Ride Sharing Market Outlook:

Ride Sharing Market size was over USD 158.26 billion in 2025 and is projected to reach USD 716.42 billion by 2035, growing at around 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ride sharing is evaluated at USD 181.48 billion.

The primary growth driver of the ride sharing market is the increasing adoption of smartphones and mobile internet access. For instance, a total of 5.45 billion people worldwide were using the internet at the start of July 2024. The global number of internet users increased by 167 million during the last year. Globally, internet user numbers are expanding at an annual rate of 3.2%, but year-on-year growth is much faster in several developing economies. This technological advancement facilitates the use of ride sharing apps, making it easier for users to book rides and for drivers to find passengers. Additionally, factors such as urbanization, growing concerns over vehicle ownership costs, and an increasing preference for convenience and cost-effectiveness contribute significantly to the market’s expansion.

Key Ride Sharing Market Insights Summary:

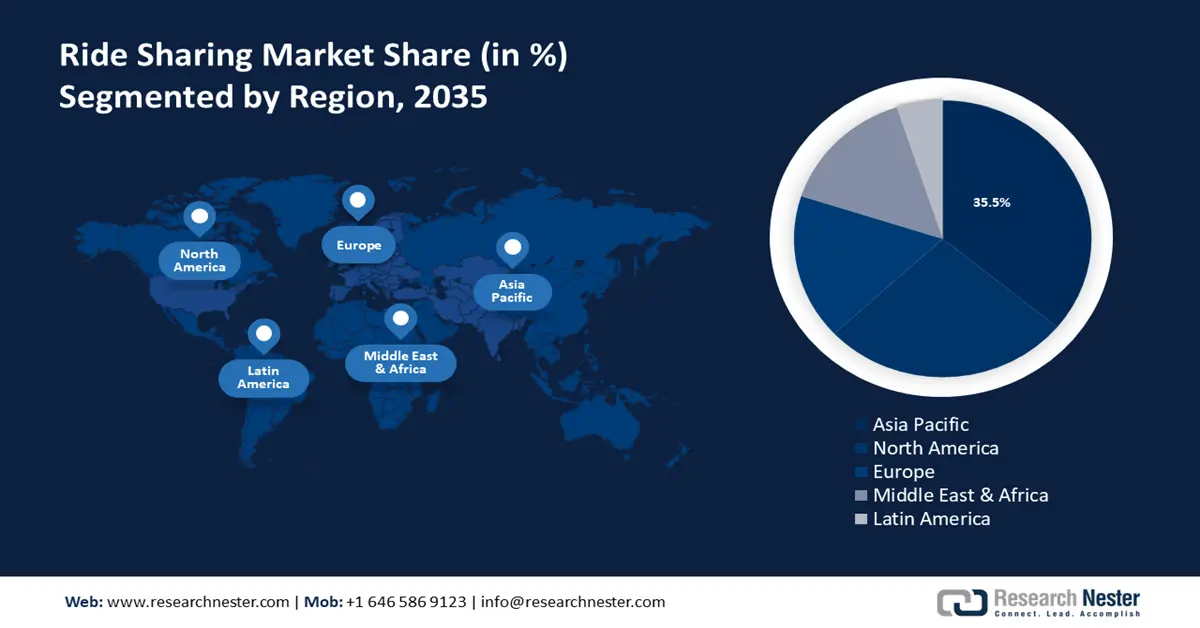

Regional Highlights:

- The Asia Pacific ride sharing market will secure over 36% share by 2035, driven by rapid urbanization and technological advancements in transportation.

Segment Insights:

- The e-hailing segment in the ride sharing market is projected to achieve significant growth till 2035, driven by urbanization, expanding tourism, and increased traffic congestion in urban areas.

- Electric vehicle segment in the ride sharing market is anticipated to secure a dominant share by the forecast year 2035, driven by zero tailpipe emissions and lower fuel costs aligning with environmental regulations.

Key Growth Trends:

- Rising environmental concerns

- Technological advancements

Major Challenges:

- Regulatory issues

- Public perception and acceptance

Key Players: Didi Chuxing Technology Company, Aptiv PLC, General Motors, Ford Motor Company, IBM International, Waymo LLC, TomTom International B.V.

