Titanium Dioxide Market Outlook:

Titanium Dioxide Market size was valued at USD 22.5 billion in 2025 and is set to exceed USD 39.54 billion by 2035, expanding at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of titanium dioxide is estimated at USD 23.67 billion.

The market is driven by the increased consumption of paints & coatings in various end-use industries. According to the American Coatings Association, more than half of all coatings manufactured annually in the US are generated in the architectural coatings sector, which is both the largest and most concentrated area of the paint business. The architectural coatings business exported about USD 14 billion worth of products in 2021.

Key Titanium Dioxide Market Insights Summary:

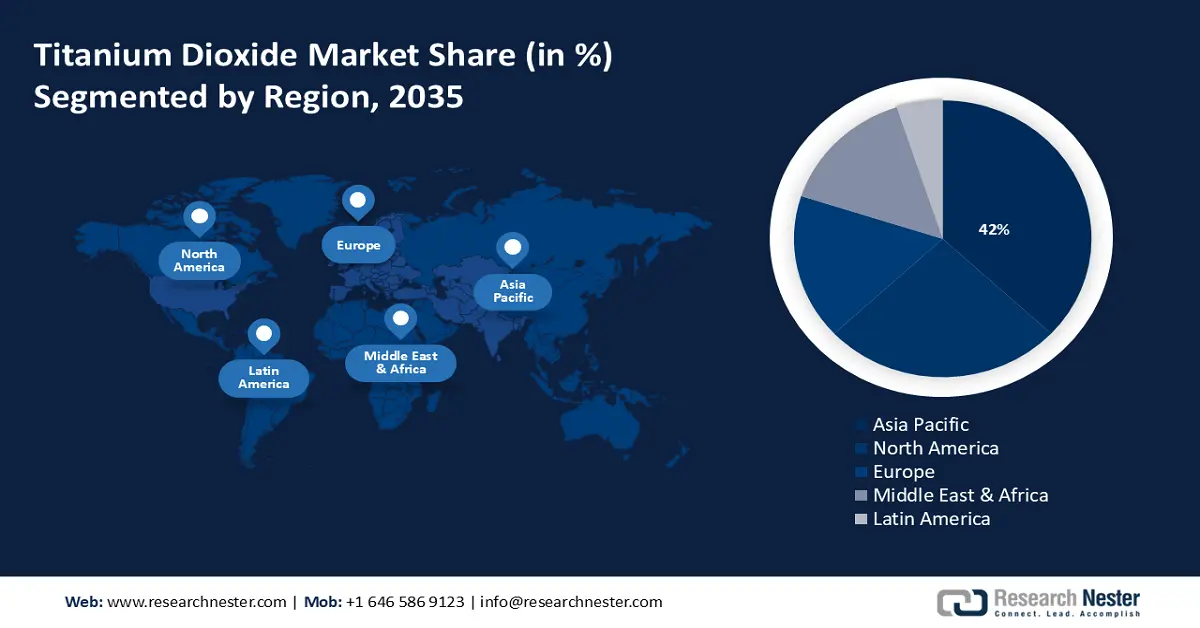

Regional Highlights:

- The Asia Pacific titanium dioxide market will dominate around 42% share by 2035, driven by growing construction activities and swift industrialization in the region.

- The North America market will account for 27% share by 2035, driven by increased building and construction activities in this region.

Segment Insights:

- Rutile segment in the titanium dioxide market is anticipated to achieve 62% growth by the forecast year 2035, driven by the growing construction industry and superior properties of rutile pigment.

- The paints & coatings segment in the titanium dioxide market is projected to experience substantial growth till 2035, driven by rising adoption in automobiles and the construction industry.

Key Growth Trends:

- Expansion of construction industry

- Growing adoption of architectural paints & coatings

Major Challenges:

- Stringent environmental regulations

- Fluctuating raw material prices

Key Players: The Chemours Company, Glantreo, The Tronox Holdings plc, LB Group, Venator Materials PLC, KRONOS Worldwide Inc., Evonik Industries AG, CNNC HUAN YUAN Titanium Dioxide Co., Ltd., The Kerala Minerals & Metals Limited, CATHAY INDUSTRIES.

