Real-Time Payments Market Outlook:

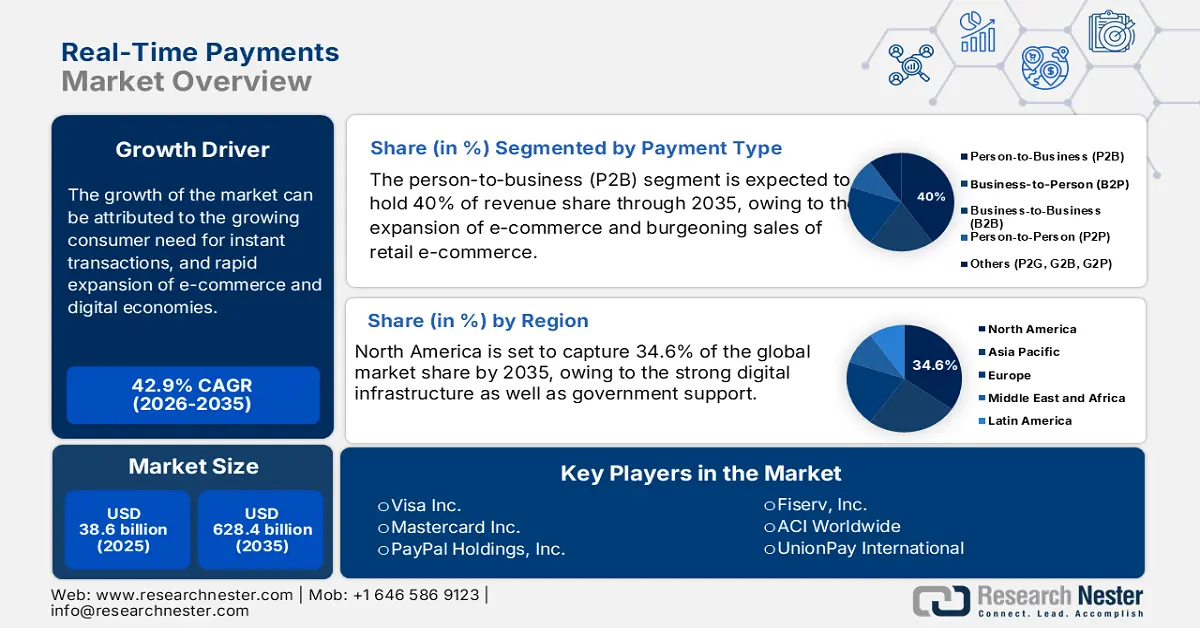

Real-Time Payments Market size was valued at USD 38.6 billion in 2025 and is projected to reach USD 628.4 billion by the end of 2035, rising at a CAGR of 42.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of real-time payments is evaluated at USD 49.2 billion.

The market for Real-Time Payments (RTP) is growing rapidly due to technological developments and regulatory endorsements. India has been the leader, with the UPI platform accounting for a substantial number of global RTP transactions. Other countries like the U.S. and China are also quickly building their own RTPs (FedNow and WeChat Pay). Europe is also making progress, with the government of Switzerland aiming for a complete instant payment system by 2026. Using ISO 20022 messaging standards has increased both security and efficiency in payments, while new technologies, such as biometric authentication, provide further protection against fraud. The introduction of digital wallets and mobile payment options is also changing how we most commonly conduct transactions. The attempts to initiate cross-border real. This time, payments are only an additional factor that the RTP market will continue to grow, demonstrating a meaningful and transformative movement toward faster models for delivering more accessible systems.

