Global Synthetic Bone Graft Substitutes Market

- Introduction

- Market definition

- Assumptions

- Market Segmentation

- Research Methodology

- Variables (Dependent and Independent)

- Multi Factor Based Sensitivity Model

- Executive Summary- Global Synthetic Bone Graft Substitutes Market

- COVID-19 Impact Analysis

- Market Dynamics

- Drivers

- Challenges

- Opportunities

- Threats

- Regulatory Landscape

- Industry Risk Analysis

- Clinical Trial Analysis

- Analysis on the Bone Graft Substitute Manufacturers

- Assessment of End Users of Synthetic Bone Graft Substitutes

- Average Pricing Analysis

- Global Synthetic Bone Graft Substitutes Market Outlook

- Market Size and Forecast, 2019-2028

- By Value (USD Million)

- By Volume (Thousand Units)

- Market Segmentation by:

- Material

- Ceramics

- Hydroxyapatite

- TCP

- Calcium Sulfate

- Bi-Phasic Calcium Phosphate

- Bioactive Glass

- Others

- Composites

- Polymers

- Ceramics

- Application

- Spinal Fusion

- Hip Surgery

- Knee Surgery

- Shoulder Surgery

- Upper Limb Surgery

- Lower Limb Surgery

- Craniomaxillofacial

- Hand and Food Surgery

- Dental Bone Grafting

- Other Surgeries

- Material

- Market Size and Forecast, 2019-2028

- North America Synthetic Bone Graft Substitutes Market Outlook

- Market Size and Forecast, 2019-2028

- By Value (USD Million)

- By Volume (Thousand Units)

- Market Segmentation by:

- Material

- Application

- Country

- Market Size and Forecast, 2019-2028

- Europe Synthetic Bone Graft Substitutes Market Outlook

- Market Size and Forecast, 2019-2028

- By Value (USD Million)

- By Volume (Thousand Units)

- Market Segmentation by:

- Material

- Application

- Country

- Market Size and Forecast, 2019-2028

- Asia Pacific Synthetic Bone Graft Substitutes Market Outlook

- Market Size and Forecast, 2019-2028

- By Value (USD Million)

- By Volume (Thousand Units)

- Market Segmentation by:

- Material

- Application

- Country

- Market Size and Forecast, 2019-2028

- Latin America Synthetic Bone Graft Substitutes Market Outlook

- Market Size and Forecast, 2019-2028

- By Value (USD Million)

- By Volume (Thousand Units)

- Market Segmentation by:

- Material

- Application

- Country

- Market Size and Forecast, 2019-2028

- Middle East and Africa Synthetic Bone Graft Substitutes Market Outlook

- Market Size and Forecast, 2019-2028

- By Value (USD Million)

- By Volume (Thousand Units)

- Market Segmentation by:

- Material

- Application

- Country

- Market Size and Forecast, 2019-2028

- Competitive Landscape, 2019-2028

- Arthrex, Inc.

- Baxter International, Inc.

- DePuy Synthes Companies

- Medtronic

- Wright Medical Group N.V.

- Biomatlante

- Stryker

- Zimmer Biomet

- Kuros Bioscience

- Bioventus LLC

Synthetic Bone Graft Substitutes Market Outlook:

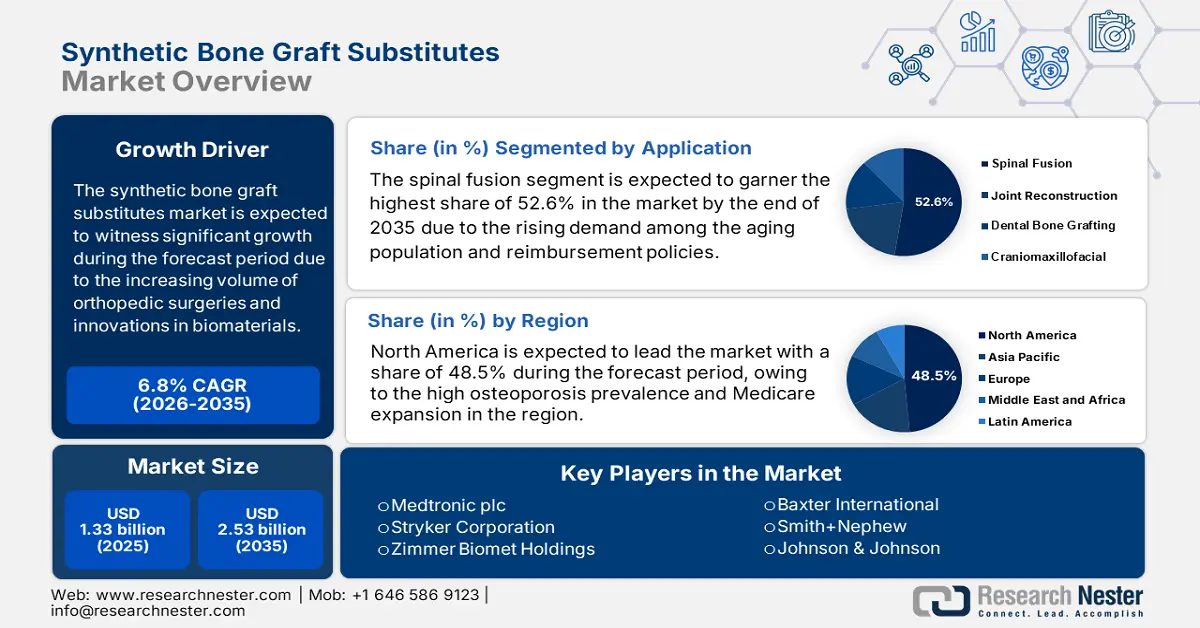

Synthetic Bone Graft Substitutes Market size was valued at USD 1.33 billion in 2025 and is projected to reach approximately USD 2.53 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of synthetic bone graft substitutes is estimated at USD 1.42 billion.

The upliftment of the market highly relies upon the increasing volume of orthopedic surgeries, innovations in biomaterials, and the growing burden of bone-related disorders. Besides, the patient pool necessitating synthetic bone graft substitutes is significantly influenced by the increasing instances of trauma, osteoporosis, and orthopedic surgeries. In this regard, according to a 2022 WHO report, musculoskeletal conditions affect more than 1.71 billion people worldwide. Additionally, according to the Bone Health & Osteoporosis Foundation, an additional 44 million Americans have inadequate bone density, putting them at higher risk, while about 10 million Americans suffer from osteoporosis. This heightened consumer base is evidence of an increased demand for synthetic bone graft substitutes.

Moreover, the global market is evolving in a dynamic way across the globe as a result of ongoing innovation, increasing demand for minimally invasive interventions. One of the most important trends driving this development is the accelerated rate of new product innovation in terms of bioceramics, biomaterial nanotechnology, and hybrid grafts. Companies such as Medtronic, Stryker, Zimmer Biomet, and Arthrex have paved the way forward in synthetic grafts, enhancing osteoconductivity, mechanical strength, and healing time while closely resembling native bone. Most importantly, advancements in the application of nanomaterials, biomimetics, 3D printing, and tissue engineering will create a new level of graft bioactivity, cell adhesion.

Key Synthetic Bone Graft Substitutes Market Insights Summary:

Regional Highlights:

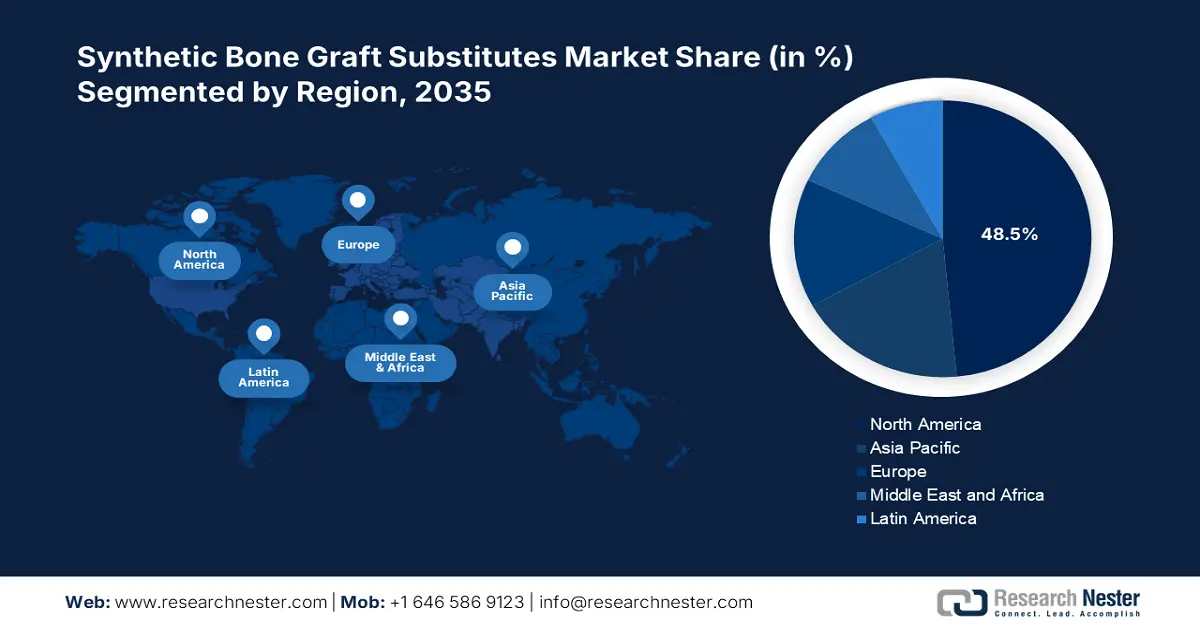

- By 2035, the North America synthetic bone graft substitutes market is projected to secure over 48.5% share, upheld by expanding Medicare coverage and rising osteoporosis incidence.

- Asia Pacific is expected to capture an 18.4% share by 2035, supported by a 9.3% CAGR enabled by rapid healthcare modernization and regional innovation in graft technologies.

Segment Insights:

- By 2035, the spinal fusion segment in the synthetic bone graft substitutes market is anticipated to command a 52.6% share, bolstered by rising surgical demand amid aging demographics and strengthened reimbursement frameworks.

- The ceramics segment is forecast to attain a 46.7% share during 2026–2035, supported by its enhanced osteoconductivity and the expanding uptake of ceramic-based orthopedic and dental interventions.

Key Growth Trends:

- Advancements in synthetic substitutes

- Supportive medical policies

Major Challenges:

- High manufacturing and development costs

- Limited awareness and reimbursement challenges

Key Players: Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings, Baxter International, Smith+Nephew, Johnson & Johnson, Olympus Corporation, NuVasive, Inc., Wright Medical Group, Orthofix Medical, DJO Global (Enovis), Cerapedics, Biocomposites Ltd, Graftys, Xtant Medical, Amedica Corporation, Surgival, Osseon LLC, Bioventus LLC, Osteopore International.

Global Synthetic Bone Graft Substitutes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.33 billion

- 2026 Market Size: USD 1.42 billion

- Projected Market Size: USD 2.53 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Turkey

Last updated on : 29 August, 2025

Synthetic Bone Graft Substitutes Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in synthetic substitutes: This is one of the crucial factors driving business in the market. As the innovations progress, the upliftment of the market also expands with constant efforts from major firms. In this regard, Biocomposites in 2023 acquired a minority stake in Renovos Biologics, aiming to advance the development of Renovite BMP-2, which is a synthetic nanoclay bone fusion gel. This collaboration appreciably enhances the product portfolio, reflecting a positive market focus to act as a solution for unmet medical needs. Moreover, the most significant advancements for practical purposes have been the integration of nanotechnology to improve surface characteristics at the molecular level, which inhibits cell adhesion, proliferation, and faster bone regeneration.

- Supportive medical policies: The market is remarkably influenced by favorable healthcare polices and government-backed medical expenditure. In this regard, the U.S. FDA extends its support with a breakthrough device designation, which was recently granted to Renovos' bone graft gel, encouraging the global players to invest in the sector, thereby contributing to market acceleration. Moreover, more countries and their related health agencies are starting to see the reception of synthetic grafts in terms of clinical and economic outcomes. Governments are developing reimbursement schemes that will cover a wider variety of synthetic graft-related procedures.

- Growing adoption of minimally invasive surgeries: Minimally invasive surgical approaches are growing in popularity due to implications of less time in the OR, less pain, and more rapid recovery. Synthetic bone graft substitutes are ideal for minimally invasive techniques due to factors like ease of use, available in injectable or moldable forms, and improved consistency/integrity. This sharing of minimally invasive surgical techniques have positively impacted the growth of synthetic bone graft substitutes in spinal surgery, dental surgery, and orthopedic surgery.

Challenges

- High manufacturing and development costs: The high costs associated with the production of synthetic bone graft substitutes act as a major restraint for the market to capture an optimum manufacturing base. The process comprises recombinant DNA technology and extensive quality control measures that makes it challenging for manufacturers involved in the market. Furthermore, the expenses associated with clinical trials and regulatory approvals further block accessibility, particularly in price-sensitive regions.

- Limited awareness and reimbursement challenges: In certain areas, limited awareness among patients and healthcare providers of the benefits of synthetic bone graft substitutes restricts market growth. In addition, reimbursement policies in developing countries and some insurance providers vary or are nonexistent to some extent, which can ultimately make these grafts too expensive. If there are limited benefit levels, then the patient's OOP cost may be a barrier, which inhibits their uptake.

