Teledentistry Market Outlook:

Teledentistry Market size was over USD 2.13 billion in 2025 and is anticipated to cross USD 9.16 billion by 2035, witnessing more than 15.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of teledentistry is assessed at USD 2.43 billion.

The rapid demand for remote healthcare services and advancement in digital health technologies are driving the growth of the teledentistry market. Teledentistry has garnered much momentum, especially after the COVID-19 pandemic, as patients started inclining towards virtual consultation modes. Other major drivers include increasing awareness regarding oral health, improvement in telehealth platforms, and integration of AI tools for better diagnostics and management of patients. For example, in June 2023, Virtual Dental Care introduced Teledentistry 3.0 which allows patients to receive dental services in the comfort of their homes, thus enhancing the product portfolio.

Opportunities are also present in the teledentistry market, including rising trends of adoption in AI-powered diagnostics and machine learning tools, improving the accuracy of remote care to help balance the growing demand for preventative care. Other opportunities include expansion in underserved and rural regions through virtual platforms offering greater access to dental care. Furthermore, an increase in mobile health technologies and partnerships with insurance companies and corporate wellness programs is anticipated to drive teledentistry market expansion. These emerging trends shape the future of telehealth which is likely to be one of the major methods through which healthcare is provided and facilitate increased access and higher degrees of patient treatment across diversified demographics.

Key Teledentistry Market Insights Summary:

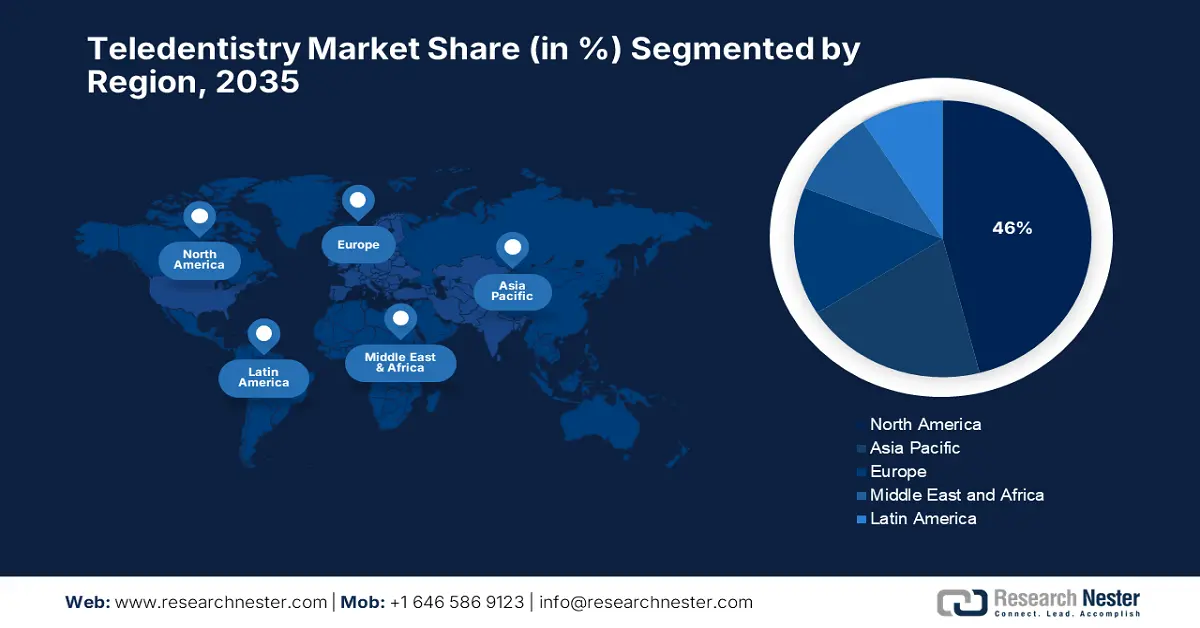

Regional Highlights:

- North America dominates the Teledentistry Market with a 46% share, propelled by advanced healthcare infrastructure, enabling widespread adoption of remote dental care through 2035.

- Asia Pacific's teledentistry market is expected to grow significantly by 2035, propelled by government initiatives on digital health infrastructure.

Segment Insights:

- The Software segment in the Teledentistry Market is projected to achieve over 49.2% market share by 2035, propelled by efficiency in remote consultation management.

- Tele-consulting segment is anticipated to hold around a 45% share by 2035, influenced by the growing preference for time-saving remote visits.

