Railway Lubricants Market Outlook:

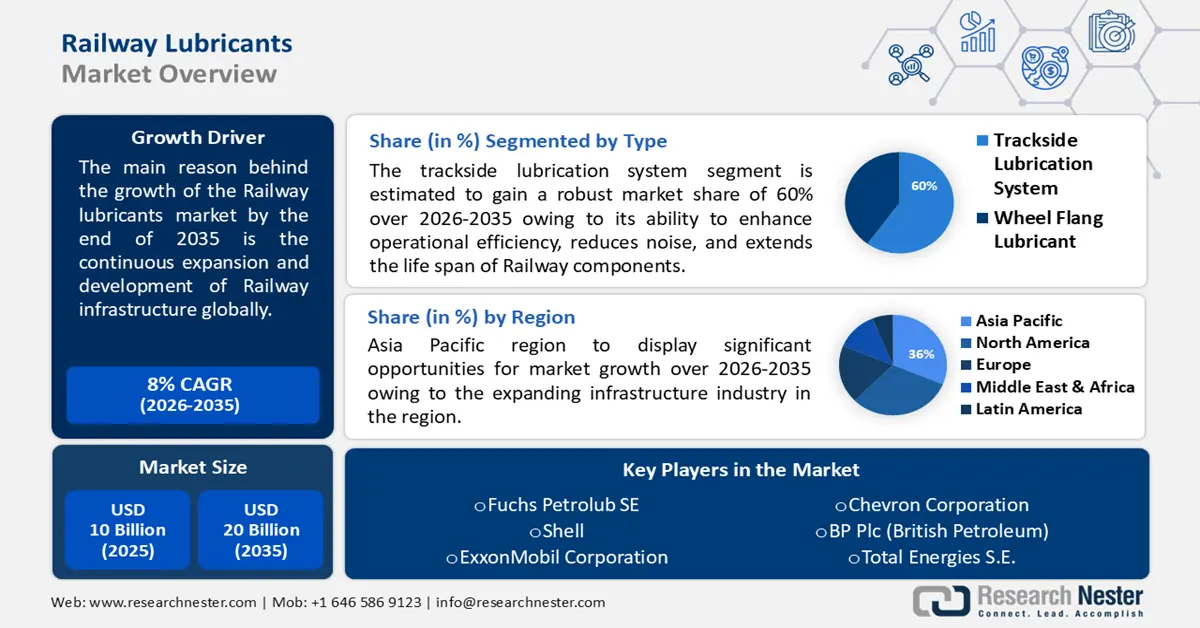

Railway Lubricants Market size was valued at USD 4 billion in 2025 and is expected to reach USD 5.53 billion by 2035, expanding at around 3.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of railway lubricants is evaluated at USD 4.12 billion.

The pivotal driver propelling the growth of the market is the continuous expansion and development of railway infrastructure globally.

As nations invest significantly in enhancing their rail networks, the demand for efficient and sustainable railway lubricants has surged. The expansion of railway infrastructure not only includes the establishment of new rail lines but also the modernization and upgrading of existing ones. A notable example illustrating this growth driver is the substantial investment in railway projects in emerging economies. For instance, according to a report, China unveiled a massive plan to invest USD 1. trillion in its infrastructure sector.

The expansion of railway infrastructure brings forth a cascading effect on the railway lubricants market. Longer rail tracks and increased train frequencies necessitate superior lubrication solutions to minimize friction, wear, and maintenance costs. As a result, manufacturers in the railway lubricants sector are poised to benefit from this sustained trend of railway infrastructure expansion. Railway infrastructure expansion is driven by the need for efficient and sustainable transportation solutions to address the growing demands of urbanization and population growth. Governments and private entities are increasingly recognizing the benefits of robust railway networks, including reduced traffic congestion, lower carbon emissions, and enhanced connectivity.

Key Railway Lubricants Market Insights Summary:

Regional Highlights:

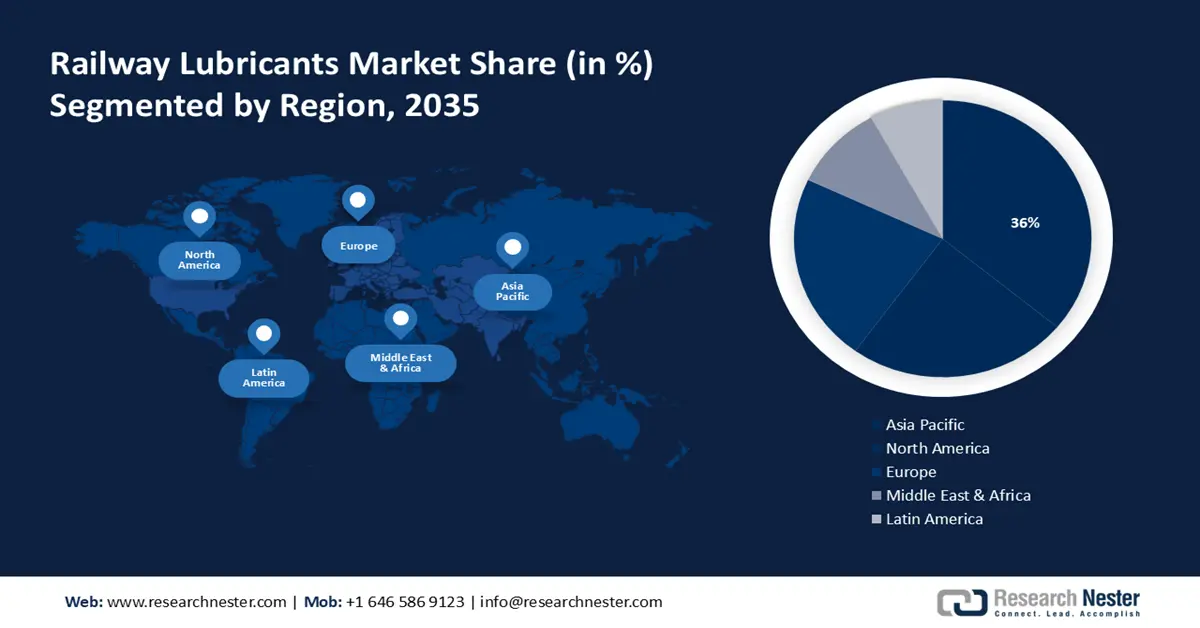

- Asia Pacific railway lubricants market is expected to capture 36% share by 2035, attributed to the rise of long-lasting and high-performance lubricants, along with ongoing technological advancements in rail lubrication.

- North America market will secure the second largest share by 2035, driven by the expansive nature of freight transport and the adoption of smart lubrication systems.

Segment Insights:

- The trackside lubrication system segment in the railway lubricants market is anticipated to hold a 60% share by 2035, fueled by regulatory rail safety standards and improved operational efficiency.

- The passenger rail segment in the railway lubricants market is expected to hold a significant share by 2035, driven by government incentives promoting sustainable transportation through rail.

Key Growth Trends:

- Increasing urbanization and population growth

- Rail freight transportation demand

Major Challenges:

- Increasing urbanization and population growth

- Rail freight transportation demand

Key Players: Fuchs Petrolub SE, Shell, ExxonMobil Corporation, Chevron Corporation, BP plc (British Petroleum), TotalEnergies SE.

Global Railway Lubricants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4 billion

- 2026 Market Size: USD 4.12 billion

- Projected Market Size: USD 5.53 billion by 2035

- Growth Forecasts: 3.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 16 September, 2025

Railway Lubricants Market Growth Drivers and Challenges:

Growth Drivers

- Increasing urbanization and population growth - The relentless pace of urbanization and the parallel growth in global population have emerged as pivotal drivers for the railway lubricants market. As urban centers expand, the demand for efficient and sustainable transportation solutions intensify. Rail transport, being a key component of urban transit systems, witnesses heightened usage and, consequently, an increased need for effective lubrication.

In 2020, the United Nations reported that approximately 55% of the world's population resided in urban areas, a figure projected to reach 68% by 2050. The surge in urbanization brings forth a surge in demand for public transportation, with railways being a preferred choice due to their capacity and eco-friendliness. - Rail freight transportation demand - The growth of the rail freight transportation sector serves as a key driver for the market. Rail transport is a vital component of the global logistics and supply chain network, offering a cost-effective and efficient solution for the movement of goods over long distances.

With the expanding e-commerce industry and increasing demand for seamless logistics, the rail freight transportation sector experiences a surge in activity. As more goods are transported by rail, the wear and tear on rail components intensify, necessitating effective lubrication solutions to ensure the smooth and reliable operation of freight trains. Railway lubricants play a crucial role in reducing friction between the wheel and rail in heavy-load scenarios, minimizing wear on both components. - Market competitiveness and product portfolio expansion: The competitive landscape of the railway lubricants market, marked by the presence of key players, influences market dynamics and growth. Companies within the sector are driven to innovate and expand their product portfolios to gain a competitive edge and address the evolving needs of the rail industry.

Market competitiveness prompts manufacturers to develop specialized lubricants catering to diverse applications within the rail sector. Whether it be high-speed passenger trains or heavy-duty freight locomotives, the demand for tailor-made lubrication solutions propels research and development initiatives.

Challenges

- Environmental concerns and regulatory compliance - One of the significant challenges confronting the railway lubricants market is the increasing scrutiny of environmental practices and the need to comply with stringent regulations. Traditional lubricants often contain substances that can be harmful to the environment. As a result, the industry is under pressure to develop and adopt more environmentally friendly formulations.

