Tire Material Market Outlook:

Tire Material Market size was over USD 94.7 billion in 2025 and is estimated to reach USD 161.3 billion by the end of 2035, expanding at a CAGR of 6.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of tire material is estimated at USD 100.4 billion.

The international market is rapidly evolving, highly influenced by technological advancements, sudden transitions in customer preferences, and the unveiling of the latest industrial applications. According to official statistics published by NLM in June 2025, nearly 3 billion new tires are readily produced every year, and almost 800 million tires tend to become waste annually. Besides, tire rubber comprises natural or synthetic rubber, accounting for 40% to 60%, along with 20% to 25% of filters and reinforcing agents such as silica and carbon black, 12% to 15% of extender or process oils, and 1% to 2% of vulcanization agents, including thiazoles and zinc. Additionally, tires consist of an estimated 50:50 ratio of natural and synthetic rubber, thereby creating a sustainability balance, which is bolstering the market’s exposure globally.

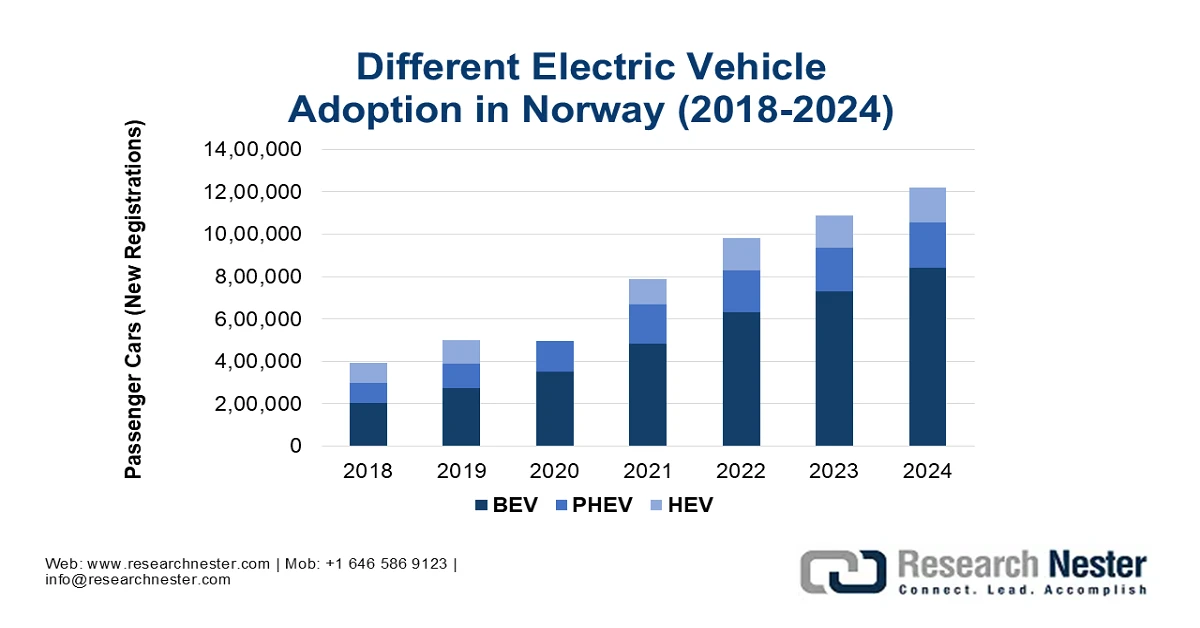

Furthermore, mobility electrification, smart tire implementation, specialty and high-performance applications, recycling strategies, and the regional supply chain diversification are other trends that are boosting the market internationally. As per an article published by the IEA Organization in 2025, the electricity fleet of electric vehicles across different modes, except for 2/3 Ws, is poised to reach 250 million, which is 4 times as many electric vehicles by the end of 2030. In addition, over 90% are electric cars, which is effectively similar to the share as of 2024, thus enhancing the market’s demand across different regions. Therefore, in this particular scenario, electric vehicle stocks have gradually increased at an average rate of almost 25% every year, which is nearly half the yearly growth witnessed between 2018 and 2024, thereby making it suitable for boosting the market’s exposure.

