Smart Hospital Market Outlook:

Smart Hospital Market size was valued at USD 63.99 billion in 2025 and is likely to cross USD 392.92 billion by 2035, expanding at more than 19.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart hospital is estimated at USD 75.45 billion.

The primary growth driver driving the smart hospital market is the increasing adoption of the Internet of Things (IoT) and Artificial Intelligence (AI) in healthcare. These technologies enable hospitals to enhance patient care, improve operational efficiency, and streamline processes through connected devices, automation, and data analytics.

Several IoT healthcare devices are playing a significant role in driving the smart hospital market, enhancing patient care and overall hospital management. Devices such as smartwatches, fitness trackers, and biosensors continuously monitor vital signs including heart rate, oxygen levels, and blood pressure. According to OMRON Corporate, global blood pressure monitor sales in 2020 grew to 2.4 million and is achieving a 20% year-on-year increase. Moreover, IoT-enabled beds in hospitals can track patient movement, monitor vital signs, and detect if a patient is trying to get out of bed, which can help reduce fall risks, and improve overall patient safety. These beds are integrated into hospital management systems to provide real-time data on bed occupancy and patient status.

IoT facilitates real-time monitoring and asset management, while AI is revolutionizing diagnostics, predictive analytics, and personalized treatment, making hospitals more efficient and responsive to patient needs. This trend is at the core of the digital transformation in healthcare, fueling the demand for smart hospital market.

Key Smart Hospital Market Insights Summary:

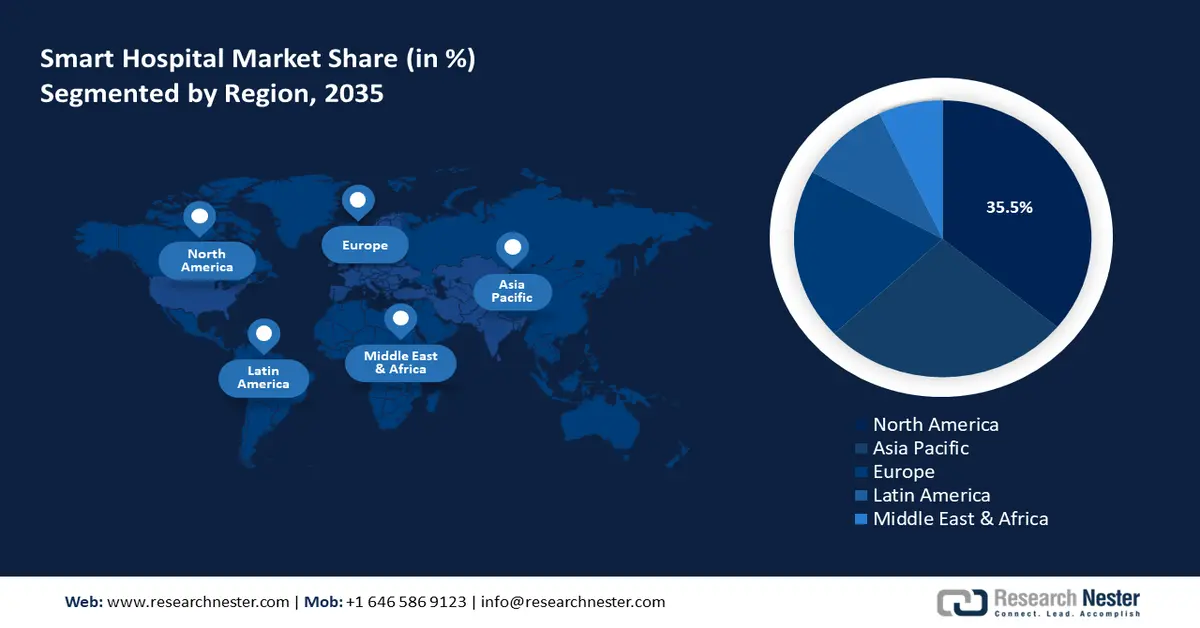

Regional Highlights:

- North America leads the smart hospital market with a 35.5% share, propelled by advancements in healthcare technology fueling growth through 2026–2035.

- The Asia Pacific Smart Hospital Market is expected to witness the fastest growth by 2035, driven by increasing demand for advanced healthcare solutions and rising healthcare expenditures.

Segment Insights:

- Hardware segment is anticipated to hold a 63% share by 2035, fueled by the adoption of diagnostic tools, wearables, IoT sensors, and automation.

Key Growth Trends:

- Adoption of Electronic Health Records (EHRs)

- Advancements in healthcare

Major Challenges:

- High initial costs and capital investments

- Limited technical expertise

- Key Players: Siemens Healthineers, GE Healthcare, Medtronic, Philips Healthcare, IBM Watson Health, Cerner Corporation, Allscripts Healthcare Solutions.