Regulatory frameworks, such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the European Union, require compliance with specific standards to minimize the impact of lubricants on ecosystems. Achieving this balance between performance and environmental responsibility poses a challenge for manufacturers in the railway lubricants sector. - Technological Adaptation and Implementation

- Market Fragmentation and Intense Competition

Railway Lubricants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.3% |

|

Base Year Market Size (2025) |

USD 4 billion |

|

Forecast Year Market Size (2035) |

USD 5.53 billion |

|

Regional Scope |

|

Railway Lubricants Market Segmentation:

Type Segment Analysis

In railway lubricants market, trackside lubrication system segment is likely to dominate around 60% share by the end of 2035. Regulatory bodies worldwide emphasize rail safety as a critical aspect of transportation infrastructure. The implementation of trackside lubrication systems aligns with these safety standards by minimizing wear and reducing the risk of derailments, contributing to the overall safety and reliability of rail networks.

The Federal Railroad Administration (FRA) in the United States emphasizes the importance of friction management programs, including the use of lubrication systems, as a means to enhance rail safety and prevent accidents. The growth of the trackside lubrication system segment is driven by its ability to enhance operational efficiency, extend the lifespan of rail components, reduce noise, cater to increasing rail traffic, enable preventive maintenance, and align with regulatory safety standards.

End User Segment Analysis

The passenger rail segment in the railway lubricants market is expected to garner a significant share in the year 2035. Government initiatives to promote rail usage through subsidies, incentives, and public awareness campaigns are crucial drivers for the growth of the passenger rail segment. Such initiatives aim to shift preferences towards sustainable transportation options and reduce the reliance on individual car travel.

The European Union's push for sustainable mobility includes significant investments in rail infrastructure and initiatives to increase rail usage. In 2020, the EU committed USD 75 billion to its Green Deal, with a focus on sustainable transportation, including rail. The growth of the passenger rail segment is further propelled by factors such as population growth, government investments in high-speed rail, sustainability considerations, addressing congestion concerns, technological advancements, and supportive government initiatives.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Railway Lubricants Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 36% by 2035. The rise of long-lasting and high-performance lubricants, along with other ongoing technological advancements in rail lubrication, is propelling the market for railway lubricants. Rail operations in the Asia-Pacific region are more reliable and efficient when sophisticated formulas and intelligent lubrication systems are integrated.

Innovations in lubricants based on nanotechnology and intelligent lubrication systems are the result of research and development efforts of top lubricant producers. In the market for railway lubricants, these developments add to the general evolution of technology. Governments in the Asia Pacific are pushing more environmentally friendly and sustainable forms of transportation as a means of addressing environmental sustainability.

This focus is matched by rail travel, which is by nature more environmentally beneficial than other modes. As environmental consciousness and regulatory demands increase, lubricants with eco-friendly compositions are becoming more and more popular. The Asia Pacific region's market is expanding due to reasons such increasing urbanization, emphasis on environmentally friendly transportation, and continuous technological development.

North American Market Insights

The railway lubricants market in the North America region is projected to hold the second largest share during the forecast period. The expansive nature of freight transport in North America is a significant driver for the market. As a crucial component of the transportation and logistics network, freight railroads require effective lubrication solutions to maintain the reliability and longevity of their extensive rail networks. The Association of American Railroads (AAR) reports that, in 2020, North American freight railroads transported over 23 million carloads of goods. This highlights the immense scale of freight operations, emphasizing the demand for robust railway lubricants. While high-speed rail projects are more prominent in other regions, there is a growing focus on modernizing rail infrastructure in North America. Initiatives to improve rail speed, reduce travel times, and enhance overall efficiency contribute to the demand for advanced railway lubricants. North America is at the forefront of adopting technological innovations in rail lubrication. The integration of smart lubrication systems, which use sensors and data analytics to optimize lubrication processes, is gaining traction to enhance efficiency and reduce maintenance costs.

Railway Lubricants Market Players:

- Fuchs Petrolub SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shell

- ExxonMobil Corporation

- Chevron Corporation

- BP plc (British Petroleum)

- TotalEnergies SE

- Quaker Houghton

- Klüber Lubrication

- SKF Group

- Whitmore Manufacturing Company

Recent Developments

- ExxonMobil reported record annual earnings of USD 96 billion in 2023, surpassing analysts' expectations and marking a significant comeback from previous years' losses. This is driven by soaring energy prices due to the ongoing global energy crisis.

- ExxonMobil continues to face criticism for its perceived sluggishness in transitioning towards renewable energy sources and adhering to stricter climate change regulations. Recent shareholder proposals and activist investor pressure emphasize the growing demand for more aggressive action on climate change, potentially shaping the company's future direction.

- Report ID: 5541

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Railway Lubricants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.