Global Stethoscope Market

- Introduction

- Executive Summary

- Market Overview

- Global Stethoscope Market

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Key Regulatory Bodies for Stethoscopes

- Competitive Landscape

- Bestselling Stethoscope Models Globally

- Company Market Share Analysis, 2023 (%)

- Strategies to Adopt for Expanding the Presence in the Global Stethoscope Market

- Start-up Companies in Smart Stethoscope

- Competitive Model

- Market Share of Major Companies Profiled, 2023

- Business Profile of Key Enterprise

- 3M

- Medline Industries, LP.

- Welch Allyn (Hill-Rom Holdings, Inc.)

- Eko Health, Inc.

- GF Health Products, Inc.

- Rudolf Riester GmbH (Halma plc)

- American Diagnostic Corporation

- Cardionics Inc.

- PAUL HARTMANN AG

- HEINE Optotechnik GmbH & Co. KG

- StethoMe sp. z o.o.

- Global Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Stethoscope Market Segmentation Analysis (2024-2035)

- By Type

- Electronic/Digital Stethoscope

- Analog Stethoscope

- By Material

- Stainless Steel

- Aluminum

- Brass

- By Usage

- Clinical Use

- Home Use

- Veterinary Use

- By Distribution Channel

- Online

- Offline

- By End user

- Physicians

- Nurses

- Medical Students

- Emergency Medical Technicians (EMTs)

- Veterinarians

- By Geography

- North America, Market Value (USD Million), and CAGR, 2024-2035F

- Europe Market Value (USD Million) and CAGR, 2024-2035F

- Asia Pacific Market Value (USD Million) and CAGR, 2024-2035F

- Latin America Market Value (USD Million) and CAGR, 2024-2035F

- Middle East and Africa Market Value (USD Million) and CAGR, 2024-2035F

- By Type

- Market Overview

- North America Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units) and Compound Annual Growth Rate (CAGR)

- North America Stethoscope Market Segmentation Analysis (2024-2035)

- By Type

- Electronic/Digital Stethoscope

- Analog Stethoscope

- By Material

- Stainless Steel

- Aluminum

- Brass

- By Usage

- Clinical Use

- Home Use

- Veterinary Use

- By Distribution Channel

- Online

- Offline

- By End user

- Physicians

- Nurses

- Medical Students

- Emergency Medical Technicians (EMTs)

- Veterinarians

- By Country

- U.S.

- Canada

- By Type

- Europe Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units) and Compound Annual Growth Rate (CAGR)

- Europe Stethoscope Market Segmentation Analysis (2024-2035)

- By Type

- Electronic/Digital Stethoscope

- Analog Stethoscope

- By Material

- Stainless Steel

- Aluminum

- Brass

- By Usage

- Clinical Use

- Home Use

- Veterinary Use

- By Distribution Channel

- Online

- Offline

- By End user

- Physicians

- Nurses

- Medical Students

- Emergency Medical Technicians (EMTs)

- Veterinarians

- By Country

- UK

- Germany

- France

- Italy

- Spain

- BENELUX

- Poland

- Russia

- Rest of Europe

- By Type

- Asia Pacific Excluding Japan Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units) and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Stethoscope Market Segmentation Analysis (2024-2035)

- By Type

- Electronic/Digital Stethoscope

- Analog Stethoscope

- By Material

- Stainless Steel

- Aluminum

- Brass

- By Usage

- Clinical Use

- Home Use

- Veterinary Use

- By Distribution Channel

- Online

- Offline

- By End user

- Physicians

- Nurses

- Medical Students

- Emergency Medical Technicians (EMTs)

- Veterinarians

- By Country

- China

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Singapore

- New Zealand

- Rest of Asia Pacific excluding Japan

- By Type

- Japan Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units) and Compound Annual Growth Rate (CAGR)

- Japan Stethoscope Market Segmentation Analysis (2024-2035)

- Latin America Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units) and Compound Annual Growth Rate (CAGR)

- Latin America Stethoscope Market Segmentation Analysis (2024-2035)

