Titanium Fluoride Phosphate Market Outlook:

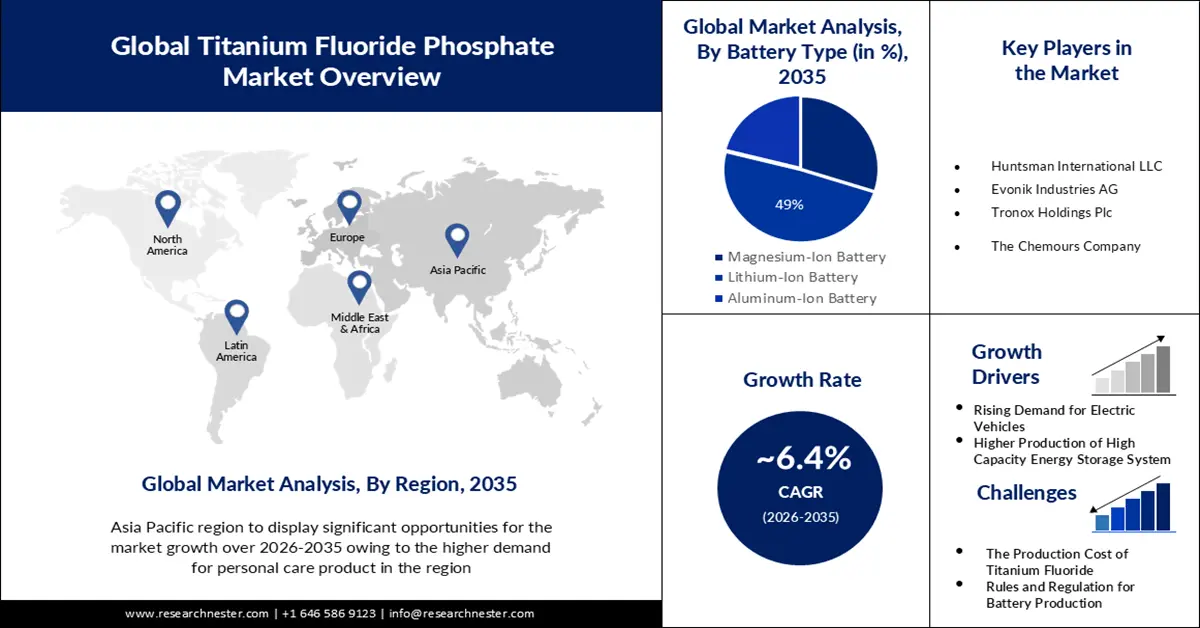

Titanium Fluoride Phosphate Market size was valued at USD 641.34 million in 2025 and is likely to cross USD 1.19 billion by 2035, expanding at more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of titanium fluoride phosphate is assessed at USD 678.28 million.

The growth of the market can be attributed to the growing adoption of electric vehicles. In the world, around 6.6 million which accounts for 9% of total automobiles in the world are electric vehicles. Moreover, in 2022, around 26 million cars on the roads were electric. TiFP is used both in lithium-ion batteries and solid-state batteries. It helps in development of electrolytes and boosts the performance and safety of batteries used in electric vehicles.

In addition to these, factors that are believed to fuel the growth of the titanium fluoride phosphate market due to the rising research and development of LiTiPO4F. Researchers are exploring LiToP)4F as a potential component in advanced battery technologies. This could include its use as electrode material or a part of electrolyte in the battery. The combined initiatives by academia, industry, and government have accelerated the development and adoption of LiToPO4F-based technologies.