Global Smart Hospital Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.99 billion

- 2026 Market Size: USD 75.45 billion

- Projected Market Size: USD 392.92 billion by 2035

- Growth Forecasts: 19.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, Singapore, India

Last updated on : 14 August, 2025

Smart Hospital Market Growth Drivers and Challenges:

Growth Drivers

-

Adoption of Electronic Health Records (EHRs): EHRs allow smart hospitals to store and manage all patient information digitally, including medical histories laboratory results, and treatment plans. This centralized system enables healthcare professionals to access accurate, up-to-date patient information anywhere in the hospital or remotely, ensuring seamless care coordination across departments.

Government and regulatory bodies in many countries are pushing for the adoption of EHRs through policies, incentives, and mandates. For instance, the U.S. Healthcare Information Technology for Economic and Clinical Health (HITECH) Act incentivizes healthcare providers to adopt and meaningfully use EHR systems. Compliance with these regulations not only drives adoption but also accelerates the development of smart hospital infrastructure. According to The Assistant Secretary for Technology Policy/Office of the National Coordinator for Health Information Technology (ASTP/ONC) by 2021, approximately four out of five office-based physicians (78%) and virtually all non-federal acute care hospitals (96%) in the U.S. had adopted a certified EHR. This represents a significant 10-year progress from 2011 when 28% of hospitals and 34% of physicians had implemented an EHR. - Advancements in healthcare: AI and Machine learning (MI) are revolutionizing healthcare by providing advanced tools for data analysis, diagnostics, and predictive healthcare. AI algorithms help doctors make faster, more accurate diagnoses based on medical imaging, patient data, and patterns. AI tools can predict patient outcomes, risk factors, and the likelihood of complications, allowing for earlier interventions.

Moreover, robotic systems are becoming increasingly important in smart hospitals, as they are used to enhance both surgical precision and hospital logistics. Robotic-assisted surgeries provide greater accuracy and control, leading to less invasive procedures, quicker recovery times, and better patient outcomes. Robots are used to deliver medication, disinfect rooms, and transport supplies, improving efficiency and reducing the spread of infections. According to a 2023 published report by the National Library of Medicine, by 2023, 7733 robotic surgical systems had been installed around the world and over 10 million robotic procedures had been conducted. These surgeries include a wide range of fields, including general surgery, urology, gynecology, and cardiothoracic surgery. - Automation and workflow optimization: Automation in smart hospitals reduces the administrative burden by digitizing and automating routine tasks such as patient registration, billing, scheduling, and appointment management. Automated scheduling systems help reduce wait times, optimize physician schedules, and minimize booking errors. Also, automation speeds up the billing cycle by automatically verifying insurance details, generating bills, and processing claims, which leads to fewer errors and faster payment cycles. As of 2023, more than 66% of hospitals and healthcare organizations use automation systems.

Additionally, automation powered by predictive analytics helps smart hospitals optimize resources by forecasting patient admissions, staffing needs, and equipment usage. Moreover, automated patient portals allow patients to manage appointments, access test results, and communicate with healthcare providers, enhancing engagement and satisfaction.

Challenges

-

High initial costs and capital investments: The high initial cost of implementing smart hospital technologies poses a significant restraint to smart hospital market growth, particularly for hospitals with limited financial resources. Expensive infrastructure upgrades, advanced medical devices, training, and maintenance requirements make it challenging for many institutions to justify the investment, especially when the return on investment (ROI) may take time to materialize. Overcoming this financial barrier is crucial for the widespread adoption of smart hospital systems.

-

Limited technical expertise: The adoption of smart hospital technologies requires skilled healthcare IT professionals, including data scientists, software engineers, and healthcare informatics experts. Many hospitals face a shortage of qualified personnel who can manage and maintain these advanced systems. Training existing staff or hiring specialized personnel increases operational costs and can delay the deployment of smart technologies.

Smart Hospital Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.9% |

|

Base Year Market Size (2025) |

USD 63.99 billion |

|

Forecast Year Market Size (2035) |

USD 392.92 billion |

|

Regional Scope |

|

Smart Hospital Market Segmentation:

Component (Hardware, Software, and Services)

The hardware segment share in the smart hospital market is estimated to exceed 63% by 2035. The increasing adoption of hardware components such as medical devices and wearables, robotics and automation equipment, IoT sensors, and security sensors are propelling the growth of the global smart hospital market. Devices such as connected diagnostic tools, health monitors, and wearable devices like smartwatches and biosensors are key drivers of the segment's growth. These devices help monitor patient vitals in real-time and are integral to remote patient monitoring and telemedicine solutions. According to a 2020 published survey report by the Pew Research Center, roughly 1 in 5 U.S. adults (21%) regularly wear a smartwatch or wearable fitness tracker.

Moreover, advanced medical imaging equipment, including MRI machines, CT scanners, and ultrasound devices integrated with AI, are helping smart hospitals offer faster, more accurate diagnostics and personalized treatment plans. Also, smart hospitals rely on massive amounts of data from patient records, diagnostics, and IoT devices. Cloud servers, data centers, and edge computing hardware are essential for strong, processing, and analyzing the data, enabling hospitals to implement AI-driven insights and real-time decision-making.

