Radiopharmaceuticals Market Outlook:

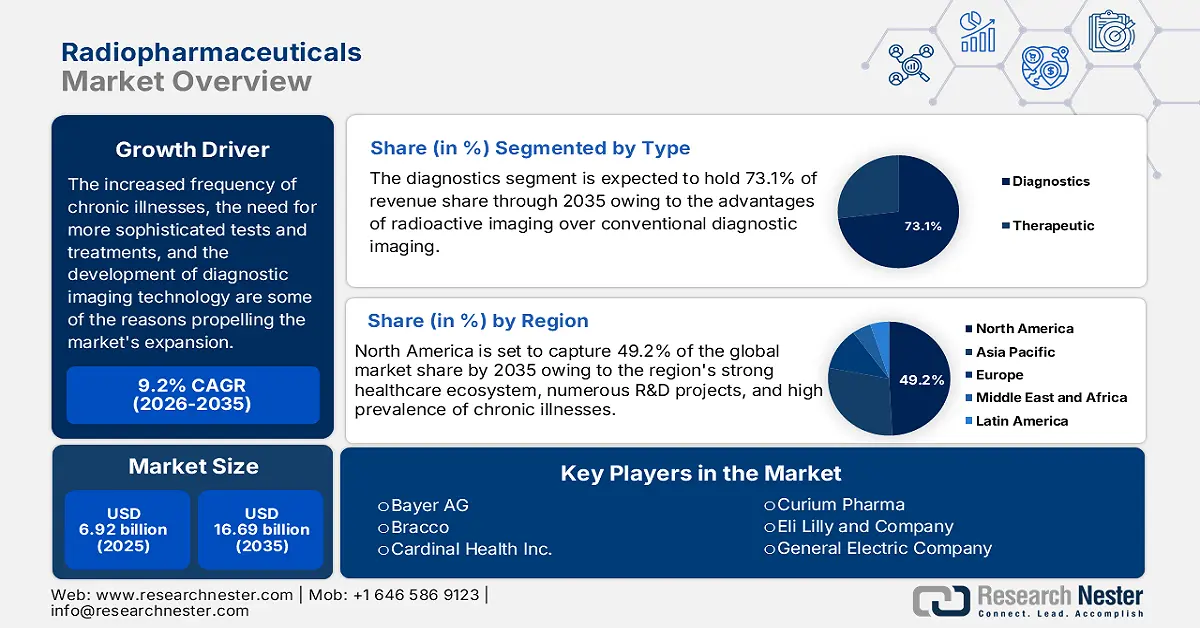

Radiopharmaceuticals Market size was over USD 6.92 billion in 2025 and is poised to exceed USD 16.69 billion by 2035, growing at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radiopharmaceuticals is estimated at USD 7.49 billion.

The increased frequency of chronic illnesses, the need for more sophisticated tests and treatments, and the development of diagnostic imaging technology are some of the reasons propelling the radiopharmaceuticals market's expansion. For instance, according to a World Health Organization (WHO) estimate, over 350 million of the 3.6 billion diagnostic tests performed globally each year involve pediatric patients.

Healthcare diagnostics have been completely transformed by developments in imaging modalities such as Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT). These technologies supplement conventional anatomical imaging techniques like CT and MRI with extensive functional and molecular information provided by radiopharmaceuticals. Market companies have improved diagnostic accuracy by developing novel radiotracers with higher specificity and sensitivity, which allows for earlier identification and more accurate characterization of chronic diseases. For example, in June 2023, GE Healthcare announced the release of the first exploratory PET nuclear imaging agent in history to assess and forecast responses to cancer immunotherapies. The recently created product makes use of 18F-CD8 in its diagnosis.