Key Real-Time Payments Market Insights Summary:

Regional Highlights:

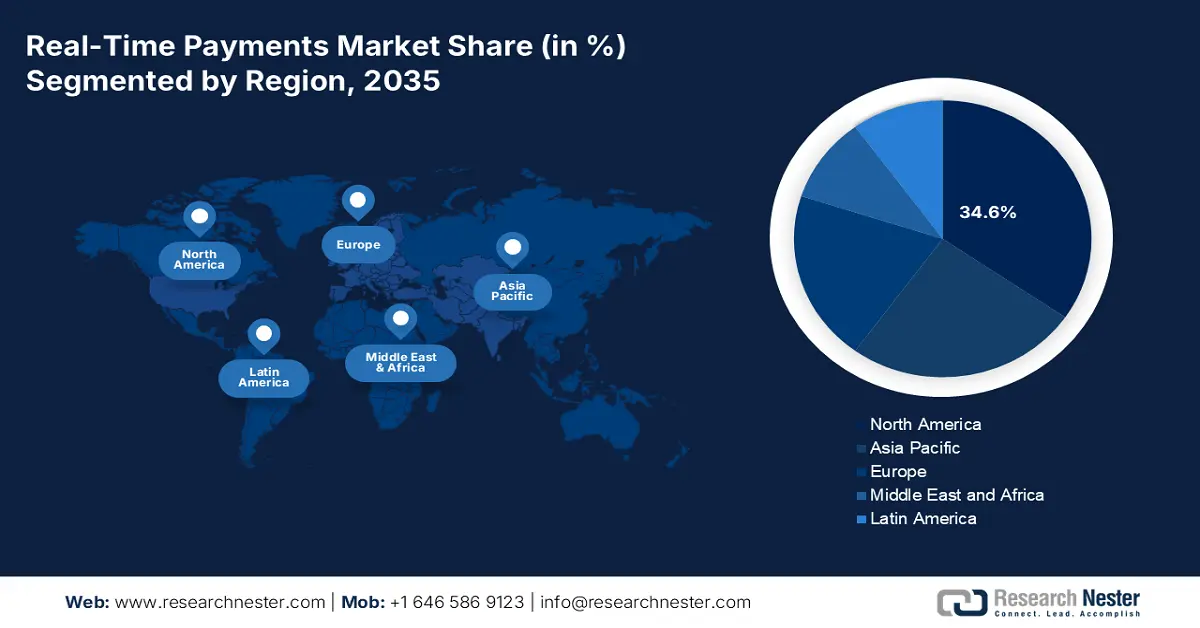

- North America is expected to hold 34.6% share by 2035, supported by strong digital infrastructure, government initiatives, and the expansion of 5G.

- Asia Pacific is projected to capture 33.3% share by 2035, impelled by rising smartphone penetration, government-backed offerings, and 5G rollout.

Segment Insights:

- The person-to-business (P2B) segment is projected to account for 40% share by 2035, propelled by the expansion of e-commerce and rising retail e-commerce sales.

- The cloud segment is anticipated to hold a significant revenue share by 2035, owing to its scalability, cost efficiency, and enhanced security.

Key Growth Trends:

- Growing consumer need for instant transactions

- Rapid expansion of e-commerce and digital economies

Major Challenges:

- Strict data protection guidelines

- Exorbitant cost of cybersecurity

Key Players: Visa Inc., Mastercard Inc., PayPal Holdings, Inc., Fiserv, Inc., ACI Worldwide, Alipay (Ant Group), UnionPay International, NPCI (National Payments Corporation of India), Paytm (One97 Communications), NEC Corporation, Samsung Pay (Samsung Electronics), LINE Pay (LINE Corporation), Adyen N.V., Worldpay (FIS), BPAY Group

Global Real-Time Payments Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 38.6 billion

- 2026 Market Size: USD 49.2 billion

- Projected Market Size: USD 628.4 billion by 2035

- Growth Forecasts: 42.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: India, China, Brazil, Australia, Singapore

Last updated on : 3 October, 2025

Real-Time Payments Market - Growth Drivers and Challenges

Growth Drivers

- Growing consumer need for instant transactions: As e-commerce, mobile banking, and digital wallets become more prevalent, individuals are making financial transactions more frequently, and across multiple channels, thereby creating an increased expectation for real-time, immediate payment processing. Traditional payment transactions may take hours or even days to settle, while RTP payments allow funds to be transferred immediately while also creating a better consumer experience and providing trust in the payment process. Furthermore, in an era of being digitally connected, today's consumers are resistant to delays in transferring money and paying bills. Therefore, instant payments allow consumers more control of their personal finances.

