Ultrapure Water Market Outlook:

Ultrapure Water Market size was valued at USD 9.8 billion in 2024 and is projected to reach a valuation of USD 28.9 billion by the end of 2037, rising at a CAGR of 8.6% during the forecast period, i.e., 2025-2037. In 2025, the industry size of ultrapure water is assessed at USD 10.6 billion.

The ultrapure water market is rising at a steady pace due to the rise in the need for high-quality water systems in the semiconductor, pharmaceutical, and biotechnology industries. Due to the increasing demand for high purity water, ultrapure water systems are becoming a critical component in the production process of manufacturing industries. In July 2024, Veolia Water Technologies launched an ultrapure water purification system for a biotechnology company with the use of MEDICA Pro 120 technology. This development supports the growing need for high purity water in molecular biology and life sciences, as well as promotes research and laboratory work with clean water.

The government and private investors are stepping up efforts to expand the market with a special emphasis on water sustainability. In November 2024, Toray Industries launched the TBW-XHR reverse osmosis membrane elements in the production of ultrapure water to increase the removal of urea. This innovation is in response to increasing concerns about the use of water in recycling in semiconductor fabrication and pharmaceutical industries. Furthermore, the United States Department of Agriculture (USDA) approved USD 16.6 million in January 2024 for the development of hydroelectric power and water purification systems in rural areas, which shows the increasing importance of ultrapure water in green energy and sustainable living.

Ultrapure Water Market - Growth Drivers and Challenges

Growth Drivers

- Rise in semiconductor manufacturing and growth of fabs: The Semiconductor industry is the leading consumer of ultrapure water used in wafer cleaning and lithography. Global semiconductor sales were USD 166 billion in Q3 2024, according to the Semiconductor Industry Association (SIA), and the use of ultrapure water systems remains strong. In June 2024, SK Hynix plans to invest USD 6.8 billion in a semiconductor fabrication plant in Yongin, South Korea, with UPW systems. This trend underlines the key position of ultrapure water in the further development of semiconductor manufacturing.

- Development in biotechnology and pharmaceutical industries: The biotechnology and pharmaceutical industries are using a large amount of ultrapure water in their research, drug production, and other laboratory applications. In January 2024, Thermo Scientific introduced the Aquanex ultrapure water system, which offers laboratories a new generation of purification for reagents and crucial applications. This growth driver is boosted by increasing spending on healthcare and life sciences, where precise water systems guarantee product quality and process performance.

- Global change in industrial processes and water reuse: Ultrpure water systems are being incorporated into overall corporate social responsibility plans to minimize waste and recycle water. In June 2024, ENOWA partnered with Nanostone Water, Inc. to design ceramic membrane technologies for water reuse and desalination technologies, which were presented at the Singapore International Water Week. This partnership is in line with the increasing focus on sustainable water treatment solutions across industries and in line with carbon-cutting goals.

Challenges

- Energy usage in water treatment systems: The generation of ultrapure water consumes much energy, especially in industries such as semiconductors and pharmaceuticals that require high purity water. Many large complexes use state-of-the-art water treatment systems that require a lot of energy and, therefore, increase expenses. This is a capital-intensive process which can be a discouragement to small businesses with few resources. To reduce the costs of production, industries are forced to embrace energy efficient technology as sustainability goals are scaling up.

- Regulatory compliance and water scarcity: Growing legal requirements for water usage and environmental protection are changing the approaches to the production of ultrapure water. Due to increasing concerns about water conservation, new regulations are being placed by governments and environmental agencies. These rules are forcing industries to opt for closed loop systems and recycling technologies in a bid to minimize water usage. However, areas that experience water scarcity face challenges in getting raw water to be used in the purification process.

Ultrapure Water Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

8.6% |

|

Base Year Market Size (2024) |

USD 9.8 billion |

|

Forecast Year Market Size (2037) |

USD 28.9 billion |

|

Regional Scope |

|

Ultrapure Water Market Segmentation:

Device Segment Analysis

The consumables segment is expected to lead the market, with a share of 50.5% during the forecast period. Ultrapure water systems require consumables such as filters, resins and membranes to ensure that the systems are running at their optimum. This is because they are used over and over again in different industries. In November 2024, Toray Industries released new TBW-XHR membrane elements to the consumable product category, strengthening the segment’s leadership. This growth is attributed to the need for replacement and upgrades of the systems to deliver quality water on a routine basis.

The consumables segment is also backed by sustained research and development activities aimed at increasing the durability and efficacy of these parts. Manufacturers are also working on improving the quality of the material used to minimize the need for replacement and time lost. Also, the concerns for water quality standards are compelling the end-users to go for certified and better performing consumables. The segment also has a higher prospect of demand in emerging markets such as the South East Asia and Middle East. Altogether, these factors strengthen the segment’s position in the ultrapure water systems market.

