Scleral Lens Market Outlook:

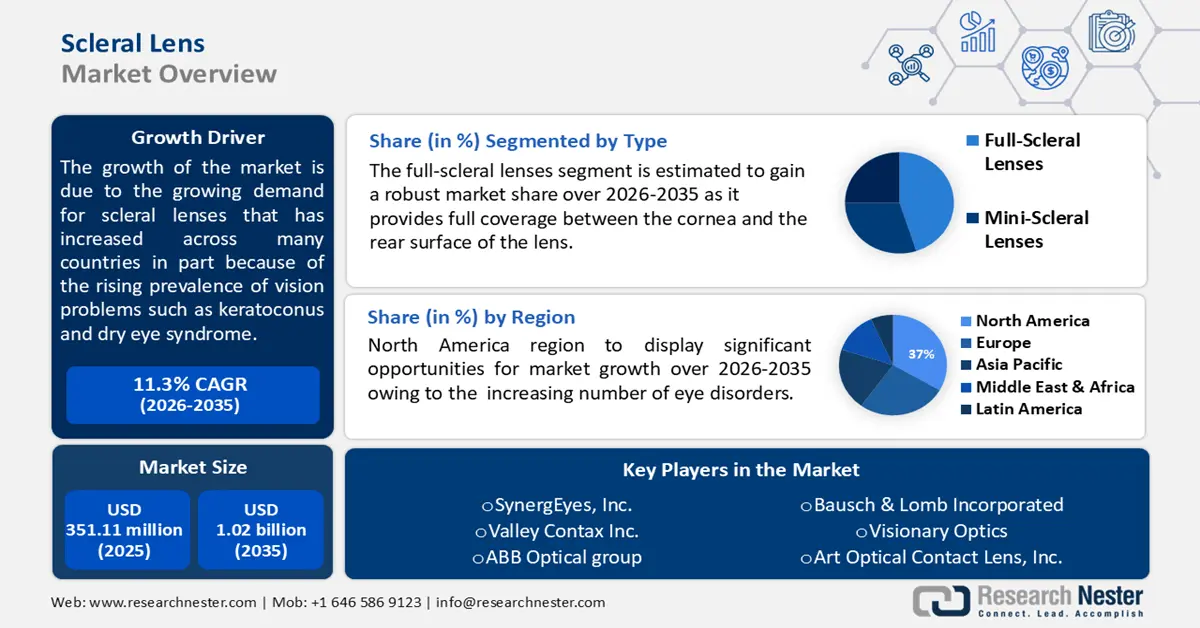

Scleral Lens Market size was valued at USD 351.11 million in 2025 and is expected to reach USD 1.02 billion by 2035, registering around 11.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of scleral lens is evaluated at USD 386.82 million.

The scleral lens market is significantly growing due to the high prevalence of vision problems such as keratoconus, corneal ectasia, and dry eye syndrome in many parts of the globe. Scleral lenses are gaining traction among people across various age groups with severe corneal conditions as they offer better comfort, stability, and visual acuity than regular contact lenses. The development of advanced materials and designs such as silicone hydrogel lenses and orthokeratology has led to increased global adoption of the use of contact lenses, including scleral lenses. In November 2021, CooperVision Specialty EyeCare launched Optimized Pupil Optics for its Onefit MED + scleral contact lenses to eyecare providers (ECPs). This high-precision design is supported by a user-friendly online fitting tool that enables ECPs to reposition the multifocal options aligning with the visual axis.

In addition, the availability of specialized scleral lens designs such as those for myopia and irregular cornea management, has further expanded the scleral lens market. Manufacturers are developing personalized scleral lenses to address each patient's unique demands. For instance, in August 2023, Visionary Optics announced the launch of Europa Tangent, a scleral lens with a combination of optimized, customizable design with a streamlined fitting process.

