Titanium Alloys Market Outlook:

Titanium Alloys Market size was valued at USD 10.24 billion in 2025 and is expected to reach USD 16.68 billion by 2035, registering around 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of titanium alloys is evaluated at USD 10.7 billion.

The titanium alloys market is experiencing significant growth, driven largely by a surge in global initiatives aimed at developing fuel-efficient aircraft. As the aerospace industry seeks to enhance performance and reduce environmental impact, manufacturers are increasingly turning to titanium alloys due to their lightweight properties, strength, and corrosion resistance. For instance, the International Civil Aviation Organization (ICAO) has set a global goal to increase the fuel efficiency of international aviation by an average of 2% per year between 2021 and 2050. At its 2010 session, the ICAO endorsed CNG2020 as a mechanism to become greenhouse gas (CO2) neutral starting in 2020 to accomplish this aim.

Also, titanium is ideally suited for use in the hostile environment of space due to its thermal stability and resistance to radiation. They are used in many structural and mechanical components of space missions, including the International Space Station and Mars rovers, to guarantee mission success and endurance in space exploration. Moreover, titanium alloys are used in critical applications in power plants, including heat exchangers and turbines, due to their resistance to heat and corrosion. The rise in renewable energy projects, such as offshore wind turbines, also supports market growth.

Key Titanium Alloy Market Insights Summary:

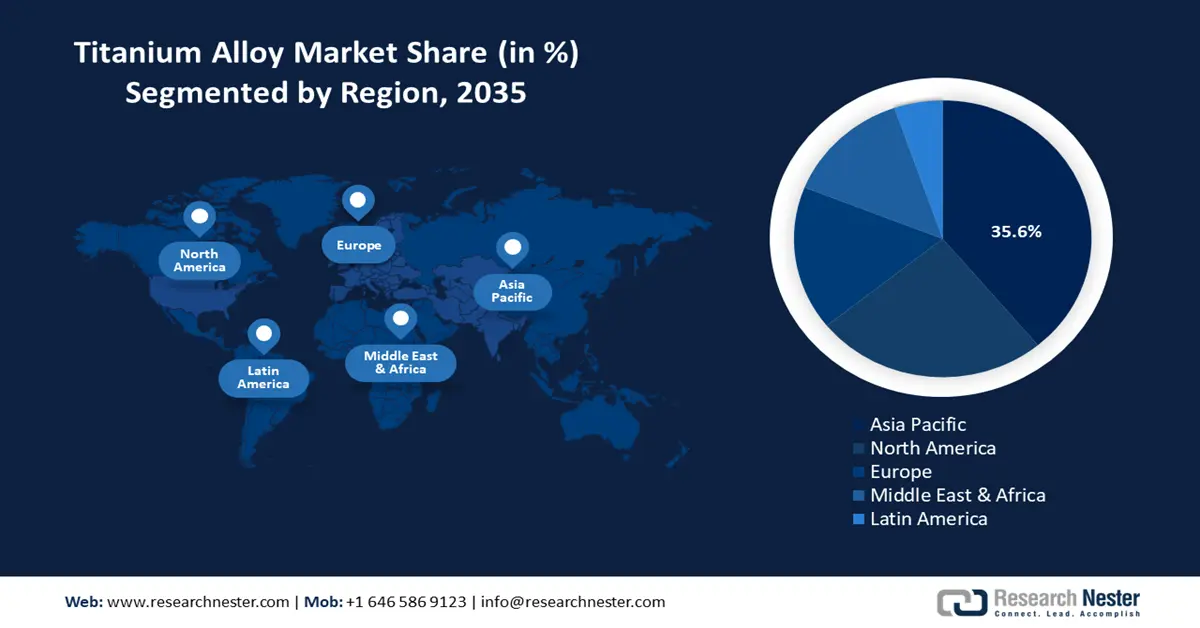

Regional Highlights:

- Asia Pacific's 35.6% share in the Titanium Alloys Market is fueled by increased usage in aerospace and defense sectors and the rising demand for fuel-efficient aircraft, driving growth through 2035.

- North America is anticipated to maintain a notable share in the Titanium Alloys Market from 2026 to 2035, driven by rising demand for titanium in 3D printing and defense R&D investments.

Segment Insights:

- The Alpha Alloys segment of the Titanium Alloys Market is expected to capture over 36.5% share by 2035, propelled by their low thermal expansion and high fire resistance coefficient.

- The Aerospace segment of the Titanium Alloys Market is expected to maintain a notable share through 2035, fueled by the swift increase in international defense accords boosting demand for high-performance materials.