Key Titanium Fluoride Phosphate Market Insights Summary:

Regional Highlights:

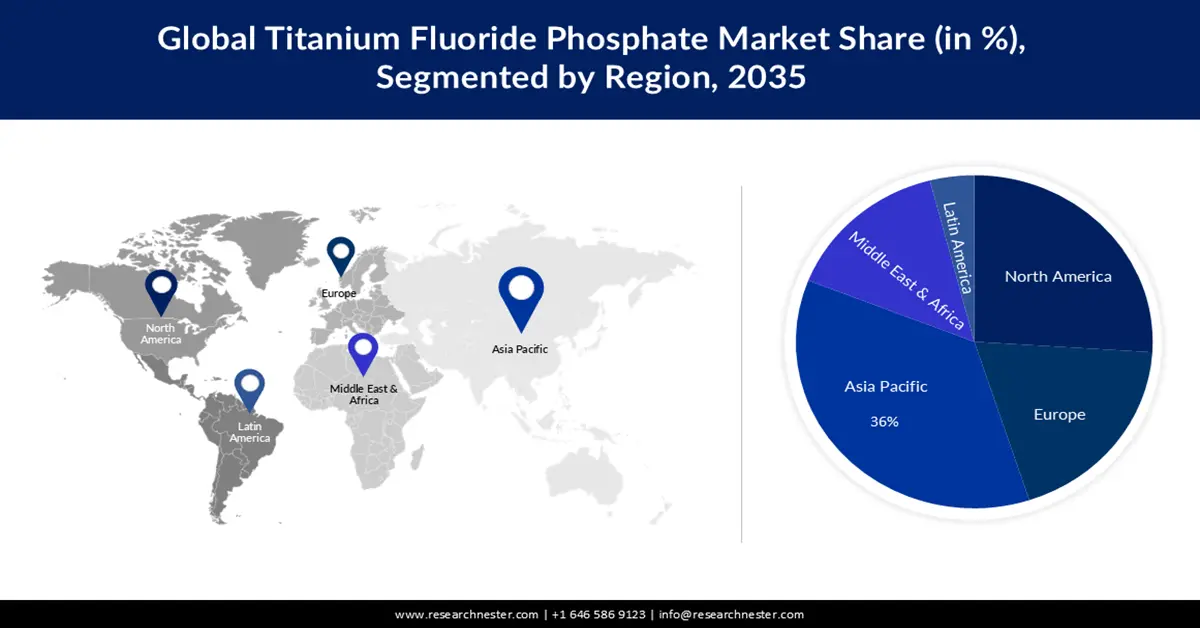

- Asia Pacific is projected to command a 36% share of the titanium fluoride phosphate market by 2035, supported by rising utilization of critical healthcare equipment driven by an expanding elderly population.

- North America is anticipated to secure around 26% share by 2035, fueled by escalating initiatives to enhance green-energy capacity.

Segment Insights:

- The lithium-ion battery segment is estimated to capture a 49% share of the titanium fluoride phosphate market by 2035, propelled by surging global demand for lithium-based batteries.

- The electric vehicle segment is set to hold nearly 40% share by 2035, underpinned by expanding battery-factory infrastructure dedicated to EV production.

Key Growth Trends:

- Rising Need for Safe Energy Storage Solutions

- Rising Regulations by the Government

Major Challenges:

- High Cost of Production

- High sensitivity of lithium ion battery towards temperatures

Key Players: The Chemours Company, Huntsman International LLC, Evonik Industries AG, Tronox Holdings Plc.

Global Titanium Fluoride Phosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 641.34 million

- 2026 Market Size: USD 678.28 million

- Projected Market Size: USD 1.19 billion by 2035

- Growth Forecasts: 6.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 25 November, 2025

Titanium Fluoride Phosphate Market - Growth Drivers and Challenges

Growth Drivers

- Rising Need for Safe Energy Storage Solutions – Installed grid-scale battery storage capacity nearly triples to nearly 970 GW in the Net Zero Scenario between 2022 and 2030. Around 170 GW of capacity will be added in 2030 alone, compared with 11 GW in 2022. TiFP has thermal stability which makes it perfect for large-scale energy storage systems. It improves the safety of grid energy storage solutions. However, Peak shaving, a practice in which extra power is kept during off-peak hours and employed during peak demand hours, can be accomplished with TiFP-enhanced energy storage. This minimizes the burden on the grid during periods of heavy demand.

- Rising Regulations by the Government- Governments across the globe are focusing on reducing emissions through working on more electronics. Moreover, the government is encouraging companies to make products that are less harmful to the environment such as automotive, and electronics companies. Therefore, this is expected to boost the growth of the titanium fluoride phosphate market.