Key Radiopharmaceuticals Market Insights Summary:

Regional Highlights:

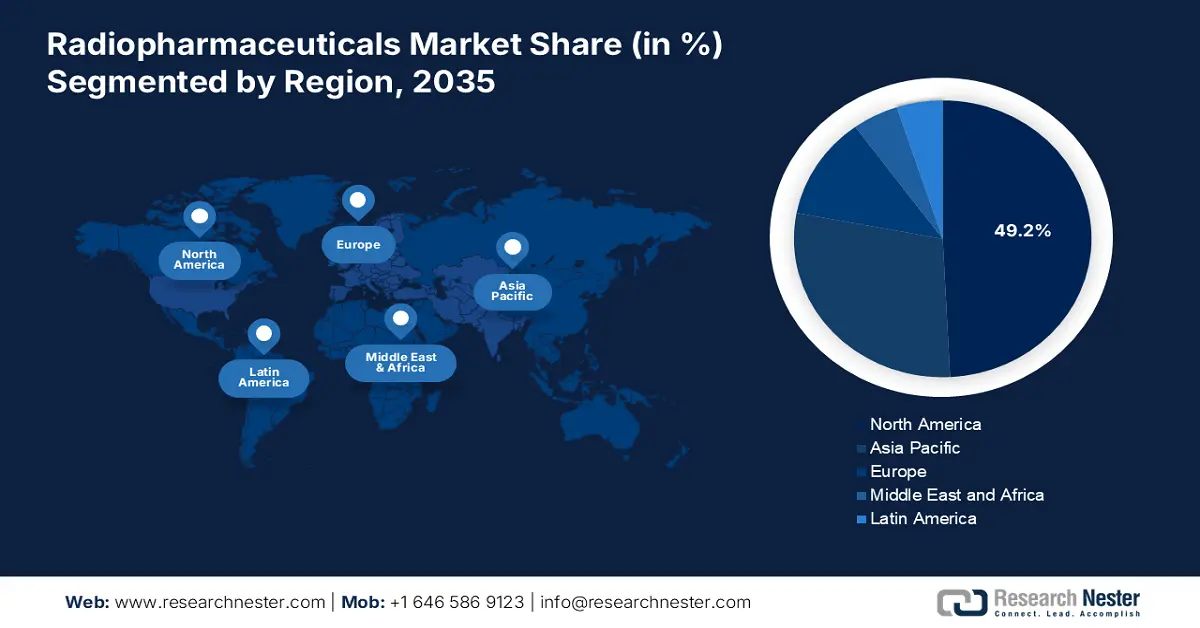

- North America leads the Radiopharmaceuticals Market with a 49.2% share, propelled by a strong healthcare ecosystem, R&D investments, and high prevalence of chronic illnesses, ensuring strong growth through 2035.

- Asia Pacific’s radiopharmaceuticals market is poised for stable growth through 2026–2035, fueled by improved healthcare infrastructure, access to advanced technology, and growing awareness of nuclear medicine.

Segment Insights:

- The Technetium 99m segment of the Radiopharmaceuticals Market is projected to see robust growth by 2035, propelled by its superior imaging properties and ability to form stable complexes.

- The Diagnostics segment is projected to hold over 73.1% market share by 2035, fueled by the growing preference for functional imaging using radioisotopes over conventional methods.

Key Growth Trends:

- Growing utilization of personalized medicine

- Growing need for neurological applications

Major Challenges:

- Many radiopharmaceuticals have short half-lives

- High cost of radiopharmaceutical development and use

- Key Players: Bayer AG, Bracco, Cardinal Health Inc., Coquà Radiopharmaceuticals Corp, Curium Pharma, Eli Lilly and Company, General Electric Company, IRE EliT, and Bristol Myers Squibb.

Global Radiopharmaceuticals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.92 billion

- 2026 Market Size: USD 7.49 billion

- Projected Market Size: USD 16.69 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Radiopharmaceuticals Market Growth Drivers and Challenges:

Growth Drivers

- Growing utilization of personalized medicine: One notable factor fueling the radiopharmaceuticals market for radiopharmaceuticals' explosive growth is personalized medicine. This innovative paradigm ushers in a revolutionary age in healthcare by customizing medical interventions to individual patients based on their unique genetic, molecular, and clinical profiles. In the field of radiopharmaceuticals, this methodology enables the development of highly accurate diagnostic and therapeutic products. By utilizing state-of-the-art imaging methods and creating radiopharmaceuticals that specifically attach to disease-specific biomarkers, medical practitioners can provide accurate diagnoses and closely monitor diseases like cancer, heart problems, and neurological disorders.

