Airport 4.0 Market Outlook:

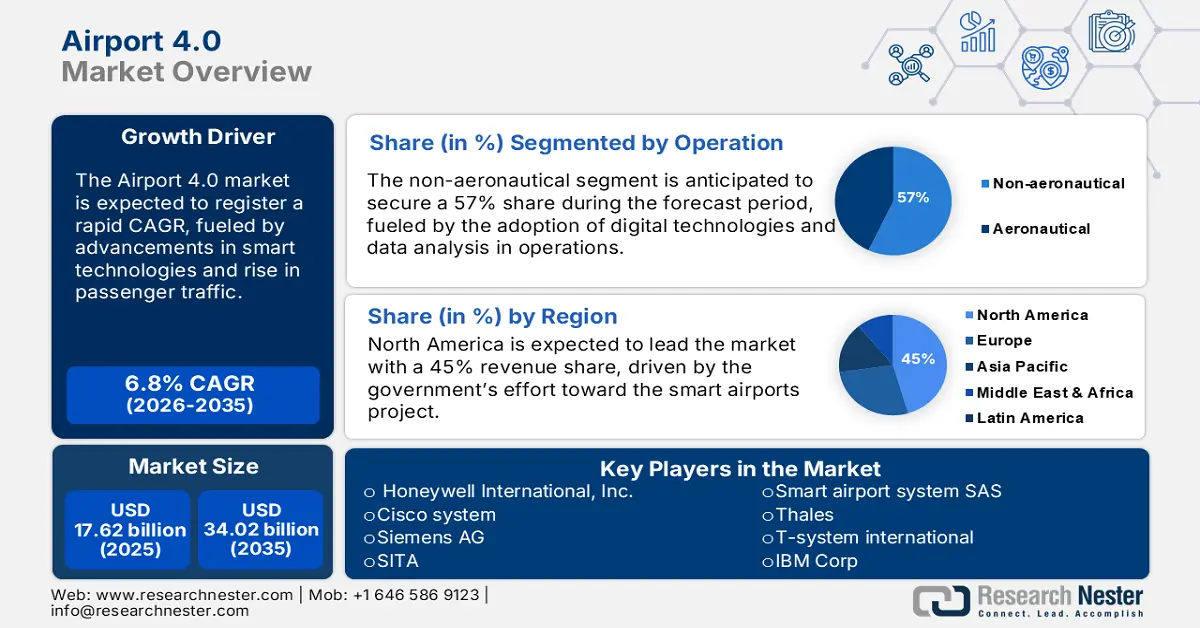

Airport 4.0 Market size was valued at USD 17.62 billion in 2025 and is likely to cross USD 34.02 billion by 2035, expanding at more than 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airport 4.0 is assessed at USD 18.7 billion.

The airport 4.0 market is expected to demonstrate considerable growth prospects during the forecast period. There has been rapid adoption of digital solutions in operations and customer service. The concept of smart airports that incorporate the use of IoT, AI, and big data technologies is gaining popularity with many such facilities. In pursuing cost-effective operations and innovative services, airports are expanding their IoT capabilities for predictive maintenance, employing AI for automated registration or baggage processing and big data analytics to realize real-time data processing. With a growing number of travelers and strict security requirements, there are opportunities for the market and modernization of existing airport systems.

There is an emerging trend among companies operating in the airport 4.0 market to focus more on smart technology development and deployment. The industry’s efforts to introduce new solutions for the better efficiency of airport services are not restricted to baggage processing. Companies work on AI-driven security systems and digital tools, aimed at increasing passenger flow and airport use efficiency. For instance, in April 2023, Frankfurt Airport signed a five-year agreement with Consultants to Government and Industry (CGI) to deliver the technology for the security of the facility. Ongoing investments in integrating modern technologies to optimize airport operations are fostering airport 4.0 market growth.

Key Airport 4.0 Market Insights Summary:

Regional Highlights:

