Thionyl Chloride Market Outlook:

Thionyl Chloride Market size was valued at USD 742.46 million in 2025 and is likely to cross USD 1.19 billion by 2035, registering more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thionyl chloride is estimated at USD 774.53 million.

The demand for thionyl chloride has been increasing steadily due to its various applications in agrochemicals, pharmaceuticals, and battery manufacturing. Being an intermediate in the production of numerous compounds, this chemical is quite important in pharmaceutical and specialty chemical industries. Due to its high demand and wide range of applications, the market for thionyl chloride is expected to continue expanding. As industries get more inclined to efficiency and seek sources with the enhancement of their material's ability to produce, a chemical source like thionyl chloride becomes crucial for them.

Thionyl chloride producers have been taking several steps towards making more sustainable and environmentally friendly production systems. For instance, in August 2021, Solvay collaborated with Saudi Basic Industries Corporation (SABIC), aiming to enhance the production of thionyl chloride while keeping its pollution low and using natural resources very efficiently. The growth in the market is due to government initiatives that have promoted domestic chemical production so that the country does not import much. Furthermore, policies that support chemical manufacturing will positively impact thionyl chloride as it supports local production and innovation.

Key Thionyl Chloride Market Insights Summary:

Regional Highlights:

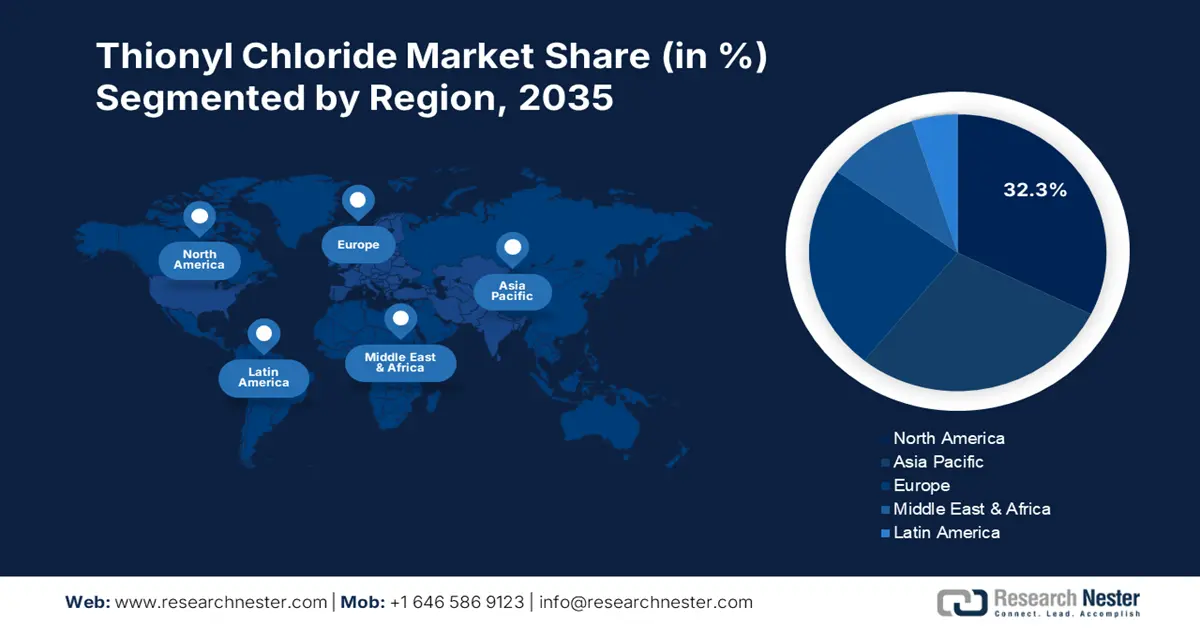

- North America dominates the Thionyl Chloride Market with a 32.3% share, driven by strong pharmaceutical and agrochemical industries and emphasis on chemical R&D, supporting growth through 2035.

- The Asia Pacific Thionyl Chloride Market is poised for lucrative growth by 2035, driven by rapid industrialization, growing chemical demand, and low-cost production capabilities.

Segment Insights:

- The Organic Synthesis segment is projected to capture over 25.2% share by 2035, propelled by increasing demand for thionyl chloride in scalable compound production.

- The Technical Grade segment is poised for substantial growth from 2026-2035, driven by its extensive use in industrial chemical processes and cost-effective applications.

Key Growth Trends:

- Expanding pharmaceutical industry

- Growing demand for agrochemicals

Major Challenges:

- Environmental regulations

- Health and Safety Issues

- Key Players: ChemTik, China Pingmei Shenma Group, Chuyuan Group, Jiangxi Selon Industrial Co. Ltd., Angene International Limited, Aurora Fine Chemicals LLC, CABB Group, Changzhou Xudong Chemical, Lanxess AG, Shandong Kaisheng New Materials Co. Ltd., Shangyu Wolong Chemical, and Sichuan Boxing.