Global Titanium Dioxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.5 billion

- 2026 Market Size: USD 23.67 billion

- Projected Market Size: USD 39.54 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Titanium Dioxide Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of construction industry - The demand for paints and coatings is being driven primarily by the global construction industry, which includes both residential and non-residential infrastructure. Rapid urbanization and industrialization, rising purchasing power parity (PPP), high living standards, and rising disposable income are the main factors driving the construction industry's expansion.

According to the most recent ICP data quoted by WHO in May 2024, the size of the world economy in PPP terms was USD 152 trillion in 2021. Over half of the total was accounted for by middle-income economies. The share of high-income economies was somewhat less than 50%. Less than 1% of the world's GDP was made up of low-income economies. Therefore, the expansion of the construction industry is fueling the growth of the titanium dioxide market. -

Growing adoption of architectural paints & coatings - Architectural paints and coatings are used with titanium dioxide. While certain specialist coatings must be chemical and corrosion-resistant, architectural paints must be UV and water-resistant. Titanium dioxide offers a very strong and long-lasting coating that is resistant to UV radiation from the sun and keeps paint looking brand-new for a long period. Paints and coatings intended for external surfaces contain titanium dioxide to improve resistance to color fading, chalking, and cracking.

-

Increased adoption in the cosmetics and construction industry - The particle size of ultrafine titanium dioxide is less than 100 nm. Titanium dioxide, an ultrafine nanomaterial, offers superior dispersibility, greater transparency, and more potent UV absorption and scattering capabilities. UVA and UVB are the two wavelengths of UV light that the sun emits.

These UV rays damage the skin, resulting in sunburn, cancer, and other issues. In the cosmetics sector, ultrafine titanium dioxide is used in a variety of products, including lotions, sunscreens, blushes, eyeshadows, and loose and pressed powders. Brightness, superior protection from UV radiation, and a faultless appearance are all provided by titanium dioxide's ultrafine nanoparticles.

Challenges

-

Stringent environmental regulations - Since the manufacturing of titanium dioxide releases a number of waste products, governments everywhere have imposed a number of regulations to regulate emissions and guarantee the proper disposal of this waste. Since titanium dioxide is acidic in nature, incorrect disposal practices lead to a host of environmental issues. When sulfuric acid is dumped into the ocean, the pH of the receiving water drops abruptly and the water's oxygen content decreases, killing marine life.

-

Fluctuating raw material prices - The fluctuation in the prices of raw materials required in the production of titanium dioxide directly impacts the growth of the market. Factors impacting the prices of raw materials necessary to manufacture titanium dioxide are the constant changes in import and export policies and stringent government norms imposed for environmental safety.

Titanium Dioxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 22.5 billion |

|

Forecast Year Market Size (2035) |

USD 39.54 billion |

|

Regional Scope |

|

Titanium Dioxide Market Segmentation:

Grade Segment Analysis

Rutile segment is poised to capture over 62% titanium dioxide market share by 2035. The segment growth can be attributed to the growing construction industry. The most prevalent naturally occurring type of titanium dioxide (TiO2) is rutile pigment, which has better weathering and concealing qualities than anatase.

In paint applications, rutile grade TiO2 is utilized as a carrier to provide white color in plastics and stop color fading in paper. For instance, in January 2023, Ti-PureTM TS-1510, an extremely effective rutile titanium dioxide pigment, was unveiled by The Chemours Company, a global chemistry company with leading market positions in Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials. TiO2 is intended to improve processing performance in plastics applications, including polyolefin masterbatch.

Process Segment Analysis

Sulfate segment in the titanium dioxide market is estimated to account for significant revenue by the end of 2035. The segment growth can be credited to the cost efficiency provided by sulfate to produce titanium dioxide. TiO2 is being used extensively in paints and coatings because of the expanding demand from the building and automotive industries. Because low-grade raw materials are used with less environmental impact and more affordable production machines are developed, technological improvement is helping to promote market expansion.

Application Segment Analysis

Paints & coatings segment in the titanium dioxide market is set to exhibit substantial CAGR from 2026 to 2035. The segment is growing due to the growing adoption of paints and coatings in automobiles and the construction industry. Also, the growing demand for automotive paint is influencing the growth of the segment.