- Rapid expansion of e-commerce and digital economies: Organizations and consumers who interact online are focusing on methods to exchange money that are fast, secure, and seamless. Traditional payment methods that have non-instantaneous delays or settlement times just do not work in the digital economy, where purchases, subscriptions, and services are instant. The instant transfer of funds afforded by real-time payments enhances the customer experience by decreasing cart abandonment rates and increasing satisfaction while shopping online. Faster cash flow and liquidity also benefit e-commerce platforms, marketplaces, and digital service providers using RTP systems since they do not have to wait days to settle payments.

- Growing cybersecurity concerns: Today's RTP systems typically have robust security capabilities like tokenization, encryption, biometric authentication, and real-time prevention of fraud, which makes them less vulnerable to cyberattacks than traditional systems that batch process transactions and verify their authenticity later. In an environment of increasing cyberattacks like data breaches, identity theft, and payment fraud, stakeholders want a system that can react quickly to detect fraud on the risk vulnerability. Additionally, financial institutions and payment service providers are required to adhere to high standards of data protection and fraud prevention prescribed by regulatory authorities.

U.S. Retail E-Commerce and Total Retail Sales – Q2 2025 (Census Bureau Estimate)

|

Metric |

Q2 2025 Estimate |

Quarter-over-Quarter Change (Q1 2025 → Q2 2025) |

Year-over-Year Change (Q2 2024 → Q2 2025) |

Share of Total Retail Sales |

|

E-Commerce Sales |

$304.2 billion |

+1.4% (±0.9%) |

+5.3% (±1.2%) |

16.3% |

|

Total Retail Sales |

$1,865.4 billion |

+0.4% (±0.4%)* |

+3.9% (±0.4%) |

— |

|

E-Commerce Sales |

$292.9 billion |

+6.2% (±0.9%) |

+5.3% (±1.2%) |

15.5% |

|

Total Retail Sales |

— |

— |

+3.8% (±0.4%) |

— |

Source: The Census Bureau of the Department of Commerce

Trends in Noncash Payments by Value in the U.S. (2000–2022, in Trillions of Dollars)

|

Year |

Checks |

ACH Debit Transfers |

ACH Credit Transfers |

Credit Cards |

Non-prepaid Debit Cards |

Prepaid Debit Cards |

|

2000 |

~40 |

~9 |

~9 |

~1 |

~0.5 |

~0.2 |

|

2003 |

~41 |

~12 |

~12 |

~1.5 |

~0.6 |

~0.2 |

|

2006 |

~42 |

~13 |

~18 |

~2 |

~1 |

~0.3 |

|

2009 |

~34 |

~15 |

~22 |

~2 |

~1 |

~0.3 |

|

2012 |

~27 |

~19 |

~28 |

~2.5 |

~1.5 |

~0.3 |

|

2015 |

~26 |

~19 |

~32 |

~3 |

~2 |

~0.3 |

|

2016 |

~26 |

~19 |

~32 |

~3 |

~2 |

~0.3 |

|

2017 |

~26 |

~19 |

~32 |

~3.5 |

~2.5 |

~0.3 |

|

2018 |

~26 |

~22 |

~38 |

~4 |

~3 |

~0.3 |

|

2019 |

~26 |

~22 |

~38 |

~4 |

~3 |

~0.3 |

|

2020 |

~26 |

~22 |

~38 |

~4 |

~3 |

~0.3 |

|

2021 |

~27 |

~30 |

~45 |

~5 |

~3.5 |

~0.4 |

|

2022 |

~28 |

~31 |

~55 |

~6 |

~4 |

~0.5 |

Source: Board of Governors of the Federal Reserve System

Challenges

- Strict data protection guidelines: Strict data protection requirements are limiting the development and acceptance of the real-time payment sector. Payment providers must invest significant resources into regulatory and compliance mandates, surrounding GDPR and CCPA compliance-related security measures, data encryption, and the legal fees associated with compliance. The regulations also limit the instant sharing of sensitive financial information between banks, merchants, and payment processors. This acts as another complicating layer to the development of streamlined instant payment systems.