Key Scleral Lens Market Insights Summary:

Regional Highlights:

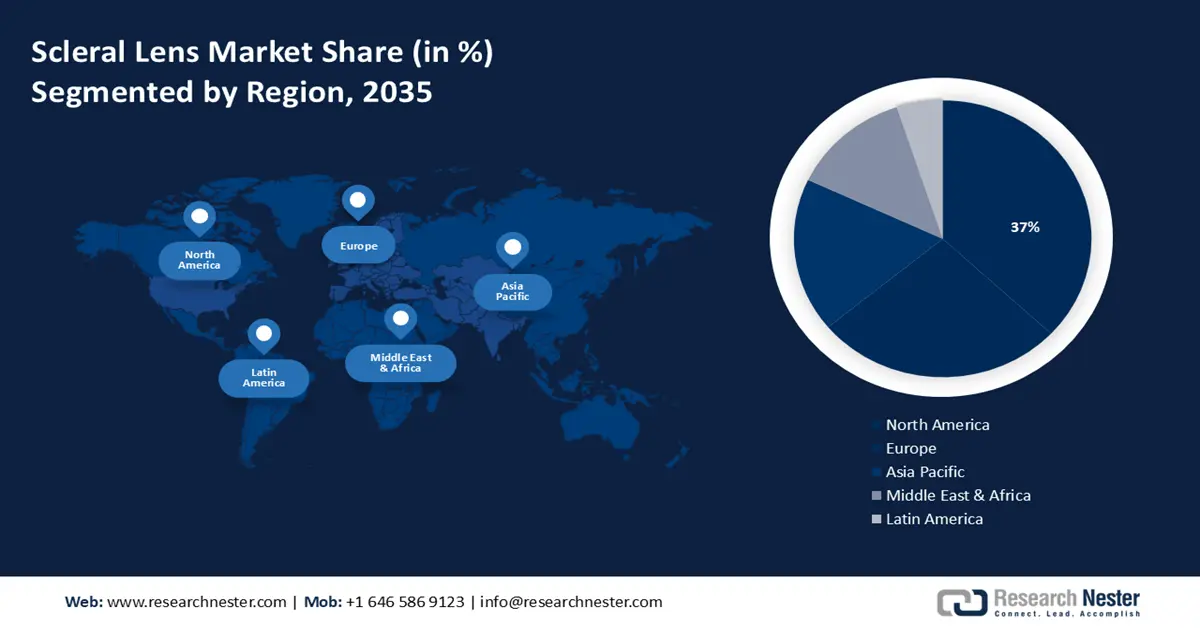

- The North America scleral lens market is predicted to capture 37% share by 2035, fueled by the rising prevalence of ocular disorders and favorable reimbursement policies.

- The Asia Pacific market will grow rapidly from 2026 to 2035, attributed to improving healthcare infrastructure and rising demand for sophisticated eye care products.

Segment Insights:

- The full-scleral lenses segment in the scleral lens market is projected to capture the largest share by 2035, driven by the rising prevalence of corneal irregularities.

- The keratoconus segment in the scleral lens market is expected to achieve rapid growth during 2026-2035, driven by the high global prevalence of keratoconus and custom lens solutions.

Key Growth Trends:

- Huge growth potential due to the aging population

- Digitalization in scleral lenses

Major Challenges:

- Insufficient awareness of scleral lenses

- High costs and limited insurance coverage

Key Players: The full scleral lenses segment is anticipated to garner the largest market size by the end of 2037 and display significant growth opportunities.

Global Scleral Lens Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 351.11 million

- 2026 Market Size: USD 386.82 million

- Projected Market Size: USD 1.02 billion by 2035

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Scleral Lens Market Growth Drivers and Challenges:

Growth Drivers

- Huge growth potential due to the aging population: According to the World Health Organization report, the population of individuals above 60 years globally was 1.4 billion in 2020 and is expected to double by 2050. As the world's population ages, age-related eye problems are becoming more common. Scleral lenses have a tremendous market opportunity as corneal disorders such as presbyopia, dry eye syndrome, keratoconus, and corneal ectasia are rapidly growing among the older population. Older adults often have different visual needs and they may require specialized vision correction. These lenses provide better fit and visual clarity compared to the traditional lenses.

- Digitalization in scleral lenses: Digitalization has significantly transformed the scleral lenses, enhancing the precision, efficiency, and customization of lens fitting processes. Several practitioners are focused on implementing advanced technologies such as optical coherence tomography (OCT) and corneoscleral topography to create detailed 3D maps of the eye’s anterior segment. Moreover, digitalization can help practitioners to extend their enterprise globally through remote fitting technologies. Using this, experts can fit scleral lenses for patients in distant locations, reducing the need for travel and making specialized care more accessible.

Challenges

- Insufficient awareness of scleral lenses: Low awareness about scleral lenses among the general public and some eye care professionals in some parts of the globe may hamper its adoption to a certain extent. Patients often hesitate due to misconceptions about the comfort and maintenance of scleral lenses. However, organizations, including the Scleral Lens Education Society (SLS) are working to solve these restrictions by offering information and education to eye care professionals about the fitting and administration of scleral lenses.

