Recombinant Human Serum Albumin Market Outlook:

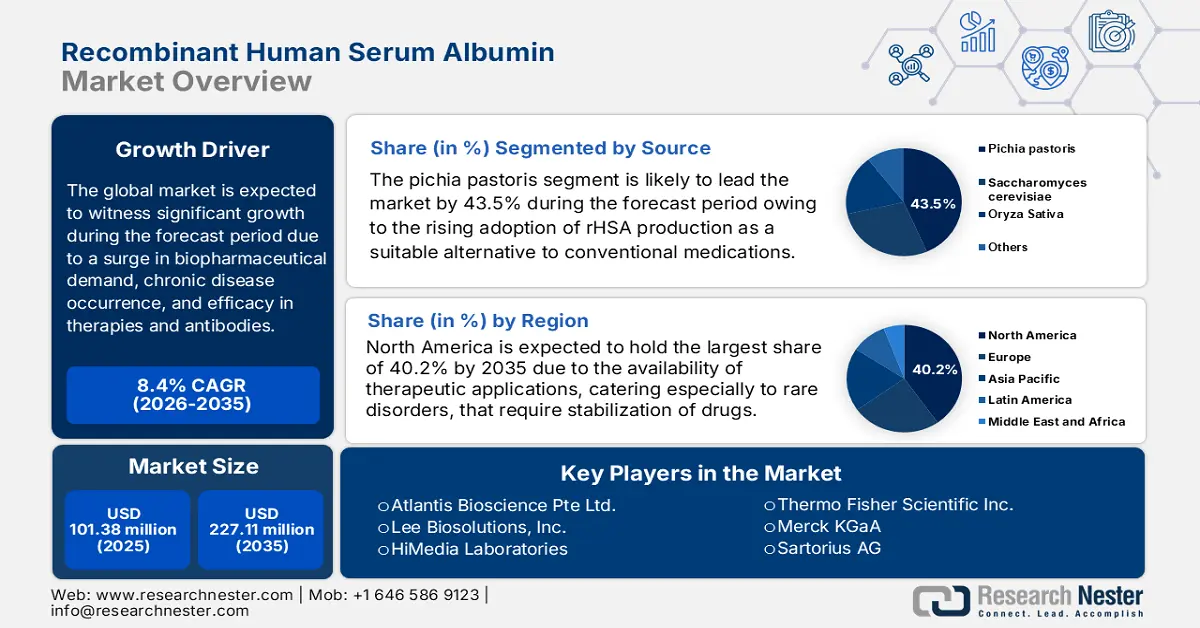

Recombinant Human Serum Albumin Market size was over USD 101.38 million in 2025 and is anticipated to cross USD 227.11 million by 2035, witnessing more than 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of recombinant human serum albumin is assessed at USD 109.04 million.

The growth of the recombinant human serum albumin market (rHSA) is attributed to the increasing necessity for high transparency and safety replacements to plasma-derived albumin. Besides, albumins are globular proteins frequently found in egg white, blood plasma, plants, and milk, and serum albumin is the most copious protein in the blood plasma of all vertebrates. According to the August 2021 NLM article, human serum albumin (HSA) comprises a plasma concentration of 35 to 50 mg/mL which has an estimated half-life of 19 days, and exists in both extravascular and intravascular spaces. This regulates the oncotic pressure and pH of the blood, thus constituting a huge demand for the market globally.

Furthermore, the expansion of the recombinant human serum albumin market highly depends upon the availability of albumin in both developed and developing nations. This, however, is possible with the continuous export and import of different varieties of albumin that include albuminates, albumins nes, and other albumin derivatives. According to the 2023 OEC report, the global valuation of all these albumin categories is USD 2.4 billion and is the 1,266th most traded product in the world with a product complexity of 0.3. Besides, the top exporter is the United States with a valuation of USD 651 million, and China is the top importer at USD 351 million, thereby an optimistic outlook for the market evolution.

