Scooter Market Outlook:

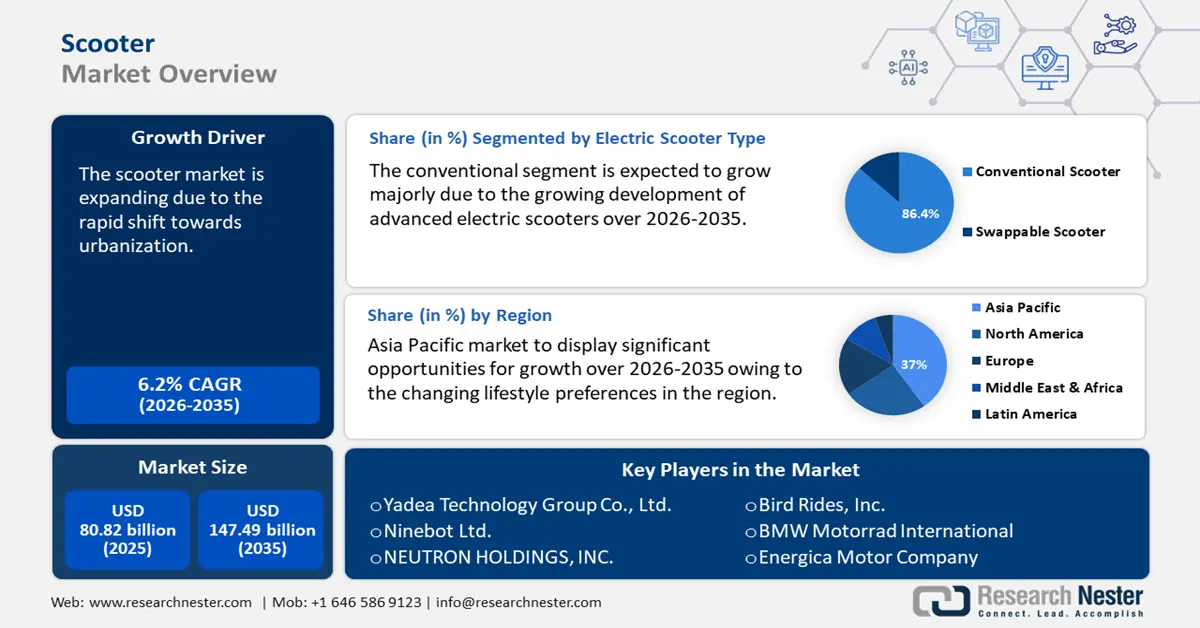

Scooter Market size was valued at USD 80.82 billion in 2025 and is set to exceed USD 147.49 billion by 2035, expanding at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of scooter is estimated at USD 85.33 billion.

The scooter market expansion is due to the rapid shift towards urbanization and improved road networks in developing nations. According to the United Nations Population Fund (UNFPA), more than half of the world’s population lives in cities and towns and this number is expected to reach up to 5 billion by 2030. Scooters are more common than cars for personal mobility since they are less expensive, simpler to use, and easier to park. In most parts of the world, scooter licensing requirements are generally less expensive and demanding than those for cars and other vehicles, and insurance is also affordable.

In many cities, scooters are seen as a practical solution to traffic congestion and pollution, offering a more sustainable alternative to traditional vehicles. Additionally, advancements in battery technology and the expansion of e-scooter sharing solutions contribute significantly to the market’s growth.

Key Scooter Market Insights Summary:

Regional Highlights:

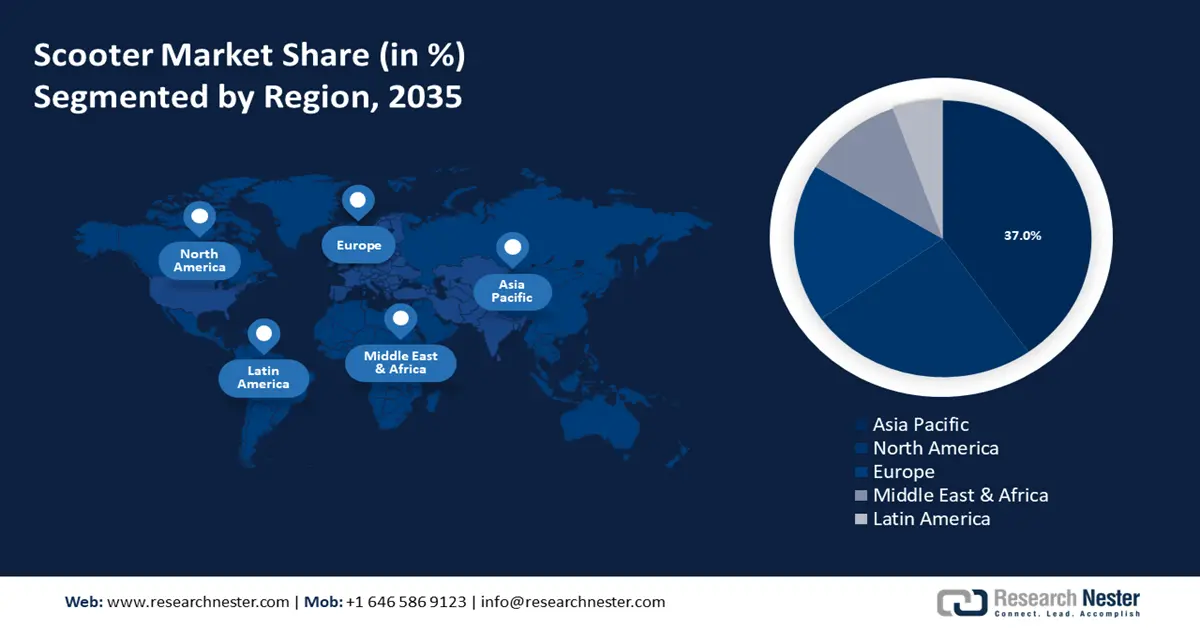

- The Asia Pacific scooter market will secure over 37% share by 2035, driven by rapid urbanization in countries such as India and China, which demands efficient space-saving transportation solutions.

- The North America market will exhibit huge growth during the forecast timeline, driven by the increasing adoption of rental electric scooters due to their sustainability and efficient mode of transportation.

Segment Insights:

- Conventional segment in the scooter market is expected to achieve 86.40% growth by the forecast year 2035, driven by the lightweight, robustness, and lower costs of conventional scooters.

- The swappable segment in the scooter market is projected to hold a 13.60% share by 2035, fueled by the development of battery-swapping technology enabling battery replacement.

Key Growth Trends:

- Growing demand for electric scooters

- Expansion of logistic businesses

Major Challenges:

- Safety concerns

Key Players: Yadea Technology Group Co., Ltd., Ninebot Ltd., NEUTRON HOLDINGS, INC., Bird Rides, Inc., SEGWAY INC., Razor USA LLC, BMW Motorrad International, Energica Motor Company, Alta Motors, Ather Energy.

Global Scooter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 80.82 billion

- 2026 Market Size: USD 85.33 billion

- Projected Market Size: USD 147.49 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Scooter Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for electric scooters: E-scooters are in greater demand on the international market as a result of consumers' growing preferences for quick travel and lower running costs, including cheaper maintenance and no fuel expenses, which make them a more economical option. It is anticipated that by 2028, there will be 143.50 million e-scooter users. By 2028, it will have 1.8% of the user base, up from 1.3% in 2024. Growing public consciousness of pollution and global warming is shifting consumer preference away from fuel-powered scooters and toward electric scooters. Also, the growing demand for lightweight vehicles and the need for modern, environmentally friendly transportation have led to an increase in the market for electric scooters.

- Expansion of logistic businesses: The rise in e-commerce and delivery services drives the need for efficient last-mile delivery solutions. Scooters, especially electric ones, are well suited for this task due to their flexibility and lower operating costs. According to the International Trade Administration, the e-commerce industry will be valued at USD 26 trillion by 2026. Logistics companies opt for scooters since they are more cost effective than traditional delivery vehicles. They help reduce expenses related to fuel, maintenance, and parking. Thus, there is an increased adoption of scooters in the logistics sector, contributing to the overall growth of the scooter market.

- Growing popularity of scooter rentals: Scooter rentals offer a convenient transportation option for short trips in urban areas. As cities face increasing traffic congestion, rental scooters provide a practical alternative for quick and efficient travel. Rentals allow users to access scooters without the upfront cost of purchase and maintenance. This flexibility attracts more people to use scooters for their daily commute or occasional needs. Moreover, increasing investments and partnerships in scooter-sharing programs and supportive regulations in urban planning contribute to the growth of the market.

- Growing incorporation of new technologies: The scooter producers are integrating new technology into their products to boost speed, improve battery efficiency, and lower the cost of ownership for consumers. Additionally, a variety of scooters have been introduced by electric scooter producers in emerging economies. For instance, in July 2024, BMW Motorrad India pre-launched reservations for the brand-new BMW CE 04, India's first high-end electric scooter. The innovative design and urban mobility are seamlessly combined in the all-new BMW CE 4. Its cutting-edge design, eco-friendly performance, and futuristic appearance redefine city commutes.

Challenges

- Regulatory challenges: Different regions and cities have varying regulations regarding scooter usage, such as speed limits, helmet requirements, and designated riding areas. Navigating this patchwork of rules can be complex for manufacturers and operators. Moreover, regulations requiring specific insurance coverage or liability measures can add operational costs and complicate the management of scooter fleets.

- Safety concerns: High rates of accidents and injuries involving scooters can deter potential users. This includes risks from collisions with vehicles, pedestrians, or other obstacles, which raises concerns about rider safety. Insufficient or poorly maintained infrastructure, such as inadequate scooter lanes or poorly lit areas, can contribute to accidents and make riding less safe, which discourages use.