- High costs and limited insurance coverage: Scleral lenses are expensive compared to regular lenses and many insurance plans do not fully cover such specialty contact lenses. In addition to this, it requires specialized optometrists for custom fitting, leading to multiple visits and trail lenses, increasing the overall costs and time.

Scleral Lens Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 351.11 million |

|

Forecast Year Market Size (2035) |

USD 1.02 billion |

|

Regional Scope |

|

Scleral Lens Market Segmentation:

Type Segment Analysis

The full-scleral lenses segment is expected to account for the largest scleral lens market share by 2035 as it provides the greatest coverage between the cornea and rear surface of the lens. Full scleral lenses are rapidly gaining popularity owing to the rising prevalence of corneal irregularities such as keratoconus and post-surgical complications among the geriatric population and rapid advancements in optical technologies.

Application Segment Analysis

The keratoconus segment in scleral lens market is likely to register rapid growth during the projected timeframe owing to its high prevalence worldwide. According to the National Institute of Health (NIH), one in 2000 people is affected by keratoconus. As regular glasses cannot fit the irregular, cone-shaped corneas of keratoconus patients, scleral lenses are the best-suited option that offers optimum clarity and comfort. Several companies are focused on innovating lens design, including tailor-made scleral lenses for enhancing visual outcomes and patient comfort.

Our in-depth analysis of the global scleral lens market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Scleral Lens Market Regional Analysis:

North America Market Insights

The North America scleral lens market is expected to account for a revenue share of 37% by the end of 2035. This growth can be attributed to the rising prevalence of ocular disorders such as keratoconus, dry eye syndrome, and other corneal irregularities. According to the National Institutes of Health (NIH), the prevalence of dry eye disease in the U.S is 4.3% and is expected to affect over 2.7 million people by 2030. In addition, the presence of well-established manufacturers and the rising availability of favorable reimbursement policies are expected to boost market growth in the region.

In the U.S., the scleral lens market is likely to expand at a rapid pace during the forecast period owing to high prevalence of ocular conditions and innovations in scleral lens design and manufacturing. The U.S. has a robust healthcare system with a large number of hospitals and eye clinics, facilitating the widespread adoption of advanced eye care solutions, including scleral lenses.

APAC Market Insights

The Asia Pacific scleral lens market is estimated to register a rapid CAGR during the forecast period owing to rising prevalence of ocular disorders, improving healthcare infrastructure, and increasing demand for sophisticated eye care products, such as scleral lenses for radial keratotomy and post-LASIK operations. In addition, supportive government initiatives and rapid technological advancements in eye care are expected to fuel scleral lens market growth in the region.

In India, the rising prevalence of eye conditions such as keratoconus, dry eye syndrome and corneal ectasia and growing awareness about the importance of early detection and treatment for eye care and vision correction solutions is fueling market growth in the country. Several key players in the nation are focused on developing advanced eye care solutions, including scleral lenses. In February 2021, LV Prasad Eye Institute (LVPEI) became the first eye care center to offer advanced scleral contact lenses in Vijayawada. These specialized contact lenses are developed for patients suffering from advanced corneal diseases, complex eye problems, and patients who have undergone complex surgeries such as corneal transplantation and corneal tear repair.

Scleral Lens Market Players:

- BostonSight SCLERAL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SynergEyes, Inc.

- Valley Contax Inc.

- ABB Optical Group

- Bausch & Lomb Incorporated

- Visionary Optics

- Art Optical Contact Lens, Inc.

- Essilor Custom Contact Lens Specialists

- AccuLens

- Optact International Co., Ltd.

- No7 Contact Lenses

- LCS Laboratoire

- HERZ submicron lathing s.r.l

- Menicon Co., Ltd.

- Advanced Vision Technologies

The global scleral lens market is highly competitive, comprising key regional and international players strategizing several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In May 2024, Bausch + Lomb Corporation announced the U.S. commercial launch of its scleral lens-focused lineup, the Zenlens ECHO. These are SmartCurve technology-based scleral lenses that fit a wide range of patient parameters such as spherical and toric peripheral curves, and prolate and oblate lenses with four diameters for normal-shaped and irregular corneas.

- In February 2023, Visionary Optics launched its scleral lens with a simpler fitting for independent adjustment of parameters in the central, limbal, and landing zones.

- Report ID: 4449

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Scleral Lens Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.