- By Type

- Electronic/Digital Stethoscope

- Analog Stethoscope

- By Material

- Stainless Steel

- Aluminum

- Brass

- By Usage

- Clinical Use

- Home Use

- Veterinary Use

- By Distribution Channel

- Online

- Offline

- By End user

- Physicians

- Nurses

- Medical Students

- Emergency Medical Technicians (EMTs)

- Veterinarians

- By Type

- Middle East & Africa Stethoscope Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units) and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Stethoscope Market Segmentation Analysis (2024-2035)

- By Type

- Electronic/Digital Stethoscope

- Analog Stethoscope

- By Material

- Stainless Steel

- Aluminum

- Brass

- By Usage

- Clinical Use

- Home Use

- Veterinary Use

- By Distribution Channel

- Online

- Offline

- By End user

- Physicians

- Nurses

- Medical Students

- Emergency Medical Technicians (EMTs)

- Veterinarians

- By Country

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- By Type

- Global Economic Scenario

- About Research Nester

Stethoscope Market Outlook:

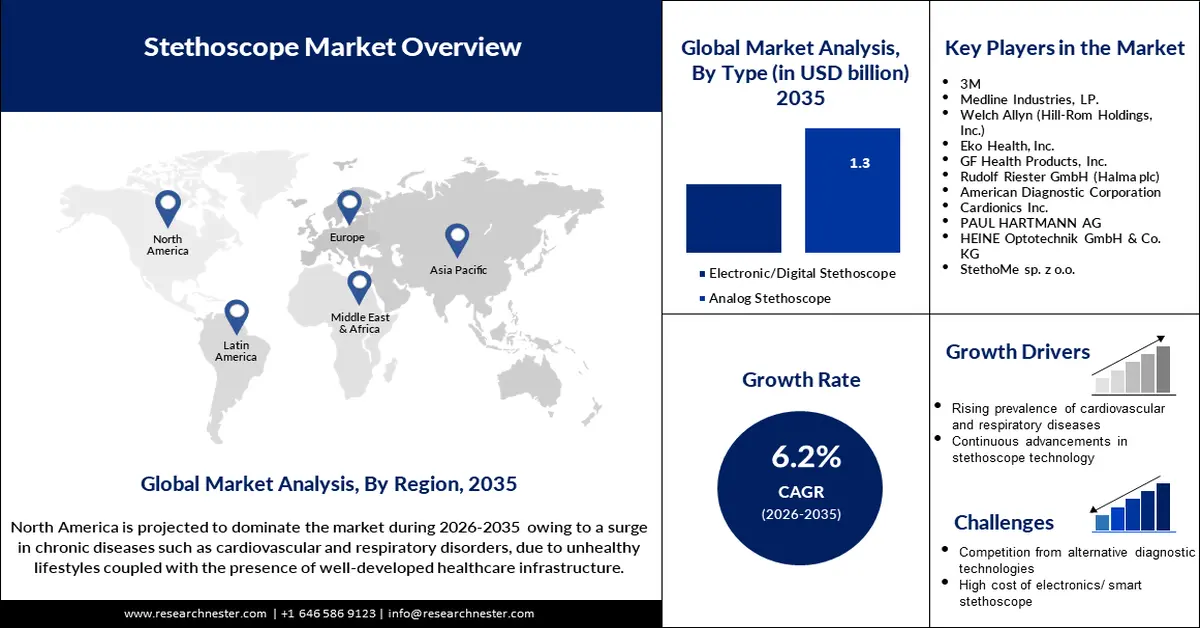

Stethoscope Market size was over USD 713.73 million in 2025 and is projected to reach USD 1.3 billion by 2035, witnessing around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stethoscope is evaluated at USD 753.56 million.

The stethoscope market is witnessing steady growth, especially with the incorporation of digital and artificial intelligence technologies, making it a vital device in the field of diagnosis. The need for better diagnostic and telemedicine has led to the development of new and more efficient stethoscopes. For instance, in June 2023, Eko Health launched its CORE 500 stethoscope equipped with AI and a 3-lead ECG that allows early disease diagnosis and better patient care. These advancements exemplify the increasing application of smart stethoscopes in improving conventional auscultation techniques to advanced diagnostic instruments.