Global Thionyl Chloride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 742.46 million

- 2026 Market Size: USD 774.53 million

- Projected Market Size: USD 1.19 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Thionyl Chloride Market Growth Drivers and Challenges:

Growth Drivers

- Expanding pharmaceutical industry: Thionyl chloride has wide applications in the synthesis of intermediates and APIs of pharmaceuticals. Growth in emerging markets remains one of the key drivers for thionyl chloride demand. Production under the Production Linked Incentive (PLI) scheme started in the country way back in March 2021 to increase indigenous pharma production. With this, the indigenous production has gone up, and thereby consumption also increased. Moreover, continued improvement in formulations is raising the demand for high-quality reagents such as thionyl chloride.

- Growing demand for agrochemicals: Increasing demand for more agricultural output leads to an increased application of agrochemicals, for which thionyl chloride is used as a starting material. The Food and Agriculture Organization (FAO) reports that pesticide usage is on the increase all over the globe. This helps the farmers to meet the food requirements of the rising population. Besides, as optimization of crop yield is one of the key focus areas across the world, the contribution of chemical inputs such as thionyl chloride is expected to grow stronger in the segment of agrochemicals.

- Battery market growth: Thionyl chloride-based lithium batteries feature a long shelf life and high energy density; hence, they can be employed as reliable sources of power in medical equipment and military devices. In January 2021, MilliporeSigma acquired AmpTec with the view to further develop its advanced therapy and diagnostics platform. This illustrates the increasing requirement for more robust, high-performance power solutions. This is one of the trends that has marked the use of thionyl chloride in contributing toward sustainable and long-lasting energy solutions in very high-stake applications.

Challenges

- Environmental regulations: Thionyl chloride is a hazardous substance and hence comes under severe environmental regulations for its production and handling. Compliance with such environmental rules increases the manufacturing cost. In February 2021, the European Chemicals Agency revised the REACH regulation guidelines and, along with that, increased the control measures over hazardous materials like thionyl chloride, affecting the production process and cost management.

- Health and Safety Issues: The hazardous, corrosive, and toxic nature of thionyl chloride heightens the demand for health and safety in the workplace. OSHA (the Occupational Safety and Health Administration in the United States) called for better safety conditions around any hazardous chemical, including thionyl chloride, as it updated its chemical exposure standards to ensure worker safety in June 2022.

Thionyl Chloride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 742.46 million |

|

Forecast Year Market Size (2035) |

USD 1.19 billion |

|

Regional Scope |

|

Thionyl Chloride Market Segmentation:

Grade (Technical Grade, Pharmaceutical Grade)

By 2035, technical grade segment is expected to capture over 67.5% thionyl chloride market share due to its extensive use in industrial applications where ultra-high purity may not be required. Technical grade thionyl chloride is widely used in the preparation of dyes, pigments, and as a chlorinating agent in various chemical processes. For example, Angene International announced in January 2022 that it expanded into technical-grade chemical specialties targeting niche and emerging end-markets. This reflects the demand in the market to keep pace with cost-advantaged technical-grade chemicals suitable for large-scale industrial use. Such expansions emphasize the growing role of thionyl chloride in regions that continue to expand production in the chemical industry.

Application (Agrochemicals, Pharmaceuticals, Dyes & Pigments, Organic Synthesis, Batteries)

In thionyl chloride market, organic synthesis segment is expected to account for more than 25.2% revenue share by the end of 2035 due to significant applications in synthesizing a variety of organic compounds. Thionyl chloride plays a vital role in the production of carboxylic acids and in the chlorination of alcohols and amines. The chemical and pharmaceutical industries, which demand huge amounts of organic synthesis products, significantly contribute to the importance of this segment. BASF SE announced in March 2022 that it is continuing to modernize its Verbund site in Ludwigshafen, Germany, investing heavily in the low three-digit million euro range on production facilities for chloroformates and acid chlorides. Furthermore, reagents such as thionyl chloride play a huge role in supporting efficient and scalable organic synthesis.

Our in-depth analysis of the thionyl chloride market includes the following segments:

|

Grade |

|

|

Application |

|

|

Production Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thionyl Chloride Market Regional Analysis:

North America Market Analysis

North America industry is estimated to hold largest revenue share of 32.3% by 2035. The pharmaceutical and agrochemical industries are highly prevalent in this region. Research and development of advanced chemicals is also given much importance in this region, which in turn has enhanced the demand for quality reagents such as thionyl chloride. Innovation in drug development and productivity in agriculture are the key growth drivers that support market growth.

