Salicylic Acid Market Outlook:

Salicylic Acid Market size was valued at USD 526.68 million in 2025 and is expected to reach USD 1.14 billion by 2035, expanding at around 8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of salicylic acid is evaluated at USD 564.6 million.

The salicylic acid market is witnessing a robust increase in the pharmaceutical and cosmetics industries owing to its wide versatility in such applications. Due to the increasing consumer awareness of skincare, the demand for safe products is growing, thus leading to boosting the market size. For instance, in April 2024, under AbbVie's auspices, Allergan Aesthetics introduced, SkinMedica Pore Purifying Gel Cleanser and SkinMedica Acne Clarifying Treatment. These products improve skin clarity without sacrificing the skin barrier, resulting in efficient acne treatment. Furthermore, it happens to be very exfoliating and, therefore, aids significantly in the treatment of dermatological conditions such as acne and psoriasis.

The current increase in acne cases worldwide, more specifically in adolescents and young adults, has increased the requirement for effective topical treatments, thereby increasing the demand for formulations based on salicylic acid. This trend of natural and organic skincare products also has led to an increased demand for plant-derived salicylic acid. Health-conscious consumers are being attracted to it. Formulation technologies in the salicylic acid market also are improving the efficacy and stability of salicylic acid in various applications, which is further pushing its use. Overall, these drivers point out salicylic acid as among the most important players in this marketplace in the fight for modern skincare needs and preferences.

Key Salicylic Acid Market Insights Summary:

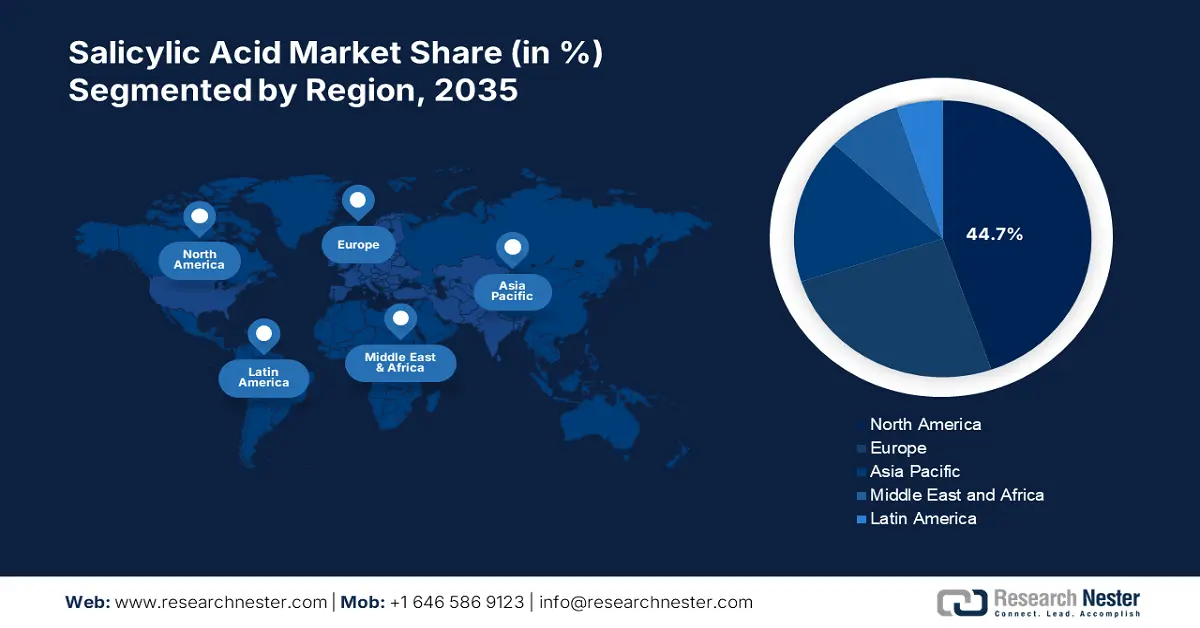

Regional Highlights:

- North America's 44.7% share in the Salicylic Acid Market is strengthened by strict regulations ensuring product safety, boosting consumer confidence, and increasing incidence of skin conditions like acne, driving growth through 2035.