- Exorbitant cost of cybersecurity: The high price tag of cybersecurity is stifling the growth of the real-time payments sector. Real-time payment systems involve the immediate transfer of valuable financial information, making them veritable targets for cyber attackers. As a result, organizations have no choice but to invest in the latest technologies including but not limited to encryption, fraud detection, intrusion prevention, and continuous monitoring to secure their transactions. These extensive expenses may weigh particularly heavily on smaller providers and FinTech startups. This makes it difficult to enter or grow within this market.

Real-Time Payments Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

42.9% |

|

Base Year Market Size (2025) |

USD 38.6 billion |

|

Forecast Year Market Size (2035) |

USD 628.4 billion |

|

Regional Scope |

|

Real-Time Payments Market Segmentation:

Payment Type Segment Analysis

The person-to-business (P2B) segment of the market is anticipated to hold the largest revenue share of 40% by the end of 2035. The growth is driven by the expansion of e-commerce and burgeoning sales of retail e-commerce. An increased preference, among consumers, for speed and convenience when making payments, is boosting demand for instant payment solutions. Companies are incorporating real-time payments to better manage their cash flows, shorten payment cycles, and improve customers' experience. The development in the services of digital wallets and mobile payments has also contributed to the rise of P2B. Even as more retail and service providers begin offering instant payment functions, the share of consumers utilizing instant payments will continue to grow; consumers are bound to get used to better spending from improved investment in payment infrastructure and improved confidence in digital payments.

Deployment Mode Segment Analysis

The cloud segment is likely to account for a major revenue share in the market led by scalability and cost efficiency. Payment solutions that are securely delivered in the cloud create the capacity for businesses to scale their operation up or down based on demand. This is especially critical when businesses offer real-time payments to merchants, which must be highly performant and be able to efficiently process a large volume of transactions. Furthermore, cloud services tend to have lower upfront capital and ongoing maintenance costs by having a subscription and pay-as-you-go model. The cloud also enables businesses to deploy new features and updates more frequently because of its inherent nature of enhancing innovation and improved security.

Component Segment Analysis

The solution segment dominated the real-time payments market because businesses heavily invested in payment solutions to enable instant, secure, and efficient transactions. Solutions such as software platforms, payment gateways, and APIs are requisites for enabling real-time payment processing. These solutions were a priority for companies contending with a consumer marketplace that demanded faster payments and a competitive payment experience in a rapidly shifting digital economy. Additionally, the adoption of advanced technologies like AI, machine learning, and blockchain within payment solutions provided security and efficiency and enhanced the adoption of these capabilities, while also having a huge market share.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Payment Type |

|

|

Deployment Mode |

|

|

Component |

|

|

Enterprise Size |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Real-Time Payments Market - Regional Analysis

North America Market Insight

The North America real-time payments market is anticipated to gain a revenue share of 34.6% in 2035. The growth is supported by strong digital infrastructure as well as government support. The RTP market also benefits from the expansion of 5G. Additionally, consumer demand for instant payments and “buy now, pay later” will also support market growth, particularly in the e-commerce space. In Canada, ISED has invested in alleviating digital inequities in the country by subsidizing the service and helping with the addition of around 1.5 million + households connected to broadband in 2023. Furthermore, the adoption of AI for fraud detection by banks and government ICT spending is significant to the market expansion.

The U.S. market for Real-Time Payments is rapidly maturing, propelled by the expansion of The Clearing House’s RTP network into numerous new banks and credit unions. Both RTP and FedNow have enabled widespread access to instant payments for banks and credit unions throughout the U.S. Consumer and business demand for payments to be spent and settled quicker, on a 24/7 schedule, is increasing. The shift is also supported by fintech innovation, as digital wallets and applications become increasingly ubiquitous and integrate real-time payments. In the business sector, real-time payments support B2B payment flows and enable businesses to have real-time control of cash flow.

Real-time payments in Canada are anticipated to grow rapidly as Payments Canada moves forward with its modernization plans to introduce the Real-Time Rail (RTR) system. Additionally, regulatory support for open banking and the development of digital financial services are fostering a more competitive and innovative payment ecosystem. Fintechs have begun to integrate and partner with traditional financial institutions to provide real-time payment offerings in the consumer-to-consumer and business payment space. As well, interest in cross-border RTP, especially with the U.S., and interest in digital transformations across a variety of industries, is creating strong momentum for real-time payments in Canada.