Albuminates, Albumins Nes, and Albumin Derivatives Export/Import

|

Countries |

Export |

Import |

|

United States |

USD 651 million |

USD 130 million |

|

Germany |

USD 343 million |

- |

|

New Zealand |

USD 252 million |

- |

|

Denmark |

USD 222 million |

- |

|

Netherlands |

USD 186 million |

USD 183 million |

|

China |

- |

USD 351 million |

|

Japan |

- |

USD 273 million |

|

India |

- |

USD 141 million |

Source: OEC 2023

Key Recombinant Human Serum Albumin Market Insights Summary:

Regional Highlights:

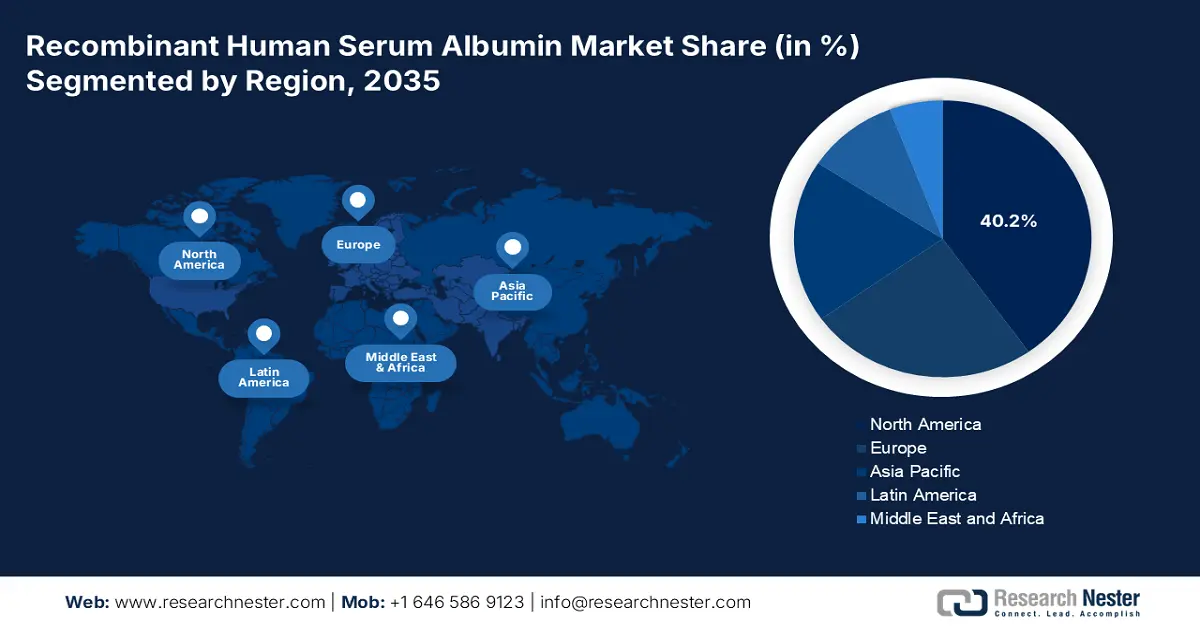

- North America holds a 40.00% share in the Recombinant Human Serum Albumin Market, propelled by well-developed healthcare facilities and strong biopharmaceutical R&D contributions, fostering growth by 2035.

- The Recombinant Human Serum Albumin Market in Asia Pacific is expected to achieve the fastest growth by 2035, attributed to increasing chronic diseases and demand for innovative therapies.

Segment Insights:

- Recombinant Human Serum Albumin segment is projected to hold a 43.50% share by 2035, driven by high protein production capacity of Pichia pastoris with AOX1 promoter.

Key Growth Trends:

- Rising occurrence of liver illness

- Growth of the biopharmaceutical sector

Major Challenges:

- Huge expenditure in the production process

- Strict regulation and manufacturing procedure

- Key Players: Albumin Bioscience, Lazuline Bio, HiMedia Laboratories., InVitria.

