Sulfur Dioxide Market Outlook:

Sulfur Dioxide Market size was over USD 10.33 million in 2025 and is projected to reach USD 15.44 million by 2035, witnessing around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sulfur dioxide is evaluated at USD 10.71 million.

Emerging market trends indicate a pivot toward high-value applications such as food preservatives, pharmaceutical intermediates, etc. These segments are growing owing to rising health and food safety standards worldwide. In June 2024, the updated list of approved food additives was released by the U.S. Food and Drug Administration (FDA) that included the use of sulfites as food additives or preservatives. For instance, the FDA highlights the use of ammonium sulfate as a dough condition, potassium sulfite as an antimicrobial agent, and sodium bisulfite as an antioxidant, among a few. The regulatory endorsement bolsters market confidence and ensures a steady revenue stream due to demands from an expanding global food industry.

Furthermore, advancements in sulfur recovery technologies align with the production requirements, which stands to boost the supply chain. In January 2024, research published in the Journal of Engineering and Applied Science compared Claus and THIOPAQ sulfur recovery techniques in natural gas plants and indicated that the THIOPAQ O&G process represented a cost-effective alternative to the traditional Claus process due to reduced chemical usage and minimal energy consumption. Furthermore, companies are leveraging the THIOPAQ O&G bio desulfurization system to provide eco-friendly solutions with the looming net zero carbon goals. Key market players, such as Schlumberger NV (SLB) are providing cost-effective solutions to sweeten gas to solid elemental sulfur and expand their revenue share in the sulfur dioxide market.

The sulfur dioxide sector is poised to benefit from emerging trends in specialty applications such as pharmaceutical intermediates and water treatment solutions. The critical role of sulfur dioxide in high-value segments highlights its relevance in end use industries. Additionally, Key market players that strategically invest in the growth avenues are positioned to capitalize on evolving demands from industries and consumers. The favorable growth opportunity in the market is evident by the expansion of profit shares in gas & services segments by the major players in the sector. For instance, Air Liquide S.A. reported a USD 3.3 billion net profit in their financial report for 2023, with North America and Europe accounting for 39% and 37% revenue share, respectively, in the gas & services segment. The report indicated large industries accounted for a 28% revenue share as end user of gas & services, which bodes well for a steady demand for sulfur recovery and elemental sulfur.

Key Sulfur Dioxide Market Insights Summary:

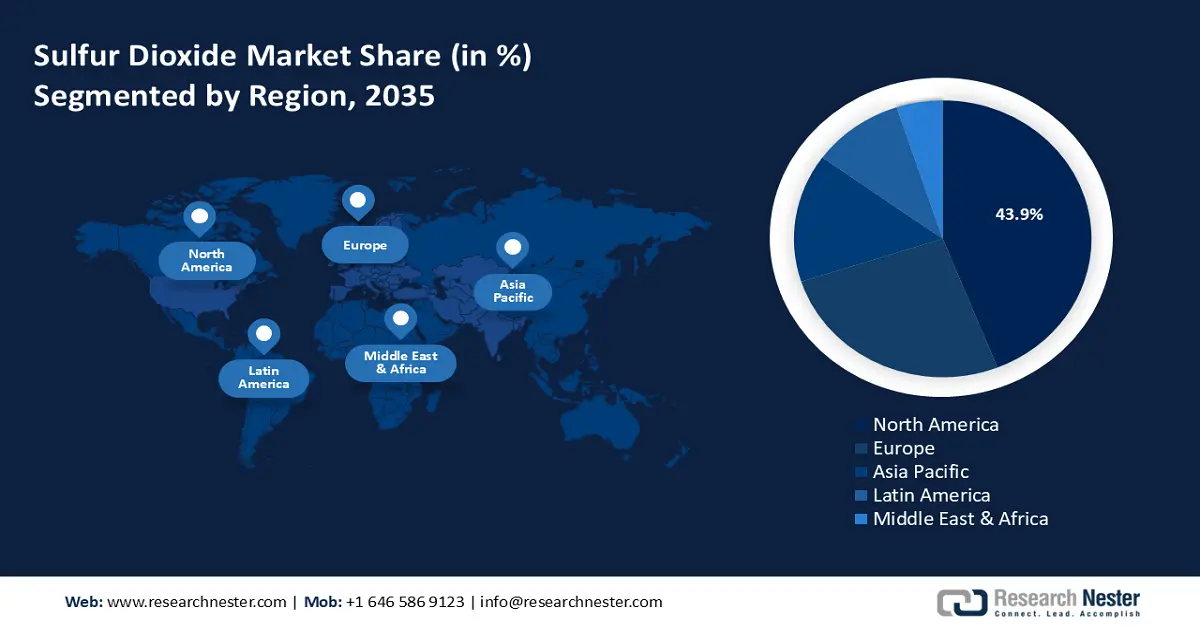

Regional Highlights:

- North America sulfur dioxide market will account for 43.90% share by 2035, driven by a diverse industrial base and environmental regulations spurring sulfur recovery investments.

- Europe market will exhibit the fastest growth during the forecast period 2026-2035, fueled by the chemical industry demand and advancements in sulfur recovery technology.

Segment Insights:

- The liquid segment in the sulfur dioxide market is expected to dominate by 2035, driven by the ease of transport and storage, and increasing industrial applications.

- The winemaking (application) segment in the sulfur dioxide market is anticipated to expand by 2035, driven by rising demand for sulfur dioxide in cask aging and microbial risk mitigation.

Key Growth Trends:

- Rising demand from the pulp & paper industry

- Growing demand for advanced water treatment solutions

Major Challenges:

- Competition from circular economy initiatives

Key Players: Linde PLC, Evonik, Merck, Air Liquide, INEOS, PVS Phosphate, Tokyo Chemical Industry Co., Ltd., Chemtrade Logistics Inc.

Global Sulfur Dioxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.33 million

- 2026 Market Size: USD 10.71 million

- Projected Market Size: USD 15.44 million by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Sulfur Dioxide Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand from the pulp & paper industry: The sulfur dioxide market is poised to benefit from steady demand from the pulp & paper industry. The European Environment Agency (EEA) has certified that sulfite pulping is more suitable for printing and requires less bleaching. Despite competition from Kraft pulping, sulfite pulping has retained a strong application in mills owing to its ability to produce brighter pulp with lower lignin content.

Furthermore, the sulfur dioxide market benefits from the expansion of the packaging that is driving demand for paper products. For instance, in September 2024, Nestlé announced packaging with paper innovations across major brands. The burgeoning trends for paper-based packing are set to expand demand for paper-based solutions, leading to rising demand for sulfite pulp, which companies can leverage to increase sulfur dioxide supply to paper mills.

The market is witnessing trends where key players are upgrading pulping lines in emerging opportunities in developing markets. For instance, in June 2023, ANDRITZ announced an order from Mpact Operations to upgrade the pulping line at its paper mill in South Africa. Andritz will upgrade the entire neutral sulfite semi-chemical pulping (NSSC) line as per the order. - Growing demand for advanced water treatment solutions: The rising prevalence of water treatment solutions is positioned to boost sulfur dioxide demands. The U.S. Environmental Protection Agency (EPA) indicates that sulfur dioxide is used in water treatment for the dichlorination of treated wastewater and as a precursor to other water treatment chemicals. The market will benefit from public and private corporations collaborating to advance water treatment solutions, with water scarcity becoming an issue worldwide.

Additionally, wastewater treatment contracts and plant projects create opportunities for sulfur dioxide distributors. For instance, in December 2024, Southland Holdings Inc. was granted a USD 60 million wastewater treatment plant project in the U.S. The demand for sulfur dioxide in wastewater treatment plants is also expected to intensify in middle-to-low-income economies where greater emphasis is being put on improving public health infrastructure. - Increasing applications in the textile industry and rising specialty applications: The sulfur dioxide market will benefit from increasing applications as a bleaching agent in the textile industry. Although environmental concerns exist, sulfur dioxide remains a cost-effective bleaching agent, especially in the bleaching of straw and wool. The market players will find distribution opportunities in medium and small-scale manufacturers seeking to reduce operation costs by adopting sulfur dioxide as a bleaching agent.