The stethoscope market growth is also supported by increased government support and investment in telehealth technologies. In January 2024, Japan’s Ministry of Health released policies that encouraged online medical treatments and opened possibilities for digital stethoscopes that work with telemedicine applications. Also, the launching of new strategic partnerships, for instance, the partnership between Eko Health and Caregility in 2022 for remote auscultation, shows that the industry is working towards increasing access to quality diagnostics. The stethoscope market is expected to be at the forefront of the larger telehealth solutions industry across the world.

Key Stethoscope Market Insights Summary:

Regional Highlights:

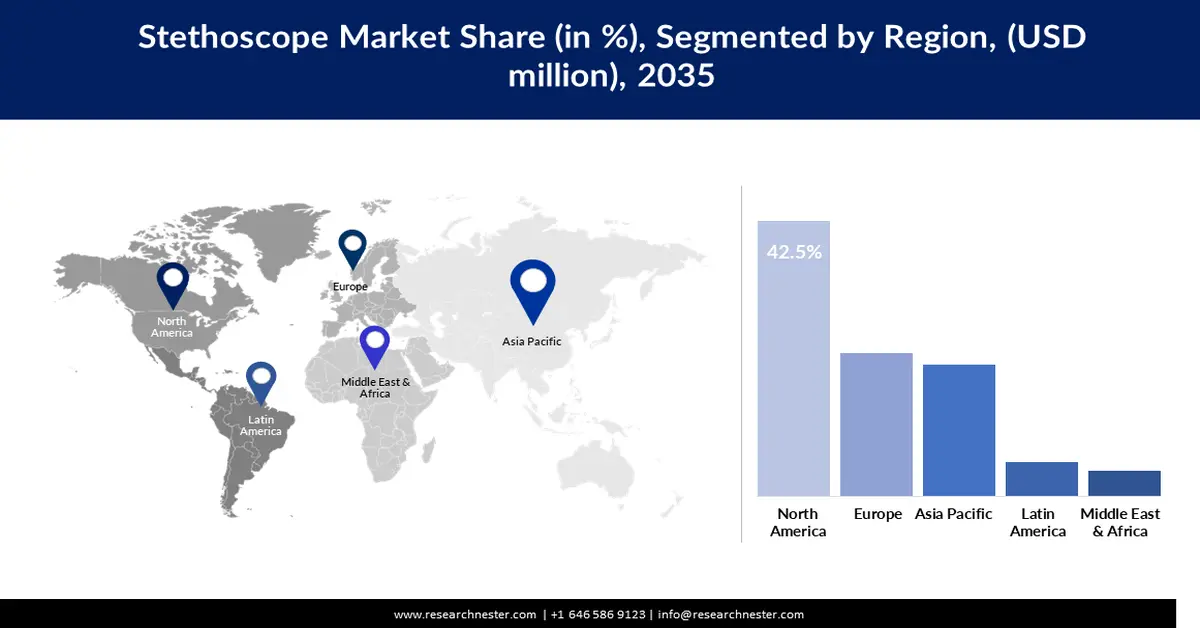

- North America leads the Stethoscope Market with a 42.5% share, propelled by growing healthcare workforce and demand for advanced diagnostic equipment, driving sustained growth through 2035.

- Asia Pacific excluding Japan’s stethoscope market is expected to experience moderate growth by 2035, driven by increasing healthcare industry advancement and rising awareness.

Segment Insights:

- The Stainless Steel segment is projected to hold over 68.9% market share by 2035, driven by its high acoustic performance, durability, and corrosion resistance.

- The Analog Stethoscope segment of the Stethoscope Market is projected to hold over 64% share by 2035, fueled by its affordability, simplicity, and high usage in developing countries.

Key Growth Trends:

- Demand for telemedicine as a solution

- Increase in cardiovascular and respiratory diseases

Major Challenges:

- Data privacy and integration challenges

- Lack of adoption in low-income areas

- Key Players: 3M, Medline Industries, LP., Welch Allyn (Hill-Rom Holdings, Inc.), Eko Health, Inc., GF Health Products, Inc., Rudolf Riester GmbH (Halma plc), American Diagnostic Corporation, Cardionics Inc., PAUL HARTMANN AG, HEINE Optotechnik GmbH & Co. KG, StethoMe sp. z o.o.