This material has excellent durability, scratch resistance, and corrosion resistance when used as pigments in paints and coatings. Due to these qualities, the compound is used extensively in the construction and automotive industries, which is expected to fuel market expansion.

Our in-depth analysis of the global market includes the following segments:

|

Grade |

|

|

Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Titanium Dioxide Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to account for largest revenue share of 42% by 2035. The market growth in the region is also expected on account of growing construction activities which have increased demand for paints & coatings in the region. Also, swift industrialization and recent economic growth in the Asia Pacific have fueled the market for titanium dioxide. Furthermore, it is anticipated that the region's automobile consumption will rise as a result of the region's automakers' increased expenditures on electric vehicle technology. In automobile coatings, titanium dioxide serves as a dispersive agent and offers excellent chalk resistance and optimum gloss retention.

Paints and coatings are in greater demand in China as a result of the country's expanding building industry. According to the International Trade Administration, an estimated USD 4.2 trillion will be invested altogether in new infrastructure during the 14th Five-Year Plan period (2021–2025). It is anticipated that this will have a favorable effect on the market in the coming years. Therefore, increasing investment in infrastructure is propelling the growth of the market in China.

In Korea, industrial activity and economic expansion are driving up the usage of titanium dioxide as a whitening, flocculant, and dispersion agent. The chemical titanium dioxide is used as a dispersive agent with excellent chalk resistance and glass retention in automotive coatings.

North America Market Insights

North America region in titanium dioxide market is set to account for more than 27% revenue share by the end of 2035. This growth is owing to the increased building and construction activities in this region. According to a report, in the first quarter of 2023, there were over 919,000 construction establishments in the United States.

It is anticipated that the construction sector in North America will experience notable expansion in the upcoming years. The North American construction business has grown as a result of the strong demand for non-residential construction projects, such as hospitals, offices, and colleges.

Hospitals and multispecialty clinics make up the healthcare infrastructure in the United States. The market is anticipated to rise due to the growing demand in the construction sector. The building of more hospitals and healthcare facilities should increase demand for decorative and architectural paints and coatings in the region. According to the American Hospital Association, the United States has 6,120 hospitals. Over the course of the projection period, this is expected to boost demand for titanium dioxide (TiO2) across the paint and coatings industry.

The market in Canada is expected to grow majorly during the forecast timeframe. The primary factors propelling the market expansion are the rising customer desire for lightweight and affordable cars and the rise in new construction and renovation projects. The TiO2 market is being driven by this as well as increased trade activity, such as exports from the region. Additionally, a motivating aspect has been the growing demand from the healthcare sector throughout the worldwide epidemic.

Titanium Dioxide Market Players:

- The Chemours Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Glantreo

- The Tronox Holdings plc

- LB Group

- Venator Materials PLC

- KRONOS Worldwide Inc.

- Evonik Industries AG

- CNNC HUAN YUAN Titanium Dioxide Co., Ltd.

- The Kerala Minerals & Metals Limited

Prominent corporations are prioritizing regional expansion using diverse business approaches. Through mergers and joint ventures, as well as partnerships with exploration and mining companies, major participants in the titanium dioxide market are discovering new sources of titanium dioxide.

Recent Developments

- Chemours, a developer of titanium technologies, thermal and specialty solutions, and advanced performance materials, has introduced Ti-Pure TS-6700, a high-performance, TMP- and TME-free TiO2 grade for aqueous architectural coatings applications. Designed to fulfill the rising sustainability standards of coating makers, Ti-Pure TS-6700 is TMP- and TME-free and is manufactured with 100% renewable electricity. Ti-Pure TS-6700 is created and manufactured using a bio-based organic surface treatment that combines pigment performance, paint processing, and sustainability.

- Glantreo has launched a new TiO2 Platform Technology - SOLIT™. Glantreo has previously focused on silica-based technology, but we have now developed a titanium dioxide (TiO2) platform. SOLIT™ is used to generate and alter spherical titanium dioxide particles ranging from 200nm to 700nm. Photocatalysis and high-k dielectric materials are some of their applications.

- Report ID: 6248

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Titanium Dioxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.