Application (Electronic Health Records, Medical Connected Imaging, and Remote Medicine Management)

The electronic health records (EHR) segment in smart hospital market is anticipated to grow significantly over the forecast period. Modern EHR systems are increasingly integrated with patient portals, allowing individuals to access their health records, track progress, schedule appointments, and communicate with healthcare providers. This enhanced patient engagement is a cornerstone of the smart hospital concept, where the focus is on a more patient-centric healthcare experience.

EHRs can be integrated with emerging technologies such as AI, MI, IoT devices, and telemedicine platforms. This integration enhances the capabilities of smart hospitals, enabling them to offer advanced diagnostic, monitoring, and treatment services.

Our in-depth analysis of the smart hospital market includes the following segments:

|

Component |

|

|

Application

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Hospital Market Regional Analysis:

North America Market Forecast

North America industry is poised to dominate majority revenue share of 35.5% by 2035. The region is experiencing growth due to advancements in healthcare technology, a focus on patient-centered care, and an increasing demand for efficient healthcare delivery. The region has seen rapid advancements in AI, MI, IoT, and robotics, all of which are integral to smart hospitals. These technologies improve diagnostics, patient monitoring, and overall hospital management.

Hospitals in the U.S. implementing AI techniques are significantly driving the growth of the smart hospital market by enhancing efficiency, accuracy, and quality of patient care. Several AI applications are transforming hospitals and pushing the adoption of smart hospital technologies. Hospitals such as Cleveland Clinic, Johns Hopkins Medicine, and Mayo Clinic are leveraging AI-driven predictive analytics to forecast patient outcomes, predict potential health risks, and manage hospital resources more effectively. More than 200 AI initiatives at Mayo Clinic are at various degrees of maturity along the discovery-translation-application research continuum, ranging from feasibility and data availability testing to algorithm and model development, clinical implementation, and application.

The Government of Canada has been actively supporting the digitization of healthcare through programs such as Canada Health Infoway and provincial e-health initiatives. These programs encourage the adoption of electronic health records, telemedicine, and other digital health tools that are critical for the development of smart hospitals. According to a 2024 National Survey of Canadian Physicians, by Canada Health Infoway and the Canadian Medical Association (CMA), stated that almost all (95%) physicians surveyed use electronic records to enter and retrieve clinical patient notes, a considerable rise from 87% in 2021, 82% in 2017, and 39% in 2010. Four out of five physicians said they use one or more computerized systems to record patient information. About 7% said they use artificial intelligence or machine learning in their primary practice to support patients. This represents a significant increase over the 2% reported in 2021.

APAC Market Analysis

The smart hospital market in Asia Pacific is poised to register the fastest growth during the forecast period. The region is experiencing rapid growth due to the increasing demand for advanced healthcare solutions, a growing population, and rising healthcare expenditures. Technological advancements, government initiatives, and the adoption of digital health platforms are key factors driving the development of smart hospitals across countries like China, India, Japan, South Korea, and Australia.

The healthcare expenditure in China has been increasing steadily as the country seeks to modernize its healthcare infrastructure. The government and private sector are investing heavily in smart hospital technologies to improve healthcare outcomes, reduce costs, and address inefficiencies in the system. In 2022, China's overall healthcare expenditure exceeded USD 1.1 trillion. This amount covered government, collective, and private out-of-pocket spending on health care.

In India, the rapidly growing population, combined with increasing urbanization, has created a higher demand for healthcare services. The rise in chronic diseases, such as diabetes, cardiovascular diseases, and respiratory issues, is driving the need for efficient hospital management and advanced medical care. Moreover, the COVID-19 pandemic accelerated the adoption of telemedicine in India, with hospitals and healthcare providers deploying virtual care platforms to reach patients in remote and rural areas. Smart hospitals are incorporating telemedicine and remote monitoring technologies to improve accessibility, particularly in underserved areas.

Key Smart Hospital Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers

- GE Healthcare

- Medtronic

- Philips Healthcare

- IBM Watson Health

- Cerner Corporation

- Allscripts Healthcare Solutions

- Cisco Systems

- Honeywell Life Care Solutions

- McKesson Corporation

The smart hospital market is expected to continue growing as the key players invest in cutting-edge technologies. Innovations in AI, MI, IoT, and telemedicine will further transform hospitals into highly connected, data-driven environments, improving both patient outcomes and hospital efficiency. The collaboration between tech giants and healthcare providers will play an important role in shaping the future of smart hospitals worldwide.

Here are some key players in the smart hospital market:

Recent Developments

- In October 2024, GE HealthCare announced CareIntellect for Oncology, a new cloud-first application that combines multi-modal patient data from different systems into a unified perspective, utilizing generative AI to summarize clinical notes and reports.

- In March 2024, Siemens Healthineers created an automated, self-driving C-arm device for intraoperative imaging in surgery. Ciartic Move3 has holonomic, omnidirectional wheels that enable exact motions in even the smallest spaces, as well as easy and accurate positioning. The system can be moved to previously set positions by pressing a button on a remote control.

- Report ID: 6601

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Hospital Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.