Rare Gas Market Outlook:

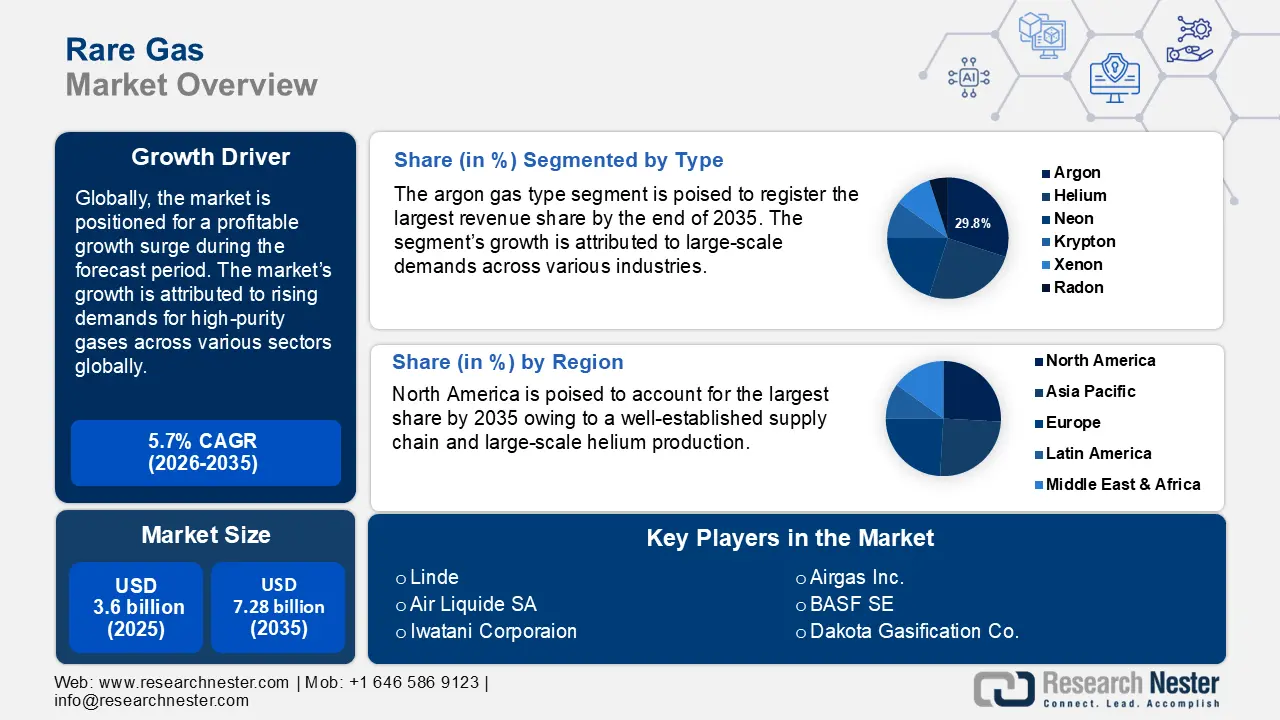

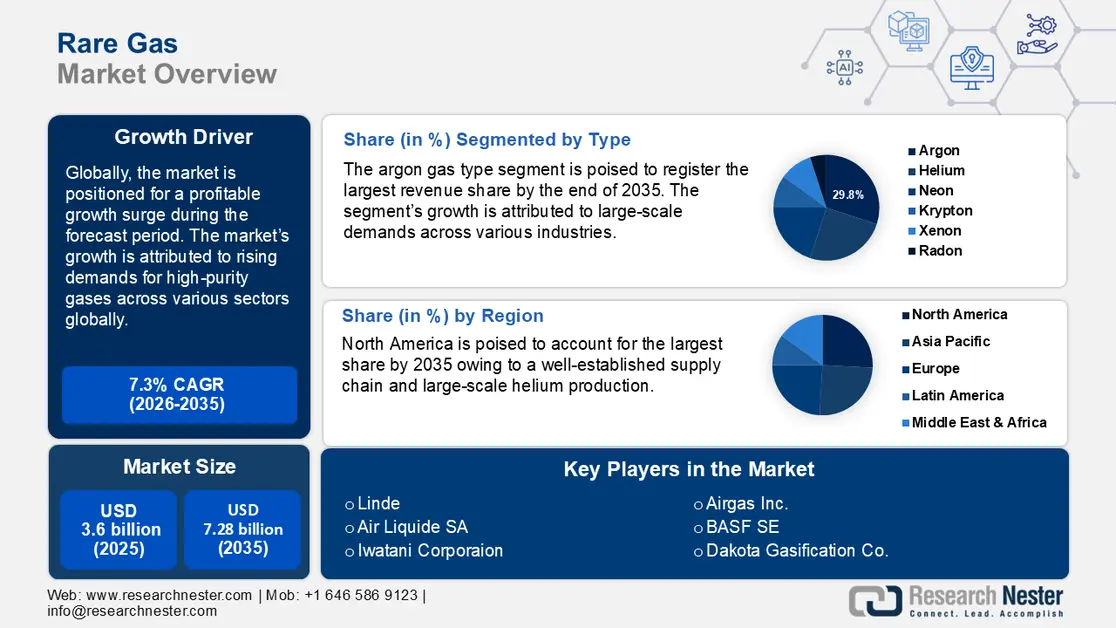

Rare Gas Market size was valued at USD 3.6 billion in 2025 and is likely to cross USD 7.28 billion by 2035, expanding at more than 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rare gas is assessed at USD 3.84 billion.

The rare gas market’s growth is attributed to the global growth of the semiconductor industry where rare gases are indispensable in the manufacturing process. For instance, in October 2024, the Semiconductor Industry Association announced global semiconductor sales to have increased by 20.6% from August 2023 to July 2024. The trends are positioned to benefit the rare gas market as demands are expected to surge. The unique chemical properties and scarcity of rare gases increase their value, positioning them as high-demand resources in cutting-edge sectors.

A major growth driver of the rare gas market is the advancements in healthcare and electronics. The rapid proliferation of consumer electronics increases demands for rare gases owing to their need in manufacturing. For instance, in November 2023, a research article in AIP Publishing highlights the expansion of laser discharge in xenon jet improves EUV-light emission. The advancements in the healthcare sector benefit the growth of the rare gas market. For instance, the reliance on medical imaging and diagnostics has increased the demand for helium and xenon in MRI machines and other imaging technologies. For instance, in February 2024, Siemens Healthineers introduces Magnetom Flow, or magnetic resonance imaging with a closed helium circuit and no quench pipe. Helium’s role as a cooling agent in superconducting magnets and xenon’s use in anesthesia creates a steady demand boosting the sector’s growth.

The global rare gas markets present significant opportunities for emerging industries. The consumer shift towards electric vehicles (EVs) and growth is driving demands for krypton and xenon to be used in the manufacturing of insulation applications and specialty lighting. Further advancements in aerospace and space explorations are positioned to open new applications for neon and helium. For instance, in September 2022, NASA selected three companies (Air Products and Chemicals Inc., Messer LLC, Linde Inc.) to supply 1.4 million liters of liquid helium and 87.7 million standard cubic feet of gaseous helium for use at facilities across the agency. The trends are beneficial for the growth of the rare gas market as companies are positioned to benefit from rising demands for rare gases across various sectors. As the market leverages the growth drivers, the profit curve is poised to witness steady growth by the end of the forecast period.