Key Growth Trends:

- Increased use in medical applications

- Growing demand in the automotive industry

Major Challenges:

- Higher production cost

- Higher reactivity

- Key Players: ATI Inc., Altemp Alloys LLC, AMG Advanced Metallurgical Group NV, Carpenter Technology Corporation, Haynes International Inc., Boeing, Precision Castparts Corp., Ulbrich Stainless Steels & Special Metals, Inc., VSMPO-AVISMA CORPORATION, CRS Holdings, LLC.

Global Titanium Alloy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.24 billion

- 2026 Market Size: USD 10.7 billion

- Projected Market Size: USD 16.68 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Russia, Germany

- Emerging Countries: China, India, Japan, South Korea, Russia

Last updated on : 13 August, 2025

Titanium Alloys Market Growth Drivers and Challenges:

Growth Drivers

- Increased use in medical applications: Titanium alloys is the most popular material in orthopedics for parts that experience high, cyclic mechanical demand, especially stems and cups in articulations like the shoulder, hip, knee, and ankle where polymeric materials are not strong enough. In addition to this, titanium alloys has been used in dentistry for instruments, braces, abutments, screws, dental posts, and temporary devices.

Moreover, the use of titanium and titanium alloys in additional medical applications, such as cardiovascular devices, is facilitated by their mechanical strength and biocompatibility. Titanium alloys can create stents, heart valves, vascular grafts, portions of implantable defibrillators, pacemaker casings, and implantable sensors, making it vital in these devices. The American Heart Association reported that worldwide, more than 200,000 heart valve replacement procedures are carried out every year; by 2050, the number is expected to rise to 850,000. Therefore, as the demand for these biomedical devices continues to rise, the titanium alloys market is poised to benefit from this growth. - Growing demand in the automotive industry: Numerous automotive components, including exhaust systems, turbochargers, and pistons, use titanium alloys. Their excellent strength-to-weight ratio, corrosion resistance, and resistance to heat make them superior to other metals. Since SUVs and lightweight vehicles are becoming popular, the use of titanium alloys in the worldwide automobile industry is on the rise. According to the International Energy Agency (IEA) report, in 2023, about 14 million new electric vehicles were registered worldwide, increasing the total number of these vehicles on the road to 40 million.

Also, the automotive industry is driven by favorable government laws on producing electric vehicles, which presents several growth potentials for titanium alloys manufacturers worldwide. Although improving vehicle performance continues to be the priority for automakers, buyers are also seeking vehicles that provide safety, reduce noise, maximize fuel economy, and continuously cut hazardous emissions. Notably, these goals are achieved by using titanium alloys, which are widely used in valve springs and suspension. - Surge in technological advancements: The development of additive manufacturing, or 3D printing, is driven by the need for complexly shaped, high-quality metal components that can be delivered on time. The conventional technique for creating titanium alloys is powder metallurgy, but the newest technology is laser additive manufacturing. The benefits of 3D metal printing titanium-based components are reduced material loss, cost-effectiveness, and lightweight design. Additionally, the capability of additive manufacturing (AM) techniques to ensure complete material utilization and eliminate waste has been demonstrated through its use in processing titanium scraps.

Furthermore, major manufacturers strive to provide sustainable and cost-effective solutions by using additive manufacturing. For instance, in April 2021, BEAMIT created a titanium Ti6242 additive manufacturing technique. For motorsport and aviation applications, the business demonstrated that the Ti6242 titanium alloys manufactured using additive technology outperforms alloys treated using traditional technologies.

Challenges

- Higher production cost: Titanium alloys production necessitates heavy machinery and equipment which usually involves extremely high operating costs. New players in the industry are expected to encounter challenges from the rising manufacturing costs due to the post-trade war price increase for titanium alloys between the U.S. and China. Furthermore, sustaining the titanium alloys supply chain in the midst of growing raw material costs may have a detrimental impact on the titanium alloys market.

- Higher reactivity: From an engineering and industrial perspective, titanium's main drawback is its high reactivity, necessitating unique handling throughout the production process. It was originally nearly impossible to get rid of impurities that are added during the Kroll process, VAR, or machining. Therefore, this may hinder the titanium alloys market expansion.

Titanium Alloys Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 10.24 billion |

|

Forecast Year Market Size (2035) |

USD 16.68 billion |

|

Regional Scope |

|

Titanium Alloys Market Segmentation:

Micro Structure (Alpha Alloys, Near Alpha Alloys, Alpha + Beta Alloys, Metastable Beta Alloys)

The alpha alloys segment is expected to hold titanium alloys market share of over 36.5% by the end of 2035. The segment growth can be attributed to their low thermal expansion and high fire resistance coefficient. These properties along with their radiation resistance make them an ideal material for space industry applications, including rocket engines, spacecraft structures, and satellite components. Moreover, due to their low density and superior corrosion resistance in H2S and chloride conditions, alpha titanium alloys are becoming popular in the aerospace and space industries.

