Rubber Process Oil Market Outlook:

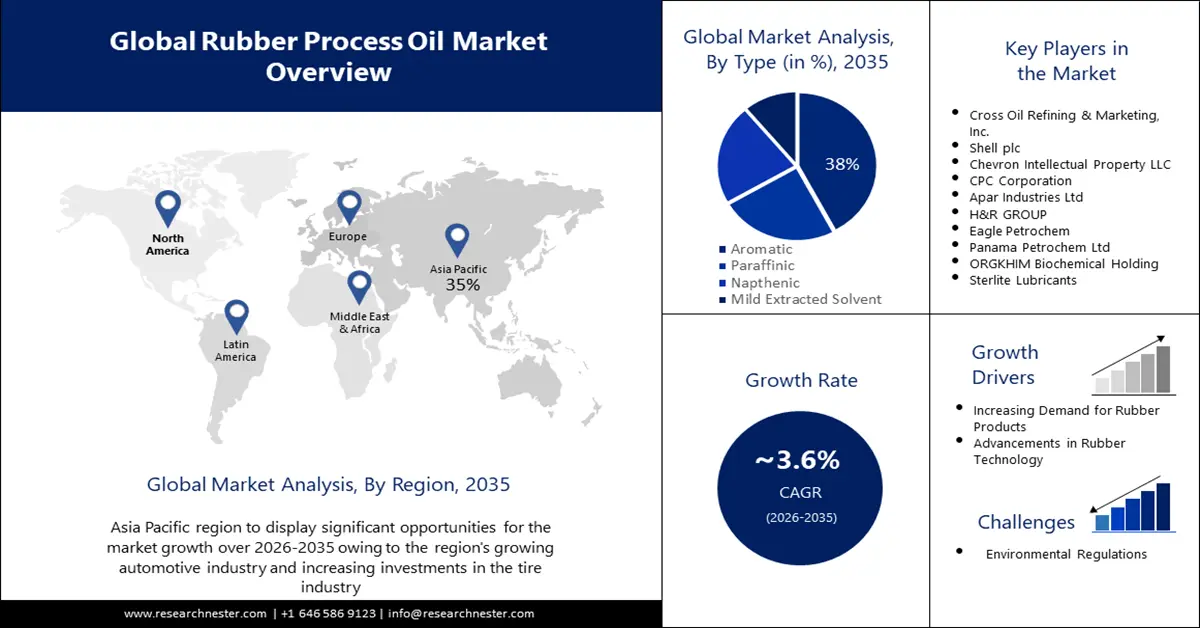

Rubber Process Oil Market size was valued at USD 3.6 billion in 2025 and is expected to reach USD 5.13 billion by 2035, registering around 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rubber process oil is evaluated at USD 3.72 billion.

Tires are the largest consumers of RPO. The increasing demand for tires, driven by growing vehicle sales, the expansion of the transportation sector, and the replacement tire market, all contribute to the demand for RPO. In 2020, the European Union (EU) manufactured 4.3 million tonnes of tires. Despite having 94 tire production facilities, within the EU the region's imports of tire categories exceed its exports.

RPO is used as a reinforcing agent in the production of rubber-based adhesives and sealants, which gives them strength and flexibility. This helps them to be used in a variety of applications, such as bonding car parts, sealing joints in buildings, and gluing together materials in the manufacturing process. As these sectors grow, the demand for RPO is expected to increase.

Key Rubber Process Oil Market Insights Summary:

Regional Highlights:

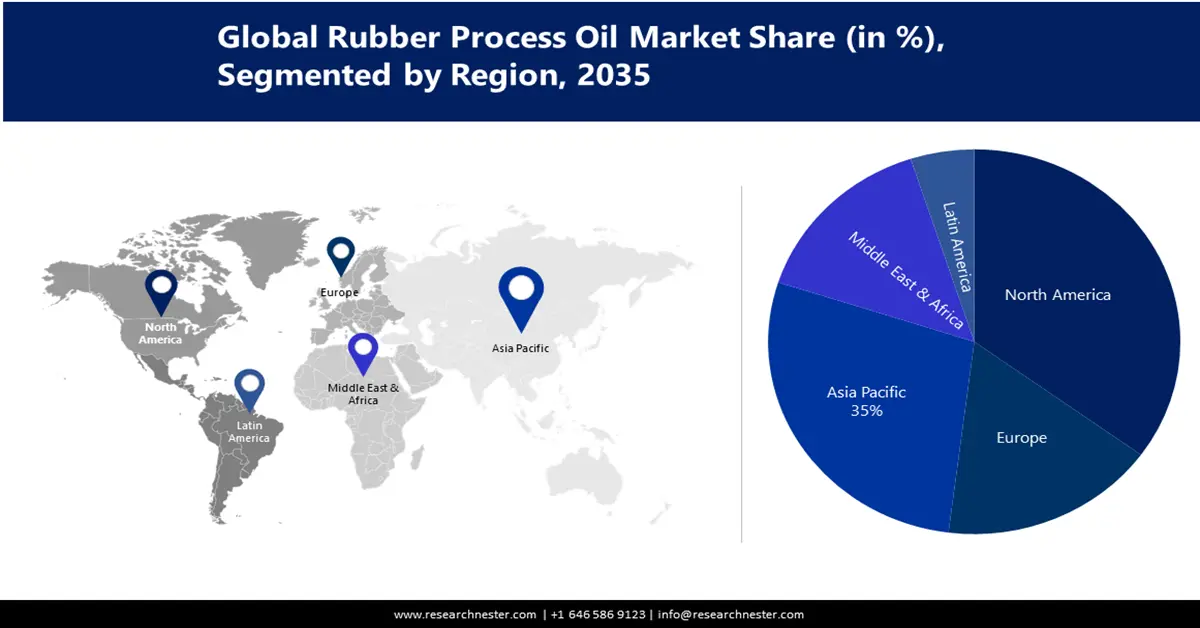

- The Asia Pacific rubber process oil market is projected to secure a 35% share by 2035, fueled by the presence of leading producers and consumers in the region.

- The North America market is expected to achieve a 28% share by 2035, attributed to increasing production of rubber-based products and industrial applications.

Segment Insights:

- Aromatic rubber process oil segment in the rubber process oil market is expected to witness 38% growth by the forecast year 2035, driven by demand for synthetic rubber in automotive applications.

- The rubber processing segment in the rubber process oil market is expected to hold a 23% share by 2035, attributed to rising industrial use of rubber products like tires and belts.

Key Growth Trends:

- Growing Automotive Industry

- Increasing Demand for Rubber Products

Major Challenges:

- Environmental Regulations

- Volatility of raw material prices such as base oils and additives

Key Players: Cross Oil Refining & Marketing, Inc., Shell plc, Chevron Intellectual Property LLC, CPC Corporation, Apar Industries Ltd, H&R GROUP, Eagle Petrochem, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, Sterlite Lubricants.

Global Rubber Process Oil Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 billion

- 2026 Market Size: USD 3.72 billion

- Projected Market Size: USD 5.13 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 11 September, 2025

Rubber Process Oil Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Automotive Industry- The automotive industry is one of the largest consumers of rubber products and thus, Rubber Process Oils. With the growing demand for automobiles worldwide, the demand for Rubber Process Oils has also been on the rise. The automotive manufacturing industry worldwide generated around USD 2.80 trillion, in revenue during 2021. The automotive industry relies heavily on rubber products, such as tires, gaskets, hoses, and shock absorbers, which are produced using Rubber Process Oils.

-

Increasing Demand for Rubber Products- The demand for rubber products has been steadily increasing in recent years, with hoses, belts, and seals being just a few examples of the many applications for rubber. As more and more industries rely on these products to function, the need for high-quality Rubber Process Oils becomes even more important. Rubber Process Oils are used to improve the processing and performance of rubber products, making them more durable and efficient. For example, they can be used to increase the elasticity of rubber, allowing it to stretch further without breaking. They can also help to reduce the amount of heat generated during processing, which can lead to faster production times and lower energy costs.