Additionally, the expanding use of sulfur dioxide in specialty applications is poised to create new revenue streams within the market. For instance, in December 2024, Stellantis and Zeta Energy announced an agreement to develop lithium-sulfur EV batteries. The batteries are expected to cost less than lithium-ion batteries, and as production picks up, it is expected to create new avenues for sulfur dioxide suppliers to support the battery-grade sulfur supply line.

Challenges

- Stringent environmental regulations: Sulfur dioxide-based applications face challenges of environmental concerns, with many industries moving away to alternative gases. Sulfur dioxide plays a role in acid rain and air pollution, causing its commercial and industrial scale usage to be heavily scrutinized.

- Competition from circular economy initiatives: The growing reliance on circular economy practices poses a challenge to virgin sulfur dioxide production dependence. Alternative materials that can help industries achieve sustainability goals pose stiff competition to sulfur dioxide. Furthermore, emerging applications have limited and uncertain scalability, and the slow expansion can delay the market’s growth.

Sulfur Dioxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 10.33 million |

|

Forecast Year Market Size (2035) |

USD 15.44 million |

|

Regional Scope |

|

Sulfur Dioxide Market Segmentation:

Form Segment Analysis

The liquid segment is projected to account for more than 80.4% sulfur dioxide market share by the end of 2035. A key driver of the segment is its ease of transport and storage of sulfur dioxide in liquid form. Additionally, advancements in safe handling systems bolster its demand with the rising prevalence of stringent emission standards. Furthermore, the liquid form is the preferred form in industrial applications for the sulfur dioxide market, ensuring the segment’s dominance.

Furthermore, advancements to reduce emissions can benefit the segment. For instance, in October 2023, Nornickel, a Russian nickel and palladium mining and smelting company, inaugurated a Sulfur Program, establishing an advanced facility for sulfur dioxide utilization. The program has the potential to increase the availability of raw materials for production and bodes well for the segment owing to the ease of transport of liquid sulfur dioxide.

The gas segment of the sulfur dioxide market by form is poised to expand its share during the forecast period. The gas form is viable for industries that require direct chemical reactions, such as flue gas desulfurization (FGD). Furthermore, demand from energy-intensive sectors such as power generation is poised to benefit the segment’s continued growth. Advancements in sulfur dioxide gas handling technologies are poised to boost transportation and production, assisting the segment’s growth.

Application Segment Analysis

By application, the winemaking segment of the sulfur dioxide market is poised to expand during the forecast period. Sulfur dioxide is a vital additive in the winemaking process, owing to its use as an antioxidant and an antimicrobial agent. The usage of sulfur dioxide in the wine, scotch & whiskey barrel casks ensures the quality of the aging process.

With the demand for casks rising, sulfur dioxide is expected to find greater applications, leading to emerging profitable opportunities in the sulfur dioxide market. For instance, in October 2024, Blue Note released a limited-edition honey rye cask. The trends indicate an increase in the production of specialized casks for aging wines and whiskey, which is positioned to create a steady demand for the application of sulfur dioxide to mitigate microbial contamination risks, especially in regions such as North America and Europe, where wine consumption is relatively high compared to other regions.

Our in-depth analysis of the global sulfur dioxide market includes the following segments:

|

Form |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sulfur Dioxide Market Regional Analysis:

North America Market Insights

In sulfur dioxide market, North America region is poised to capture over 43.9% share by 2035 and is poised to hold a leading position by the end of the forecast period. A diverse industrial base drives the market and environmental regulations have spurred investments in sulfur recovery. The U.S. and Canada lead the revenue share of the North America sulfur dioxide market.

Sulfur dioxide is expected to find increasing applications as a feedstock for sulfuric acid in fertilizer production for the growing agricultural sector in North America. Additionally, the food & beverage industry in the region is poised to drive demand owing to increasing sales of processed food. The U.S. Department of Agriculture estimates a total export value of USD 36.61 billion for processed foods. This creates a steady demand for sulfur dioxide to be used as an additive to extend the shelf life of processed foods.