End use (Aerospace & Defense, Power Generation, Chemical Processing, Automotive, Marine, Fashion & Apparel, Oil & Gas Processing, Architecture, Medical, Sports)

The aerospace segment in titanium alloys market is estimated to garner a notable share in the forecast period. The growth can be attributed to several major factors, such as the swift increase in international defense accords, the exchange of fighter aircraft, and the growth of the aviation industry worldwide. Additionally, the proliferation of space programs and increased satellite launches have accelerated market expansion. According to the Space Foundation, with 223 launch attempts and 212 successful launches, global launch activity hit all-time highs for the third consecutive year. Compared to 2022, commercial launch activity rose by 50% in 2023. In addition to China, India, and Japan seeing higher activity, the U.S. saw a 33% rise in launch attempts. Titanium alloys are ideal for military, spaceship, and aircraft applications due to their exceptional properties, which include low weight, high tensile strength, and durability.

Our in-depth analysis of the global titanium alloys market includes the following segments:

|

Micro Structure |

|

|

Grade Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Titanium Alloys Market Regional Analysis:

APAC Market Statistics

Asia Pacific titanium alloys market is anticipated to hold revenue share of more than 35.6% by 2035. The market is growing in the region due to titanium alloy's increased use in various end-use industries, including chemical, medical, and aerospace. There is a rising demand for lightweight, high-performance fasteners driven by the need for aircraft that are not only lightweight but also fuel-efficient. This trend is fueled by the increasing desire for cost-effective, comfortable, and swift travel options, alongside a surge in international air travel.

Furthermore, the titanium alloys market is expected to witness significant growth in India and China due to the increasing expenditure on defense and military. Also, spending on defense infrastructure, purchasing new weapons, ammunition, and technologies, as well as domestic defense R&D, has received attention.

The governments of both nations have raised their defense budgets in anticipation of the ongoing border confrontations. For instance, in India, the budget allocation of USD 74.3 billion for 2024 represents a minor increase over 2023, focusing on improving domestic defense manufacturing and modernizing the armed services. On the other hand, China's 2024 defense budget was USD 236 billion.

North America Market Analysis

North America will hold a notable share of the titanium alloys market in the projected period. The market is growing in the region owing to the growing need for titanium in 3D printing technology and government investments in research & development activities for the production of titanium alloys. For instance, in October 2023, to boost titanium powder manufacturing for defense supply chains, the Department of Defense announced that IperionX Technology, LLC was granted USD 12.7 million through the Defense Manufacturing Act Investment (DPAI) Program.

Furthermore, increased aircraft exports in the U.S. is escalating the demand for titanium alloys. The U.S. became the world's top exporter of aircraft and spacecraft in 2022, with USD 40.3 billion in exports. Moreover, a growing preference for environmentally friendly materials, which consume less energy and emit fewer greenhouse gases during manufacture, is driving titanium alloys market expansion. Also, Canada’s aging population and growing incidence of orthopedic disorders are surging demand for titanium alloy-based orthopedic implants such as hip and knee replacements. According to the Government of Canada, 6.6 million seniors, or nearly one-fifth (17.5%) of the total population, lived in Canada in 2019. By 2040, the number of seniors is expected to rise to about one-fourth of the total population.

Key Titanium Alloys Market Players:

- ATI Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altemp Alloys LLC

- AMG Advanced Metallurgical Group NV

- Carpenter Technology Corporation

- Haynes International Inc.

- Boeing

- Precision Castparts Corp.

- Ulbrich Stainless Steels & Special Metals, Inc.

- VSMPO-AVISMA CORPORATION

- CRS Holdings, LLC

Leading producers of titanium alloys are implementing creative strategies such as acquisitions, mergers, inventive marketing techniques, and technology breakthroughs. In addition to these strategies, firms are working with end-use industries to boost their earnings and solidify their position in the titanium alloys market.

Recent Developments

- In March 2024, ATI Inc. celebrated the commissioning of its cutting-edge 12,500-ton billet forging press, which is vital to the manufacturing of titanium for aerospace and defense. The Bakers South II press, or BSOII, went online in Q1-2024 to match ATI's expanded titanium melt capacity, providing increased capabilities for the production of high-performance, difficult-to-manufacture unique alloys.

- In November 2021, Boeing and Russian titanium producer VSMPO-AVISMA signed a Memorandum of Understanding (MOU), confirming that VSMPO-AVISMA will continue to be the leading titanium supplier for existing and future Boeing commercial aircraft.

- Report ID: 6842

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Titanium Alloy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.