Key Rare Gas Market Insights Summary:

Regional Insights:

• By 2035, the North America rare gas market is anticipated to command a substantial share during 2026–2035, underpinned by robust production and distribution networks across the region.

• By 2035, the Asia Pacific region is projected to witness the fastest revenue expansion, bolstered by rapid semiconductor manufacturing and electronics production growth.Segment Insights:

- By 2035, the argon segment is expected to hold around 29.8% share in the rare gas market across 2026–2035, stimulated by its extensive use in manufacturing, healthcare, and electronics.

- By 2035, the electronics and semiconductors segment is set to retain the largest revenue share, reinforced by the essential role of rare gases in semiconductor and electronics fabrication.

Key Growth Trends:

- Advances in additive manufacturing

- Rising adoption of advanced imaging in healthcare

Major Challenges:

- High costs of production and extraction

- Geopolitical tensions leading to supply chain vulnerabilities

Key Players: Linde, Air Liquide SA, Air Products & Chemicals, BASF SE, Dakota Gasification Co., Matheson & Air Products, Airgas Inc., American Gas Products, Iwatani Corporation.

Global Rare Gas Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 billion

- 2026 Market Size: USD 3.84 billion

- Projected Market Size: USD 7.28 billion by 2035

- Growth Forecasts: 7.3%

Key Regional Dynamics:

- Largest Region: North America (Substantial Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 2 December, 2025

Rare Gas Market - Growth Drivers and Challenges

Growth Drivers

- Advances in additive manufacturing: The advances in additive manufacturing or 3D printing are a significant growth driver. Rare gases such as argon and nitrogen are used as shielding gases in the 3D printing of metal parts, preventing oxidation and ensuring the production of high-quality metal components. For instance, in October 2024, TriMech announced a partnership with One Click Metal to bring user-friendly metal 3D printing to cater to businesses in North America and the Bold series uses the inert gas supply of nitrogen or argon.