The U.S. is expected to account for the largest share due to vigorous pharmaceutical and chemical manufacturing. The well-developed pharmaceutical infrastructure, along with continued research and development, supports increased use of the intermediate thionyl chloride. This further contributes to the rise in thionyl chloride applications in the U.S., encompassing specialty chemicals and agrochemicals, considering that American companies hold strong innovation commitments and rigorously observe safety protocols.

Canada is also witnessing an increased demand for thionyl chloride supported by strong regulations by the government to ensure chemical safety. For example, the regulatory framework under the Canadian Environmental Protection Act (CEPA) requires chemicals such as thionyl chloride to undergo a rigorous environmental assessment, which points toward the country's concern for producing the chemical safely. The regulatory thrust helps in producing this chemical in the least environmentally damaging method so that thionyl chloride can help maintain

Asia Pacific Market Analysis

In thionyl chloride market, Asia Pacific region is set to observe lucrative CAGR till 2035. This growth is driven by rapid industrialization and economic developments in countries like China and India. Expansion in the pharmaceutical, agrochemical, and electronics markets increases the demand for the production of thionyl chloride. Furthermore, the availability of raw materials and low-cost production increase the prospects in this market.

China is among the leading producers and consumers of thionyl chloride worldwide, majorly propelled by its gigantic chemical manufacturing structure. In the agrochemical industry, the country caters to its gigantic agricultural needs, hence boosting the consumption of thionyl chloride in pesticide manufacture. Moreover, the country dominated countries such as the U.S. with massive investments in chemical industry capital. The country’s investments amounted to 46% in the year 2022, surpassing other competitors compared to 10% for the USMCA (United States-Mexico-Canada Agreement). This trend has underlined the significant resource allocation that the country is making towards the production of chemicals, reinforcing its demand for thionyl chloride.

India also witnessed a rise in the demand for thionyl chloride due to pharmaceutical industries encouraged by the Production Linked Incentive (PLI) scheme under the government. The government of India 2024-25 Interim Budget also shows this priority, allocating Rs. 1,000 crore (US$ 120 million) for bulk drug parks, which is a significant increase to strengthen the domestic supply chain. As India continues to expand its pharmaceutical sector and further cements its position as a global production base, thionyl chloride consumption is expected to increase in support of mass-scale drug synthesis.

Key Thionyl Chloride Market Players:

- Angene International Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aurora Fine Chemicals LLC

- CABB Group

- Changzhou Xudong Chemical

- ChemTik

- China Pingmei Shenma Group

- Chuyuan Group

- Jiangxi Selon Industrial Co. Ltd.

- Lanxess AG

- Shandong Kaisheng New Materials Co. Ltd.

- Shangyu Wolong Chemical

- Sichuan Boxing

- Sigma Aldrich Co. LLC

- Sumitomo Seika Chemicals Co. Ltd.

The market is highly competitive, with companies such as Lanxess AG, CABB Group, and Jiangxi Selon Industrial Co., Ltd., among others, looking into capacity expansion, mergers, and acquisitions, as well as new product development in order to enhance their respective market positions. For example, In February 2022, CABB Group recently expanded the production facility in Pratteln, Switzerland, to manufacture more high-purity thionyl chloride. Such an expansion is expected to cater to the increasing pharmaceutical and agrochemical sectors' demand for high-grade reagents. The move by the company is to keep pace with the increasing competition in the market and to stay ahead of competitors as major players increase their capabilities to capture larger portions of the market and better adapt to global demand trends.

Here are some leading players in the thionyl chloride market:

Recent Developments

- In August 2024, China Pingmei Shenma Holding Group acquired an 80.2% stake in Pingmei Longji New Energy Technology from Henan Yicheng New Energy for approximately CNY 870 million. The acquisition aligns with Pingmei Shenma’s goals to expand its renewable energy and photovoltaic technology offerings, which includes integrating advanced raw materials like thionyl chloride for energy storage solutions. The deal awaits shareholder approval and reflects China Pingmei's ambition to strengthen its presence in the energy and materials sector.

- In June 2024, at Battery Show Europe, LANXESS launched its advanced materials specifically engineered for lithium-ion batteries. This includes key raw materials like thionyl chloride, essential in the production of battery electrolytes. The portfolio supports Europe’s push for local, sustainable supply chains and lowered carbon emissions, with LANXESS’s materials facilitating safer and more efficient battery cooling, recycling, and production processes. By bolstering regional manufacturing independence, LANXESS emphasizes thionyl chloride’s critical role in electrolyte formulation for lithium batteries.

- Report ID: 6623

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thionyl Chloride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.