Additionally, the development of radiopharmaceutical-based therapies that are painstakingly designed to minimize side effects and efficiently combat diseases is fueled by personalized medicine. The process of matching patients to radiopharmaceuticals that are specifically tailored to their genetic makeup and characteristics of their disease not only improves treatment outcomes and safety but also drives radiopharmaceuticals market expansion by spurring research and development efforts to create new, highly specialized radiopharmaceuticals. - Growing need for neurological applications: The radiopharmaceuticals market is taking on a new shape owing to its widening neurological applications, which are painting a bright picture of exciting opportunities. Numerous factors that are changing the dynamics of demand for radiopharmaceuticals are driving this transformation. Above all, the increasing incidence of neurodegenerative diseases, such as Alzheimer's and Parkinson's, demands a change to accurate diagnosis, ongoing monitoring, and fundamental research. With their ability to shed light on the complexities of brain function and molecular diseases, radiopharmaceuticals have emerged as invaluable resources for both researchers and neurologists.

- Research & development investments: The development of radiopharmaceutical technologies depends critically on R&D investments. Large sums of money are invested by pharmaceutical corporations, educational institutions, and research groups in the search and development of novel radiotracers, improved imaging modalities, and creative therapeutic uses. For example, in April 2022, the clinical-stage radiopharmaceutical business Evergreen Theragnostics, Inc. revealed that it had raised USD 26.0 million through multiple investment rounds. The funds obtained will help the business explore and radiopharmaceuticals market its potential radiopharmaceutical product.

Challenges

- Many radiopharmaceuticals have short half-lives: The expansion of the radiopharmaceuticals market is significantly hampered by the relatively short half-lives of many of these drugs. These short half-lives, which are frequently expressed in minutes to hours, restrict the window of opportunity for these compounds' administration and synthesis. First of all, in terms of manufacture, it requires an extremely effective and streamlined manufacturing process since delays can result in significant radioactive decay, which can make the radiopharmaceutical less effective or ineffective. The need for accuracy and speed in manufacturing can lead to higher operating expenses and complexity.

- High cost of radiopharmaceutical development and use: Radiopharmaceuticals are essential to healthcare facilities as they ensure efficiency and safety in biotechnology and pharmaceutical businesses. They have certain drawbacks in addition to their great qualities. Technological improvements are projected to fuel growth in the radiopharmaceutical industry. However, given that radiopharmaceuticals are expensive to create and deploy and that the market may not be growing quickly, a number of barriers may stand in the way of the radiopharmaceuticals market reaching its full potential.

Radiopharmaceuticals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 6.92 billion |

|

Forecast Year Market Size (2035) |

USD 16.69 billion |

|

Regional Scope |

|

Radiopharmaceuticals Market Segmentation:

Type (Therapeutic, Diagnostics)

The diagnostics segment is set to hold over 73.1% radiopharmaceuticals market share by the end of 2035. In imaging modalities like SPECT and PET, radioisotopes including technetium-99m, iodine-131, and fluorine-18 are frequently utilized. These isotopes are added to radiopharmaceuticals, which are given to patients and subsequently monitored with specialist imaging apparatus. Furthermore, by 2032, it is anticipated that the advantages of radioactive imaging over conventional diagnostic imaging would contribute to the growth of the category. Utilizing radioisotopes for functional imaging, as opposed to conventional anatomical imaging techniques (like CT or MRI), which show structural information, discloses metabolic activity, cellular function, and biochemical activities within tissues.

Moreover, during the forecast period, a rising number of industrial advancements by radiopharmaceuticals market players such as alliances, joint ventures, and collaborations are anticipated to accelerate segment expansion. For example, Jubilant Radiopharma and Evergreen Theragnostics inked a strategic collaboration agreement in June 2023 so that the former would produce and market the latter's OCTEVY tumor diagnostic tool in the U.S.

Radioisotopes (Technetium 99m, Gallium 68, Iodine I, Fluorine 18, Copper 64, Radium 223, Zirconium 89, Other radioisotopes)

By the end of 2035, technetium 99m segment is expected to capture around 45% radiopharmaceuticals market share. Tc-99m has advantageous nuclear characteristics for imaging in medicine. With an energy level of 140 keV, the gamma rays it releases have exceptional penetration through tissue and can be detected by gamma cameras. This characteristic allows for high-resolution imaging while exposing patients and medical professionals to the least amount of radiation. Furthermore, Tc-99m's capacity to form stable complexes with a variety of ligands makes it simple to include in a broad spectrum of radiopharmaceuticals. Because of its adaptability, radiopharmaceuticals for specialized diagnostic uses, such as cardiology, oncology, nephrology, and neurology, have been developed.