Key Growth Trends:

- Technology innovation

- Convenience and accessibility

Major Challenges:

- Challenges in regulations and licensing

- Patient awareness and adoption

- Key Players: Dentulu, Inc., Koninklijke Philips N.V., MouthWatch, LLC, quip (Toothpic), and SmileDirectClub.

Global Teledentistry Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.13 billion

- 2026 Market Size: USD 2.43 billion

- Projected Market Size: USD 9.16 billion by 2035

- Growth Forecasts: 15.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Canada, Japan

- Emerging Countries: India, China, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Teledentistry Market Growth Drivers and Challenges:

Growth Drivers

- Technology innovation: Advances in AI, cloud computing, and integrated telehealth platforms are fundamentally driving the teledentistry market. These technologies allow more accurate diagnostics and easier management of patients on virtual platforms, which ultimately raises the quality and efficiency of dental care. In January 2021, TeleDentists teamed up with Holland Healthcare, Inc. to deliver on-demand teledentistry via the TelScope Telehealth system. This partnership reflects the growing use of digital health tools in teledentistry, improving access and flexibility for patients and boosting market expansion.

- Convenience and accessibility: The demand for virtual healthcare services from underserved populations is one of the major growth factors for teledentistry. Virtual platforms allow patients to receive dental care from their homes, thus helping regions that are lacking in dental services. For example, in August 2023, DentaQuest partnered with Teledentistry.com to extend virtual care to underserved populations to bridge gaps in access afterhours. This tie-up is indeed a typical example of how the industry leverages convenience to widen its reach, especially in regions that have inadequate dental infrastructure.

- Government support: Government policies promote the expansion of telehealth services and, accordingly, speed up the growth of teledentistry. This involves incentives to utilize digital healthcare tools and improved reimbursement frameworks that encourage more providers to adopt telehealth solutions. For instance, the Consolidated Appropriations Act of 2023 has an extension of telehealth flexibilities necessary for Medicare providers to provide remote services without geographic restrictions until the end of December 2024. This policy will not only promote the growth and development of teledentistry but also improve access to oral health care in rural and underserved areas.

Challenges

- Challenges in regulations and licensing: Different regulations and licensing requirements in various regions limit the scalability of teledentistry. In this regard, differences in telehealth laws across states or countries reduce the possibility of providers offering cross-border services and scaling. For example, a dentist licensed to practice in one state may not be allowed to practice through telehealth in another state because of different licensure rules. This fragmentation brings administrative challenges that are acting as a deterrent to wider adoption.

- Patient awareness and adoption: While teledentistry enjoys apparent advantages in the fields of convenience and accessibility, it faces a lack of awareness, especially among older populations, not as familiar with telehealth technologies. Most patients either remain unaware of the availability of services or lack the technological literacy to engage with these platforms. This is particularly evident in rural and underserved communities.

Teledentistry Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.7% |

|

Base Year Market Size (2025) |

USD 2.13 billion |

|

Forecast Year Market Size (2035) |

USD 9.16 billion |

|

Regional Scope |

|

Teledentistry Market Segmentation:

Component (Software, Service, Hardware)

Software segment is predicted to hold more than 49.2% teledentistry market share by 2035. For maintaining records of patients, managing schedules, and carrying out remote consultations, software solutions are highly preferred. These systems offer dental practices increased efficiency and integration with other healthcare platforms. For example, in 2022, MouthWatch integrated its TeleDent platform into the management system of Open Dental Software to extend advanced operational capabilities to practices of all sizes. This further illustrates the depth of the role of the software segment in making teledentistry operations seamless.

Application (Tele-consulting, Screening & Monitoring, Education & Training, Other Applications)

By the end of 2035, tele-consulting segment is estimated to capture around 45% teledentistry market share, owing to the growing preference for remote consultations that save time and convenience for both patients and dental experts. Tele-consulting involves preliminary diagnosis and treatment planning without actually having to see the patient, thus reducing exposure to infection. This is highly useful for routine check-ups and follow-ups, especially in remote or underserved areas that do not have good access to dental clinics.

For example, in January 2022, Dentulu, Inc. partnered with Independa to enhance teledentistry services via LG televisions, allowing for more convenient video consultations directly through home entertainment systems. Besides, various developments in AI and analytics are further refining teleconsultation by offering more accurate diagnostic tools and personalized suggestions on the mode of care.

