Surrogacy Market Outlook:

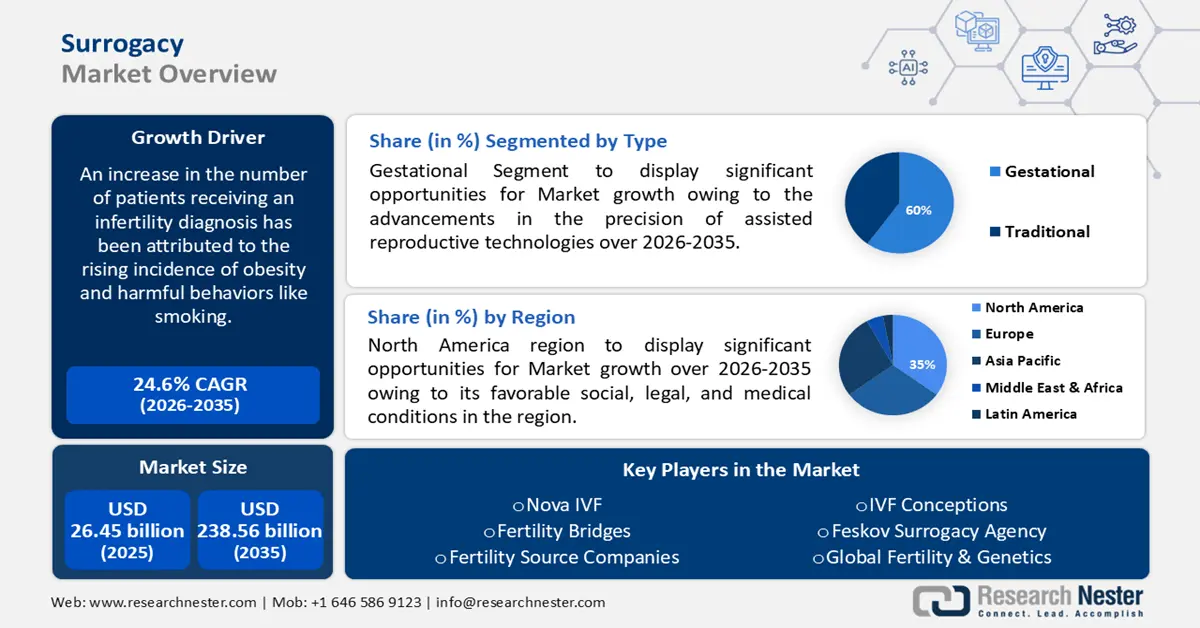

Surrogacy Market size was over USD 26.45 billion in 2025 and is anticipated to cross USD 238.56 billion by 2035, growing at more than 24.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surrogacy is assessed at USD 32.31 billion.

An increase in the number of patients receiving an infertility diagnosis has been attributed to the rising incidence of obesity and harmful behaviors like smoking. As per the data by WHO; in 2020, cigarettes were used by 22.3% of people worldwide, comprising 36.7% of men and 7.8% of women.

Key Surrogacy Market Insights Summary:

Regional Highlights:

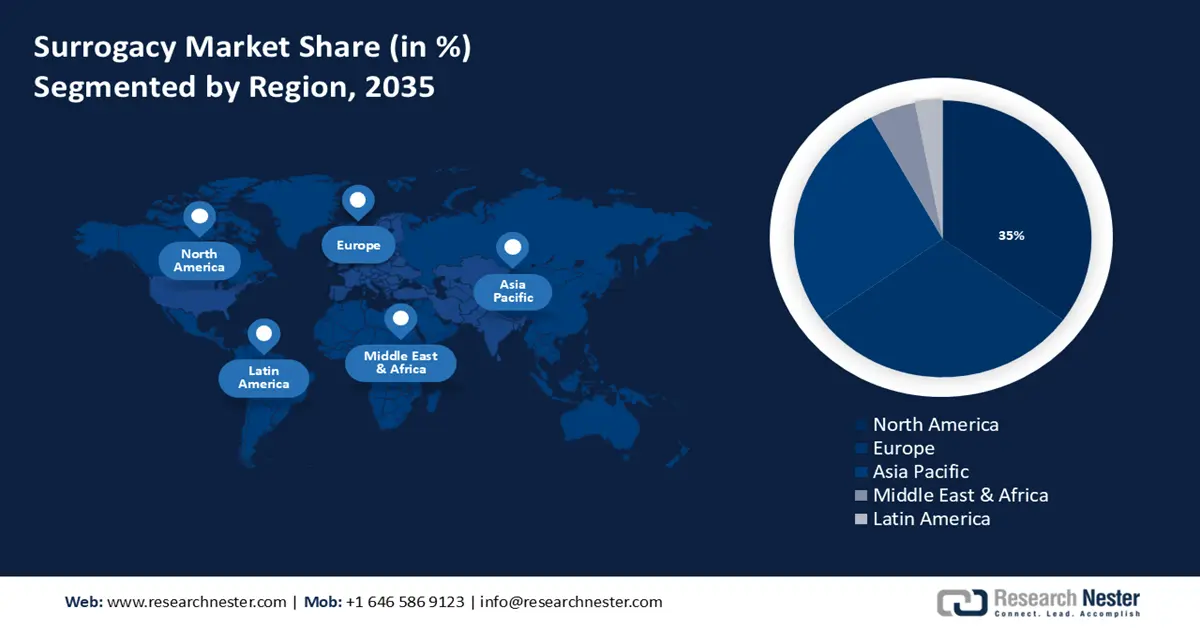

- North America surrogacy market will secure over 35% share by 2035, driven by favorable social, legal, and medical conditions for surrogacy.

- Europe market will achieve substantial CAGR during 2026-2035, driven by improved healthcare infrastructure and innovative technology-based surrogacy treatments.

Segment Insights:

- The gestational segment in the surrogacy market is projected to see significant growth till 2035, driven by the high success rates of gestational surrogacy with IVF advancements.

- The ivf with icsi segment in the surrogacy market is forecasted to witness notable growth till 2035, driven by its effectiveness in treating male infertility.

Key Growth Trends:

- Increasing acceptance of assisted reproductive technologies

- Worldwide tourism for surrogacy

Major Challenges:

- Legal and moral difficulties

- Significant expenses and barriers to finance

Key Players: Nova IVF, Fertility Bridges, Fertility Source Companies, IVF Conceptions, Feskov Surrogacy Agency, Global Fertility & Genetics, Growing Generations, European Sperm Bank, World Center of Baby.

Global Surrogacy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.45 billion

- 2026 Market Size: USD 32.31 billion

- Projected Market Size: USD 238.56 billion by 2035

- Growth Forecasts: 24.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, India, China, United Kingdom, Canada

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Surrogacy Market Growth Drivers and Challenges:

Growth Drivers

- Increasing acceptance of assisted reproductive technologies - The surrogacy market is primarily driven by the increasing acceptability and utilization of Assisted Reproductive Technology (ART). For individuals who struggled with conception, surrogacy offered a workable way to becoming a mother. Advances in medical technology, success rates, and public knowledge of surrogacy as a reproductive option all contributed to the market's rise. According to the statistics of CDC; 167,689 of the 413,776 ART cycles carried out in 2021 involved egg or embryo banking cycles, in which all of the produced eggs or embryos were saved for later use.

- Worldwide tourism for surrogacy - Surrogacy tourism has increased in nations with surrogacy-friendly legislative and regulatory environments, and it is currently expanding globally. This development allowed persons from economies with expensive or restrictive surrogacy laws to use the convenient and reasonably priced surrogacy solutions available in other countries. The surrogacy market in these areas was further stimulated by the influx of overseas clients. Currently, people from outside India, primarily non-resident Indians, commission around 10% of surrogacies.

- Developments in reproductive technologies - The advancements in reproductive medicine have improved the safety and effectiveness of surrogacy. Innovations like IVF, genetic screening, and embryo transfer techniques increase the likelihood and success rate of pregnancy, which makes surrogacy appealing to people who want to establish or expand their families.

For example, in gestational surrogacy, the pregnancy success rate per embryo transfer varies from 30% to 60%. The use of younger, healthier surrogates could result in higher success rates. In the US, 2% of babies born were created with the use of assisted reproductive technologies. Although success rates differ, the caliber of the eggs and embryos has a direct bearing on them. The live birth rate of PGT-tested embryos is 75–80%.

Challenges

- Legal and moral difficulties - One of the main barriers to the surrogacy market is the intricate legal and ethical framework around the practice. Different countries have different laws regarding surrogacy; in some, it is outright prohibited. These legal ambiguities as well as potential moral dilemmas between intended parents and the child bearer may seriously obstruct the market's growth.

- Significant expenses and barriers to finance - Surrogacy is an expensive process that involves numerous charges, such as agency fees, legal fees, medical costs, and surrogate compensation. Many single people and couples are discouraged from choosing surrogacy due to the financial hardship, which is exacerbated by a larger issue with firms that have little insurance coverage in this situation, raising expenses and impeding surrogacy market growth.