Electric 2/3-Wheeler Stock in the Stated Policies Scenario (2024-2030)

|

Year |

Number of Vehicles |

|

2024 |

68 million |

|

2025 |

78 million |

|

2026 |

92 million |

|

2027 |

108 million |

|

2028 |

126 million |

|

2029 |

147 million |

|

2030 |

170 million |

Source: IEA Organization

Key Tire Material Market Insights Summary:

Regional Highlights:

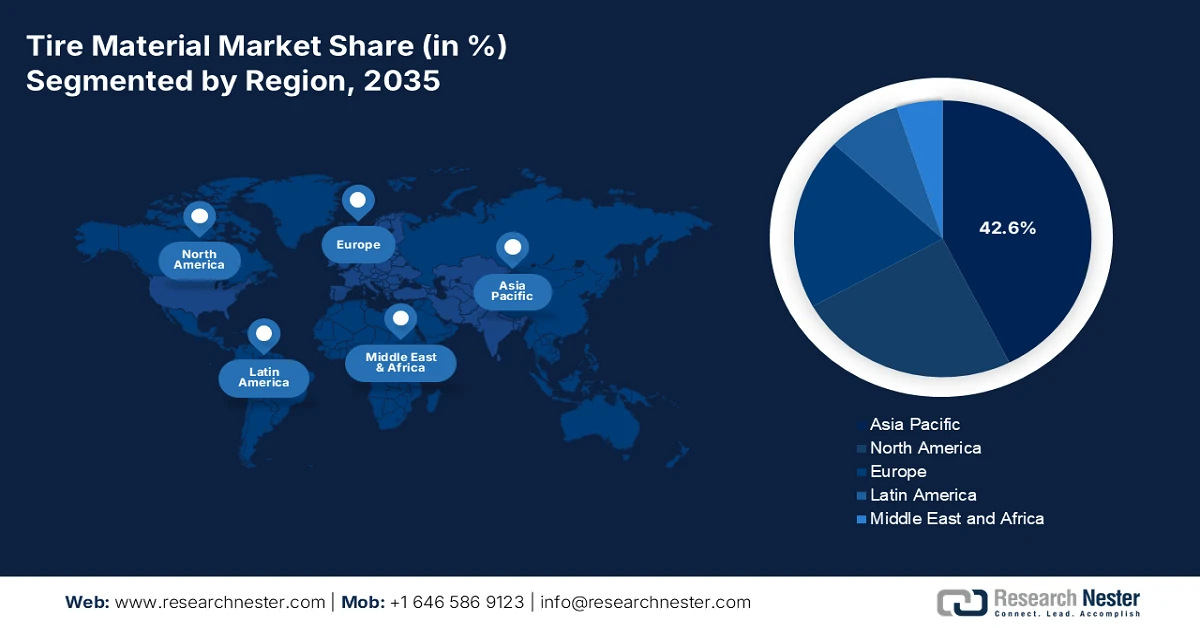

- Asia Pacific is forecast to command the largest 42.6% share by 2035 in the tire material market, buoyed by rapid automotive manufacturing expansion, strong chemical R&D capabilities, and supportive government sustainability frameworks.

- Europe is projected to register the fastest growth over the forecast period, stimulated by stringent environmental regulations, accelerating electric vehicle penetration, and large-scale investments aligned with circular economy initiatives.

Segment Insights:

- Natural rubber (Elastomers) is projected to account for a dominant 55.8% share by 2035 in the tire material market, supported by its exceptional elasticity, fatigue endurance, and high tear resistance enabling superior performance in heavy-duty and aircraft tires.

- Carbon black (Reinforcing Fillers) is expected to secure the second-highest share by the end of the forecast period, underpinned by its ability to significantly enhance tire strength, abrasion resistance, and overall durability through advanced reinforcement properties.

Key Growth Trends:

- Increase in urbanization

- Rise in middle-class consumption

Major Challenges:

- Volatility in raw material prices

- Environmental regulations and compliance expenses

Key Players: Bridgestone Corporation (Japan), Michelin Group (France), Goodyear Tire & Rubber Company (U.S.), Continental AG (Germany), Sumitomo Rubber Industries, Ltd. (Japan), Pirelli & C. S.p.A. (Italy), Hankook Tire & Technology Co., Ltd. (South Korea), Yokohama Rubber Company, Ltd. (Japan), Toyo Tire Corporation (Japan), Kumho Tire Co., Inc. (South Korea), Apollo Tyres Ltd. (India), MRF Limited (India), CEAT Limited (India), Giti Tire (Singapore), Nokian Tyres plc (Finland), Cooper Tire & Rubber Company (U.S.), Balkrishna Industries Limited (India), Sailun Group Co., Ltd. (China), Dunlop Tyres (UK), Rubber Research Institute of Malaysia (Malaysia).