Challenges

- High Cost of Production- Due to the necessity for specialized equipment and methods, the manufacture of titanium fluoride phosphate can be costly. The high cost of manufacture may limit its competitiveness in comparison to alternative battery materials, such as lithium iron phosphate. Moreover, the procedure of production also required huge energy, since it involved multiple cycles of heating and cooling and high-temperature reactions. The production process is small scale, therefore it becomes even more expensive in comparison to large-scale manufacturing which increases the per-unit production cost.

- High sensitivity of lithium-ion battery towards temperatures

- Problems associated with the manufacturing of lithium-ion batteries

Titanium Fluoride Phosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 641.34 million |

|

Forecast Year Market Size (2035) |

USD 1.19 billion |

|

Regional Scope |

|

Titanium Fluoride Phosphate Market Segmentation:

Battery Type Segment Analysis

The lithium-ion battery segment is estimated to account for 49% share of the titanium fluoride phosphate market in the year 2035. The growth of the segment can be attributed to the growing demand for batteries made up of lithium. The advent of electric vehicles has boosted its demand. Moreover, lithium-ion batteries find their application in various devices, such as pacemakers, solar energy storage, watches, digital cameras, smartphones, laptops, and others. The demand for lithium-ion batteries for electric vehicles (EVs) is fast increasing; it is expected to reach 9,300 gigatonnes-hours (GWh) by 2030, representing a 1,600% increase over 2020 levels across the globe.

Application Segment Analysis

Titanium fluoride phosphate market from the electric vehicle segment is expected to garner a significant share of around 40% in the year 2035. Electric car sales have expanded exponentially in recent years, owing to the enhanced range, greater model availability, and improved performance. The growth of the segment is attributed to the growing setup of battery factories specifically for electric vehicles. Volkswagen has introduced its plan to establish 6 new factories in Europe to achieve a combined capacity of 240 GWh by 2030. Moreover, the Pansonic-Tesla Gigafactory 1 in Newada is the world's largest mega factory, having an annual capacity of 37 GWH.

Our in-depth analysis of the global titanium fluoride phosphate market includes the following segments:

|

Battery Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Titanium Fluoride Phosphate Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 36% by 2035. The growth of the market can be attributed majorly to the rising demand for critical healthcare equipment, such as pacemakers, monitoring devices, resuscitation devices, and others. The aging population of Asia Pacific has also increased the instances of chronic diseases, therefore the need for this equipment is also rising. Every year, over 20,000 pacemakers are implanted in India, and the number is rapidly increasing. Furthermore, the rising initiatives by the government to boost the share of renewable energy share in the overall power sector is also expected to drive the market growth in the region.

North American Market Insights

The North America titanium fluoride phosphate market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed to rising initiatives to boost the capacity of green energy. The US wants to create roughly 50GW of net renewable generating capacity globally by 2030, up from 3.3GW in 2021. Following the acquisition of projects from 7X Energy, the government is pursuing solar energy projects across the United States through a 50-50 joint venture with Lightsource BP and through BP separately owned projects. A multiyear analysis of the North American power grid revealed that improving transmission and increasing electricity exchange might have considerable advantages, underlining potential customers for a coordinated, low-carbon continental system.

Titanium Fluoride Phosphate Market Players:

- The Chemours Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman International LLC

- Evonik Industries AG

- Tronox Holdings Plc

Recent Developments

- Evonik Industries AG has announced to hand over their Lulsdorf site to ICIG. The procedure was completed on June 30, and the site only focuses on specialty chemicals. Investors have acquired the entire site and all the business operations through it in Germany. Previously, the companies were part of Evonik's Performance Materials Division. Evonik has taken its initial step towards eliminating all three components of the division with its sale. ICIG will take over all production facilities and over 600 people. Employees have been granted extensive protection rights.

- The Chemours Company the leading provider of titianium technologies and advanced performance materials has announced to receive the third annual Carrier of the Year Award that recognizes the great efficiency of transporting Ti-Pure titanium dioxide (TiO2) to the customers. For the second year in a row, Marten Transport with Platinum award and Hirschbach Transportation Services with Gold award have been recognized.

- Report ID: 5275

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Titanium Fluoride Phosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.