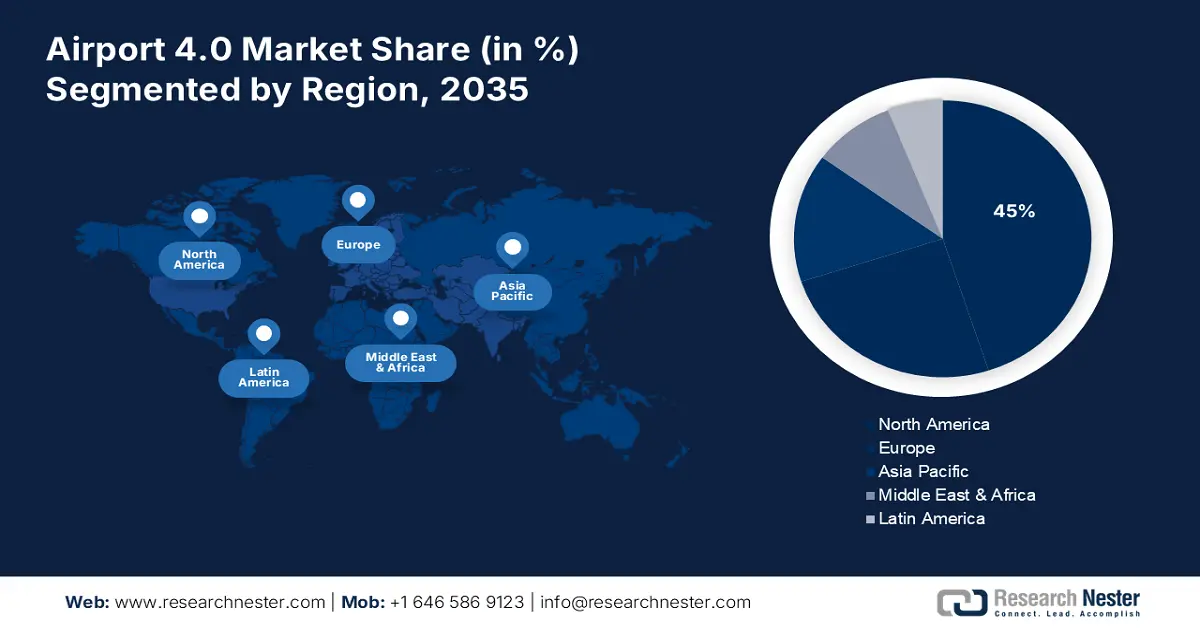

- North America is set to capture a 45% share of the airport 4.0 market by 2035, underpinned by escalating investments in digital airport infrastructure and advanced technology deployment.

- Europe is projected to expand its share considerably through 2035, sustained by extensive smart-airport initiatives and the accelerating integration of digital technologies.

Segment Insights:

- The non-aeronautical segment is expected to secure a 57% share by 2035 in the airport 4.0 market, fueled by the rising emphasis on diversified revenue channels supported by digital and data-driven consumer management.

- The large airport segment is anticipated to lead the market by 2035, strengthened by increasing passenger volumes and the rapid adoption of AI-enabled operational upgrades.

Key Growth Trends:

- Greater focus on increasing the experiences of passengers

- Growth in cybersecurity applications

Major Challenges:

- Level of complexity of integrating new technologies with existing systems

- Stringent regulations surrounding Airport 4.0

Key Players: Honeywell International, Inc., Cisco Systems, Siemens AG, SITA, Smart Airport System SAS, Thales, T-System International, IBM Corp, Raytheon Technologies, and Huawei Technologies Co., Ltd.

Global Airport 4.0 Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.62 billion

- 2026 Market Size: USD 18.7 billion

- Projected Market Size: USD 34.02 billion by 2035

- Growth Forecasts: 6.8%

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, United Arab Emirates, South Korea, Singapore

Last updated on : 1 December, 2025

Airport 4.0 Market - Growth Drivers and Challenges

Growth Drivers

- Greater focus on increasing the experiences of passengers: Airports implement technologies such as AI-fueled self-service kiosks, biometric tests, and automatic luggage transport to ease passengers’ transit. For example, in November 2023, Collins Aerospace was selected to offer new AI security detecting software, integrating the operations of airports and intelligence systems, and increasing efficiency and accuracy at NEOM Bay Airport. Passengers focus on traveling more quickly and easily, leading to more than half of the 10 billion spending on Airport 4.0 solutions for passenger improvements. Along these lines, demand is increasing as more technologies and solutions are integrated, benefitting Airport 4.0.

- Growth in cybersecurity applications: As more airports are connected, more information flows digitally. Implementing secure systems becomes imperative for governments and airport operation agencies to preserve critical functioning. For instance, Thales Group developed a new HELIXVIEW baggage detecting system in June 2022, incorporating AI and cybersecurity interests. The use of the new system can obtain a higher level of security for airports, as well as an enhanced performance from the operation.

- Increased use of the IoT and big data software with Airport 4.0: The numbers and data logs in Airport 4.0 are used for real-time monitoring and preventive upkeep and reparation actions. The system maintains the travel service availability at a higher level and for less spending. In April 2024, SITA launched SITA Airport Operations Total Optimizer, a new-generation airport operations management platform, securing 30% faster action times. Over one-third of its software will exchange traditional systems with improved ones. It alternates with considerable propensities, leading to the application of more IoT and big data solutions relative to previous types.

Challenges

- Level of complexity of integrating new technologies with existing systems: It is difficult for airports to modify their infrastructure and make space for digital solutions. Additionally, things that have to be added have to operate simultaneously with current ones with no disruptions. Some companies often face challenges while implementing a new baggage handling system which poses a serious concern to the adoption of Airport 4.0 solutions.

- Stringent regulations surrounding Airport 4.0: Another important obstacle is the legislation that determines the conditions under which new technologies can be implemented. Regulations and standards are crucial for ensuring safety, and there is no way that outdated legislation can address current security concerns. On the other hand, these rules can slow down the implementation of some new solutions. Local standards and requirements need to be satisfied, so the deployment can get delayed.