Scooter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 80.82 billion |

|

Forecast Year Market Size (2035) |

USD 147.49 billion |

|

Regional Scope |

|

Scooter Market Segmentation:

Electric Scooter Type

The conventional segment in the scooter market is poised to capture the largest share of 86.4% by the end of 2035. The segment growth can be attributed to the advantages of conventional scooters, such as being lightweight and robust, and having lower initial and maintenance costs. Furthermore, conventional electric scooter manufacturers focus on developing technologically advanced electric scooters at a minimum price, contributing to a high segmental share. For instance, in 2023, the TVS X was the second electric scooter that TVS Motor Company released. This cutting-edge scooter is built on the sturdy TVS XLETON platform, which is well-known for its high-strength aluminum construction.

On the other hand, the swappable segment is also expected to garner a significant share of 13.6% during the forecast period. The segment is expanding since automakers are working harder and longer to develop battery-swapping technology that will enable scooter owners to replace their depleted batteries with fully charged ones. Battery-swappable electric scooter manufacturers are beginning to provide models without built-in batteries so that consumers can choose the batteries that best suit their needs and budget.

Product

The normal (or conventional) segment in the scooter market is estimated to hold a notable share by the end of 2035. The segment is growing, and the market for scooters is expected to rise as a result of rising disposable income. With higher disposable income, consumers may choose to upgrade or replace older scooters with newer models. This trend can boost sales in the conventional scooter segment. Moreover, in areas with well-developed fuel infrastructure, conventional scooters are convenient and practical, as they do not rely on charging facilities. Also, the availability of a diverse range of models catering to different needs and preferences helps sustain demand in the normal scooter segment.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Electric Scooter Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Scooter Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 37% by 2035. The market expansion is attributed to the rapid urbanization in countries such as India, and China, which demands efficient space-saving transportation solutions. Scooters are well-suited for navigating crowded urban environments. Moreover, rising disposable incomes and economic growth in the region increase consumers’ purchasing power, making scooters more accessible to a larger segment of the population. According to the International Monetary Fund, in 2023, economic growth in Asia Pacific exceeded forecasts and achieved 5.0%annual growth.

In China, consumers are highly opting for scooters as their primary mode of transportation. Due to the government's emphasis on environmentally friendly transportation and the advancement of battery technologies, electric scooters have become more popular in the country. Compared to conventional gasoline-powered scooters, electric scooters are more environmentally friendly and sustainable, supporting the nation's environmental objectives.

In India, scooters are a popular mode of transport due to their ease of use and ability to handle diverse road conditions, contributing to their widespread adoption. Additionally, the Government of India has introduced policies and incentives to promote electric vehicles, including electric scooters. Initiatives such as Faster Adoption and Manufacturing of Hybrid and Electric vehicles (FAME) scheme support the growth of the electric scooter market.

In South Korea, shared electric scooters are gaining popularity as urban areas become increasingly crowded. Shared electric scooters are in high demand in major cities like Seoul and Busan, driven by both locals and visitors looking for a convenient method to get around the city.

North America Market Insights

North America will also encounter huge growth for the scooter market during the forecast period and will hold the second position owing to the increasing adoption of rental electric scooters because of their sustainability and efficient mode of transportation. The demand for rental electric scooters among consumers is mostly due to their accessibility and availability, which also promotes the market's overall growth.

In the U.S., the growing demand for electric scooters is one of the major factors propelling the market growth in the region. For instance, by 2029, there will be 30.90 million users, with a user penetration rate of 8.34% in 2024 and 8.9% in 2029.

In Canada, increasing technological advancements including enhanced security measures, alert systems, remote telemetry, and GPS tracking are accelerating the growth of the market. For instance, in 2024, Monimoto, a global leader in GPS tracker solutions for power sports and bicycles, introduced the Monimoto 9, a dust and water-resistant unit tailored to the needs of UTV/SxS users. Its tiny size and enhanced durability make it an ideal way to provide peace of mind to off-road enthusiasts.

Scooter Market Players:

- Yadea Technology Group Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ninebot Ltd.

- NEUTRON HOLDINGS, INC.

- Bird Rides, Inc.

- SEGWAY INC.

- Razor USA LLC

- BMW Motorrad International

- Energica Motor Company

- Alta Motors

- Ather Energy

To maintain their market positions, industry players are pursuing strategic initiatives such as regional expansion, mergers and acquisitions, partnerships, and collaboration. Organic expansion remains the primary strategy for the majority of the market's incumbents. Electric scooter producers concentrate on product launch activities in emerging markets.

Recent Developments

- In August 2024, Urja Global Limited, a major player in renewable energy and electric vehicles, announced the upcoming launch of its new high-speed electric scooter, CHETNA. This advanced scooter has received the HoMoLoGATIoN CERTIFICATE and is intended to meet the needs of today's families through modern technology, stylish design, and safety features.

- In August 2023, Apollo announced the launch of the Apollo Go Electric Scooter. This revolutionary addition to the Apollo scooter series was poised to reshape urban mobility with an unrivaled combination of power, performance, and cutting-edge technology. The Apollo Go is the product of the team's unwavering pursuit of quality and dedication to improving urban mobility.

- Report ID: 6357

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Scooter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.