Our in-depth analysis of the teledentistry market includes the following segments

|

Component |

|

|

Application |

|

|

Specialty |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Teledentistry Market Regional Analysis:

North America Market Analysis

By the end of 2035, North America teledentistry market is likely to account for more than 46% share, partly due to advanced healthcare infrastructure, increasing integration of digital health platforms, and growing awareness of benefits associated with telehealth services. Other key factors include an aging population and an increase in the incidence of oral health problems that are driving the wide diffusion of teledentistry solutions. In addition, advancements in AI-driven diagnosis and cloud-based telehealth management systems are further accelerating the adoption of teledentistry across the region.

The U.S. significantly contributes to the dominance of North America in the teledentistry market. The major players, such as Henry Schein and Patterson Companies, are rapidly growing their teledentistry portfolios to meet the swelling demand for remote dental services. Patterson Companies completed the acquisition of Carestream Health's teledentistry business in March 2023, a strategic move prepared to further enable its remote service offerings in dentistry. This transaction is part of a broader trend in the U.S. market, where companies are developing comprehensive and accessible virtual dental care solutions through various consolidation strategies to reach an expanding telehealth market.

In Canada, the government is also actively promoting the inclusion of teledentistry within its larger framework of telehealth to promote better access to health care in remote and rural areas. Since a greater percentage of the population lives in rural areas, virtual health services are now becoming a necessity, thereby, patients can consult dental professionals without having to travel long distances. The development of digital infrastructure, especially extending broadband in underserved areas, has been crucial for Canada in minimizing connectivity issues. In that respect, increased access to high-speed internet will guarantee that more individuals have the opportunity to use teledentistry platforms to address health disparities and enhance access to dental care in remote communities.

Asia Pacific Market Analysis

North America industry is likely to hold largest revenue share of 46% by 2035. Additionally, the large population, especially in countries such as India and China, presents immense possibilities for market growth in the region. A key driver of this growth could be government initiatives on digital health infrastructure improvement, particularly in rural areas of the region. Moreover, increasing smartphone and internet penetration across the region enables the population to access dental experts remotely, thus facilitating the rise in teledentistry services.

Teledentistry demand in India is growing, particularly among the underserved sections where access to conventional dental services is negligible. One recent key development in this industry came when Colgate-Palmolive launched a free teledentistry consultation service in June 2020, offering virtual dental consultations to Indian patients. These are some of the initiatives undertaken that underline the rising importance of global healthcare companies in the management of demand for remote dental care in India by facilitating access and preventive care services to its population through telehealth platforms.

China is also becoming a lucrative teledentistry market, with telehealth platforms partnering with local dental care providers to expand their services. The government has, over the past few years, encouraged telehealth as part of broad health reforms that target improvement in access to rural and remote regions. Such integration of telehealth platforms with local providers allows for the facilitation and delivery of dental care services to underserved regions, promoting teledentistry market growth.

Key Teledentistry Market Players:

- Acteon Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dentulu, Inc.

- Koninklijke Philips N.V.

- MouthWatch, LLC

- quip (Toothpic)

- SmileDirectClub

- Smile Virtual LLC

- Straight Teeth Direct

- Teledentix

- Virtudent, Inc.

The teledentistry market is highly competitive, with several players competing for market share in the space based on innovation, partnerships, and mergers and acquisitions. Some leading companies in the market include Virtual Dental Care, Inc., Henry Schein, Patterson Companies, DentaQuest, and MouthWatch, LLC. Leading companies will further enhance their portfolio of teledentistry with increased usage of technological advancements, such as AI diagnostic solutions and cloud-based management platforms.

The competition is, therefore, foreseen to get even more intense since many companies will enter the market to capitalize on the surging demand for remote dental care solutions. In February 2023, DentalIntel, which provides remote care solutions for dental practitioners, was acquired by Henry Schein, a major distributor of healthcare products and services in the U.S. Henry Schein responded to the opportunity available and continuously upgraded their technological capabilities for better patient outcomes with an overall digital dental care solution for the patients in mind. The merger underlined an increasing trend of consolidation in the teledentistry market, where firms seek to expand their services and build up market share.

Here are some leading players in the teledentistry market:

Recent Developments

- In May 2024, Dentistry.One by MouthWatch was honored with the 2024 Health Care Hero award from NJBIZ, recognizing its innovative approach to virtual dental care. This accolade emphasizes the impact of on-demand teledentistry services and personalized care coordination in driving market growth.

- In December 2023, TeleDentists partnered with WebMD in Kansas City, Missouri, to enhance access to teledentistry services. This collaboration reflects the growing trend of integrating mainstream healthcare platforms with teledentistry solutions. By leveraging WebMD’s extensive reach, the partnership aims to broaden the availability of dental care, making remote consultations more accessible, particularly for underserved populations.

- Report ID: 6522

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Teledentistry Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.