Global Recombinant Human Serum Albumin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 101.38 million

- 2026 Market Size: USD 109.04 million

- Projected Market Size: USD 227.11 million by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Recombinant Human Serum Albumin Market Growth Drivers and Challenges:

Growth Drivers

-

Rising occurrence of liver illness: The increase in the prevalence of this disorder is a huge growth factor for the recombinant human serum albumin market globally. According to the April 2024 Office for Health Improvement and Disparities report, the death rate in England increased by approximately 40% owing to liver disease. In addition, the premature demise rate due to alcoholic liver sickness was 11.6 per 100,000 population in 2022, and this enhanced by 61.3%. Besides, the hospital admission rates in 2023 increased to 155.2 per 100,000 population, thereby driving the market demand.

-

Growth of the biopharmaceutical sector: The expansion of the recombinant human serum albumin market hugely depends upon the continuous development of the biopharmaceutical industry across nations. For instance, in January 2025, Lutris Pharma declared its securing of USD 30 million in financing to ensure the development of LUT014. It is an advanced topically applied gel intended to reduce EGFRi-induced rashes, a common adversative side effect of these cancer-fighting therapies. This is a huge contribution to the overall industry which is positively impacting the market.

Challenges

-

Huge expenditure in the production process: This is one of the primary challenges for the recombinant human serum albumin market internationally. The production includes complicated biotechnological procedures that comprise unconventional protein expression systems and recombinant DNA technology. These, in turn, require substantial funding for research and development, extremely dedicated labor, and urbane equipment, all of which cater to high production costs, thereby restraining the market upliftment.

-

Strict regulation and manufacturing procedure: There is the provision of stringent policies that are essential to abide by while manufacturing rHSA. These policies necessitate expert personnel and investments in research and developmental activities which complicates the manufacturing process. Besides, biosafety maintenance is another hurdle for the recombinant human serum albumin market that requires minute down-streaming and high protein expression levels to cater to safety concerns. All these factors effectively hinder the market, thus a barrier to its expansion.

Recombinant Human Serum Albumin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 101.38 million |

|

Forecast Year Market Size (2035) |

USD 227.11 million |

|

Regional Scope |

|

Recombinant Human Serum Albumin Market Segmentation:

Source (Pichia pastoris, Saccharomyces cerevisiae, Oryza Sativa)

Based on the source, the pichia pastoris segment is expected to account for around 43.5% recombinant human serum albumin market share by 2035. In an article, published by NLM in November 2022, the production of recombinant proteins by pichia pastoris, is highly driven by the AOX1 promoter. This eventually caters to more than 10 g/L which is equivalent to 30% of total cell proteins, thus uplifting the segment’s growth effectively. Therefore, it is increasingly implemented owing to its ability to harvest high-density cultures and prompt multifaceted proteins with appropriate folding and post-translational alterations, thus positively uplifting the market.

Application (Cell Culture Media, Stem Cell Therapy, Drug Formulations, Cryopreservation)

Based on the application, the cell culture media segment in the recombinant human serum albumin market is estimated to exhibit CAGR of around 39.2% till 2035. According to a report by Research Nester, the global cell culture media market is projected to hold significant revenue share by the forecast timeline. Besides, the use of rHSA in this segment is extremely critical owing to its capability to support cell evolution, alleviate proteins, and control osmotic compression. Additionally, it is utilized as a supplement in different cell culture media types, especially for mammalian cell lines, stem cells, and hybridoma, thereby imitating albumin’s organic purposes deprived of infection from blood-derived bases.

Our in-depth analysis of the global market includes the following segments:

|

Source |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recombinant Human Serum Albumin Market Regional Analysis:

North America Market Analysis

North America in recombinant human serum albumin market is expected to capture around 40.2% revenue share by the end of 2035. The availability of well-developed healthcare facilities along with supportive regulatory organizations is suitable for ensuring innovation and advancements to expand the market in the region. In addition, the dynamic contribution of both large-scale and small-scale biotechnology and pharmaceutical entities intensely devolved in biopharmaceutical research and development helps as a driving force to boost the market's growth.

