properties associated with its revolutionary 3D ultrasonic dentistry imaging and diagnostic equipment.

Challenges

-

Market entry barriers - Regulations may impose high entry barriers for new manufacturers or products, requiring substantial investments in regulatory compliance, clinical trials, and documentation. This can deter small companies or startups from entering the market, limiting competition and innovation.

-

Shortage of skilled technicians - While the ultrasound imaging equipment market is experiencing significant advancements, some factors, including product recalls, regulatory warnings, and defective products, are negatively impacting the reputation of major companies in the industry.

Ultrasound Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 10.54 billion |

|

Forecast Year Market Size (2035) |

USD 20.35 billion |

|

Regional Scope |

|

Ultrasound Market Segmentation:

Portability Segment Analysis

Cart/trolley segment is poised to dominate ultrasound market share of around 59.1% by the end of 2035, impacting the landscape of ultrasound revenue share. Cost-effectiveness and growing adoption of ultrasound systems with features such as improved picture quality, high-grade battery capacity, and user-friendly interfaces are driving this segment's growth. Moreover, cart/trolley ultrasounds enable clinicians to provide point-of-care imaging directly to critical patients, particularly in emergency rooms and intensive care units (ICUs). Additionally, it facilitates prompt diagnosis, decision-making regarding treatment, and administration, all of which improve patient satisfaction and recovery. In July 2023, Konica Minolta Healthcare Americas, Inc. unveiled the PocketPro H2, a cutting-edge cordless handheld ultrasonic device. The company collaborated with Healcerion to distribute the device to offer an affordable and versatile ultrasound imaging device, across the U.S. for human and animal applications.

Application Segment Analysis

The radiology segment in ultrasound market is expected to be the fastest-growing segment with a staggering CAGR during the forecast period. The number of radiology centers is rising, and general imaging & medical complication diagnosis are using this technology more, which is propelled to fuel this revenue share. For instance, GE Healthcare in 2022 estimated that radiology had experienced more than 31% of gain in Magnetic Resonance Imaging (MRI) between 2007 and 2018.

Moreover, radiology uses ultrasound technology extensively for diagnostic imaging in different medical specialties, such as cardiology, musculoskeletal imaging, oncology, and obstetrics and gynecology. Owing to its versatility, radiologists can assess a wide range of medical conditions, making it an indispensable tool. Furthermore, unlike other imaging modalities like CT and X-rays, ultrasound imaging is non-invasive and it does not use ionizing radiation. This lowers the risk of radiation exposure and makes it safer for patients, especially elderly patients and pregnant women. Growth in this sector will boost the diagnostic imaging value in the near future.

Our in-depth analysis of the global market includes the following segments:

|

Portability |

|

|

Product |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ultrasound Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 42% by 2035. The growth in this region is driven by the surge in cosmetic surgeries coupled with innovative technologies in healthcare. American Society of Plastic Surgeons in 2023 projected that cosmetic surgery procedures showed an increase of 19% since 2019. This will act as a growth factor for Artificial Intelligence (AI) in healthcare during the forecast years.

The U.S. showed increasing spending on healthcare by public and private sectors. For instance, the Centers for Medicare & Medicaid Services in July 2024 estimated that U.S. healthcare spending increased by 4.1%, while health spending accounted for about 17.3% of the country’s GDP.

Increasing cancer cases in Canada is propelling the market expansion during the forecast period. According to the Canadian Cancer Statistics 2023, prostate and colorectal cancers together dominated for 49.8% of all male cancers diagnosed under 25 years of age since 2018.

APAC Market Insights

The Asia Pacific region will also encounter huge growth in the ultrasound market share during the forecast period with a notable size and will account for the second position. This growth is led by the increasing cardiovascular diseases and gastrointestinal disorders in this region. American College of Cardiology in 2021 stated that Asia Pacific saw an increase in CVD deaths from 5.6 million in 1990 to 10.8 million in 2019. Nearly 39% of these deaths from CVD occurred in people under the age of 70, compared to the U.S., where the percentage of premature CVD deaths was 23%.

There is a growing demand for advanced medical devices in China that is anticipated to increase market revenue. According to recent estimates, China’s medical devices industry is expected to set a share of about USD 36 billion in 2024.

The ultrasound market is anticipated to grow in coming years owing to Japan's growth in the healthcare technology sector in recent years. For instance, the International Trade Administration published a report in 2022 stated that about 37% of Japan’s population uses digital technology in health-related concerns and the health-tech market in Japan is predicted to surpass 3 billion by 2025.

Ultrasound Market Players:

- Koninklijke Philips N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mindray

- Zimmer MedizinSysteme GmbH

- General Electric Healthcare

- Mindray Medical International Limited.

- Siemens Healthineers AG

- Canon Inc.

- ESAOTE SPA

- GE Healthcare

Key players in the ultrasound market employ strategies that include production and development of revised product portfolios and new product launches, industry expansions aimed at improving their business operations and existing services, acquisitions of major health businesses to rapidly grow their core offerings, and distribution agreements with branded pharmaceutical manufacturers to reach a larger consumer base. Some of the key players include:

Recent Developments

- In February 2022, Koninklijke Philips N.V. introduced Lumify, a portable point-of-care ultrasound device, to broaden its range of products and provide sophisticated hemodynamic assessment and measurement functionalities.

- In July 2023, Mindray, a global leader and creator of healthcare solutions and technology in ultrasound, patient monitoring, and anesthesia, announced the release of its TE Air Wireless Handheld Ultrasound, a revolutionary imaging solution that enhances ultrasound accessibility.

- Report ID: 6284

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ultrasound Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.