Synthetic Tannins Market Outlook:

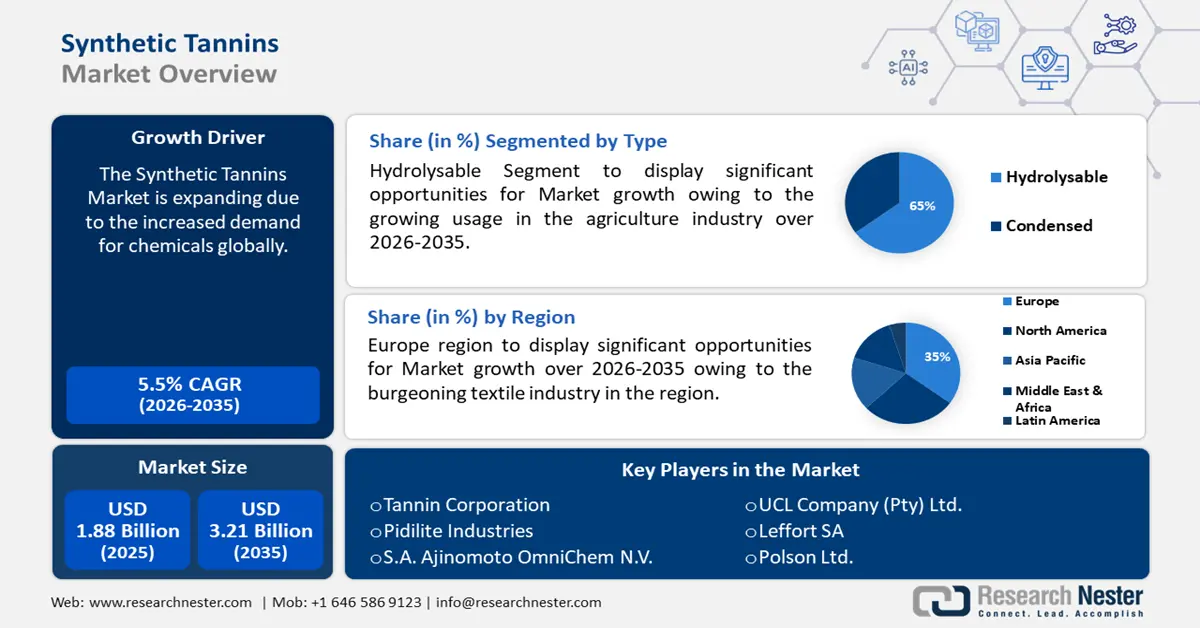

Synthetic Tannins Market size was valued at USD 1.88 billion in 2025 and is set to exceed USD 3.21 billion by 2035, registering over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of synthetic tannins is estimated at USD 1.97 billion.

The increased demand for chemicals globally may augment the need for synthetic tannins accordingly in several end-use industries. One of the biggest industries in the world, the chemicals sector saw significant expansion in several areas as it plays a significant role in the expansion of the world economy, trade, and employment.

According to the International Energy Agency, demand for high-value chemicals has increased over the last ten years by 3.0% per year.

Key Synthetic Tannins Market Insights Summary:

Regional Highlights:

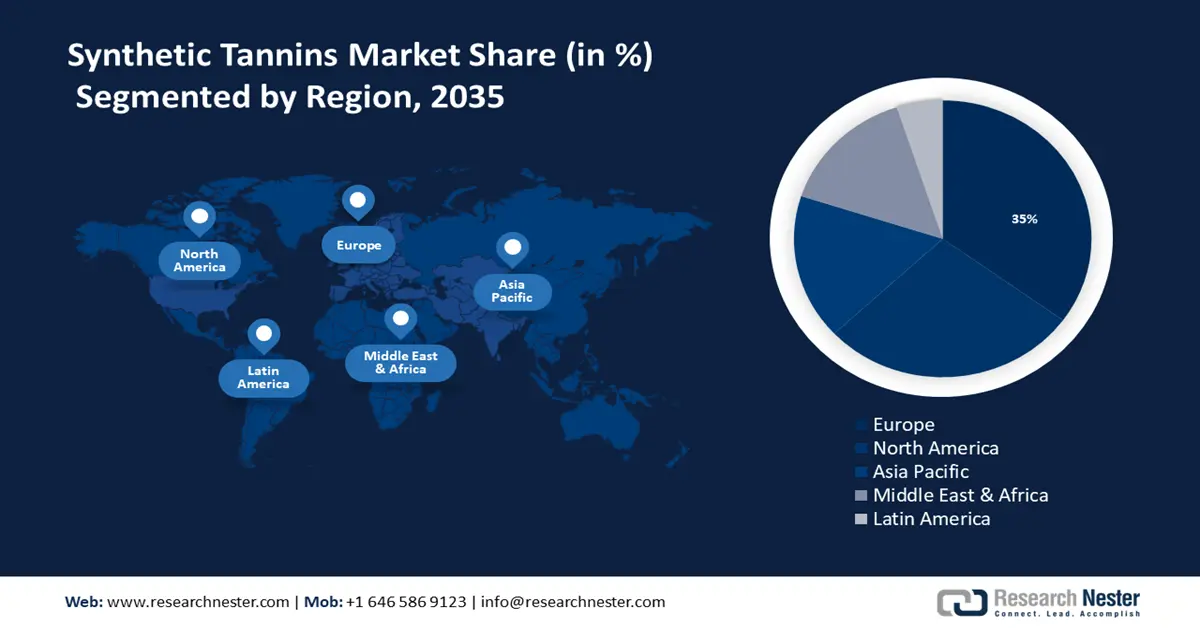

- Europe synthetic tannins market achieves a 35% share by 2035, fueled by the booming textile industry and increasing demand for luxury footwear and European textiles.

- North America market will capture the second largest share by 2035, driven by the growing demand for sealants and adhesives, particularly in the construction sector.

Segment Insights:

- The hydrolysable segment in the synthetic tannins market is projected to experience significant growth till 2035, driven by the expanding agriculture industry boosting demand for synthetic tannins.

Key Growth Trends:

- Growing pharmaceutical industry

- Rising applications in dermatology

Major Challenges:

- Environmental concerns

- The availability of natural alternatives may limit the adoption of synthetic tannins, as consumers may prefer eco-friendly products.

Key Players: Syn-Bios S.p.A., UCL Company (Pty) Ltd., Leffort SA, Zhushan County Tianxin Medical & Chemical Co., Ltd., Tannin Corporation, Pidilite Industries, S.A. Ajinomoto OmniChem N.V., Polson Ltd.

Global Synthetic Tannins Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.88 billion

- 2026 Market Size: USD 1.97 billion

- Projected Market Size: USD 3.21 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Italy, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Synthetic Tannins Market Growth Drivers and Challenges:

Growth Drivers

- Growing pharmaceutical industry - Tannins are useful in the pharmaceutical industry and are now regarded as an essential ingredient having both internal and external effects in a range of medications, nutraceuticals, and medicinal preparations.

As per data, the global pharmaceuticals industry is expected to reach over USD 1475 billion in 2028. - Rising applications in dermatology - Synthetic tannins are especially useful materials because they are recognized adjuvants in the treatment of superficial skin illnesses that cause itching, inflammation, and tears.

They have also been utilized as alternatives to steroid-based anti-inflammatory treatments, particularly for pediatric dermatoses, one of the most typical presentations in a dermatology clinic, which are indicative of children's hygiene and general health.

For instance, in 2022, there were over 220 million people worldwide who suffered from atopic dermatitis. - Growing demand for food - Synthetic tannins can be used in tea and other plant-based meals and beverages as an auxiliary owing to their anti-inflammatory and antioxidant properties.

According to the World Resource Institute, the majority of the anticipated rise in food demand between 2010 and 2050 is driven by the projected growth in population of 2.8 billion people.

Challenges

- Environmental concerns - The market for synthetic tannins is impacted by regulatory scrutiny and environmental concerns since it may cause dangerous chemicals to leak into the environment, contaminating the air and water.

Besides this, there are numerous extremely damaging environmental practices associated with the leather business, as leather tanning produces a lot of waste, contaminates waterways, and causes deforestation. - The availability of natural alternatives may limit the adoption of synthetic tannins, as consumers may prefer eco-friendly products.

Synthetic Tannins Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.88 billion |

|

Forecast Year Market Size (2035) |

USD 3.21 billion |

|

Regional Scope |

|

Synthetic Tannins Market Segmentation:

Type Segment Analysis

Hydrolysable segment is anticipated to dominate synthetic tannins market share of over 65% by 2035, owing to the growing agriculture industry. One type of tannin known as hydrolysable tannin, or pyrogallol-type tannin, is made up of molecules, usually glucose, whose hydroxyl groups are partly or completely esterified by phenolic acids such as gallic or ellagic acid.

