Software License Management Market Outlook:

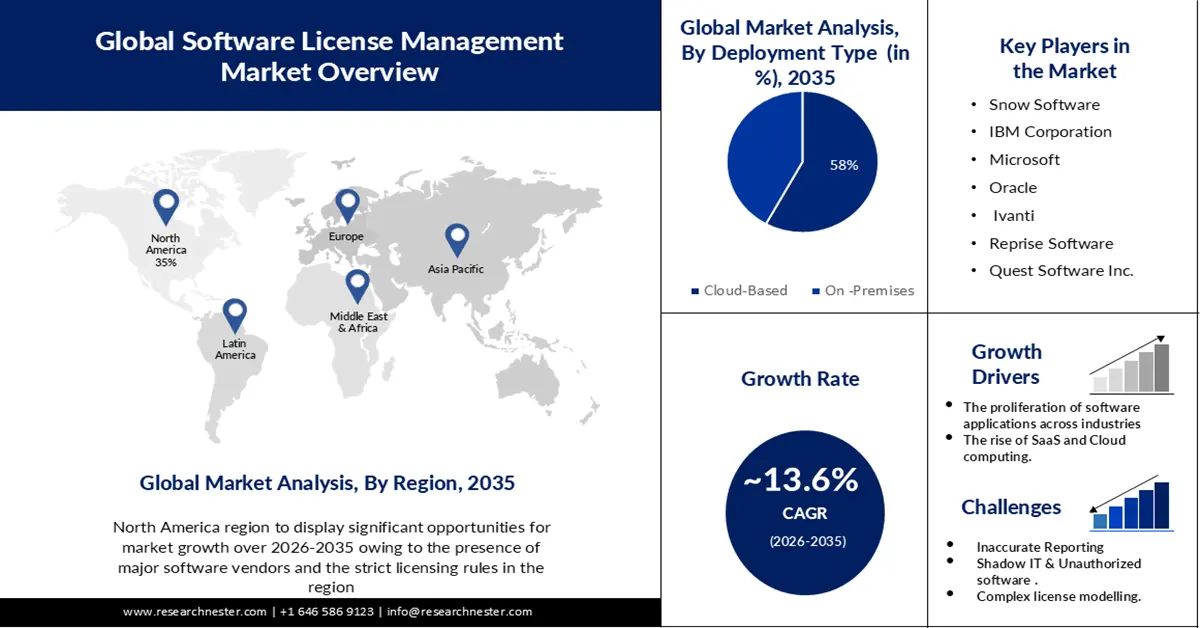

Software License Management Market size was valued at USD 3.27 billion in 2025 and is likely to cross USD 11.7 billion by 2035, registering more than 13.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of software license management is assessed at USD 3.67 billion.

The software license management market's growth can be attributed to the rising number of software audits in business operations. The software audit primarily works as “health check” for the company’s IT infrastructure. These audits ensure whether the software systems are functioning correctly and in line with business objectives. In case a company does not conduct a software audit, there are increased security vulnerabilities such as data breaches. For instance, according to Harvard Business Review, the number of data compromises in 2023 jumped 78% from the previous year due to supply chain attacks.

Additionally, SLM is widely adopted by entrepreneurs as it provides visibility into the usage of software and allows companies to find out and eradicate unnecessary licenses. It also helps in finding out better deals based on data usage and saves costs. These factors are fueling the demand for the SLM in the coming period.