Synthetic Bone Graft Substitutes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.33 billion |

|

Forecast Year Market Size (2035) |

USD 2.53 billion |

|

Regional Scope |

|

Synthetic Bone Graft Substitutes Market Segmentation:

Application Segment Analysis

The spinal fusion segment is expected to garner the highest share of 52.6% in the market by the end of 2035. The dominance of the segment is attributable to the extended demand among the aging population and reimbursement policies. Besides the improved outpatient reimbursement policies, expanding access and innovative bioactive formulations will allow a larger population to contribute to the segment’s dominance. Moreover, developments in synthetic grafts position these materials for complex spinal procedures requiring precision and reliability. The increasing elderly population, coupled with the global increase in back pain and spinal injuries, will accelerate the demand for spinal fusion surgery.

Material Segment Analysis

The ceramics segment is projected to hold a lucrative share of 46.7% in the market during the forecast period. The growth in the segment is subject to its superior nature, i.e., utilizing hydroxyapatite ceramics is known to enhance biocompatibility and osteoconductive of the material. Furthermore, this growing adoption of ceramic dental procedures is another driver for the segment’s adoption. Ceramics are also being used more widely because they are resorbed and replaced by natural bone over time, which is advantageous for a variety of orthopedic and dental applications. Also, developments in ceramics manufacturing have improved the performance of ceramics in load-bearing orthopedic applications and complex bone defects.

End User Segment Analysis

The hospitals hold a large share of the market because they are the primary environments for complex orthopedic, spinal, dental, and trauma surgeries that require bone grafts. The most favorable environment for bone grafting is one that typically has well-established surgical infrastructure, quality orthopedic and neurosurgical teams. Hospitals also have access to newer, costly synthetic graft products because they have budgets that allow them to cover these potential expenses. On top of that, trauma cases are on the rise because of sports injuries, increases in domestic violence, and socioeconomic issues that lead to trauma injuries.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Application |

|

|

Material |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synthetic Bone Graft Substitutes Market - Regional Analysis

North America Market Insights

The North America synthetic bone graft substitutes market is set to account for more than 48.5% of the global market share by the end of 2035. The key hallmark of the regional market’s dominance is the high osteoporosis prevalence, coupled with the Medicare expansion. The number of aging individuals who face degenerative bone diseases is growing exponentially. This has increased the demand for and urgency to develop safe and effective solutions for bone regeneration. As reported by the National Osteoporosis Foundation, about 54 million Americans suffer from osteoporosis or low bone mass. Besides this, the risk of fractures increases with worsening bone health, often requiring surgical treatment and bone grafting. This clinical demand is supported by an increasing healthcare infrastructure and easy access to orthopaedic and dental services.

The North American market is dominated by the U.S. in terms of volume, population and the prevalence of osteoporosis and related orthopaedic conditions. This level of demand is supported by the introduction of advanced surgical technologies and the presence of prominent medical device companies. The upside with synthetic grafts is the benefits associated with the expansion of Medicare and improving reimbursement from insurance companies; patients' access to a myriad of synthetic grafts has made them the 'standard of care' in many procedures. The landscape of medication and technology investment in R&D, as well as swift enrollment in product approvals from the FDA, and a diligent surgical workforce, also contribute to growth alongside promotional education throughout the country.

Canada is a major player in the North America synthetic bone graft substitutes market, owing to an estimated 7.1% CAGR influenced by public and private healthcare systems. Further, the growth is buoyed by an increasing elderly population and respective increases in osteoporosis fractures. In Canada, funding for health insurance is predominantly provided to citizens and permanent residents by the government, radically improving patient access to orthopaedic care. Patient access for procedures involving bone grafting is assured as provincial health insurance plans increasingly cover various iterations of the procedure. Due to an environment with advanced research and collaboration, there are more opportunities for early adoption of innovative products. The importance of public health education and stronger investments in population health prevention and education strategies are promoting increased awareness and active treatment.

APAC Market Insights

Asia Pacific synthetic bone graft substitutes market is anticipated to witness the fastest growth with a share of 18.4%, growing at a CAGR of 9.3% during the forecast timeline. The regional development is facilitated by the presence of key countries and their developmental tendency. Japan offers its support with the rising number of aging populations. Besides, South Korea is contributing with 3D-printed grafts, utilizing bioresorbable materials. Urbanization, increased access to healthcare, and rising disposable incomes are allowing even more patients the option to select modern surgical treatment as an option. The overall market is also being amplified with government investments to improve healthcare infrastructure and improve orthopaedic care in rural areas and underserved communities. Additionally, the Asia-Pacific is becoming a hotbed for innovation and affordable manufacturing for synthetic graft materials. Local companies connected and international medtech companies are further progressing research and development and setting up manufacturing bases in China and India to keep pace with the regional demand.