- Europe's salicylic acid market is experiencing substantial growth by 2035, fueled by shifting consumer preferences towards advanced pharmaceutical and personal care products.

Segment Insights:

- Artificial Source salicylic acid segment is expected to exceed 58.5% market share by 2035, attributed to its cost-effectiveness and consistent performance in skincare and pharmaceuticals.

Key Growth Trends:

- Advancement in formulation technology

- Expansion of the cosmetic industry

Major Challenges:

- Skin irritation and sensitivity

- Competition from alternative ingredients

- Key Players: Alfa Aesar, Alta Laboratories, JM Loveridge Limited, Novocap, Vizg Chemicals, CDH Fine Chemicals.

Global Salicylic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 526.68 million

- 2026 Market Size: USD 564.6 million

- Projected Market Size: USD 1.14 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Salicylic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in formulation technology: The development of sophisticated formulation techniques in the salicylic acid market results in increased applications of salicylic acid in cosmetics and pharmaceuticals and bolstered consumer acceptance. For instance, in June 2024, Flychem announced the launch of the most cutting-edge, high-purity encapsulated salicylic acid, the KOSAVA. With its unmatched stability and efficacy, the ground-breaking KOSAVA powered by ProbiCap technology is raising the bar for the pharmaceutical and personal care sectors. Thus, the creation of such innovative products will propel the salicylic acid market expansion.

- Expansion of the cosmetic industry: With the expanding cosmetic industry base and consciousness about skincare ingredients and their benefits, the demand for products containing salicylic acid is also skimming. In addition, salicylic acid's exfoliating and keratolytic qualities make it a popular ingredient in skincare products, thus propelling demand for such products. It helps to provide youthful skin and lessen imperfections. Furthermore, social media and beauty influencers promote salicylic acid use in their skincare regimens and hence fuel this trend, and increased sales of acne treatment products and formulations follow. Therefore, it creates a conducive environment for innovation and the introduction of new products.

Challenges

-

Skin irritation and sensitivity: Concern over skin-related issues such as sensitivity and irritation, that result from adverse effects of any salicylic acid-containing product, poses a significant challenge. Although it is a very popular ingredient for treating acne as well as other skin ailments, its side effects can discourage the continuation of its use. In addition, manufacturers are compelled to carefully formulate their products to minimize irritation while maximizing efficacy, which can complicate product development and marketing strategies in an increasingly competitive landscape of the salicylic acid market.

- Competition from alternative ingredients: Due to the rising consumer preference for natural and organic formulations that claim similar benefits, competition from alternative ingredients poses a challenge. Alpha hydroxy acids (AHAs), plant-based exfoliants, and botanical extracts are increasingly marketed as being more effective than salicylic acid in the treatment of acne and skin texture. Therefore, consumer preference toward perceived safer and more holistic options will affect the demand for salicylic acid-based products negatively as consumers will opt for more value-driven alternatives in terms of sustainability and ingredient transparency.

Salicylic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 526.68 million |

|

Forecast Year Market Size (2035) |

USD 1.14 billion |

|

Regional Scope |

|

Salicylic Acid Market Segmentation:

Source (Artificial/Synthetic, Natural)

Based on the source, the artificial/synthetic segment is projected to capture salicylic acid market share of over 58.5% by 2035, due to cost-effectiveness and consistent quality in production. Artificially synthesized salicylic acid provides manufacturers with a reliable and scalable option for formulating skincare and pharmaceutical products, with uniform potency and performance. For instance, in January 2024, VLCC presented India's first-ever serum facewash line, featuring eight distinct varieties infused with salicylic acid serum, vitamin C serum, and hyaluronic acid serum. Thus, these innovations enable companies to maintain competitive prices while fulfilling the penetrating demand for effective acne treatments and skincare solutions.

Application (Healthcare, Food Preservatives, Cosmetics)

Based on application, the healthcare segment is projected to garner significant growth traction in the salicylic acid market due to its keratolytic action that exfoliates the skin and opens pores. It is more widely used in over-the-counter prescription preparations. In September 2023, Crown Therapeutics announced the addition of two new PanOxyl products, PanOxyl Adapalene 0.1% Gel and PanOxyl Clarifying Exfoliant with 2% Salicylic Acid. It has an alcohol-free, pH-balanced formula with blue algae and antioxidants to reduce redness and irritation while unclogging and minimizing the appearance of pores. The increased prevalence of skin diseases necessitates more effective therapeutic agents, enhancing their usage in the healthcare industry.

