Recycled Plastics Market Outlook:

Recycled Plastics Market size was over USD 68.51 billion in 2025 and is anticipated to cross USD 159.24 billion by 2035, witnessing more than 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of recycled plastics is assessed at USD 73.94 billion.

With the growing awareness regarding environmental and energy concerns, countries across the world have started focusing on reducing greenhouse gas emissions. Plastic products can serve the purpose of ensuring that achieve greener and more sustainable living standards. These products require much less energy in the manufacturing process as compared to other materials. Various applications like construction, transport, electronics, and packaging require less energy. According to report published by Plastivision in 2021, emissions of greenhouse gases could increase by 61% if plastics are replaced with alternative materials and it can also boost lifecycle energy consumption by 57%.

Key Recycled Plastics Market Insights Summary:

Regional Highlights:

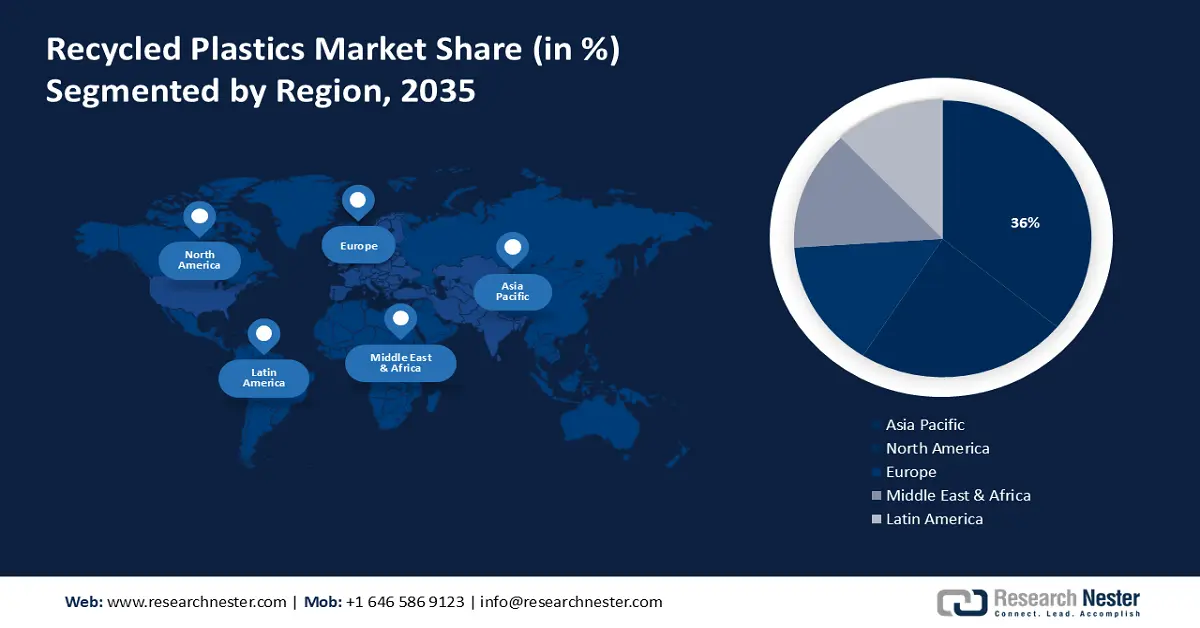

- Asia Pacific recycled plastics market will hold more than 36% share by 2035, driven by increasing population and demand for sustainable plastic products.

Segment Insights:

- The plastic bottles segment in the recycled plastics market is anticipated to experience robust growth till 2035, fueled by the massive use of plastic bottles for packaging drinks, cosmetics, and other products.

- The packaging segment in the recycled plastics market is projected to secure a 37% share by 2035, influenced by the increasing adoption of recycled plastic in e-commerce packaging.

Key Growth Trends:

- Increase in the purchase of electronic items and personal care products in online mode

- Growing demand for recycled plastics in the construction industry

Major Challenges:

- People's inclination towards virgin plastic

- Harmful effect on the environment after downcycling plastic

Key Players: Alpek S.A.B. de C.V., Biffa, KW Plastics, Waste Connections, Cabka, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, Loop Industries, Inc., MBA Polymers Inc., Plastipak Holdings Inc.

Global Recycled Plastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 68.51 billion

- 2026 Market Size: USD 73.94 billion

- Projected Market Size: USD 159.24 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Recycled Plastics Market Growth Drivers and Challenges:

Growth Drivers

- Increase in the purchase of electronic items and personal care products in online mode – The growing demand for online shopping for various products such as electronics & smart devices and personal care products, including face masks, headphones, and cosmetics, is driving the demand for recycled plastics. This plastic is majorly used in different types of packaging sources.

- Growing demand for recycled plastics in the construction industry - The growth of the construction sector in developing countries is expected to drive the demand for recycled plastics. This recycled plastic is used in the manufacturing of various components that are used in providing insulation from heat and cold, windows, and fences.

According to the Plastic Soup Foundation report issued in 2021, around 18% of plastic is used in construction and building. The increased use of recycled plastic in the building & construction sector can be attributed to increased foreign investment in the construction industry.

Challenges

- People's inclination towards virgin plastic - The increasing demand for virgin plastic is due to the benefits it provides over recycled plastic. Virgin plastic has higher mechanical properties, safety, and impact resistance as compared to recycled plastic.

Moreover, the government has started promoting the use of recycled plastic in packaging but manufacturers are not sure due to the chances of contamination.