The U.S. holds a dominant share in the North America sulfur dioxide market. The food & beverages sector is expected to remain the largest end user of sulfur dioxide while the market is poised to expand owing to the rise of specialty applications, creating opportunities to supply sulfur dioxide. For instance, in October 2024, Lyten announced plans to build the world’s first lithium-sulfur gigafactory in the U.S. Lithium-sulfur batteries would depend on sulfur-based compounds for energy storage and as production scales up, the sulfur dioxide market is poised to find a new revenue stream.

Canada is positioned to expand its market share in the sulfur dioxide market of North America by the end of the forecast period. The agricultural sector of Canada is expected to drive demand for sulfur-based fertilizer solutions. Furthermore, the advent of advanced gas treatment solutions is poised to boost sulfur recovery, creating additional supply streams for the market. For instance, in May 2023, CSV Midstream Solutions Corp. selected Axens to supply the technologies for the sulfur recovery unit for the Albright Sour Gas processing plant in Canada. Additionally, it indicates emerging demand for advanced sulfur recovery solutions that companies can leverage within the market.

Europe Market Insights

The Europe sulfur dioxide market is poised to register the fastest growth during the forecast period. The chemical industry of Europe is poised to remain a significant consumer of sulfur dioxide. Additionally, Europe has a robust winemaking sector led by France, Spain, and Italy that bolsters demand for the use of sulfur dioxide in the aging process. Germany and France are two major markets of Europe.

Furthermore, advancements by companies based in Europe to provide innovative sulfur recovery technology are poised to boost the sector’s growth. For instance, in September 2024, NEXTCHEM (Maire), from Italy, announced that they would execute a technological assessment and a process design package to upgrade the existing sulfur recovery unit of the HAOR complex in Azerbaijan. The contracts indicate burgeoning opportunities for companies based in Europe to provide sulfur recovery solutions and bolster the supply chain in the region.

Germany is a major contributor to the Europe sulfur dioxide market. The presence of industry-leading chemical companies in the country benefits the sulfur dioxide sector. In March 2024, Evonik announced the expansion of sustainable catalyst offerings with Octamax which will be a cost-efficient solution to improve sulfur removal and maximize octane retention. The expansion of refineries is poised to provide opportunities for businesses in the region to provide advanced sulfur recovery solutions.

France is an emerging in the Europe sulfur dioxide market. The wine sector of France is renowned worldwide, and sulfur dioxide is expected to experience a steady demand from winemakers in the country, boosting the sector’s growth. The European Union (EU) imposes strict regulations on the amount of sulfur dioxide in wines, with red wine restricted to no more than 150 mg/L and white wine at 200 mg/L. In July 2023, research published in MDPI indicated sulfur dioxide to continue representing an essential preservative in the wine-making process, despite challenges from alternative products, and stated that an adequate concentration of sulfur dioxide is vital for the stability of wine and preserving its aroma. The study is a reassurance for sulfur dioxide suppliers who are navigating the challenges of sulfur dioxide becoming obsolete for the wine industry.

Sulfur Dioxide Market Players:

- Linde PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik

- Merck

- Air Liquide

- INEOS

- PVS Phosphate

- Tokyo Chemical Industry Co., Ltd.

- Chemtrade Logistics Inc.

The sulfur dioxide market is projected to register robust growth during the forecast period. The key market players are investing in technological advancements, strategic collaborations, and regional expansions to increase market shares. Furthermore, businesses in the sector are investing to increase the production of high-purity sulfur dioxide for industrial end users. Investment opportunities in emerging markets in low-to-middle-income economies are positioned to benefit the companies further.

Here are some key players in the sulfur dioxide market:

Recent Developments

- In September 2024, Lyten’s lithium-sulfur battery technology was chosen to be demonstrated on the International Space Station. The rechargeable lithium-sulfur battery cells were selected by the International Space Station (ISS), and the Defense Innovation Unit (DIU) is funding the work on the ongoing lithium-sulfur development.

- In January 2023, Technip Energies was awarded a contract to upgrade Aramco’s sulfur recovery facilities at the Riyadh Refinery. The contract will cover the implementation of the three new tail gas treatment (TGT) units, and improve the performance of the existing three sulfur recover units (SRU) in the wake of stringent sulfur dioxide emission regulations.

- Report ID: 6831

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sulfur Dioxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.