Global Tire Material Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.7 billion

- 2026 Market Size: USD 100.4 billion

- Projected Market Size: USD 161.3 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: India, Thailand, Indonesia, Vietnam, Mexico

Last updated on : 3 February, 2026

Tire Material Market - Growth Drivers and Challenges

Growth Drivers

- Increase in urbanization: The rapid urbanization in Latin America, Africa, and Asia is gradually increasing the demand for construction equipment, buses, and commercial vehicles, which is enhancing the market’s exposure globally. According to official statistics published by the World Bank Organization in 2026, more than 4 billion people reside in cities, and this particular shift is expected to continue, with the urban population projected to be more than double by the end of 2050, wherein almost 7 in 10 people are poised to reside in cities. Besides, internationally, 1.8 billion people, which is 1 in 4, reside across high-risk flood zones, with the majority living in urbanized coastlines and river plains. Therefore, this directly boosts tire consumption, eventually uplifting the demand for reinforcing fillers and synthetic rubber.

- Rise in middle-class consumption: The growth in disposable incomes across emerging nations is positively fueling automobile ownership, especially for two-wheelers and passenger cars, which is positively boosting the market’s growth. As stated in a data report published by FRED Organization in January 2026, the global disposable income amounted to USD 21,267 billion in December 2023, which is followed by USD 22,329 billion in 2024, and USD 23,094 billion in 2025. This continuous rise in demographic transition is readily driving the need for high-performance and affordable tire materials, particularly in Southeast Asia, China, and India, thereby creating a huge growth opportunity for the market.

- Technological innovation in polymer science: The aspect of breakthroughs in polymer chemistry is significantly enabling the tire material market with long-lasting lifespan, reduced rolling resistance, and enhanced grip. As stated in a data report published by the CIEL Organization in 2024, plastic polymers currently account for 8% to 14% of oil demand, and with present trends, this is projected to rise significantly. In addition, petrochemicals readily drive plastic polymer production, and by the end of 2030, their demand is expected to surge by 56 billion cubic meters, which is equivalent to half of Canada’s overall gas consumption. Besides, a few countries are proactively focused on pursuing strategies to enhance the production of coal-based plastics, thus denoting an optimistic outlook for the market internationally.

Challenges

- Volatility in raw material prices: The tire material market is heavily dependent on natural rubber, synthetic rubber, and petrochemical derivatives. Price volatility in these inputs creates uncertainty for manufacturers. Natural rubber prices fluctuate due to climate change impacts on Southeast Asia-based plantations, while synthetic rubber is tied to crude oil prices, which are influenced by geopolitical tensions and supply disruptions. This volatility affects production costs, profit margins, and long-term planning. For instance, when crude oil prices surged in 2022, synthetic rubber costs also rose, thus forcing tire manufacturers to adjust pricing strategies. Moreover, small-scale players are particularly vulnerable, as they lack the financial resilience to absorb sudden cost increases.

- Environmental regulations and compliance expenses: Governments worldwide are tightening environmental regulations on chemical production and tire manufacturing. Agencies such as the Europe Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) enforce strict standards on emissions, waste disposal, and chemical safety. Compliance requires significant investment in cleaner technologies, waste treatment facilities, and sustainable material research and development. For instance, Europe’s REACH regulation mandates extensive testing and documentation for chemical substances, increasing operational costs for tire material producers. While these regulations push the market toward sustainability, they also create financial and logistical burdens.

Tire Material Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 94.7 billion |

|

Forecast Year Market Size (2035) |

USD 161.3 billion |

|

Regional Scope |

|

Tire Material Market Segmentation:

Elastomers Segment Analysis

The natural rubber sub-segment, which is part of the elastomers segment, is anticipated to garner the highest share of 55.8% in the market by the end of 2035. The sub-segment’s upliftment is highly driven by its elasticity, fatigue resistance, and superior tear resistance. Additionally, its ability to withstand extreme deformation and high tensile strength has made it indispensable for heavy-duty aircraft and truck tires. Based on government estimates published by the Rubber Board Government in May 2025, the sub-segment’s production in India accounted for 875,000 tons between 2024 and 2025, denoting an optimistic growth of 2.1% in comparison to 857,000 tons between 2023 and 2024. Besides, the overall area under rubber plantation in the nation approximately expanded to 941,200 ha, thereby creating a positive outlook for the sub-segment’s growth in the market.