Global Ride Sharing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 158.26 billion

- 2026 Market Size: USD 181.48 billion

- Projected Market Size: USD 716.42 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, United Kingdom

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 18 September, 2025

Ride Sharing Market Growth Drivers and Challenges:

Growth Drivers

- Rising environmental concerns: Ride sharing helps lower the number of vehicles on the road, reducing overall greenhouse gas emissions and traffic congestion. By maximizing vehicle occupancy, rise sharing makes more efficient use of transportation resources compared to single-occupancy car trips. Moreover, many rise sharing companies are incorporating electric vehicles (EVs) into their fleets, which help reduce reliance on fossil fuels and lower emissions. For instance, companies such as Lyft and Uber have committed to transitioning their fleets to EVs. In 2020, Lyft announced its goal of achieving 100% EVs on its platform by the end of 2030.

- Technological advancements: Ride sharing apps use GPS to match riders with drivers in real-time, enabling efficient route planning and location tracking. Additionally, AI-driven dynamic pricing adjusts fares based on demand and supply, improving profitability for drivers and balancing demand. Advanced data analytics provide insights into user behavior, traffic patterns, and operational efficiencies. Companies use this data to optimize routes, manage fleet operations, and enhance user experience.

- Efficient use of resources: Carpooling or vanpooling allows multiple passengers to share the cost of a ride, making it more affordable for users compared to solo trips. This cost efficiency drives more users to ride sharing platforms. Apps such as UberPOOL enable riders to share rides with others heading in the same direction, reducing the per-person cost of transportation. Moreover, carpooling often integrates with existing public transport systems, providing a seamless travel experience for users combining different modes of transportation.

Challenges

- Regulatory issues: Varying regulations and legal requirements across different regions can hinder the expansion of ride sharing services. Regulations related to licensing, insurance, and safety standards can be complex and costly. In some cities, ride sharing companies face restrictions on operating hours or mandatory driver background checks, impacting their flexibility and scalability.

- Public perception and acceptance: Negative perceptions or resistance from traditional taxi services, as well as concerns about the impact on public transportation systems, can affect the adoption of ride sharing services. Traditional taxi drivers and unions in some countries protest against the competition posed by ride sharing services, influencing public opinion and regulatory responses.

Ride Sharing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 158.26 billion |

|

Forecast Year Market Size (2035) |

USD 716.42 billion |

|

Regional Scope |

|

Ride Sharing Market Segmentation:

Service Type Segment Analysis

The e-hailing segment is anticipated to dominate the ride sharing market share of 35.1% in the coming years. This growth of the segment is expected to be driven by the global urbanization rate, the expanding tourism industry, and increased traffic congestion in urban areas. Urbanization often leads to a concentration of job opportunities in metropolitan areas. Individuals seeking better employment may use ride-hailing as an economical commuting option than owing a car.

Moreover, specialized services such as those for seniors or individuals with disabilities increase market inclusivity and cater to niche segments. For instance, Uber’s Uber WAV, and similar services are part of a growing trend to accommodate special needs. Thus, e-hailing service type contribute to the expansion and diversification of the market by addressing various consumer needs and preferences, supported by substantial growth figures and evolving market trends.

Distance Segment Analysis

The short segment is estimated to gather substantial CAGR till 2035. The focus on short-distance travel within the ride sharing market caters to the need for convenience, cost effectiveness, and frequent use, contributing significantly to the segment growth. Convenience makes ride sharing a popular choice for short commutes, errands, and quick trips, contributing to increased usage. Many urban users rely on ride sharing for trips that are too short to warrant public transit or parking hassles. Furthermore, short-distance ride sharing helps mitigate urban traffic congestion and parking challenges by offering alternatives to personal vehicles.