Asia Pacific Market Insight

The Asia Pacific real-time payments space is projected to account for 33.3% of total global revenue in 2035. The growth is fueled by an increase in smartphone penetration, government-backed offerings, and 5G rollout. It is also encouraging that some governments are providing some level of regulatory support to the industry in terms of growth and adoption. In addition, India's real-time payment market is the fastest growing, driven by the rising acceptance of Unified Payments Interface (UPI) and an increasing reliance on AI to detect fraud.

India has rapidly become one of the fastest-growing markets for real-time payments in the world, mainly propelled by government initiatives such as the UPI, which has ushered in a digital revolution within the payment ecosystem in India, enabled by real-time transfers of bank account funds at very little cost and available to consumers and merchants 24/7. All this has contributed to the growth of infrastructure by the deep penetration of smartphones in India, a large unbanked and underbanked population who are rapidly transitioning to digital, and government initiatives encouraging a shift toward cashless payments.

The real-time payments sector in China is flourishing because mobile payment platforms such as Alipay and WeChat Pay have embedded real-time payment systems into daily life. The Chinese government’s digital economy strategy, coupled with a robust fintech ecosystem, has resulted in a robust market in which real-time payments are provided even for small amounts. Moreover, the development of the Digital Yuan (e-CNY) supports the infrastructure for instant payments.

Europe Market Insight

The Europe real-time payments market is on track for growth, citing regulatory support, a strong push towards digitalization, and demand from consumers for speed and convenience. A major driver is the initiative of the European Union by way of the SEPA Instant Credit Transfer (SCT Inst) that promotes real-time payments in euros across member states. Regulatory support builds credibility and trust in real-time payment systems and fosters consistency and interoperability of real-time payment systems. Users and businesses in Europe have rapidly adopted digital and contactless payments largely due to the increased growth of e-commerce, mobile banking, and innovation from fintech companies.

The real-time payments market in France is expected to grow due to the increasing digital transformation of the banking and financial services industry. The French government and regulatory bodies are supporting the adoption of instant payments through policy initiatives. In addition, rising consumer demand for faster and frictionless payment experiences, particularly with e-commerce payments and peer-to-peer transfer payments, is prompting banks and fintechs to invest in infrastructure for real-time payments.

Germany is also seeing strong growth in its real-time payments market, fueled by a tech-savvy population, a solid banking market, and a growing preference for digital payments. Widespread adoption of SEPA Instant Payments has further facilitated the rollout of instant payment solutions across banks. Growing B2B payments and government payments with faster settlement needs are also motivating institutions to emerge and update their processes to include real-time capabilities. This is to improve operational efficiency while also addressing customer satisfaction.

Key Real-Time Payments Market Players:

- Visa Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mastercard Inc.

- PayPal Holdings, Inc.

- Fiserv, Inc.

- ACI Worldwide

- Alipay (Ant Group)

- UnionPay International

- NPCI (National Payments Corporation of India)

- Paytm (One97 Communications)

- NEC Corporation

- Samsung Pay (Samsung Electronics)

- LINE Pay (LINE Corporation)

- Adyen N.V.

- Worldpay (FIS)

- BPAY Group

The real-time payments market faces strong competition from technological and regional regulatory innovation. The U.S. has large players like Visa and Mastercard, each with global networks. China’s Alipay has a foothold with its mobile wallet. All stakeholders are engaging in their strategic initiatives. They are all taking a heavy interest in 5G and blockchain, giving them new options for speed and security.

Below are the areas covered for each company in the real-time payments market:

Recent Developments

- In May 2025, Balance, the financial infrastructure platform for B2B commerce, announced the launch of a new real-time payments tool, offering retailers instant payment confirmation and simplifying the customer experience.

- In April 2025, Visa partnered with Anthropic, IBM, Microsoft, Mistral AI, OpenAI, Perplexity, and introduced intelligent to introduce a new era of commerce that enables AI agents to process payments on Visa’s network.

- Report ID: 5157

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Real-Time Payments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.