Sodium-air Battery Market Outlook:

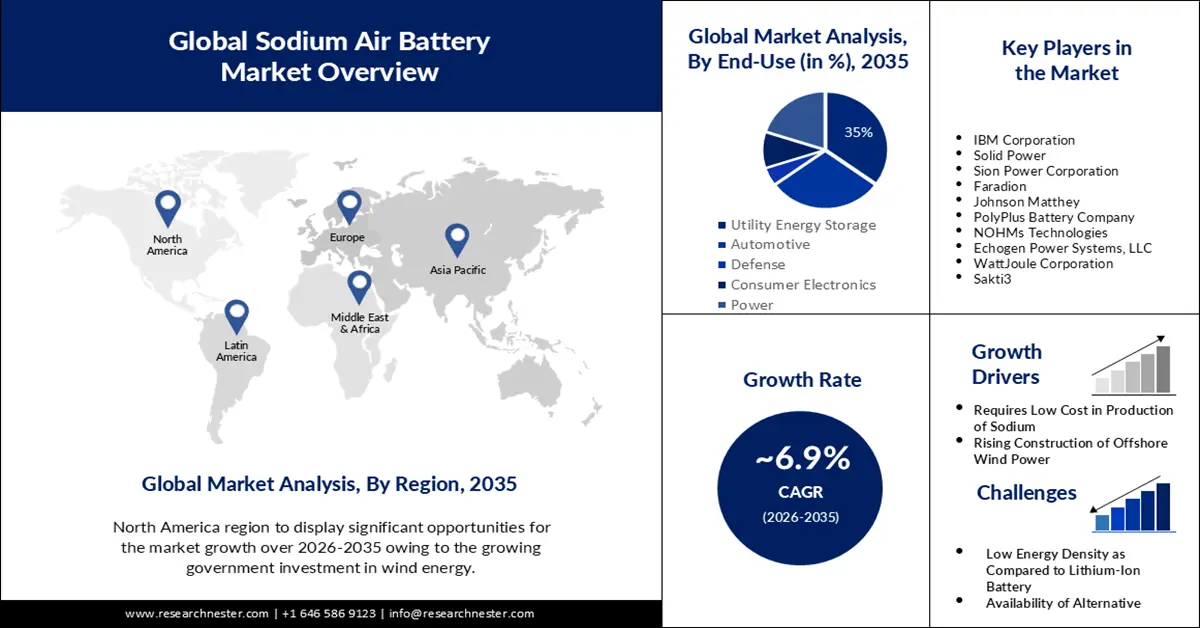

Sodium-air Battery Market size was over USD 2.24 billion in 2025 and is anticipated to cross USD 4.37 billion by 2035, growing at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sodium-air battery is assessed at USD 2.38 billion.

This growth in the market revenue is poised to be dominated by growing demand for electric vehicles. For instance, approximately 9 million electric cars were purchased in 2022 and this year it is set to expand at about 34% which equates to close to 13 billion electric vehicles. Hence, the demand for sodium-air batteries is estimated to rise. Moreover, the government is offering subsidies for the purchase of electric vehicles which has driven more attention from common people.

Additionally, the use of porous carbon in the cathode of sodium-air batteries is also set to grow owing to it being lightweight. However, besides this porous carbon has an exceptionally specific surface area and pore structure and is also composition-designable. Furthermore, porous carbon has outstanding mechanical and electrical qualities owing to the high electrical conductivity of carbon materials and their distinctive microstructure. Therefore, with the growth in manufacturing of lightweight porous carbon the market demand might grow but there is still more research to be done in this field. Hence, the rise in R&D activities in the utilization of lightweight porous carbon in the cathode of sodium-air battery is expected to expand market growth in the coming years.

Key Sodium-air Battery Market Insights Summary:

Regional Highlights:

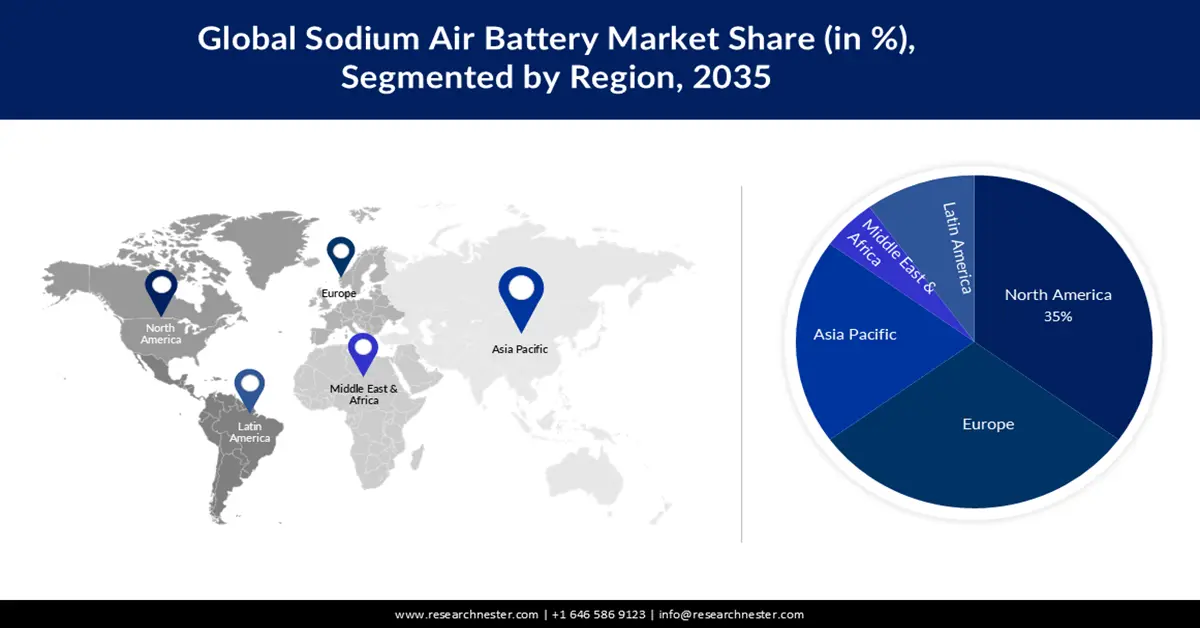

- By 2035, the North America region is anticipated to secure nearly 35% share of the sodium-air battery market, bolstered by escalating government investment in wind energy.

- The Europe region is projected to advance steadily through 2026–2035, supported by stringent emission-reduction regulations and a strong presence of sodium-air battery manufacturers.

Segment Insights:

- By 2035, the non-aqueous segment is expected to capture around 60% share of the sodium-air battery market, sustained by its broader liquid range and wider voltage window enabling higher energy storage capacity.

- The utility energy storage segment is forecast to hold about 35% share by 2035, underpinned by intensifying investment in renewable-oriented grid infrastructure expansion.

Key Growth Trends:

- Requires Low Cost in the Production of Sodium

- Rising Construction of Offshore Wind Power

Major Challenges:

- Low Energy Density as Compared to Lithium Ion Battery

- Availability of Alternative

Key Players: IBM Corporation, Solid Power, Sion Power Corporation, Faradion, Johnson Matthey, PolyPlus Battery Company, NOHMs Technologies, Echogen Power Systems, LLC, WattJoule Corporation, Sakti3.

Global Sodium-air Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.24 billion

- 2026 Market Size: USD 2.38 billion

- Projected Market Size: USD 4.37 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, United Kingdom, Australia, Canada

Last updated on : 25 November, 2025

Sodium-air Battery Market - Growth Drivers and Challenges

Growth Drivers

-

Requires Low Cost in the Production of Sodium - Due to its wide distribution in the earth's crust and seawater, sodium is a substance that is readily accessible. In contrast to lithium, sodium is more readily available in large quantities in the earth's crust and requires less to extract and purify. This reduces the price of sodium-ion batteries, which in turn lowers the entire cost of products including electric automobiles that are used in daily life. Hence, the sodium-air battery market revenue for sodium-air batteries is growing.

- Rising Construction of Offshore Wind Power - The greenhouse gas emissions through the electricity sector is growing in large amounts in recent years. The combustion of fossil fuels for the production of electricity is responsible for more than 39% of energy-related carbon dioxide (CO2) emissions. One of the key strategies for minimizing greenhouse gas (GHG) emissions is to decarbonize the electrical sector by boosting the share of renewable energy sources in the generation mix. Offshore wind power is one of the renewable energy technologies that is anticipated to have an impressive future which is why its construction is growing further driving market growth.

- Surge in the Use of Portable Electronic Gadget - Portable electronic gadgets include smartphones, laptops, tablets, e-readers, MP3 players, and more. These gadgets are further expected to carry little weight which is why the market demand for sodium-air batteries is rising. This is because along with the low weight of this battery, it is also expected to have a high-density energy storage system.