Key Software License Management Market Insights Summary:

Regional Highlights:

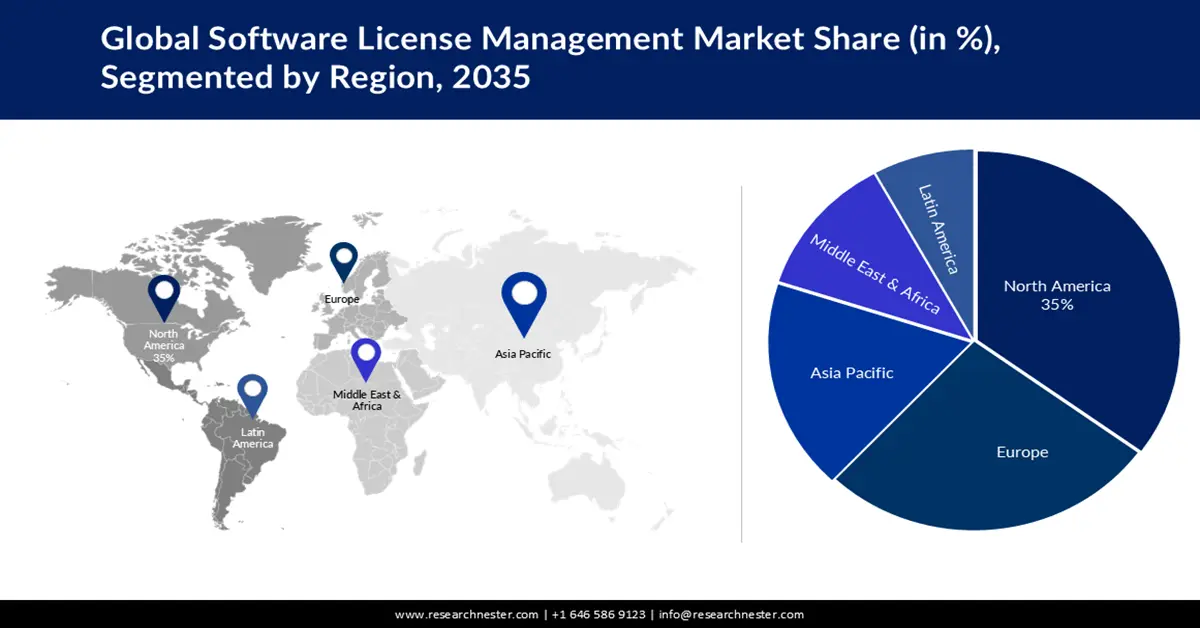

- The North America software license management market will dominate more than 35% share by 2035, attributed to the presence of major software vendors, strict licensing rules, and rising remote work complexity.

- The Europe market will capture a significant revenue share by 2035, driven by increased focus on software compliance due to GDPR and enhanced cybersecurity measures.

Segment Insights:

- The cloud-based segment in the software license management market is projected to achieve a 58% share by 2035, influenced by the global adoption of SaaS and remote work solutions.

- The end-user (bfsi) segment in the software license management market is expected to maintain the largest share by 2026-2035, driven by digitization efforts and demand for paperless banking operations.

Key Growth Trends:

- Rising need to maintain software inventory

- Increase in usage of cloud and SaaS

Major Challenges:

- Complex licensing model

- Inaccurate reporting

Key Players: Flexera, Snow Software, IBM Corporation, Microsoft, Oracle, ASPERA technology s.r.o., ServiceNow, Inc., Broadcom., BMC Software, Inc.

Global Software License Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.27 billion

- 2026 Market Size: USD 3.67 billion

- Projected Market Size: USD 11.7 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Software License Management Market Growth Drivers and Challenges:

Growth Drivers

- Rising need to maintain software inventory: Maintaining a software inventory is pivotal as it helps in ensuring cybersecurity as well as operational efficiency. SLM offers software inventory management that informs about renewal and the database of the entire software footprints. It keeps reminding of not to pay for unused licenses and avoid duplicate subscriptions. These factors are bolstering the market growth during the forecasted period.

- Increase in usage of cloud and SaaS: The shift toward cloud computing and Software as a Service (SaaS) enterprise applications have changed the way software is deployed and licensed. With the rising usage of cloud, the requirement for licensing is also increasing subsequently. Almost all the software based on cloud render services through the subscription model, which requires robust management of licenses to ensure compliance. According to data published by the European Union in 2023, 42% of enterprises bought cloud computing services. The rising usage of the cloud is instilling the demand for the software license management, further augmenting the market growth.