The increasing adoption of 3D printing in various industries such as healthcare, and automation is boosting the demand for rare gases. For instance, in May 2024, BMW Group announced the expansion in the use of 3D-printed, customized robot grippers. Additionally, rare gas suppliers are poised to benefit due to long-term opportunities in the 3D printing industry. - Rising adoption of advanced imaging in healthcare: The surge of advanced imaging in the healthcare sector fuels demands for rare gases such as xenon and helium. The application of xenon in anesthesia and helium as a cryogenic cooling agent in MRI is positioned to create a steady demand for suppliers. The surging demand for liquid helium has pushed producers to increase production benefiting the global rare gas market. For instance, in August 2024, Renergen announced the start of commercial production of liquid helium at its production plant in South Africa.

The healthcare sector’s reliance on neuroimaging and MRI is growing, and the surge is correlated with an increase in demand for rare gases. As the diagnostic imaging sector in healthcare experiences a profit surge, the requirement for high-purity rare gases will increase. - Expansion of semiconductor and electronics manufacturing: The surge in the growth of semiconductors and electronics manufacturing benefits the global rare gas market by creating a sustained demand. Rare gases such as neon and argon are vital in lithography systems and etching. The global trends indicate semiconductor nodes to have become smaller and more precise, boosting demands for pure-rare gases. Additionally, surging demands for the use of neon gas in excimer laser for photolithography to create microchip patterns create a stable demand for rare gases. For instance, in December 2023, EFC Gases and Advanced Materials launched a neon gas recycling system qualified by Cymer for use with its excimer lasers.

Challenges

- High costs of production and extraction: The separation of rare gases is an energy-intensive and specialized process. This can lead to high costs in production. An increase in capital and operation costs in production can increase prices. Higher costs can also make it difficult for industries to build an affordable supply chain. Environmental concerns about greenhouse gas emissions during the extraction and purification of rare gases can affect the market’s growth. Rare gas producers can face stringent environmental regulations to comply with emission standards, which can drive operations costs.

- Geopolitical tensions leading to supply chain vulnerabilities: Geopolitical tensions can disrupt global supply chains, driving prices up and stifling growth of the global rare gas market. Companies reliant on rare gases must contend with geopolitical issues and find alternative supply chains in such scenarios.

Rare Gas Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 3.6 billion |

|

Forecast Year Market Size (2035) |

USD 7.28 billion |

|

Regional Scope |

|

Rare Gas Market Segmentation:

Type (Argon, Helium, Neon, Krypton, Xenon, Radon)

By type, argon segment is projected to dominate around 29.8% rare gas market share by the end of 2035. The segment’s growth is attributed to its wide-scale use across various industries such as manufacturing, healthcare, and electronics. The demand for argon is surging in the welding and casting industries, in the manufacture of titanium and specialty alloys. The use of argon as a primary inert shielding gas in welding and as a base for specialized mixes drives its demand. Additionally, increasing research on the efficacy of argon is positioned to lead to greater adoption in applications by the end of the forecast period. For instance, in December 2023, a research paper published in the Multidisciplinary Digital Publishing Institute highlighted that treatment with argon plasma removed carbon contaminants and improved the surface energy of the material.

The helium gas segment of the rare gas market is poised to increase its revenue share by the end of the forecast period. The sector’s growth is attributed to increasing demands from the aerospace and healthcare sectors. Additionally, the segment’s demand is driven by its use in the Large Hadron Collider which requires superfluid helium to operate. For instance, in July 2024, CERN announced four new helium tanks that will supply the new High-Luminosity LHC refrigerators. By the end of the forecast period, the segment is positioned to leverage the growth of quantum computing to increase its revenue share. For instance, in December 2023, Alice & Bob announced a tape out of a new helium 1 16-Qubit quantum processing unit.

End use Industry (Electronics and Semiconductors, Healthcare, Lighting, Manufacturing and Fabrication, Energy and Power, Aerospace and Aviation, Research Institutions)

By end use industry, the electronics and semiconductors to hold the largest revenue share by 2035 and is poised to increase its revenue share in the rare gas market by the end of the forecast period. The segment’s growth is owed to rare gases being indispensable to the manufacturing process of semiconductors and electronics. For instance, xenon is indispensable for the manufacturing of semiconductors and memory chips. With a surging demand for electronics in emerging fields like artificial intelligence, 5G, and IoT, the electronics and semiconductors segment is positioned to continue its robust growth. For instance, in June 2023, a joint research team from the Korea Institute of Machinery and Materials developed a large-scale 4-inch plasma etching technology for the mass production of next-generation two-dimensional semiconductors.