- Surge in Industry Mobility - There has been growth in demand for goods & services all across the world. Due to this, there has been a surge in demand for automotive as well as drones, and autonomous robots. Hence, with this, the demand for sodium-air batteries is also projected to surge since it is believed to improve asset utilization and reduce operating costs.

Challenges

-

Low Energy Density as Compared to Lithium-Ion Battery - In comparison to other common batteries including lithium batteries, sodium-ion batteries have a lower energy density, which means they can hold less energy per unit weight. This is one of its key drawbacks. Additionally, they are less long-lasting and efficient. Hence, this element is anticipated to restrain the sodium-air battery market expansion in the forecast timeframe.

- Availability of Alternative – Since sodium-air battery is still under research and development the use of this battery is still not in abundance. Even though it is set to rise further, currently lithium-ion and lead-ion battery plays a significant role. Moreover, as sodium is larger than lithium, the ions in a sodium ion battery are heavier and are unable to move readily in liquid electrolytes. The weight of sodium is typically three times that of lithium. Hence, this factor is set to hinder the growth of the market.

- Costly R&D Operation for Sodium-air Battery

Sodium-air Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 2.24 billion |

|

Forecast Year Market Size (2035) |

USD 4.37 billion |

|

Regional Scope |

|

Sodium-air Battery Market Segmentation:

Electrolyte Segment Analysis

The non-aqueous segment is projected to account for 60% share of the global sodium-air battery market during the forecast period. This could be on account of the wider liquid range offered by non-aqueous electrolytes. Moreover, it also consists of a greater voltage window which makes it fit for a sodium-air battery as compared to an aqueous electrolyte. Hence, with this adoption, the sodium-air battery could be able to store large amounts of energy. As a result, the demand for this segment is surging.

End-Use Segment Analysis

The utility energy storage segment is estimated to garner the largest share in the sodium-air battery market at about 35% by 2035. The major factor driving the segment growth is rising investment in grid infrastructure for renewable energy. For instance, the has been growth in overall investment which consists of about USD 3 trillion for system maintenance and approximately USD 16 trillion for infrastructure expansion to accommodate increased power generation and demand. Moreover, the amount invested annually also triples from close to USD 273 billion in 2022 to over USD 871 billion in the ten years before 2050. Moreover, there are many rural regions where the supply of electricity is difficult. Therefore, there are certain sustainable energy projects taking place. However, dependence on lithium-ion batteries could hinder these projects since lithium needs to be exported from other parts of countries as it is not available in abundance. As a consequence, the demand for sodium-ion batteries is surging in order to provide utility energy storage in rural parts.

Our in-depth analysis of the global market includes the following segments:

|

Electrolyte |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium-air Battery Market - Regional Analysis

North American Market Insights

The North America region sodium-air battery market is poised to gather the highest share of approximately 35% during the forecast period. The growth of the market in this region is set to be influenced by growing government investment in wind energy. In 2021, the U.S. wind sector built 13,413 megawatts (MW) of additional wind capacity, bringing the total installed wind capacity to 135,886 MW. With an investment of USD 20 billion, this is the second-greatest amount of wind capacity set up in a single year (after 2020). Moreover, if present and future capacity expansion plans continue as planned, wind power could produce approximately 39 percent of North America's electricity by 2050 and solar power another about 31%.

European Market Insights

The sodium-air battery market in Europe is also projected to experience the significant growth during the coming years. The market in this region is growing on account of rising government strict regulations to lower the carbon emission and achieve zero emission target in coming years. Additionally, this region consists of large number of key players involved in field of manufacturing sodium-air battery. As a result, the market in this region is facing upward movement.

Sodium-air Battery Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solid Power

- Sion Power Corporation

- Faradion

- Johnson Matthey

- PolyPlus Battery Company

- NOHMs Technologies

- Echogen Power Systems, LLC

- WattJoule Corporation

- Sakti3

Recent Developments

- Faradion stated that their first sodium-ion battery had been successfully installed at a trail site in the Yarra Valley of New South Wales, Australia.

- A leader in sustainable technologies, Johnson Matthey (JM), announced that it has reached an agreement to sell a portion of its Battery Materials business to EV Metals Group, a leading provider of battery chemicals and technology worldwide.

- Report ID: 5334

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium-air Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.