The synthetic bone graft substitutes market in India is poised for rapid growth because of the increasing rates of osteoporosis, growing number of road traffic incidents, and an increase in orthopaedic and dental surgeries. The forecast by SaveLIFE Foundation predicts that India saw 4,61,312 traffic accidents in 2022, resulting in 1,68,491 fatalities and 4,43,366 injuries. The government's emphasis on improving overall access to healthcare is feeding the increased usage of synthetic grafts, both in public and private hospitals. The rise of new minimally invasive surgical techniques is supporting strong demand for injectable and mouldable synthetic grafts.

The country of China holds a significant position in the Asia-Pacific market thanks to its aging population and high incidence of osteoporosis and joint-related illnesses. The use of synthetic bone grafts is expected to gradually increase in the public hospital sector. Many local biotech and medical device companies are working with prominent, well-respected research institutions to develop the next generation of bone graft materials and are looking at the challenge of combining bioactivity with a low-cost structure. The National Medical Products Administration (NMPA), through its efforts to streamline regulations and processes for product approvals, is also helping to grow the market potential for synthetic grafts.

Europe Market Insights

The synthetic bone graft substitutes market in Europe is steadily expanding as the population ages and the prevalence of osteoporosis and other bone-related disorders remains high. Germany and France lead the market with advanced healthcare systems and comprehensive reimbursement policies. Innovation is advancing in the sector, as there is an increased number of partnerships between medtech companies, research institutions, and regulatory bodies that are aimed specifically at developing bioactive/biocompatible or minimally invasive grafts. Healthcare infrastructure is solid and growing in Europe, while physician awareness of grafts as part of the Procedure increases.

The synthetic bone graft substitutes market in France is a slowly growing market. This is due to an increasing aging population, a strong public health care system that covers advanced orthopaedic procedures, and the impact of government reimbursement policy to support the common use of bone graft materials. France, like many countries, is reporting a high rate of osteoporosis and functional impairments from other bone-related traumas in the aging population who require orthopaedic solutions and or graft biomaterials. The number of hospitals and or surgical centres in hospitals in France, adopting bioactive and or injectable synthetic grafts, is growing.

Germany is one of the largest and most developed synthetic bone graft substitute markets in Europe, due to its highly developed healthcare system and high volume of orthopaedic and spinal procedures. With an aging population and an increasing number of osteoporosis cases, the demand for ample bone regeneration materials is growing rapidly. In Germany, statutory health insurance covers a large number of orthopaedic procedures using synthetic graft materials, creating incentives for clinical use. Germany is heavily active in medical technology, with many global medtech leaders and numerous research entities active in synthetic bone graft innovation, particularly bio ceramics and nanotechnology. The very high level of surgeon knowledge, stringent quality control measures in place, and pursuit of regulatory recognition help drive the market to prefer synthetic over natural graft types.

Key Synthetic Bone Graft Substitutes Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Zimmer Biomet Holdings

- Baxter International

- Smith+Nephew

- Johnson & Johnson

- Olympus Corporation

- NuVasive, Inc.

- Wright Medical Group

- Orthofix Medical

- DJO Global (Enovis)

- Cerapedics

- Biocomposites Ltd

- Graftys

- Xtant Medical

- Amedica Corporation

- Surgival

- Osseon LLC

- Bioventus LLC

- Osteopore International

There is a prominent visibility for the synthetic bone graft substitutes market due to the presence of key organizations with a collective aim of capturing a high market share. The market presents itself as a highly consolidated form, with Medtronic, Stryker, and Zimmer Biomet controlling 61% of global revenue. In this regard, NIH states that Stryker’s 3D-printed Tritanium grafts reduced revision rates by 30%. Similarly, in 2023, Zimmer Biomet acquired Embody, which strengthened its collagen graft portfolio, reflecting positive market adoption. Focus on affordable healthcare and collaborations with regulatory frameworks further strengthens the global market landscape.

Recent Developments

- In July 2025, Medtronic plc, a global leader in healthcare technology, revealed a noteworthy advancement in its INFUSE Bone Graft for TLIF Investigational Device Exemption (IDE) Study. The independent Data Monitoring Committee (DMC) concluded that the trial satisfied the established requirements for early success after the first interim analysis. Medtronic is currently getting ready to submit a Premarket Approval (PMA) application to the FDA in the United States.

- In March 2025, Elute, Inc., a clinical stage company and emerging leader with a groundbreaking controlled and extended drug delivery platform, received approval of BonVie+, a novel bone void filler implant from the U.S. Food and Drug Administration (FDA).

- Report ID: 2850

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.