Reinforcing Fillers Segment Analysis

By the end of the forecast period, the carbon black segment under reinforcing fillers is projected to hold the second-highest share in the market. The segment’s growth is highly fueled by the aspect of its production through the incomplete combustion of heavy petroleum products; carbon black enhances tire strength, durability, and resistance to wear. Its microscopic structure provides superior reinforcement by improving tensile strength and abrasion resistance, making it indispensable for passenger, commercial, and specialty tires. The segment’s growth is closely tied to rising automotive production and demand for high-performance tires in both developed and emerging economies. Carbon black also plays a critical role in improving tire safety by enhancing grip and reducing rolling resistance, which contributes to fuel efficiency.

Textile Reinforcements Segment Analysis

The polyester segment in the tire material market is expected to account for the third-highest share by the end of the stipulated timeline. The segment’s development is primarily attributed to its popularity stemming from its excellent dimensional stability, high strength-to-weight ratio, and resistance to heat and fatigue. Polyester fibers provide structural integrity to tires, ensuring they maintain shape under high loads and speeds. Besides, in comparison to nylon, polyester offers lower shrinkage and better thermal stability, making it particularly suitable for passenger car and light truck tires. The segment’s growth is driven by rising demand for lightweight and fuel-efficient tires. Polyester reinforcements reduce rolling resistance, contributing to improved vehicle efficiency and compliance with stringent emission standards.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Elastomers |

|

|

Reinforcing Fillers |

|

|

Textile Reinforcements |

|

|

Metal Reinforcements |

|

|

Plasticizers & Chemicals |

|

|

Manufacturing Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tire Material Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to garner the largest market share of 42.6% by the end of 2035. The market’s upliftment is highly driven by generous advancements in chemical research and development, the presence of robust government sustainability mandates, and rapid automotive production. According to official statistics published by the AFMA Organization in July 2024, the light vehicle industry in the region has experienced a 0.8% growth as of 2023, highly propelled by economic recovery as well as resolved supply chain risks. Besides, China has led this growth with an 11% year-on-year (YoY) increase in vehicle units sold, which is followed by 8% in India and 15% in Japan. Moreover, Thailand has aimed to produce 725,000 electric vehicles every year by the end of 2030, while Indonesia has significantly attracted EV projects, including BYD’s USD 1.3 billion factory, all of which are positively impacting the market’s exposure.

The tire material market in China is growing significantly, owing to massive automotive production, the existence of government sustainability mandates, chemical and industrial scale infrastructure, as well as research and development innovation. As stated in an article published by the CEN ACS Organization in January 2025, the country’s chemical product manufacturing and chemical raw materials industry effectively grew by 9.5% as of 2024. However, domestic enterprises across different industries reduced by an average of 4.3%. Besides, the country’s government has significantly rolled out huge economic stimulus measures, which includes loans of over USD 1.3 trillion to assist localized governments in paying their respective debts and effectively stimulate their respective economies, thereby making it suitable for bolstering the market.

The aspects of government investments in chemicals, rapid industrialization and automotive demand, green chemistry adoption, policy and circular economy initiatives are readily responsible for uplifting the market in India. As stated in an article published by the IBEF Organization in December 2025, the chemical industry in the country is one of the most influential industries for manufacturing, readily contributing nearly 7% of the gross domestic product (GDP). The industry significantly manufactures more than 80,000 commercial products in bulk chemicals, agrochemicals, petrochemicals, specialty chemicals, fertilizers, and polymers. Besides, the chemical industry in the nation amounted to Rs. 21,50,750 crore (USD 250 billion) as of 2024, and is projected to surge to Rs. 35,26,800 to Rs. 39,67,650 crore (USD 400 billion to USD 450 billion) by the end of 2030, thus proliferating the market’s upliftment in the country.

Europe Market Insights

Europe tire material market is expected to emerge as the fastest-growing region during the forecast period. The market’s development is highly propelled by the existence of strict regional sustainability mandates, the rise in electric vehicle adoption, and circular economy approaches. According to official statistics published by the SOCI Organization in December 2025, chemicals are the ultimate part of the region’s manufacturing industry, significantly responsible for the majority of investment, amounting to 17.7% of the total. Besides, the Europe Commission has estimated that generous investment is essential between 2030 and 2050, with the chemical industry accounting for 37% or €12.9 billion every year. However, other estimates for suitable funding of net-zero strategies in the industry recommended that the shift can cost an estimated €35 billion per year, thus denoting a huge growth opportunity for the market.