Airport 4.0 Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 17.62 billion |

|

Forecast Year Market Size (2035) |

USD 34.02 billion |

|

Regional Scope |

|

Airport 4.0 Market Segmentation:

Operation Segment Analysis

By operation, the non-aeronautical segment is expected to dominate the global airport 4.0 market with a 57% share during the forecast period, driven by an increasing focus on generating revenues from other sources such as retail, food, and other entertainment. The use of digital technologies and data analysis in the collection of non-aeronautical revenues and consumer management is a major factor in non-aeronautical segment growth. For example, in October 2023, Fraport AG launched a new digital retail platform for passengers at Frankfurt Airport where passengers can purchase products online and receive purchases at gates in the future.

Size Segment Analysis

The large airport segment in terms of size is expected to dominate the airport 4.0 market over the medium and small-size airport segments during the forecast period owing to increasing passenger traffic and complex operation transformational changes in large-size airports. The advent of Airport 4.0 solutions, which pursue implementing AI-based security systems and real-time data analytics, among other advanced solutions, is expected to drive the Airport 4.0 market during the forecast period. Air Marakanda, which operates the newly modernized Samarkand International Airport, completed the first phase of digitalization within its smart airport project in July 2022, which is expected to strengthen the operational success of large airport size and dominate the market.

Application Segment Analysis

The airside segment in the airport 4.0 market is expected to register robust revenue CAGR during the forecast period. Increasing attention is been given to various solutions that increase investment in complete airside logistics, such as ground control, all ground handling, aircraft management, and air traffic control. In July 2022, Siemens AG announced the increased focus on specializing in airside solutions in the field of airport logistics. This system will allow the reduction of operational delays and ensure effective airside operation.

Our in-depth analysis of the airport 4.0 market includes the following segments

|

Operation

|

|

|

Size |

|

|

Application |

|

|

End Market |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airport 4.0 Market - Regional Analysis

North America Market Insights

North America industry is set to account for largest revenue share of 45% by 2035 One of the significant drivers of the region’s growth is the substantial investments in digital infrastructure and the introduction of advanced technologies that contribute to the more effective operation of airports. The U.S. and Canada are leaders in this market as big data, AI, and IoT are increasingly being used in airports in these countries with an aim to improve the passenger experience as well as the efficiency of the operation.

In the U.S., large airports aim to make significant investments in digital technologies. For example, in April 2023, the Transportation Security Admiration announced that Idemia Identity& Security USA would implement next-generation credential technology for USD 128 million. This contract is intended to improve airport security and emphasizes the commitment of the U.S. federal government to the support of innovative solutions for smart airports.

In Canada, the government also takes serious steps to ensure that the adoption of Airport 4.0 technologies is quick. For example, in February 2023 the Canadian government invested in smart airport initiatives to improve airport operation using the examples of easing passenger screening and other processes with the assistance of AI. Thus, Canada is an important market for Airport 4.0 products, including software and other solutions, as the region is undertaking steps to develop the most efficient airport operation.

Europe Market Insights

In Europe, the adoption of airport 4.0 is rising, and the region’s share in the global airport 4.0 market is estimated to rise at a considerable rate through 2035. The main factors contributing to the high rate of the region’s growth are the substantial investments in smart airport projects by airports in the region and the development of digital technologies. European countries use big data, IoT, and other tools to improve airport operations by making them more efficient and secure and providing a better traveling experience for the passengers. AI and similar tools, for example, are used in the UK to observe passenger behavior flow in the London City airport to improve the efficiency of services provided to travelers and in other European locations for similar purposes.

The government in Germany is also working on the development of smart airports and taking specific steps to ensure faster adoption of new approaches by large airports. In particular, in June 2023, Frankfurt Airport announced its plans to introduce a partnership with CGI to speed up the digital transformation and implement AI-driven solutions to improve passenger flows and operations.

Airport 4.0 Market Players:

- Honeywell International, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cisco system

- Siemens AG

- SITA

- Smart airport system SAS

- Thales

- T-system international

- IBM Corp

- Raytheon Technologies

The airport 4.0 market is witnessing increased competition due to the presence of several major players. Indeed, key players are leading the industry in developing and deploying advanced digital solutions for airports; these players include Siemens AG, Thales Group, Honeywell International Inc., Collins Aerospace, and SITA. Preliminary investments by companies are in considerable numbers in technologies like AI, IoT, big data analytics, and other related technologies for enhancement in airport operations, passenger experience, and more safety measures. The competitive landscape is marked by mergers, acquisitions, and strategic partnerships as companies work to expand their market presence and capabilities with consistency.

Here are some leading players in the airport 4.0 market:

Recent Developments

- In July 2024, TADERA introduced a new operations module as part of its AirportIQ platform, aiming to streamline airport management and optimize operational efficiency.

- In June 2024, ORIX Corporation launched an integrated digital platform to enhance airport operations and improve passenger experiences through innovative technologies.

- In May 2024, Airbus announced the launch of an innovative aviation liquid hydrogen project, focusing on sustainable fuel solutions to advance eco-friendly airport operations.

- Report ID: 6390

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airport 4.0 Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.