Radiotheranostics Market Outlook:

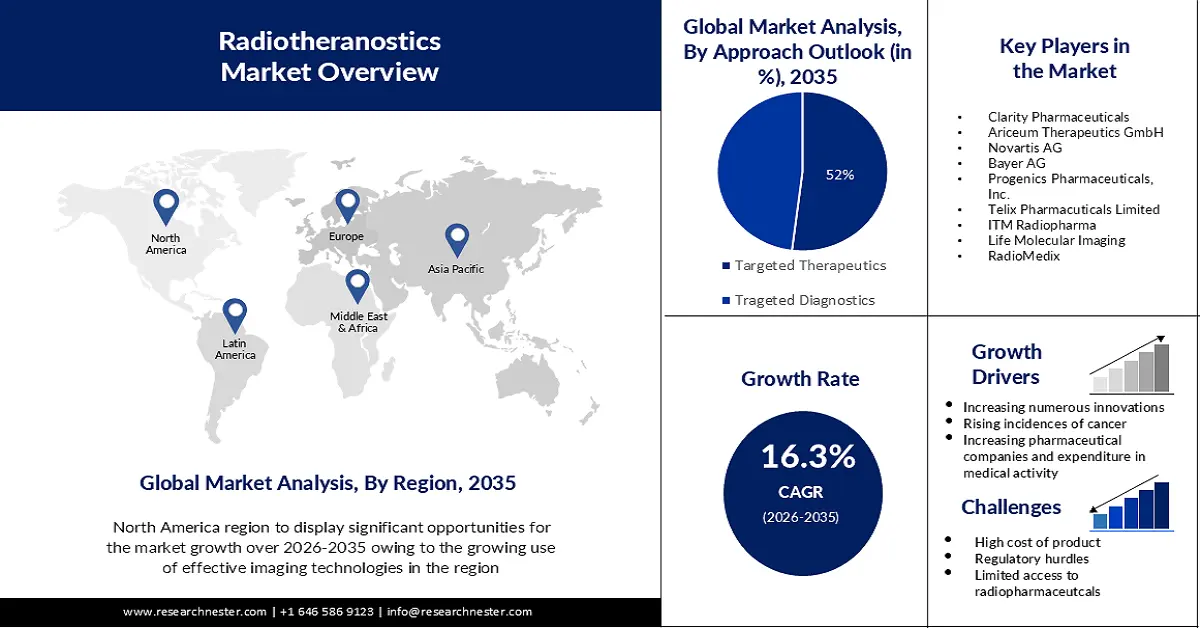

Radiotheranostics Market size was valued at USD 6.78 billion in 2025 and is expected to reach USD 30.69 billion by 2035, registering around 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radiotheranostics is evaluated at USD 7.77 billion.

One major factor driving market expansion is the growing trend of personalized medicines in the management of cancer. The idea of individualized medicine in cancer treatment has also been influenced by developments in diagnostics, treatment options, and our understanding of cancer biology. The most recent estimates, there has been an over 75,000 genetic testing kits and 300 tailored medications are available for use by patients with various chronic and infectious diseases, uncommon genetic diseases, and malignancies.

Additionally, there will probably be new market opportunities due to pharmaceutical companies' increased efforts to produce novel radiotheranostics with longer half-lives and improved treatment outcomes. For example, ITM reported in April 2022 that patient recruitment for their phase III study, COMPETE, with its primary candidate, targeted radionuclide therapy, ITM-11, had been successfully completed. Additionally, Pluvicto (Lu177), which Novartis announced was approved by the FDA in March 2022, can be used to treat adult patients with specific types of metastatic tumors.

Key Radiotheranostics Market Insights Summary:

Regional Highlights:

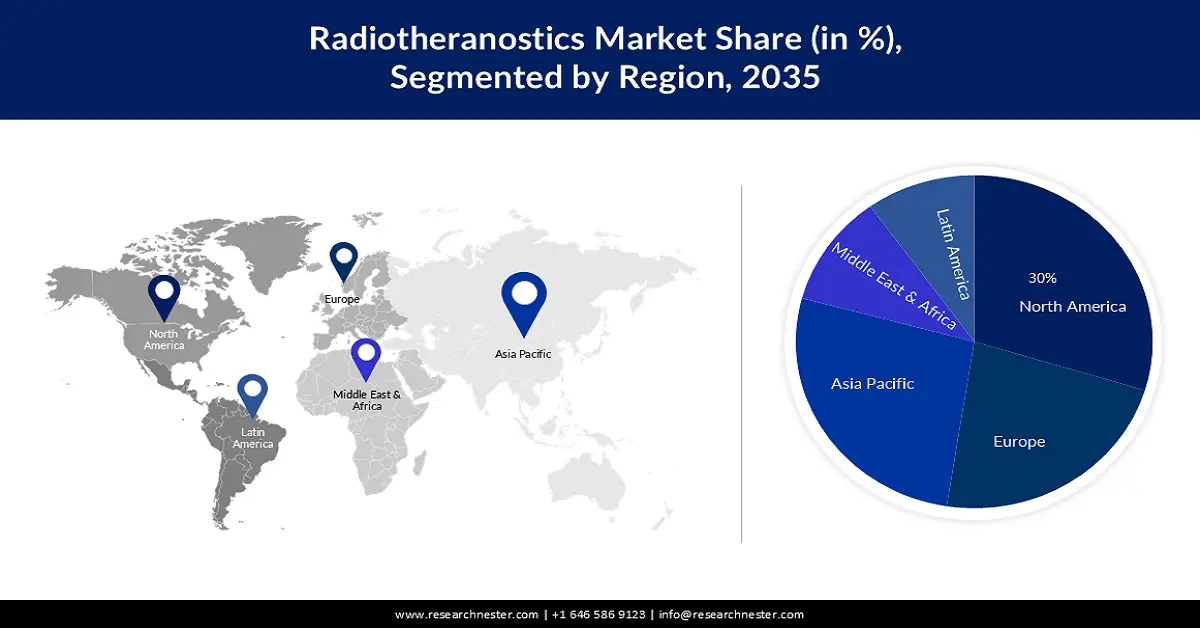

- North America’s radiotheranostics market will secure over 30% share by 2035, driven by increasing use of imaging technologies, precision medicine trends, and investments in cancer research.

- Asia Pacific’s market will attain a 27% share by 2035, attributed to high cancer prevalence and rising investments in nuclear medicine in the region.

Segment Insights:

- The targeted therapeutic segment in the radiotheranostics market is projected to hold a 52% share by 2035, fueled by radiopharmaceuticals delivering targeted radiation to cancer cells.

- The lutetium-177 segment in the radiotheranostics market is projected to hold a 30% share by 2035, driven by the increasing availability and uptake of Lu-177 due to its longer half-life and recent product approvals.

Key Growth Trends:

- The Rising Incidence of Cancer

- Numerous Innovations in Technology

Major Challenges:

- High Cost of Implementation

Key Players: Clarity Pharmaceuticals, Ariceum Therapeutics GmbH, Novartis AG, Bayer AG, Progenics Pharmaceuticals, Inc., Telix Pharmacuticals Limited, ITM Radiopharma.

Global Radiotheranostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.78 billion

- 2026 Market Size: USD 7.77 billion

- Projected Market Size: USD 30.69 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Radiotheranostics Market Growth Drivers and Challenges:

Growth Drivers

- The Rising Incidence of Cancer- The rising incidence of cancer is driving up demand for radiotheranostics in the healthcare industry, which is driving market expansion. Offering diagnostic and therapeutic skills, enabling accurate cancer cell imaging, and facilitating targeted therapy which improves treatment outcomes and is another important growth-inducing factor are critical to the management of cancer. In 2020, there were projected to be 18.1 million cases of cancer worldwide. Men accounted for 9.3 million of these instances, while women made for 8.8 million. In addition, the capacity of radiopharmaceuticals to precisely identify cancer aids in the selection of the best course of treatment for specific patients, thereby propelling the market's expansion. Additionally, radio theranostics helps track the effectiveness of treatments and evaluates the course of diseases, which drives market expansion.

- Numerous Innovations in Technology- Another important factor that promotes growth is the development of high-resolution imaging modalities like single-photon emission computed tomography (SPECT) and positron emission tomography (PET), which offer detailed anatomical and functional information and enable accurate localization and characterization of cancerous lesions. The quality and specificity of imaging in radiotheranostics are also being further improved by the integration of sophisticated detectors, image reconstruction algorithms, and hybrid imaging systems, which is driving the market's growth. In addition, novel radiotracers with enhanced pharmacokinetic characteristics and target specificity are being developed, which will boost market growth by enabling better molecular target visualization as well as more precise disease staging and diagnosis. In addition, improvements in production methods and radiolabelling techniques resulted in increased accessibility and availability of a wide range of radiopharmaceuticals, which in turn drove market expansion.

- Advantageous Policies of the Government- Adoption and advancement of radiotheranostics depend on supportive government policy. Furthermore, governments everywhere are seeing how much better patient care can be achieved using radiotheranostics, and they are putting supportive legislation in place to help it flourish. Additionally, the market is growing due to the creation of reimbursement frameworks for radiotheranostic treatments, which cover therapeutic interventions employing radiopharmaceuticals and diagnostic imaging. Patients will face fewer financial obstacles as a result, and radiotheranostics will be more widely used in therapeutic settings. Regulatory bodies have also expedited imaging equipment and the approval process.

Challenges

- High Cost of Implementation - Both patients and healthcare providers may face difficulties due to the high expense of radiopharmaceuticals and radiotheranostics procedures. To guarantee more adoption and market expansion, these technologies' affordability and cost-effectiveness must be addressed.

- There can be regional differences in the accessibility and availability of radiotheranostics equipment and facilities. The broad implementation and application of radiotheranostics may be impeded by inadequate infrastructure and resources in specific regions.