The recombinant human serum albumin market in the U.S. is driven by the involvement of international organizations making relative contributions. For instance, in February 2025, Zydus Lifesciences Ltd. declared that its subsidiary, Zydus Lifesciences Global FZE has entered into an exclusive commercialization, supply, and licensing agreement with Zhuhai Beihai Biotech Co., Ltd for BEIZRAY, a 505(B)(2) albumin solubilized docetaxel injection for the U.S. market. Beihai will be responsible for the supply and Zydus will cater to the marketing of the product in the country, thereby amplifying the market.

The recombinant human serum albumin market in Canada is progressively uniting its spot owing to investments by government and administrative organizations. In February 2025, the Government of Canada funded over USD 2.3 billion in 41 projects across the therapeutics, vaccine, and manufacturing ecosystems to initiate life science innovation. Besides, in February 2023, Protein Industries Canada received federal funding of USD 150 million for five years to support the upliftment and innovation of organizations to commercialize the latest products. Therefore, with such contributions, the market is positively expected to develop in the country.

APAC Market Statistics

The Asia Pacific region in the recombinant human serum albumin market is expected to demonstrate the fastest growth during the forecast timeline. Factors such as the occurrence of chronic diseases as well as the surge in the demand for innovative therapies are highly driving the market development in the region. According to the January 2022 NLM article, the overall prevalence of chronic kidney disorder in the region ranges between 7% to 34.3%, with approximately 434.3 million adults suffering from the condition. This also includes 65.6 million affected by the advanced version of the condition, thereby boosting market demand.

The recombinant human serum albumin market in India is on the rise due to the rising prevalence of sepsis. As per the June 2022 NLM article, a clinical study was conducted on adult patients in the country to estimate the sepsis incident rate. The study denoted that out of 677 patients, 382 that is 56.4% suffered from the condition. In addition, the incidence of Sepsis-2 was 46.2% and Sepsis-3 was 33.2% with nominal concordance. Also, the most common microorganisms found in such patients included 77.9% of bacterial and 14.1% of fungal infections. Therefore, this constitutes the increasing need for rHSA in the country, thus driving market growth.

The recombinant human serum albumin market in China is achieving traction since there is ongoing interest and development in rHSA due to huge demand and limitations in outdated HSA withdrawal from human plasma. Besides, initiatives are undertaken by biotech firms to sell their operating facilities in the country to expand the market. For instance, in September 2024, Australia-based CSL Limited agreed with Chengdu Rongsheng Pharmaceutical to trade its Wuhan Zhong Yuan Rui De Biologicals Products plasma assortment and fractional process operations for USD 185 million, thus a strategic move to ensure upliftment.

Key Recombinant Human Serum Albumin Market Players:

- ACROBiosystems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abcam Limited.

- Atlantis Bioscience Pte Ltd.

- Albumin Bioscience

- Lazuline Bio

- Lee Biosolutions, Inc.

- HiMedia Laboratories.

- InVitria

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Sartorius AG

- Sonnet BioTherapeutics Holdings, Inc.

- Grifols

- Dyadic International, Inc.

- Proliant Health and Biologicals

Organizations in the recombinant human serum albumin market are actively participating in providing the latest products and services through agreements, collaborations, partnerships, and mergers and acquisitions. For instance, in January 2025, Sonnet BioTherapeutics Holdings, Inc. announced the granting of the Patent No. EP3583125 B1, Albumin Binding Domain Fusion Proteins, by Europe Patent Office (EPO). This covers Sonnet’s Fully Human Albumin Binding (FHAB) technology and comprises therapeutic combined proteins that utilize FHAB for tumor targeting and maintenance as well as provide prolonged pharmacokinetics.

Here's the list of some key players:

Recent Developments

- In December 2024, Grifols notified the topline data from its Phase 3 PRECIOSA clinical trial, evaluating the potential of long-term albumin treatment with Grifols Albutein on patients with decompensated cirrhosis and ascites.

- In June 2024, Dyadic International, Inc. partnered with Proliant Health and Biologicals based on the development and advertising of recombinant albumin. Through this deal, Dyadic received a payment of USD 1.5 million and agreed to share profits of Proliant from the sale of animal-free recombinant albumin products produced using Dyadic’s filamentous fungal microbial platforms.

- Report ID: 7478

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.