As per the Food and Agriculture Organization of the United Nations, global primary crop production increased by 54% between 2000 and 2021, reaching 9.5 billion metric tons in 2021.

They serve as chemical barriers against insects, microorganisms, and herbivorous vertebrates, affect the dynamics of soil nutrients, and have antioxidant, anticancer, and cardioprotective properties that improve the nutritional value of plant-based diets. Moreover, gallic and ellagic tannins are other classifications for hydrolyzable tannins, which have been employed as feed additives owing to their biological characteristics as antimicrobials.

In addition, proanthocyanidins, another name for condensed tannins, are useful additives that are applied to acrylic-based transparent coatings to prolong the life of the polymer coating and are ubiquitous polyphenols that serve a variety of ecological roles, including protecting plants from microbial infections and herbivores.

End-Use Segment Analysis

The leather segment is likely to garner a notable revenue share. The growing footwear industry is the primary driver of the segment's growth. Globally, the footwear market is expected to expand by over 3% between 2024 and 2028. The synthetic tanning procedure is typically used in conjunction with either chrome tanning or another tanning process, in chrome leather manufacture to ensure retaining since they give the leather the essential "fullness."

All shoe manufacturing firms employ this synthetic tannins since it has the biggest profit margin and demand. In addition, synthetic tannins are employed as dispersing agents for vegetable tannins and dyestuffs and can impart these peculiar qualities to tanned leather, making it so distinctive and easy to identify.

Our in-depth analysis of the synthetic tannins market includes the following segments:

|

Type |

|

|

Form |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synthetic Tannins Market Regional Analysis:

European Market Insights

Europe industry is predicted to hold largest revenue share of 35% by 2035. impelled by the burgeoning textile industry. Over the past ten years, the sector has seen sustained expansion in terms of output value and trade exchange and has significantly contributed to European income. The demand for luxury footwear and high-quality European textiles is rising, which may create a huge demand for synthetic tannins in the coming years.

Furthermore, the EU tanning sector is the biggest global provider of leather to the global market, which catalyzes the downstream value-generating process.

In Europe, Germany is third in terms of leather production and is the third-biggest leather bag import market. Besides this, Germany is the fourth-largest exporter of leather footwear in the world, having exported around USD 3 billion worth of leather footwear.

For instance, with more than 1 billion square feet of leather produced annually, Italy is without a doubt the top producer of leather in Europe.

North American Market Insights

The North American synthetic tannins market is estimated to be the second largest, during the forecast timeframe, led by growing personal disposable income. As a result, more and more individuals in the region are spending on construction projects, which have increased the demand for sealants and adhesives, leading to a significant rise in the demand for synthetic tannins owing to their exceptional moisture resistance and superior adhesive performance.

The strict environmental laws and the food and beverage industry's consistent need for packaging products are expected to continue to be major factors in the adhesives and sealants market's expansion in the United States.

One of the main drivers of the Canadian economy is the leather products sector, where a range of intricate tanning and finishing techniques are used to transform raw hides and skins into premium leather of all kinds.

Synthetic Tannins Market Players:

- Syn-Bios S.p.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- UCL Company (Pty) Ltd.

- Leffort SA

- Zhushan County Tianxin Medical & Chemical Co., Ltd.

- Tannin Corporation

- Pidilite Industries

- S.A. Ajinomoto OmniChem N.V.

- Polson Ltd.

The synthetic tannins market consists of several key players. These key players are launching various strategic initiatives to expand their market position in the synthetic tannins industry.

Recent Developments

- Pidilite Industries partnered with Italy-based Syn-Bios to expand its product line and offer a wide range of leather chemical products in Bangladesh, Vietnam, Nepal, India, and Sri Lanka to establish new standards within the leather sector.

Furthermore, the companies will cooperate technically to provide all-inclusive solutions for the leather sector through this partnership and also manage the distribution and sales of Syn-Bios goods. - S.A. Ajinomoto OmniChem N.V. announced the acquisition of OmniChem Private Limited to assume total command of the CRAMS enterprise.

- Report ID: 6052

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Synthetic Tannins Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.