- Harmful effect on the environment after downcycling plastic - In the downcycling process, used or very little used plastic is recycled and fabricated into a new product with less quality as compared to virgin plastic.

This newly developed plastic is used in very limited places which becomes a major disadvantage of this recycled plastics market. The recycled plastic product cannot go for another round of recycling because it has turned into a completely different product. Such products end up in landfills harming the environment as it takes thousands of years for plastic to degrade.

Recycled Plastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 68.51 billion |

|

Forecast Year Market Size (2035) |

USD 159.24 billion |

|

Regional Scope |

|

Recycled Plastics Market Segmentation:

Product Segment Analysis

Polyethylene terephthalate segment is set to capture over 32% recycled plastics market share by 2035. The large-scale adoption of PET for packaging various products and bottling is the major factor resulting in segment growth. It is lightweight, can be recycled easily, and has higher durability. Moreover, the government is supporting to use of recycled PET instead of virgin PET for packaging bottles and other beverages.

Recycled PET has various other applications including manufacturing furniture, carpets, and fibers. According to the International Bottled Water Association, more than 1.5 billion pounds of used PET plastic bottles and containers majorly containing beverage bottles and cosmetics containers are recovered in the United States each year for recycling.

Source Segment Analysis

By the end of 2035, plastic bottles segment is expected to capture around 45% recycled plastics market share. The segment growth can be attributed to the large-scale use of plastic bottles for the packaging of soft drinks, water, cosmetics, oils, pharmaceuticals, and others.

The majority of the plastic waste generated is from packaged drinking water. Recycled plastic is used for manufacturing drinking bottles with the cause of saving our environment. Moreover, the government has introduced various regulations which state the compulsory use of recycled plastic for manufacturing water bottles. As per a recent report issued in 2021, around 1.3 billion plastic bottles are used every single day worldwide, which is about 1 million per minute.

Application Segment Analysis

In recycled plastics market, packaging segment is expected to account for around 37% revenue share by 2035. The segment growth is due to the increasing adoption of recycled plastic for various applications majorly plastic containers leading to rapid growth of e-commerce worldwide.

The massive orders received through e-commerce platforms have increased progressively leading to the large-scale use of recycled plastic for product packaging, resulting in segment growth. For instance, the world produces around 141 million tonnes of plastic packaging a year which contributes to 1.8 billion tonnes of carbon emissions annually.

Our in-depth analysis of the recycled plastics market includes the following segments:

|

Product |

|

|

Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recycled Plastics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 36% by 2035. The market growth in the region is also expected on account of the increasing population leading to higher demand for plastic products in various industries. Additionally, inadequate collection of waste and processing infrastructures are the major drivers of plastic pollution in the APAC region. Conversion of plastic waste into sustainable packaging materials helps in reducing the plastic waste present in the region. According to a recent report, around half of the world's plastics (52% of 390.7Mt globally) are generated in the Asia-Pacific (APAC) region in 2021.

Increasing consumer awareness regarding the sustainable use of recycled plastic in Indonesia is resulting the growth of recycled plastics market. Plastic waste generation is quite high in the region as it’s a tourist place. According to the World Bank, Indonesia generates around 7.8 million tons of plastic waste annually out of which 4.9 million tons of plastic waste is not properly managed.

The recycled plastics market in China is growing due to the conversion of plastic waste into fuel. According to the State Council report issued in 2022, China's complete focus is on plastic recycling which has helped reduce crude oil consumption by 510 million tons and prevented 61.2 million tons of carbon dioxide emissions. These measures taken by the government also prevented 90 million tons of solid waste from being generated.

North American Market Insights

The North America region will also encounter huge growth for the recycled plastics market during the forecast period and will hold the second position owing to the fast development of the building & construction industry with increasing demand for recycled plastic in these industries having significantly contributed towards the growth of the recycled plastics market in the region.

According to the Associated General Contractors (AGC) of America, more than 919,000 construction establishments took place in the U.S. in the 1st quarter of 2023 which has given employment to 8.0 million employees and created nearly USD 2.1 trillion worth of structures each year. With the growing construction rate, demand for recycled plastics is gradually increasing.

In the US, recycled plastic is majorly used in making fibers, sheet and film, strapping, food and beverage bottles, and nonfood containers. The country has a huge potential to convert recycled plastics into useful products. For instance, only 5% to 6% of plastics get recycled in the United States as plastic consumption is very high in the region.

The recycled plastics market in Canada is growing as the region is completely focusing on recycling plastic. According to the government of Canada, the country can recycle around 9% of its plastic waste every year, while producing more than 3 million tons annually.

Recycled Plastics Market Players:

- Alpek S.A.B. de C.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biffa

- KW Plastics

- Waste Connections

- Cabka

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- Loop Industries, Inc.

- MBA Polymers Inc.

- Plastipak Holdings Inc.

The major key players in the recycled plastics market are completely focusing on turning plastic waste into products that can be used commercially resulting in protecting the environment from landfills.

Recent Developments

- Waste Connections released its 2023 sustainability report mentioning the company's progress towards its long-term goal and aspirational sustainability targets. The major achievements include a 14% year-over-year reduction in greenhouse gas emissions and a doubling of the Company's targeted improvement. In addition, the Company reaffirmed its commitment to invest approximately USD 200 million in renewable natural gas (RNG) facilities expected online by 2026.

- Plastipak Holdings Inc. manufacture, and recycling of plastic containers announced that they’ve partnered with Kraft Heinz to transition KRAFT Real Mayo and MIRACLE WHIP containers to be made entirely from recycled PET (rPET) material.

- Report ID: 6184

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recycled Plastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.