In addition, due to this radioisotope's adaptability, industry participants are always concentrating on the creation and launch of related products. During the projection period, a favorable environment for category growth is anticipated to be created by such product debuts in conjunction with a considerable pipeline. For example, Curium and NRG inked a strategic agreement in August 2022 to produce molybdenum-99, which is essential to the manufacturing of technetium-99m, a radioisotope. This action has improved the ability to provide uninterrupted nuclear imaging services to patients.

Our in-depth analysis of the radiopharmaceuticals market includes the following segments

|

Type |

|

|

Radioisotopes |

|

|

Application |

|

|

Source |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radiopharmaceuticals Market Regional Analysis:

North America Market Analysis

North America industry is estimated to account for largest revenue share of 49.2% by 2035. There are numerous key reasons for North America's market dominance in radiopharmaceuticals. The demand for radiopharmaceuticals is fueled by the presence of a strong healthcare ecosystem, increasing investments in R&D projects, and high prevalence of chronic illnesses. North American healthcare rules and advantageous reimbursement policies encourage the use of radiopharmaceuticals.

Growing aging populations, new uses in neurology and cancer, and improvements in imaging technology have led to an increase in the use of radiopharmaceuticals in the U.S. The United States has a strong healthcare system and vast resources for research and development, which facilitate the advancement of radiopharmaceuticals and their application in clinical settings.

Asia Pacific Market Analysis

Asia Pacific in radiopharmaceuticals market is expected to experience a stable CAGR during the forecast period. For a variety of reasons, the Asia Pacific area has established itself as a leader in the radiopharmaceuticals industry. In addition, the market is expanding due to improvements in healthcare infrastructure, more accessibility to cutting-edge medical technology, and increased knowledge of the benefits of nuclear medicine.

The prevalence of chronic diseases and rising government measures to upgrade healthcare services are driving the China radiopharmaceutical sector. There is a growing need for sophisticated diagnostic and therapeutic options, such as radio imaging and treatment methods, due to the country's growing middle class and rising healthcare costs.

The Government of India has undertaken actions in the past few years regarding the medical inclusion of the lower and middle classes that have altered the nation's overall health infrastructure. The latest epidemic gave this progress a significant acceleration. The implementation of sophisticated techniques including the use of radiopharmaceuticals to treat cancer and other chronic diseases has become easier for healthcare facilities across the nation due to the Medicare transition.

Key Radiopharmaceuticals Market Players:

- PharmaLogic Holdings Corp.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG

- Bracco

- Cardinal Health Inc.

- Coquí Radiopharmaceuticals Corp

- Curium Pharma

- Eli Lilly and Company

- General Electric Company

- IRE EliT

- Bristol Myers Squibb

There are both large pharmaceutical enterprises and specialized businesses in this competitive sector. Leading companies set themselves apart via technological innovations, intensive research and development, and calculated alliances. While rising players concentrate on specialty technologies and novel medicines, established companies make use of their resources and worldwide reach. Quality and regulatory compliance are vital, and businesses must adhere to strict requirements. Pricing and customer service tactics can have an impact on competition since businesses want to provide value and top-notch assistance. All things considered, the radiopharmaceuticals market is dynamic, propelled by ongoing innovation and a concentration on upholding strict standards for both product development and customer service.

Here are some leading players in the radiopharmaceuticals market:

Recent Developments

- In May 2024, PharmaLogic Holdings Corp. announced a new radiopharmaceutical research and production facility in the U.S. to improve patient care and diagnostic results, the new facility will concentrate on creating novel radio-ligand therapeutic and diagnostic medications.

- In February 2024, Bristol Myers Squibb and RayzeBio, Inc. signed a formal merger agreement to enhance their pharmaceutical product base. According to the deal, Bristol Myers Squibb will pay USD 62.50 in cash per share to acquire RayzeBio, for an expected total equity value of USD 4.1 billion, or USD 3.6 billion net of estimated cash received.

- Report ID: 6519

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radiopharmaceuticals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.