- Advancements in Rubber Technology- Advancements in rubber technology have led to the development of high-performance tires that require specialized Rubber Process Oils. These oils are designed to enhance the performance and durability of the tires, allowing them to withstand harsh conditions such as extreme temperatures and rough terrain. One example of a specialized Rubber Process Oil is the use of functionalized polymers in tire compounds. These polymers are designed to improve the grip and handling of the tires, providing better traction on wet or slippery surfaces. Another example is the use of resins in tire compounds, which can improve wear resistance and reduce rolling resistance, resulting in improved fuel efficiency.

Challenges

-

Environmental Regulations: One of the most significant challenges for RPO is the tightening of environmental regulations. Many traditional RPO formulations are derived from aromatic hydrocarbons, which are considered harmful to the environment due to their potential carcinogenic properties. This has led to increased scrutiny and the need for more environmentally friendly RPO formulations.

-

Volatility of raw material prices such as base oils and additives

- Economic fluctuations, trade tensions, and global market dynamics impacting demand for rubber products

Rubber Process Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 3.6 billion |

|

Forecast Year Market Size (2035) |

USD 5.13 billion |

|

Regional Scope |

|

Rubber Process Oil Market Segmentation:

by Type Segment Analysis

The aromatic rubber process oil market is estimated to gain the largest market share of about 38% in the year 2035. The segment growth can be attributed to the increasing demand for synthetic rubber in the automotive industry, which is a major application segment for aromatic rubber process oil. The increasing demand for synthetic rubber in the automotive industry is largely due to its superior performance and durability over natural rubber. Additionally, the aromatic rubber process oil offers better resistance to heat and oxidation, making it an ideal choice for the automotive industry.

Application Segment Analysis

The rubber processing segment in the aromatic rubber process oil market is estimated to gain a significant share of about 23% in the year 2035. The segment growth can be attributed to the increasing demand for rubber products, such as tires, conveyor belts, and hoses, due to increasing industrialization and urbanization. As more industries rely on rubber products, there is a greater demand for rubber processing applications to manufacture them. This has resulted in increased research and development of more efficient rubber processing techniques, as well as new technologies to improve the quality and performance of rubber products.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rubber Process Oil Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 35% by 2035, due to presence of largest producers and consumers of rubber process oil in the region. The market growth in the region is also expected on account of China, India, and Japan being the largest producers and consumers of rubber process oil in the region. Additionally, these countries are also focusing on reducing their dependence on imports, which further contributes to market growth in the region. Furthermore, the region's growing automotive industry and increasing investments in the tire industry are also driving the growth of the market in the region.

North American Market Insights

The North America rubber process oil market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The market’s expansion can be attributed majorly to the increasing production of rubber-based products, and the growing adoption of rubber process oils in various industrial applications. Approximately 35 million metric tons of rubber are produced in the United States each year. This, in turn, is leading to an increased demand for rubber process oils, which are used in the manufacturing process of rubber-based products. Furthermore, the increasing preference for synthetic rubber, which is more cost-effective and energy-efficient, is also driving the growth of the market.

Rubber Process Oil Market Players:

- Cross Oil Refining & Marketing, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shell plc

- Chevron Intellectual Property LLC

- CPC Corporation

- Apar Industries Ltd

- H&R GROUP

- Eagle Petrochem

- Panama Petrochem Ltd

- ORGKHIM Biochemical Holding

- Sterlite Lubricants

Recent Developments

- Shell Overseas Investments B.V. And B.V. Dordtsche Petroleum Maatschappij, both subsidiaries of Shell plc have finalized the sale of Shell Neft LLC, which includes Shell stations and lubricants business in Russia, to PJSC LUKOIL.

- Cross Oil Refining & Marketing Inc. along with Process Oils, Inc., a subsidiary of Ergon company have agreed from August 23, 2022. As per this agreement Process Oils will exclusively handle the marketing and sales of Cross Oils Corsol, L Series, B Series CrossTrans, and Ebonite oils produced at Martin Operating Partnership L.P. Smackover refinery located in Arkansas.

- Report ID: 5222

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rubber Process Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.