Surrogacy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.6% |

|

Base Year Market Size (2025) |

USD 26.45 billion |

|

Forecast Year Market Size (2035) |

USD 238.56 billion |

|

Regional Scope |

|

Surrogacy Market Segmentation:

Type Segment Analysis

Gestational segment is estimated to dominate around 60% surrogacy market share by the end of 2035. Using the gestational surrogacy method, the intended parents' or donors' eggs and sperm are used to conceive the pregnancy, which is then carried by the surrogate. It has special advantages including removing the genetic link between the surrogate and the child, which resolves psychological and legal issues.

Additionally, same-sex couples, those interested in genetic variety, and individuals and couples with reproductive difficulties can benefit from gestational surrogacy. Also, the success rates of gestational surrogacy are increasing because to advancements in the precision of assisted reproductive technologies, namely in vitro fertilization (IVF). As per the information of National Library of Medicine; as of September 4, 2023, IVF has been used to conceive approximately 5 million children globally since 1978.

Technology Segment Analysis

By 2035, IVF with ICSI segment is projected to dominate over 38% surrogacy market share. In vitro fertilization (IVF) in conjunction with intracytoplasmic sperm injection (ICSI) is the dominant technology in the surrogacy business worldwide. In cases where conventional IVF methods may not yield the desired results, IVF with ICSI involves directly inserting a single sperm into an egg to initiate fertilization.

Male infertility has been found to benefit greatly from this approach. These days, many couples who are experiencing infertility choose to use this approach. It has become a dominant category due to its ability to treat a variety of infertility disorders and its consistently high success rates. More than 8 million IVF babies have been born, and more than 2.5 million cycles are carried out annually, translating into more than 500,000 births.

Our in-depth analysis of the global surrogacy market includes the following segments:

|

Type |

|

|

Technology |

|

|

Age Group |

|

|

Service Provider |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surrogacy Market Regional Analysis:

North America Market Insights

North America in surrogacy market is likely to dominate over 35% revenue share by 2035. North America seized the lead in the surrogate business due to its favorable social, legal, and medical conditions. In the USA, gestational surrogates participated in 1.93% of ART cycles and made up 3% of all transfers.

In the United States, this dominance is influenced by a number of factors, such as a large pool of potential surrogates, state-of-the-art medical facilities, developed legal frameworks protecting the rights of intended parents and surrogates, and a general favorable opinion of using surrogacy to start a family. Currently, over 5% of all ART cycles carried out in the US involve surrogacy.

Europe Market Insights

Europe surrogacy market size is predicted to account for substantial share by 2035. The region has adopted more innovative technology-based surrogacy treatments as a result of improved healthcare infrastructure. In order to encourage investment and innovation in healthcare, the European Union (EU) has also put in place a number of health programs. One such program is EU4Health, which was approved in March 2021 by European Commission and has a value of USD 5.12 billion.

In the United Kingdom, a notable rise in infertility-related problems among couples who aren't ready for kids is predicted to drive surrogacy market expansion in the upcoming years. More than 25 million people in the European Union suffer from infertility, according to the European Society of Human Reproduction and Embryology.

The market demand for surrogacy in Germany is driven by the rising number of infertility cases, the rising rate of gamete donations and sperm bank. Between 6.6 and 7.5% of women in Germany who are of reproductive age are currently infertile.

The demand for surrogacy is boosted by the rise in single-parent families and the legalization of single-parent surrogacy in France. According to the data, 2 million of the 8 million families that were looked at in 2020 had children living with just one parent, or "single-parent" families. This represents 24.7% of all French households.

Surrogacy Market Players:

- Circle Surrogacy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nova IVF

- Fertility Bridges

- Fertility Source Companies

- IVF Conceptions

- Feskov Surrogacy Agency

- Global Fertility & Genetics

- Growing Generations

- European Sperm Bank

- World Center of Baby

In order to meet the changing needs of all parties involved in the process and achieve moral as well as legal compliance, the major players in the surrogacy market must concentrate on making adjustments and creating products that are in line with demand.

Recent Developments

- Circle Surrogacy & Egg Donation sponsored a Lifetime of Pride and Joy, a campaign that promotes and supports family equality by increasing awareness of the accessibility of reproductive care for the LGBTQ+ community. This powerful commercial raises awareness of the critical issue of easily available reproductive care while simultaneously celebrating and advancing family equality. Circle Surrogacy is embracing the diversity of contemporary families and taking a strong statement for inclusivity and understanding by taking part in this campaign.

- AHH's Nova IVF Fertility, a pioneer in the field of assisted reproductive healthcare announced within the next four years, an astonishing network of 100 clinics are to be established, according to an ambitious roadmap. This strategic development plan demonstrates the organization's steadfast dedication to offering affordable, cutting-edge reproductive care throughout India.

- Report ID: 6177

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surrogacy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.