Global Stethoscope Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 713.73 million

- 2026 Market Size: USD 753.56 million

- Projected Market Size: USD 1.3 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Stethoscope Market Growth Drivers and Challenges:

Growth Drivers

- Demand for telemedicine as a solution: New telemedicine services have enhanced the stethoscope market greatly, and the demand for stethoscopes with AI and telehealth features has increased. For instance, MedM launched its compatibility with the iBiomedi ES-2020 stethoscope for remote patient monitoring in September 2024 and improved diagnostic capability. Owing to the increased use of virtual health care and the growth of telemedicine, stethoscope technologies are rapidly evolving.

- Increase in cardiovascular and respiratory diseases: The rising incidence of cardiovascular and respiratory diseases worldwide has created a need for more efficient diagnostic equipment. In April 2024, the FDA approved an AI-enabled stethoscope that was developed by Mayo Clinic and Eko Health for the identification of heart failure. These advancements meet the fundamental requirement of identifying diseases with high fatality rates at an early stage and, therefore, the need to innovate in stethoscope design.

- Improvements in the technology of digital stethoscopes: The future of diagnostics is here as digital stethoscopes are now enhanced with AI and have superior acoustic technology. For example, Riester introduced the ri-sonic E-stethoscope in January 2024, which incorporated AI-based platforms for the identification of cardiac murmurs. These advancements satisfy the increasing need of healthcare workers for hybrid devices that combine standard components with new technological options.

Challenges

- Data privacy and integration challenges: The application of AI and IoT in digital stethoscopes brings about the issues of data protection and system compatibility. According to the National Telehealth Survey of February 2024, the users’ concern with data protection remains a concern even as the use of telemedicine continues to rise. These challenges must be met for manufacturers to be able to integrate securely with HCITs and meet data protection laws.

- Lack of adoption in low-income areas: Expenses and poor healthcare facilities do not allow the use of innovative AI stethoscopes in low-income countries. However, these barriers prevent access to the new diagnostic devices, hence leading to the disparity in the provision of health care services. Therefore, manufacturers' concentration should be on cost effective inventions and partnerships to meet these gaps in the needy regions.

Stethoscope Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 713.73 million |

|

Forecast Year Market Size (2035) |

USD 1.3 billion |

|

Regional Scope |

|

Stethoscope Market Segmentation:

Type (Electronic/Digital Stethoscope, Analog Stethoscope)

Analog stethoscope segment is likely to dominate over 64% stethoscope market share by 2035. The segment has experienced growth owing to the affordability, simplicity, and high usage of traditional stethoscopes, especially in developing countries. The traditional types are preferred by doctors because they are tough, dependable, and do not require electricity to operate. In June 2023, the TRICORDER program led by Imperial College London described the continued value of analog stethoscopes in primary care, alongside AI technologies. Also, the advancements in acoustic performance, for instance, lighter weight and better chest pieces, continue to be useful.

Material (Stainless Steel, Aluminum, Brass)

By the end of 2035, stainless steel segment is set to hold over 68.9% stethoscope market share. The material’s high acoustic performance and the fact that it is both durable and corrosion resistant make it ideal for use in high quality stethoscopes. Stainless steel stethoscopes are very popular with physicians and other healthcare givers who need clear sound for identification purposes. Eko Health introduced the CORE 500 stethoscope in October 2024, the chest piece of which is made of stainless steel and is intended for the best sound and durability. Furthermore, the use of stainless steel stethoscopes is also being integrated into modern and enhanced stethoscopes with AI and digital features.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Material |

|

|

Usage |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stethoscope Market Regional Analysis:

North America Market Analysis

North America in stethoscope market is anticipated to dominate over 42.5% revenue share by 2035. The healthcare industry in the region is mature, and the number of healthcare professionals is constantly growing, which leads to the need for better diagnostic equipment. The U.S. Bureau of Labor Statistics predicted that healthcare employment will continue to increase, and veterinary positions will increase by 19% from 2023 to 2033. The position of North America in the field of healthcare technology development enhances its importance in the global stethoscope market.