Our in-depth analysis of the market includes the following segments:

|

Application |

|

|

Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Salicylic Acid Market Regional Analysis:

North America Market Analysis

North America in salicylic acid market is anticipated to account for around 44.7% revenue share by 2035, driven by strict regulations that impact the market for a product to be safe as well as effective. Consumer confidence increases with such an approach to regulation, and, on the other hand, it boosts manufacturers' skills to be more creative. Hence, the market finds more complex salicylic acid products of high quality for the consumer to fulfill expectations as set by regulators.

The growing incidence of acne and other skin conditions among diversified populations greatly influences the U.S. landscape in the salicylic acid market. For instance, in December 2022, Naturium expanded its line of acne products by introducing its salicylic acid 2% body spray, which penetrates pores and treats and prevents blemishes. This blend helps to balance skin tone and texture while clearing up and combatting breakouts. In addition, increasing awareness and acceptability of skincare regimens are driving this trend.

The salicylic acid market in Canada is greatly influenced by agencies and regulatory bodies' concerns toward consumer safety and product efficacy. Moreover, producers innovate the products with premium ingredients to give an unparalleled experience to consumers. For instance, in August 2024, with its most sought-after ingredients, The Ordinary recently debuted its body care line. These products have formulas that include some of the brand's best-loved skincare ingredients such as niacinamide and salicylic acid are included.

Europe Market Statistics

Europe salicylic acid market is expected to witness substantial growth in the revenue during the forecast timeline from 2025 to 2035. The creation and introduction of cutting-edge products into the market are being propelled by shifting consumer preferences and the rising need for efficient pharmaceutical and personal care products. For instance, in November 2024, Vichy, which is a local company, announced the launch of a new shampoo that contains selenium sulfide and salicylic acid.

The manufacturers in France prioritize the use of botanical ingredients in cosmetics. They firmly believe in the importance of following a structured skincare regimen that is frequently low maintenance but effective. Moreover, they cater to the needs of all skin types in their products. For instance, in May 2021, Bioderma launched the Sebium Lotion and Night Peel which restores skin pH, controls sebum production, and hydrates the skin for eight hours. The components, which include zinc, glycerin, agaric acid, and salicylic acid, are meant to clarify and cleanse the skin while avoiding bacterial blockage.

The salicylic acid market in Germany is anticipated to expand considerably between 2025 and 2035 as a result of the presence of new and sophisticated products in the market and the existence of major cosmetics companies that are striving to develop novel products to sustain competition. In addition, the pharmaceutical industry's need for salicylic acid is fueled by the rising percentage of the elderly population as well as the rising incidence of chronic illnesses.

Key Salicylic Acid Market Players:

- Simco Chemicals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alfa Aesar

- Alta Laboratories

- JM Loveridge Limited

- Novocap

- Vizg Chemicals

- CDH Fine Chemicals

- Thermo Fisher Scientific Inc.

- Siddharth Carbochem Products Ltd.

Companies are optimizing and innovating their process in the salicylic acid market to enhance the performance of the ingredient in delivering efficacy in the skincare routine. For instance, in February 2024, L'Oréal Paris debuted its Hyaluron + Plump line, which included hyaluronic and salicylic acid-infused products. The collection's ingredients are designed to hydrate ends, remove dullness from hair, and exfoliate the scalp to cleanse it. This innovation focuses not only on differentiating brands in a competitive market but also caters to the emergent consumer demand for effective, high-quality skincare solutions for growth in the market for salicylic acid.

Here’s the list of some key players:

Recent Developments

- In November 2024, Dove debuted the acne clear serum body wash, which contained 1% salicylic acid to help clear and prevent acne. It renders targeted solutions for various skin needs along with exceptional care.

- In July 2024, Re'equil announced a new skin-clarifying serum with encapsulated salicylic acid and granactive ACNE. This product reduces visible acne marks and sebum production and soothes inflammation to promote clearer skin.

- Report ID: 6802

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Salicylic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.