The market in Germany is gaining increased traction due to the availability of government-funded sustainability programs, robust chemical industry infrastructure, and strong automotive manufacturing. As stated in a data report published by the GTAI in 2025, the country is considered the world’s largest car-producing hub, with 60% branded vehicles readily manufactured by domestic OEMs, and of these, 24% have been physically developed in the country as of 2023. Besides, there has been a record of over 1.6 million all-electric vehicle registrations by the end of 2024, along with nearly 160,000 charging stations, of which over 125,000 were categorized as normal charging stations, with more than 35,000 fast-charging stations. Moreover, different automotive organizations have recorded huge registrations, thus enhancing the market’s demand in the country.

Organizational Groups with Maximum Transactional Patent Registrations in Germany (2025)

|

Company Name |

Registration |

Share of Registration in % |

|

Bosch |

3,026 |

6.2 |

|

Volkswagen |

2,525 |

5.2 |

|

Schaeffler |

991 |

2.0 |

|

BMW |

927 |

1.9 |

Source: GTAI

The push for chemical industries to implement eco-friendly tire materials, achieve carbon neutrality targets, increase electric vehicle penetration, and implement aggressive sustainability policies are factors that are boosting the tire material market in Norway. As per an article published by the EVTCP Organization in 2025, as of 2024, electric vehicles accounted for 89% of new car sales in the country, denoting a rise from 82% in 2023, and gradually moved near to the 2025 objective. Besides, the average payer’s pricing of the latest passenger cars reduced to €48,000, with Tesla remaining the most popular car. Moreover, the country has successfully surpassed its ultimate target of 9,000 fast chargers, gaining an average of 87 battery electric vehicles per charger. Meanwhile, the continuous rise in battery, plug-in hybrid, and hybrid electric vehicles is also proliferating the market in the country.

Source: EVTCP Organization

North America Market Insights

North America tire material market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by advanced chemical manufacturing, sustainability mandates, and an increase in demand for automotive. Based on government estimates published by the USITC Government in January 2024, more than 1 million people are employed in the U.S. for producing motor vehicles as of 2022, which represents over 8% of the domestic manufacturing employment. In addition, automotive exports account for the majority of U.S. exports, catering to 8% to 10% of exports. Besides, automotive assembly tends to act as a multiplier in localized communities, wherein every additional assembly employment enhances local jobs by 6.6%. Therefore, with continuous growth in this industry, the market is gradually increasing in the region.

The presence of the EPA green chemistry program, an increase in energy chemical production, advanced manufacturing programs, and the existence of clean energy chemicals are responsible for boosting the tire material market in the U.S. As per an article published by the Center for Sustainable Systems in 2026, 82% of energy in the country derives from fossil fuels, 8.7% from nuclear, and 9.1% from renewable sources. Besides, the country comprises an estimated 463,400 TWh of renewable energy technical potential, which is more than 100 times the electricity consumption and less than 1% of its utilization. Besides, as per the January 2026 EIA Government article, there has been a decrease in energy-based carbon dioxide emissions by 2.2% this year in comparison to 2025, thereby making it suitable for bolstering the market’s exposure in the overall country.

Renewable Energy Utilization in the U.S. (2020-2023)

|

Energy Source (Quads) |

2020 |

2021 |

2022 |

2023 |

|

Geothermal |

0.12 (1.6%) |

0.12 (1.5%) |

0.12 (1.5%) |

0.12 (1.5%) |

|

Solar |

0.51 (7.0%) |

0.63 (8.2%) |

0.76 (9.4%) |

0.88 (10.6%) |

|

Hydroelectric |

0.97 (13.3%) |

0.86 (11.2%) |

0.87 (10.7%) |

0.82 (9.9%) |

|

Wind |

1.15 (15.8%) |

1.29 (16.9%) |

1.48 (18.3%) |

1.45 (17.6%) |

|

Biomass |

4.55 (62.3%) |

4.75 (62.1%) |

4.86 (60.0%) |

4.98 (60.4%) |

Source: Center for Sustainable Systems

The tire material market in Canada is gaining increased exposure, owing to government sustainability mandates, automotive industry transformation, trade and resource advantage, along with the presence of research and innovation programs. As per an article published by the Government of Canada in August 2024, the wide-ranging transition to electric vehicles is crucial to decarbonizing on-road transportation, accounting for 20% of the country’s overall greenhouse gas emissions, of which 50% has been produced by light-duty vehicles and passenger cars. Besides, the Minister of Energy and Natural Resources declared a federal investment of USD 7.5 million for 35 projects through the Zero-Emissions Vehicles Awareness Initiative (ZEVAI). This investment has been suitable for educating and raising awareness among the population regarding zero-emission vehicles, thus uplifting the market’s exposure.

Key Tire Material Market Players:

- Bridgestone Corporation (Japan)

- Michelin Group (France)

- Goodyear Tire & Rubber Company (U.S.)

- Continental AG (Germany)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Pirelli & C. S.p.A. (Italy)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- Yokohama Rubber Company, Ltd. (Japan)

- Toyo Tire Corporation (Japan)

- Kumho Tire Co., Inc. (South Korea)

- Apollo Tyres Ltd. (India)

- MRF Limited (India)

- CEAT Limited (India)

- Giti Tire (Singapore)

- Nokian Tyres plc (Finland)

- Cooper Tire & Rubber Company (U.S.)

- Balkrishna Industries Limited (India)

- Sailun Group Co., Ltd. (China)

- Dunlop Tyres (UK)

- Rubber Research Institute of Malaysia (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Bridgestone Corporation is the world’s largest tire manufacturer and a major consumer of natural and synthetic rubber. The company invests heavily in sustainable tire materials, including bio-based polymers and advanced fillers, aligning with Japan’s green innovation policies.

- Michelin Group is a pioneer in eco-friendly tire technologies, with strong research and development in recyclable materials and low-resistance compounds. Its commitment to the circular economy and partnerships under the Europe Green Deal position it as a leader in sustainable tire material innovation.

- Goodyear Tire & Rubber Company emphasizes advanced synthetic rubber and silica-based compounds to enhance fuel efficiency and durability. The company collaborates with U.S. government sustainability programs, including EPA-backed initiatives, to reduce environmental impact in tire material production.

- Continental AG is a key innovator in high-performance elastomers and reinforcing fillers, supported by Germany’s strong chemical industry infrastructure. The company’s focus on smart, sustainable tire materials aligns with Europe-driven regulatory frameworks and Germany’s automotive leadership.

- Sumitomo Rubber Industries, Ltd. is expanding its portfolio of eco-friendly tire materials, including bio-based elastomers and advanced textile reinforcements. Its research and development initiatives are closely tied to Japan’s industrial innovation programs, strengthening its competitive position in the Asia Pacific market.

Here is a list of key players operating in the global market:

The worldwide tire material market is highly competitive, dominated by established players from Asia, Europe, and North America. Companies such as Bridgestone, Michelin, and Goodyear leverage scale, research and development, and sustainability initiatives to maintain leadership. Strategic priorities include investment in bio-based polymers, recyclable fillers, and AI-driven manufacturing processes. Asian manufacturers, particularly in China, Japan, and India, are expanding aggressively through government-backed sustainability programs and partnerships with automotive OEMs. Besides, in January 2026, Solvay introduced its newest bio-circular silica infrastructure in Italy, readily facilitating Europe-based sustainability rules for tires and effectively supporting consumers’ sustainability objectives. This is possible while expanding Italy’s industrial leadership, which is positively impacting the tire material market’s growth globally.

Corporate Landscape of the Tire Material Market:

Recent Developments

- In November 2025, Flexsys declared that it has successfully developed the industry’s first-ever viable alternative to 6PPD for its utilization in tires by collaborating with highly regarded federal and independent research laboratories.

- In November 2025, The Goodyear Tire & Rubber Company has significantly completed the notified divestiture of the majority of its Goodyear Chemical business to an affiliate of Gemspring Capital Management for a purchase of USD 650 million.

- In December 2024, Prism Worldwide announced that it has generously raised USD 40 million in Series A and Series A1 funds to consolidate operations, expand the team, and make capital investments in equipment and technology, thus making it suitable for developing sustainable and high-performance polymer-based end-of-life tires.

- Report ID: 3537

- Published Date: Feb 03, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tire Material Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.