In the U.S., the increasing population of healthcare professionals increases the need for stethoscopes. The National Council of State Boards of Nursing estimated that in 2024, there were around 4.85 million registered nurses, which makes nursing the most populated profession in the healthcare field. The growth in the use of telemedicine has also led to the development of AI-based stethoscopes that facilitate remote patient examination. Also, the policies to increase the coverage of primary care are promoting the use of high-performance medical equipment, this is in line with the country’s goal to enhance healthcare delivery.

The healthcare industry in Canada is also gradually developing with an emphasis on digital health technologies. Telemedicine and remote diagnostic services have been expanded owing to technological advancement, especially in rural areas that face the challenge of accessing health care services. With the government’s commitment to the modernization of healthcare, more consumers are using advanced stethoscopes that are connected with AI and IoT. Due to the efforts being made to enhance the health of its citizens, the country is a potential market for advanced diagnostic solutions.

Asia Pacific Market Statistics

Asia Pacific stethoscope market is projected to register significant growth over the forecast period, attributed to the increasing advancement in the healthcare industry and increased awareness of healthcare. With the region's investment in medical devices growing and the primary care services being extended, there is a rising need for stethoscopes. Furthermore, the use of AI diagnostic tools in hospitals and clinics across Asia Pacific shows the region’s commitment to improving healthcare through technology.

India healthcare industry is rapidly expanding due to policies like Ayushman Bharat that seek to offer healthcare to millions of Indians at low costs. The demand for stethoscopes is increasing owing to the fact that primary healthcare facilities are rapidly being extended in rural areas. Furthermore, the growing incidence of cardiovascular and respiratory diseases is generating the need for better diagnostic solutions, which has led to the use of digital stethoscopes with Artificial Intelligence. India is emerging as one of the leading countries in the Asia Pacific stethoscope market for healthcare modernization.

China has rapidly developed its healthcare market due to government efforts to enhance the healthcare systems in rural and urban areas. The country is focused on embracing AI in its healthcare systems, and this has created a lucrative stethoscope market for digital stethoscopes. Focusing on primary care and telemedicine, China is experiencing an increasing use of advanced diagnostic technologies. The government’s effort to enhance the healthcare delivery system makes China a crucial stethoscope market in Asia Pacific.

Key Stethoscope Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medline Industries, LP.

- Welch Allyn (Hill-Rom Holdings, Inc.)

- Eko Health, Inc.

- GF Health Products, Inc.

- Rudolf Riester GmbH (Halma plc)

- American Diagnostic Corporation

- Cardionics Inc.

- PAUL HARTMANN AG

- HEINE Optotechnik GmbH & Co. KG

- StethoMe sp. z o.o.

The stethoscope market is highly competitive with key players and new market entrants contributing to the development of novel technologies in the market. Some of the leading players in the global market include 3M, Medline Industries, Welch Allyn (Hill-Rom Holdings, Inc.), and Eko Health, Inc., which have a large number of products and a well-established distribution network. Some of these companies are coming up with new products by incorporating new technologies such as Artificial Intelligence as well as Digital Interfaces into their stethoscopes.

In April 2024, Mayo Clinic and Eko Health released an FDA-cleared AI algorithm that was embedded into a digital stethoscope for heart failure classification. This development is an example of how companies are leveraging AI and approval to gain market share. Such strategic decisions can be attributed to the growth of the stethoscope market to enhance the diagnostic equipment that fits the current healthcare systems.

Here are some leading companies in the stethoscope market:

Recent Developments

- In May 2024, A&D Company, Limited signed a USD 1 million investment agreement with Aevice Health to support its expansion in the U.S. and Japan. With backing from JETRO Singapore, Aevice leverages A&D's sales network to enhance its respiratory health IT solutions globally.

- In October 2023, Smartsound and SK Telecom signed a partnership agreement to launch AI stethoscopes for animals, WITHaPET, along with AI auscultation and diagnostic services. The solution combines video diagnosis and AI to deliver precise disease identification for pets, enhancing veterinary care.

- In June 2023, Sparrow BioAcoustics obtained FDA approval for its smartphone software that transforms devices into medical stethoscopes. This Software as a Medical Device enables smartphones to capture, analyze, and share data on cardiovascular and pulmonary sounds, revolutionizing portable diagnostics.

- Report ID: 6987

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stethoscope Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.