- In certain situations, reimbursement policies and coverage for radiopharmaceuticals and radiotheranostics operations may be restricted. This may put patients and healthcare providers at a financial disadvantage, which will hinder the uptake and application of radiotheranostics.

Radiotheranostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 6.78 billion |

|

Forecast Year Market Size (2035) |

USD 30.69 billion |

|

Regional Scope |

|

Radiotheranostics Market Segmentation:

Approach Outlook Segment Analysis

The targeted therapeutic segment in the radiotheranostics market is anticipated to hold largest revenue share of about 52% during the forecast period. Utilizing radiopharmaceuticals for targeted therapy is part of the targeted therapeutic approach in the radiotheranostics sector. The market expansion is influenced by the fact that these radiopharmaceuticals are made to target and deliver radiation to certain disease targets or cancer cells within the body. Roughly 10 million deaths, or roughly one in six deaths, globally will be attributable to cancer in 2020. Additionally, by combining a therapeutic radioactive ingredient with a targeting molecule, like peptides or antibodies, radiopharmaceuticals can bind to tumor cells specifically and deliver a therapeutic dose of radiation to kill or stop the growth of cancer cells, which is what is driving the segment’s expansion in the market.

Radioisotopes Segment Analysis

The lutetium-177 segment is expected to hold 30% share of the global radiotheranostics market during the forecast period. The market's increasing LU-177 product availability and uptake is fuelling the Lutetium-177 segment's rise. Furthermore, compared to other therapeutic isotopes, Lu-177 has a longer half-life, allowing for a longer course of treatment and possibly better patient outcomes. For example, L-177 has a physical half-life of 6.7 days, according to Springer. Additionally, new product releases and recent product approvals have accelerated the segment's growth. For example, in December 2022, the European Commission approved Novartis's Pluvicto-targeted radioligand therapy for the treatment of prostate cancer.

Our in-depth analysis of the global radiotheranostics market includes the following segments:

|

Radioisotopes |

|

|

Approach Outlook |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radiotheranostics Market Regional Analysis:

North American Market Insights

The radiotheranostics market in the North America region is projected to account for 30% of the revenue share during the forecast period. The North America radiotheranostics market is being driven by the increasing use of effective imaging technologies, a growing trend toward precision medicine, and a strong need for therapeutic radiopharmaceuticals. Growing national investments to facilitate a precision medicine approach are anticipated to propel the regional growth in the market Similarly, the Consolidated Appropriations Act, of 2022 awarded USD 6.9 billion to the National Cancer Institute (NIC) based on data from March 2022. This represents a USD 353 million net increase over FY 2021. The FY 2022 budget includes USD 50 million for the Childhood Cancer Data Initiative and USD 194 million for the Cancer Moonshot. Furthermore, a multitude of industry participants and their diverse strategic endeavors are propelling the sector in the area. For example, Ratio Therapeutics Inc. stated in March 2023 that it had licensed a targeted drug from Merck that was utilized in PET imaging.

APAC Market Insights

The radiotheranostics market in the Asia Pacific region is attributed to hold the second largest revenue share of about 27% during the forecast period. The primary drivers of regional market growth are the high cancer prevalence in the area and rising investments in nuclear medicine. As an example, Global Medical Solutions, Ltd. and BWXT Medical Ltd. announced in March 2021 that they would be collaborating to manufacture and provide radiopharmaceuticals and radioisotopes throughout the Asia-Pacific area. The market acceptance in APAC is also being accelerated by a rise in nuclear imaging procedures in the area.

Radiotheranostics Market Players:

- TransCode Therapeutics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clarity Pharmaceuticals

- Ariceum Therapeutics GmbH

- Novartis AG

- Bayer AG

- Progenics Pharmaceuticals, Inc.

- Telix Pharmacuticals Limited

- ITM Radiopharma

- Life Molecular Imaging

- RadioMedix

- Hitachi, Ltd.

- Chiba University

- Shimadzu Corporation

- Canon Medical System Corporation

- Toshiba Corporation

Recent Developments

- TransCode Therapeutics, Inc. (NASDAQ: RNAZ), the RNA oncology company committed to defeating cancer using RNA therapeutics, is pleased to announce its execution of an option agreement giving TransCode the right to negotiate an exclusive, worldwide, royalty-bearing license related to a radiotheranostic technology disclosed in patent application PCT/US2021/057912 entitled THERAPEUTIC, RADIOLABLED NANOPARTICLES AND METHODS OF USE THEREOF. Invented by TransCode Co-Founder and CTO, Dr. Zdravka Medarova, and her colleagues at Massachusetts General Hospital, the technology represents another potential advancement in the diagnosis and treatment of cancer.

- Clarity Pharmaceuticals announced that the first patient in its phase1/2theranostic trial, which is testing 64Cu/67Cu SAR-bisPSMA theranostic product in people with metastatic castrate-restant prostate cancer, has been given a dose. The promising preclinical and clinical result so far support clarity’s investigation of the optimised SAR-bisPSMA product in additional oncology indications where the theranostic approach may be useful.

- Report ID: 5501

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radiotheranostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.