Application Segment Analysis

The cleaning liquid application is expected to dominate the market, recording a 47.8% share by 2037 due to the importance of ultrapure water in cleaning semiconductor wafers and pharmaceuticals. In March 2024, Pall Corporation presented new advanced filtration solutions for wafer cleaning at SEMICON West in order to improve the performance of semiconductor manufacturing facilities. This innovation shows the value of ultrapure water in the control of contamination and underlines that higher production yields are possible through operational excellence.

Another driver of demand in the cleaning segment is the increasing number of technologies that require nanoscale cleanliness, where even the slightest particles can hinder performance. Some of the industries that are using the concept of ultrapure water cleaning include optics, biotech and advanced material industries. Also, relationships between equipment manufacturers and semiconductor fabs are motivating the development of custom cleaning solutions. As the facilities expand and companies move to increase their production, the wear and tear of cleaning equipment and material needs to be replenished frequently. Therefore, the cleaning application remains relevant as a foundation for future development of the ultrapure water market.

Our in-depth analysis of the ultrapure water market includes the following segments:

|

Segment |

Sub-Segments |

|

Device |

|

|

Application |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

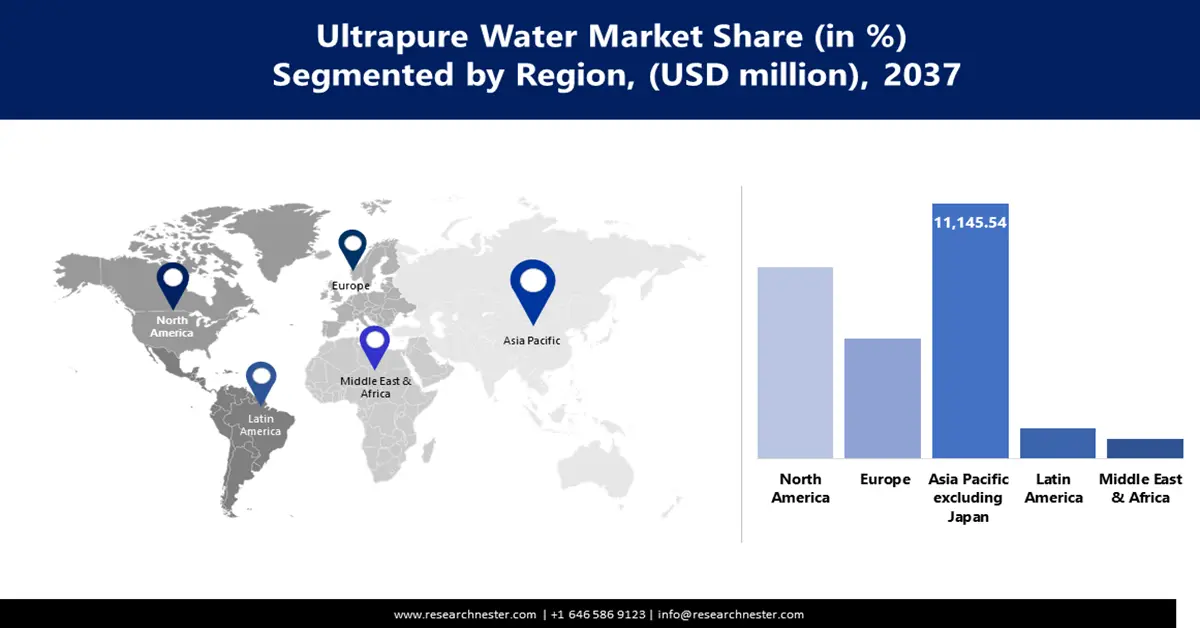

Ultrapure Water Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

Asia Pacific Excluding Japan is expected to capture 38.5% of the ultrapure water market share during the forecast period due to the increasing industrialization and increasing semiconductor production. The increase in industries like microelectronics, pharmaceuticals, and petrochemicals requires the use of ultrapure water in manufacturing. With increased rates of population density, the need for ultrapure water in various industries, including food, beverage, and energy industries, remains high, making Asia Pacific a significant market.

The ultrapure water market in India is anticipated to rise due to the government's investment in the expansion of the semiconductor industry and industrial development. Initiatives such as the Production Linked Incentive (PLI) scheme are likely to boost the demand for high purity water in sectors such as electronics and pharmaceuticals. With the country on the path to becoming a manufacturing hub, investments in water treatment facilities are also rising, which in turn is supporting the growth of ultrapure water plants in major industrial zones of the country.