Our in-depth analysis of the rare gas market includes the following segments:

|

Type |

|

|

End use Industry |

|

|

Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rare Gas Market - Regional Analysis

North America Market Forecast

By the end of 2035, North America rare gas market is projected to account for substantial revenue share. The market’s growth is attributed to robust production and distribution networks in the region. The U.S. and Canada lead the revenue share in North America. Additionally, the aerospace sector in the region is driving demands for rare gases. The market in North America is poised to leverage the large-scale commercial helium production in the region to increase its revenue share by the end of 2035. For instance, in April 2024, Pulsar Helium Inc., announced a major helium discovery in North America.

The U.S. is poised to register the largest revenue share in the rare gas market. The market’s growth is owed to the leading position of the country in commercial helium production globally. For instance, the Observatory of Economic Complexity estimated the U.S. to rank fourth globally in helium exports valued at USD 5.2 million. The market is positioned to benefit from large-scale production of helium in the country. Riley Ridge, Panhandle West, Cliffside, Panoma, and Hugoton are the major fields from where helium is extracted in the country and contain an estimated 3.9 billion cubic meters of helium. The large production allows ease of supply to industries such as defense, and healthcare. The rare gas sector is positioned to increase its revenue share by the end of the forecast period by leveraging the rising demands of rare gases domestically and for export. In September 2024, Desert Mountain Energy Corporation announced the separation of commercial volumes of helium from a complex natural gas stream.

The rare gas market in Canada is projected to increase its revenue share during the forecast period. The market’s growth is owed to Canada establishing itself as an emerging helium supplier. The emergence of the country in helium production boosts the supply chains globally and in North America. The United States Geological Survey positions Canada to account for the fifth-largest helium share in the world. In November 2023, Helium Evolution and its partner, North American Helium, confirmed the first joint helium discovery in Saskatchewan.

APAC Market Analysis

The Asia Pacific rare gas market is projected to register the fastest revenue growth during the forecast period. The sector’s growth is attributed to rapid growth in semiconductor manufacturing and electronics production. The revenue growth is led by China, Japan, South Korea, and India. Government-backed initiatives promoting self-sufficiency in supply chains are poised to benefit the APAC market. Additionally, rapid urbanization in the region has fueled extensive construction activities that drive demand for argon in welding applications and steel manufacturing. For instance, in January 2024, SeAH Changwon Special Steel ordered the second ABB stirring technology for a steel plant in South Korea that is expected to boost production.

China holds the largest share in the rare gas market of Asia Pacific. The sector’s profitable growth curve in the country is attributed to its position as a top importer and exporter of rare gases other than argon globally. For instance, the Observatory of Economic Complexity estimated China to rank second globally in both imports and exports of rare gases other than argon in 2022. For instance, China accounted for USD 757 million worth of exports and USD 656 million worth of imports in 2022. The robust import and export curve in the country opens opportunities for rare gas suppliers. For instance, in September 2024, Wärtsilä Corporation announced that they would supply the cargo handling and fuel gas supply system for four new medium-sized gas carrier (MGC) vessels.

South Korea is projected to register the fastest increase in revenue share in the APAC market. The market’s growth is owed to the country’s emergence as a major player in import and export of rare gases. For instance, the Observatory of Economic Complexity estimated South Korea to be the fourth largest exporter of rare gases in 2022, accounting for USD 241 million while the country was the largest importer of rare gases in the same year, at an estimated import of USD 821 million. The large-scale imports in the country is owed to surging demands from the domestic semiconductor industry. The market is poised to continue its growth surge by leveraging increasing investments on rare gas production domestically. For instance, in April 2024, Air Liquide announced new state-of-the-art krypton and xenon plant in South Korea to cater to demands in the semiconductor and space industries.

Rare Gas Market Players:

- Linde

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide SA

- Air Products & Chemicals

- BASF SE

- Dakota Gasification Co.

- Matheson & Air Products

- Airgas Inc.

- American Gas Products

The global rare gas market is positioned for a profitable growth curve during the forecast period. Key market players are investing to improve supply chains to cater to rising demands across various industries.

Here are some key players in the rare gas market:

Recent Developments

- In May 2024, Airbus launched a new technological demonstrator to accelerate the maturation of superconducting technologies for use in electric propulsion systems of a future hydrogen-powered aircraft. The new demonstrator is named Cryoprop.

- In December 2022, Linde Engineering announced a major upgrade for CERN’s Large Hadron Collider. The Linde Krytotechnik subsidiary signed a contract with the CERN laboratory in Switzerland to supply two identical helium cryogenic refrigeration systems.

- Report ID: 6662

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rare Gas Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.