Vehicle Type Segment Analysis

By the end of 2035, the electric segment is expected to dominate the global ride sharing market. EVs produce zero tailpipe emissions, which helps reduce the overall footprint of ride sharing services and aligns with growing environmental regulations. As cities and countries implement stricter emissions standards, the adoption of EVs in ride sharing fleets supports regulatory compliance and appeals to environmentally conscious consumers. Additionally, EVs have lower fuel costs compared to traditional internal combustion engine vehicles, which make EVs more economical for ride sharing companies, contributing to reduced overall expenses and potentially higher profits. For instance, EVs can reduce per-kilometer running costs by up to 60% compared to ICE vehicles.

Our in-depth analysis of the global market includes the following segments:

|

Service Type |

|

|

Sharing Type |

|

|

Vehicle Type |

|

|

Data Science |

|

|

Travel Mode |

|

|

Distance |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ride Sharing Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to account for largest revenue share of 36% by 2035. The market expansion is attributed to the rapid urbanization, growing middle class population, and rising technological advancements. The region is witnessing a staggering population density in major cities like Beijing, Tokyo, Mumbai, and Jakarta. Urbanization drives demand for efficient and flexible transportation solutions, boosting the adoption of ride sharing services. For instance, according to the United Nation Human Settlements Program (UN-HABITAT) urbanization remains a defining megatrend in the Asia-Pacific region. APAC is home to more than 2.2 billion people or 54% of the world's urban population. By 2050, Asia's urban population is predicted to increase by 50%.

In China, advances in technology, such as mobile app development, GPS, and payment systems, enhance the convenience and efficiency of ride sharing services. Technological integration improves user experience and operational efficiency. For instance, DiDi Chuxing and other players utilize sophisticated algorithms and data analytics to optimize routes and manage demand.

India has a growing middle-class population with increasing disposable incomes that drives demand for convenient and affordable transportation. According to the People Research on India’s Consumer Economy (PRICE), the middle class population in the country grew 6.3% per year between 1995 and 2021. Additionally, the Indian government is increasingly supporting ride sharing through favorable regulations and policies, including guidelines for safety and service standards.

In South Korea, there is a focus on integrating ride sharing with public transportation systems to enhance urban mobility. This helps improve last-mile connectivity and overall transportation efficiency. Kakao Mobility is the leading mobility service provider has been working on integrating its services with public transit options to provide seamless travel solutions.

North America Market Insights

North America ride sharing market will also encounter enormous growth owing to the rising consumer preferences which play a crucial role in shaping the market. Fast and reliable service with features such as real-time tracking and quick payment options are highly valued by the users. Enhanced safety features, such as driver background checks, in-app safety tools, and insurance coverage, are critical for user trust and satisfaction. Additionally, consumers are showing interest in environmentally friendly options such as electric or hybrid vehicles.

In the U.S., the presence of strong key players significantly influences the ride sharing market. for instance, Uber is one of the largest and most well-established ride sharing companies, dominates the U.S market with a broad range of services including UberX, Uber POOL, and UberEats for food delivery. Its extensive network and technological innovation give it a substantial competitive advantage.

In comparison to traditional taxi services, Canada's market has rapidly evolved in recent years, as it provides a smooth booking experience and lower wait times. The Canadian economy has been significantly impacted by the growth of ride sharing which has contributed to making Canadians' daily lives easier by enhancing mobility and expanding options.

Ride Sharing Market Players:

- Uber Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Didi Chuxing Technology Company

- Aptiv PLC

- General Motors

- Ford Motor Company

- IBM International

- Waymo LLC

- TomTom International B.V.

Companies play a central role in driving the market through various strategies and innovations. Companies invest in technology to enhance user experience, such as improved mobile apps, real-time tracking, and advanced algorithms for efficient routing. Moreover, by offering a range of services, from budget rides to premium options, companies cater to diverse customer needs.

Recent Developments

- In June 2023, Ford Motor Company announced a partnership with Uber to provide rideshare drivers with an electric lease option to assist them in reducing emissions and operating expenses.

- In October 2022, Uber Technologies Inc. along with Hyundai and Aptiv announced to implementation of driverless vehicles in their ride-hailing and delivery systems. The agreement is the first to cover both delivery and ride-hailing and can connect with millions of Uber users.

- Report ID: 6352

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ride Sharing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.