China is one of the major players in the Asia Pacific of ultrapure water and has set a goal for the Made in China 2025 strategy. The government set the goal to reach a USD 305 billion output of semiconductors by 2030, which will cover 80% of domestic demand and require numerous large-scale ultrapure water systems for chip production. In May 2024, Veolia Water Technologies launched the first regeneration plant in China that provides ultrapure water to sectors like pharmaceuticals, petrochemicals, microelectronics, etc. This development is in line with China’s effort to boost its infrastructure and address the increasing water requirement in the industries.

North America Market Insights

North America ultrapure water market is projected to expand at a CAGR of 8.7% during the forecast period from 2025 to 2037 due to its application in semiconductor and pharmaceutical industries. The region’s strategic emphasis on advanced manufacturing technologies and technological advancement requires high-purity water systems necessary in precision-oriented industries. This has been due to the stringent laws on water quality and environmental protection in North America that make industries adopt sustainable ultrapure water solutions.

The U.S. leads the North America UPW market owing to increased investments in semiconductors and water recycling technologies. In August 2022, President Biden signed the CHIPS and Science Act, which provides USD 39 billion for the enhancement of domestic semiconductor manufacturing, and this will create more demand for ultrapure water in wafer fabrication. Also, in 2024, the U.S. Department of the Interior committed USD 179 million to finance new water reuse projects, which contribute to water security in the western states and provide adequate water supply to water-intensive sectors.

The ultrapure water market in Canada is rising at a steady pace due to the increasing business in the pharmaceutical and energy sectors. As a result of the growing concern in environmental conservation, industries in Canada have been procuring new technologies in water treatment to enhance quality. The government’s policy shifts towards the use of clean energy and environmentally friendly manufacturing are also driving market expansion. At the same time, partnerships between technological companies and international water treatment organizations are improving the nation’s capacity to create ultrapure water which is critical in technological innovation and eco-friendly production processes.

Key Ultrapure Water Market Players:

- Asahi Kasei Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont

- EBARA Technologies, Inc.

- Evoqua Water Technologies

- Hach Company

- Kurita Water Industries Ltd.

- Mitsubishi Chemical Group Corporation

- Nanostone Water

- Nomura Micro Science Co.,Ltd.

- Organo Corporation

- OVIVO

- Pall corporation

- Thermo Fisher Scientific Inc.

- Veolia Water Technologies

The global ultrapure water market is highly competitive, and the key industry players that are driving the innovation include Veolia Water Technologies, Pall Corporation, and Toray Industries. These organizations are increasing their product offerings through mergers and acquisitions and new product developments in order to meet the growing needs for UP water in various sectors. In June 2024, Veolia introduced Hubgrade Water Footprint, an artificial intelligence based real-time water management system that underlines the company’s vision of adopting technological approaches in water management.

Furthermore, in August 2024, Veolia increased its mobile ultrapure water services in Europe for the pharmaceutical, life science, and cosmetic sectors. This initiative is evidence of the transition to the market of a new generation of solutions that allow for the flexible use of services and continuous operation. The market remains dynamic as companies are investing in sustainable, efficient, and technologically driven systems to produce and supply ultrapure water.

Here are some leading companies in the ultrapure water market:

Recent Developments

- In March 2025, Gradiant secured a contract to design and build an ultrapure water (UPW) facility for a major semiconductor manufacturer in Dresden, Germany. This project marks Gradiant's second major semiconductor water treatment endeavor in the city, reinforcing its position as a key partner for critical water infrastructure in advanced industries. The initiative also coincides with Gradiant's full integration of H+E into its brand, enhancing its global service capabilities.

- In February 2025, BGR Tech Ltd. partnered with South Korea's Elchemtech Co. Ltd. to introduce advanced Proton Exchange Membrane (PEM) water electrolyser technology in India. This collaboration aims to bolster green hydrogen production by integrating Elchemtech's high-efficiency H2Lyser PEM electrolysers into BGR Tech's balance-of-plant solutions. Both companies are also exploring local manufacturing or assembly of PEM stacks to support the 'Make in India' initiative.

- In February 2025, CN Water expanded its focus to the semiconductor industry for its ultrapure water solutions. With over 35 years of experience and more than 700 operational plants nationwide, CN Water aims to leverage its expertise to meet the stringent water purity requirements of semiconductor manufacturing, marking a strategic move beyond its traditional pharmaceutical clientele.

- In October 2024, Mitsubishi Chemical’s Kyushu-Fukuoka Plant announced plans to expand ion exchange resin production capacity. Located in Kitakyushu City, the facility's expansion will address increasing demand for ultrapure water applications in semiconductors and pharmaceuticals. The initiative focuses on enhancing resin quality and production efficiency. Mitsubishi’s investment strengthens its competitive edge in ultrapure water markets, aligning with global semiconductor growth.

- Report ID: 6952

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ultrapure Water Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert