Third Party Risk Management Market Outlook:

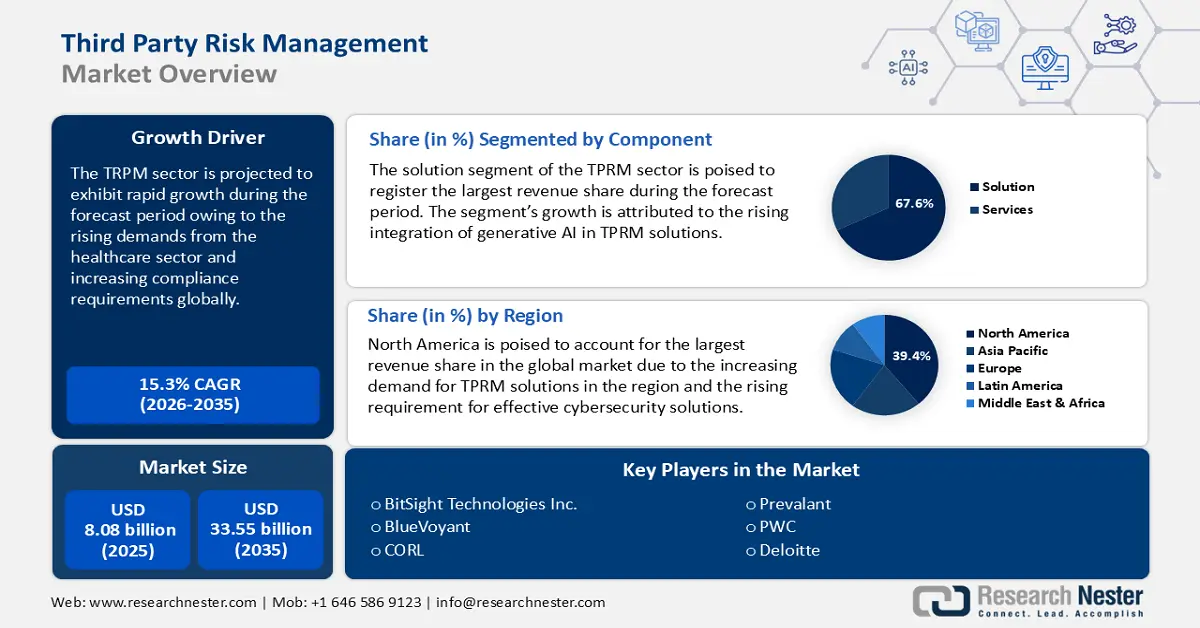

Third Party Risk Management Market size was over USD 8.08 billion in 2025 and is projected to reach USD 33.55 billion by 2035, growing at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of third party risk management is evaluated at USD 9.19 billion.

The third party risk management sector’s growth is due to rising reliance on external vendors to manage sectors that heavily rely on sensitive data such as the financial and healthcare sector. Third party risk management solutions provide diligent background checks and financial assessments while assisting organizations comply with regulatory requirements. For instance, in May 2024, the Office of the Comptroller of the Currency (OCC) of the U.S. Department of Treasury released a TPRM guidance for the community banks in the country, which will benefit the larger adoption of TPRM solutions in the BFSI sector.

The global supply chain risk management is a major driver of adopting TPRM services. The rising interdependency of supply chains has led to investments in mitigating risks. The COVID-19-related supply chain disruptions have further necessitated investments to secure the global supply chain and rising threats of geopolitical instability and cybersecurity risks bolster the need for TPRM solutions to proactively identify supply chain vulnerabilities. The rising opportunities for third party supply chain management are evident by businesses expanding their portfolios to offer innovative solutions. For instance, in May 2024, Kharon and Exiger announced a strategic partnership to help businesses and government organizations secure fragile global supply chains.

The third party risk management market is poised to provide lucrative opportunities to small and medium-sized enterprises by providing solutions for risk protection, creating a profitable segment for the service providers. Additionally, industrial expansion in emerging economies is positioned to enable TPRM service providers opportunities to expand their portfolios and leverage new revenue streams in the global market. For instance, in October 2024, the African Development Bank released a contract to select a company for acquisition, implementation, maintenance, and training of third party risk management solutions. Such lucrative contracts are positioned to boost the robust growth of the sector and tailored region-specific or industry-specific solutions are poised to provide a steady stream of opportunities in the TPRM market.

Key Third-party Risk Management Market Insights Summary:

Regional Highlights:

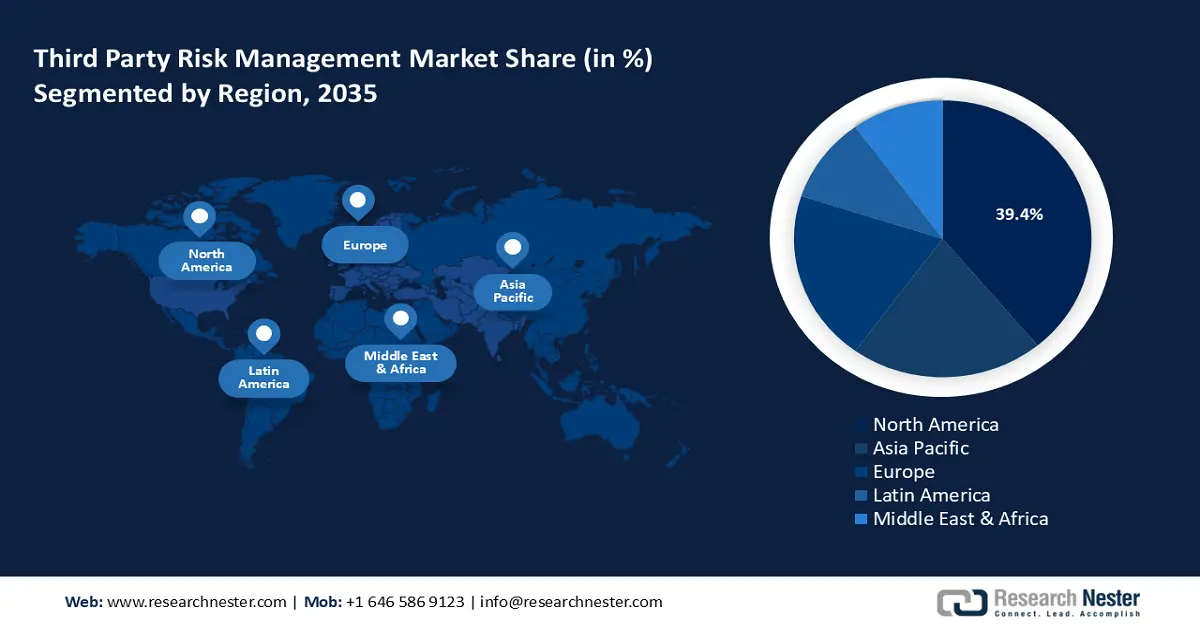

- North America third party risk management market will dominate around 39.40% share by 2035, driven by the increasing prevalence of cyber threats and stringent compliance requirements, boosting demand for TPRM solutions.

- Europe market will grow rapidly through 2035, driven by the implementation of NIS-2 directives and DORA to improve supply chain security and cybersecurity measures.

Segment Insights:

- The solution segment in the third party risk management market is projected to secure a 67.60% share by 2035, driven by the rise of automated solutions powered by generative AI for third-party risk management.

- The bfsi segment in the third party risk management market is expected to hold the largest share by 2035, attributed to the rising cyberattack cases and the need for robust risk management and security solutions.

Key Growth Trends:

- Rising demand from the healthcare sector

- Environmental, Social, and Governance (ESG) compliance and AI risk management demands

Major Challenges:

- Blind spots in periodic risk management

- Complex management of fourth- and fifth-party vendors

Key Players: BitSight Technologies Inc., BlueVoyant, CORL, Prevalent, 6Clicks, PwC, Aon PLC, Deloitte, OneTrust, Logicmanager Inc.

Global Third-party Risk Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.08 billion

- 2026 Market Size: USD 9.19 billion

- Projected Market Size: USD 33.55 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 16 September, 2025

Third Party Risk Management Market Growth Drivers and Challenges:

Growth Driver

- Rising demand from the healthcare sector: The third party risk management sector is positioned to exhibit profitable growth by leveraging the rising demand from the healthcare sector. The increasing adoption of electronic health records (EHS) drives demand for third party vendors to manage sensitive data. Additionally, the advent of cloud solutions for healthcare boosts demand for third party risk management to ensure data privacy along with operational continuity. For instance, in February 2024, Health 3PT announced advancements in solving TPRM issues in the healthcare sector, and are poised to help organizations reduce vendor risk and streamline their vendor risk process.

Furthermore, ransomware attacks on healthcare systems have jeopardized treatments, leading to significant financial losses. The healthcare sector is investing proactively to mitigate such risks through third party risk management frameworks, and TPRM solutions provider can benefit from the rising demand by expanding their solutions portfolio. For instance, in June 2024, CORL announced the release of the CORL Companion, which is an AI-powered assistant for healthcare vendors to automate and enhance security assessment responses. - Environmental, Social, and Governance (ESG) compliance and AI risk management demands: The rising ESG regulations imposed on corporations are a pivotal factor in driving demand for third-party risk management. TPRM solutions can access vendors for their alignment in ESG goals to create a sustainable supply chain. The rising consumer scrutiny of major corporations and their environmental impact has necessitated the adoption of TPRM solutions. Additionally, corporations are actively seeking to mitigate greenwashing risks to avoid incurring penalties. For instance, in October 2024, the Securities and Exchange Commission charged the advisory firm Wisdom Tree for failing to adhere to investment criteria for ESG-marketed funds.

Furthermore, the rising proliferation of AI solutions globally in various sectors has necessitated robust AI risk management solutions and TPRM companies can leverage the emerging segments by forwarding innovative solutions. For instance, in November 2024, Mitratech launched AI and ESG added capabilities for its third party risk management platform. - Technological innovations in risk management: The third party risk management market is set to benefit from the technological innovations in risk management. Integration of AI-powered analytics in third party risk management software is poised to improve the quality and accuracy of services. For instance, in November 2024, Diligent announced the launch of AI-powered due diligence reports that will offer organizations easy access to comprehensive third-party agreements.

Additionally, TPRM service providers are set to leverage demand from multiple end users to offer advanced solutions and expand their revenue share. An emerging driver of the market is the rise of blockchain with the potential to provide a tamper-proof way to verify vendor credentials while mitigating data manipulation risks. For instance, in November 2024, Arxiv published a study on the efficacy of a blockchain-enhanced framework for secure third-party vendor risk management and found a significant reduction in identified vulnerabilities within the vendor assessment process. The positive findings of the research hold the potential for increasing the prevalence of blockchain-enhanced frameworks in TPRM solutions.

Challenges

- Blind spots in periodic risk management: The periodic vendor assessments can limit real-time assessment, and instead be reliant on static snapshots of risks. Additionally, periodic assessments can create blind spots that can undermine risk management strategies and affect the sector’s growth. The periodic approach can cause challenges in volatile industries such as the BFSI sector.

- Complex management of fourth- and fifth-party vendors: Challenges may arise in effectively managing risks associated with fourth and fifth-party vendors that can cause supply chain entanglements. Overlooking the extended supply chain network can create vulnerabilities that are prone to breaches. For instance, the SolarWinds cyberattack is indicative that insufficient scrutiny of upstream vendors can lead to catastrophic consequences for government and businesses alike.

Third Party Risk Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 8.08 billion |

|

Forecast Year Market Size (2035) |

USD 33.55 billion |

|

Regional Scope |

|

Third Party Risk Management Market Segmentation:

Component Segment Analysis

By 2035, solution segment is set to dominate third party risk management market share of over 67.6%. A major growth driver of the segment is the rise of automated solutions with the advent of generative AI. TPRM solutions providers are leveraging machine learning solutions to advance risk monitoring. Furthermore, cloud-based solutions are gaining traction owing to their ability to provide centralized dashboards for multi-vendor engagements.

The third party risk management market analysis indicates that TPRM solutions providers who are proactively expanding portfolios to integrate AI solutions are well-positioned to be ahead of the curve in the competitive market. For instance, in July 2024, Prevalent announced the addition of multiple AI-powered threat sensing solutions to the Prevalent Third Party Risk Management Platform and offers SaaS enterprise applications. The rising opportunities in the segment are indicated by the adoption of Prevalent's SaaS solution by multiple organizations, evident by Prevalent and TBDCyber announcing a strategic third party risk management partnership in August 2024.

The services segment of the third party risk management market is poised to expand during the forecast period. The rising demand for TPRM services as a package drives the segment's growth. Businesses are demanding TPRM services in a package that will include consulting, implementation, training, managing, deployment, etc., tailored to an organization's specific needs creating lucrative opportunities for the segment's growth.

Furthermore, consulting services help businesses design effective frameworks for vendor selection and provide robust risk assessments. TRPM consulting services are positioned to find heightened demand from sectors with high-risk stakes such as the pharmaceutical sector. Key players operating in the segment are investing in acquisitions to broaden their market presence. For instance, in December 2024, Schellman & Company, LLC announced the carve-out acquisition of the TPRM practice from Connor Consulting.

End user Segment Analysis

The BFSI segment share of third party risk management market will be the largest by the end of the forecast period. A major growth driver of the increasing end use in the BFSI vertical is the rising cases of cyberattacks. Advancements in TPRM software benefit the adoption rates owing to robust risk management and security solutions provided. Furthermore, regulatory frameworks such as the Basel III require banks to meet risk-based capital ratios prompting financial institutions to manage heightened vendor diligence.

TPRM solutions providers are expanding AI capabilities to leverage the rising demand from the BFSI sector. For instance, in October 2024, the Audit board announced a robust collection of AI offerings to automate time-consuming workflows and management of risks by offering automated vendor assessments, and framework updates. Additionally, banking software companies are leveraging AI-integrated TPRM solutions for risk management. For instance, in August 2024, Treasury Prime, a leading banking software company announced a partnership with Cobalt Labs to help bank clients access new capabilities for third party risk management compliance while scaling Banking as a Service (BaaS) programs.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

End user |

|

|

Organization |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Third Party Risk Management Market Regional Analysis:

North America Market Insights

North America in third party risk management market is set to account for more than 39.4% revenue share by the end of 2035 owing to the increasing prevalence of cyber threats. TPRM solutions providers are bolstering their cybersecurity offerings to leverage the rising demand for risk management solutions. instance, in October 2024, 6clicks, a leading provider of AI solutions for cyber governance and risk in the region was named a Cool Vendor in the 2024 Gartner Cool Vendors in third party risk management report.

Furthermore, continued oversight and guidance by the Federal Reserve, along with other U.S. agencies, prompts businesses in North America to implement robust management practices. Additionally, the rising adoption of digital tools and technologies, including cloud services, heightens the requirement for TPRM solutions. Furthermore, the regional supply chain disruptions caused by the pandemic have highlighted the need to assess third party vulnerabilities.

The U.S. holds a significant revenue share in the North America third party risk management market. The stringent compliance requirements in the U.S. drive the adoption of third party risk management services. For instance, the Cybersecurity Maturity Model Certification (CMMC) is required for companies in the Defense Industrial Base DIB (DoD) supply chain. Companies in the U.S. operating within the supply chain risk management segment are set to leverage from offering solutions for the stringent certification frameworks. For instance, in August 2024, LMI announced a contract to develop the Supply Chain Risk Evaluation Environment (SCREEn) for the U.S. Department of Defense (DoD) Chief Digital and Artificial Intelligence Office (CDAO), and the contract is valued at USD 43 million.

Furthermore, sectors such as healthcare are increasingly integrating TPRM solutions to comply with stringent data privacy regulations such as HIPAA. The finance sector in the U.S. is projected to improve its standing as a major end user of TPRM services by the end of the forecast period. Companies are leveraging collaboration to create robust TPRM platforms for effective risk management in the BFSI sector. For instance, in December 2024, MetLife and General Atlantic announced the formation of Chariot RE with an initial combined equity investment of over $1 billion that is poised to provide risk management solutions in reinsurance.

Canada is a lucrative market in the North America third party risk management sector owing to rising demand from multiple end use industries. Unlike the U.S. market, where compliance frameworks are industry-specific, Canada has an approach that emphasizes universal data protection standards such as the Personal Information Protection and Electronic Documents Act (PIPEDA) and the General Data Protection Regulation (GDPR). The stringent frameworks drive demand for TPRM services in the country.

Furthermore, the rise of a digital ecosystem has amplified the significance of TPRM as businesses in Canada expand in the international markets. Businesses are expanding their portfolio to provide robust TPRM services and leverage the opportunities in the domestic market of Canada. For instance, in August 2024, Abaxx announced the acquisition of PrivacyCode Inc., and the acquisition is poised to boost the risk management tools portfolio of Abaxx.

Europe Market Insights

The Europe third party risk management market is poised to exhibit a rapid growth during the forecast period. The implementation of NIS-2 directives by the European Union (EU) to improve the security of supply chains has created lucrative markets within Europe that key players in the TPRM sector are tapping into. In October 2024, the implementing regulation of NIS-2 was applied to specific categories of companies providing digital services as the EU seeks to improve cybersecurity measures. Additionally, the Digital Operational Resilience Act (DORA) was implemented in Europe from January 2023 to ensure that the financial sector in Europe remains resilient in the event of critical operational disruption.

The robust regulatory frameworks in Europe create a burgeoning market for key companies operating within the market to offer effective TPRM solutions, as well as expand their services to other markets. For instance, in March 2024, Aon plc announced the launch of the digital platform, Partner Risk Insights, to help U.S. organizations simplify the way they manage insurance-related third-party risk.

Germany is positioned as a burgeoning market in the Europe third party risk management market due to its status as an economic and industrial powerhouse, requiring robust TPRM solutions. The well-established manufacturing sector in Germany requires regular supply chain assessment. Furthermore, the German Supply Chain Due Diligence Act (SCDDA) requires enterprises with central administration in the country to ensure due diligence obligations boosting demand for TPRM solutions to evaluate risks in the vendor ecosystems.

Additionally, the increasing proliferation of cloud services in various sectors is positioned to boost a continued demand for TPRM services. To leverage the opportunities, businesses are launching efficient solutions in the domestic market. For instance, in August 2024, Coalition announced the launch of its Active Cyber Insurance in Germany through its subsidiary, Coalition Insurance Solutions GmbH which is designed to help businesses spot and respond to emerging cyber threats.

France is a lucrative market in the Europe third party risk management market. The increasing digitalization drive in the country creates opportunities in the TPRM market, and the European Union drives growth, with businesses actively seeking TPRM solutions to secure supply chains and improve cybersecurity. Additionally, the ESG reporting requirements for corporations’ prompt companies to invest in robust TPRM consultancy services to mitigate risks.

Additionally, companies with a presence in France are integrating the DORA frameworks to provide heightened TPRM solutions. For instance, in August 2024, ProcessUnity announced the launch of its turnkey Digital Operational Resilience Act (DORA) solution for entities regulated in the European Union (EU) and their business partners. With more businesses seeking to effectively navigate the stringent regulatory frameworks, the sector in France is poised to provide a stable stream of opportunities in the TPRM market.

Third Party Risk Management Market Players:

- BitSight Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BlueVoyant

- CORL

- Prevalent

- 6Clicks

- PwC

- Aon PLC

- Deloitte

- OneTrust

- Logicmanager Inc.

- UpGUARD

- Panorays

The third party risk management market is poised to expand during the forecast period. Leading market players are leveraging AI and ML to boost risk detection and provide actionable real-time monitoring solutions to improve TPRM adoption. Investments in R&D to develop software platforms and portfolio expansion via strategic acquisitions are poised to assist major players in expanding their revenue shares in the market. In November 2024, BlueVoyant released its fifth annual global survey on supply chain cyber risk management demonstrating progress in TPRM with respondents shifting focus from awareness to enforcement and compliance.

Here are some key players in the market:

Recent Developments

- In December 2024, Certa was named to 2024 ProcureTech100, highlighting their leadership in AI-Powered third party risk management. The recognition comes as Certa launches groundbreaking generative AI capabilities across its platform, setting new standards for intelligent third-party management.

- In Novemeber 2024, Viso Trust announced the securing of USD 24 million in total with participation from existing investors, Bain Capital Ventures, Work-Bench, Sierra Ventures, and Lytical Ventures, and new investors, Allstate Strategic Ventures, Cisco Investments, EnvisionX Capital, and Scale Asia Ventures. This funding will further VISO TRUST's mission to transform TPRM through an adaptive AI-driven platform and provide effective TPRM solutions to enterprises globally.

- Report ID: 5758

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Third-party Risk Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.