- Globalization of businesses: Organizations with global operations often need to manage software licenses across different regions and jurisdictions. Software license management solutions provide centralized control, enabling businesses to maintain compliance across diverse geographical locations.

Challenges

- Complex licensing model: Software vendors often use complex and varied licensing models, including per-user, per-device, subscription-based, concurrent user, and more. Managing these diverse models can be challenging for organizations, leading to confusion and potential over-purchasing. These factors may increase additional hustle for the workers.

- Inaccurate reporting: There is always a risk associated with the inaccuracy in the values and the probable risks for the improper usage of the software. Also, the usage of software may lead to overspending and inadequate record keeping.

Software License Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 3.27 billion |

|

Forecast Year Market Size (2035) |

USD 11.7 billion |

|

Regional Scope |

|

Software License Management Market Segmentation:

Deployment Type Segment Analysis

Cloud-based segment is anticipated to have the largest market share of 58% during the assessed time. The exponentially rising trajectory of growth is backed by rising incorporation for cloud-based solutions globally. Factors such as rising adoption of SaaS and increasing remote work solutions are augmenting the segment’s growth. Adopting cloud-based services also provides the users access to features and services based on changing demand. These solutions are ideal for organizations that want to reduce the burden from their IT team.

End-User Segment Analysis

The largest share of the market is going to be held by the BFSI. The main driver of this will be the growing number of bank account holders. Banks are working towards providing their customers with contactless services and switching to a paperless system. In 2022, Journal of Emerging Technologies and Innovative Research 33% of bank employees strongly agree that paperless banking is more effective and less time consuming. Most of the banks are converting their documents into digital formats and availing services such as software license management on a large scale. These factors are acting as a catalyst for the segment growth in the assessed time.

Our in-depth analysis of the global software license management market includes the following segments:

|

Deployment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Software License Management Market Regional Analysis:

North America Market Insights

North America industry is poised to account for the largest revenue share of 35% by 2035. The presence of major software vendors and the strict licensing rules have also contributed to the market growth in the region. Also, license optimization and entitlement have become a common thing across the region, particularly in the U.S. The surge in remote work has complicated the license compliance and tracking. According to data published by the Bureau of Labor Statistics in the U.S., around 27% of the workforce was working remotely in 2022. Additionally, the market in Canada is also gaining traction due to the presence of a stringent regulatory framework and exorbitant cost for the non-compliance.

Europe Market Insights

Europe holds a significant share of the software license management market. The prominent markets in this area are the United Kingdom, Germany, France, and the Netherlands. The EU's General Data Protection Regulation is increasing the focus on software compliance, thereby driving demand for SLM solutions. Also, in February 2025, the European Union Agency for Cybersecurity (ENISA) reaffirms its mission to garner the robust level of cybersecurity across the region. In Germany, the software license management market is expected to witness remarkable growth due to rising measures taken by organizations. The data published by the Association of the Internet Industry in May 2023, 78% of the Germans took action to protect their data.

Software License Management Market Players:

- Flexera

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Snow Software

- IBM Corporation

- Microsoft

- Oracle

- ASPERA technology s.r.o.

- ServiceNow, Inc.

- Broadcom.

- BMC Software, Inc

The competitive landscape of the software license management is rapidly evolving as established key players, IT giants, and new entrants are investing in novel security technologies. Key players in the market are focused on developing products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In July 2024, Licenseware joined hands with HAT distribution to develop the next generation software asset management tools. This collaboration endeavors to give state-of-the-art software management solutions across New Zealand and Australia.

- In May 2024, ManageEngine launched its SaaS management solution to aid businesses get rid of SaaS sprawl. It will also help in gaining real-time visibility into all SaaS metrics and enhance the overall ecosystem.

- Report ID: 5204

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software License Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.