Quinoline Market Outlook:

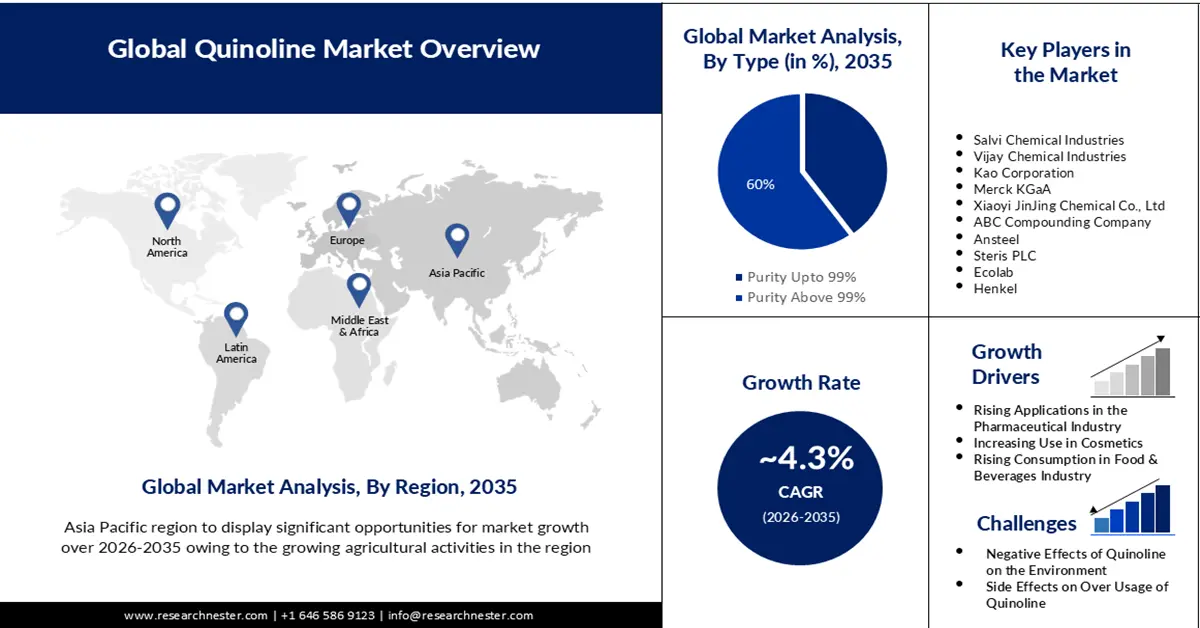

Quinoline Market size was valued at USD 395.37 billion in 2025 and is expected to reach USD 602.35 billion by 2035, registering around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of quinoline is evaluated at USD 410.67 billion.

The growth of the market is attributed to the rising usage of quinoline drug synthesis across the world. Quinoline-derivative drugs such as chloroquine, quinine, mefloquine, moxifloxacin, levofloxacin, gatifloxacin, and ofloxacin are used in the treatment of malaria and tuberculosis in the healthcare sector. Based on a study conducted by the Centers for Disease Control and Prevention (CDC) in 2021 with the CDC’s Tuberculosis Trails Consortium and the National Institutes of Health which is sponsored by AIDS Clinical Trails Group declared the results of a 4-month regimen from a randomized controlled trial. The 4-month regimen containing was found effective for the treatment of tuberculosis in patients above 12 years of age. The regimen comprises of with rifapentine, moxifloxacin, isoniazid, and pyrazinamide.

The increasing prevalence of malaria among people owing to a lack of proper awareness and a hygienic environment is estimated to propel quinoline market growth. The worldwide cases of malaria reached over 240 million in the year 2021 increased from 230 million in 2019 as per the estimations.

Key Quinoline Market Insights Summary:

Regional Highlights:

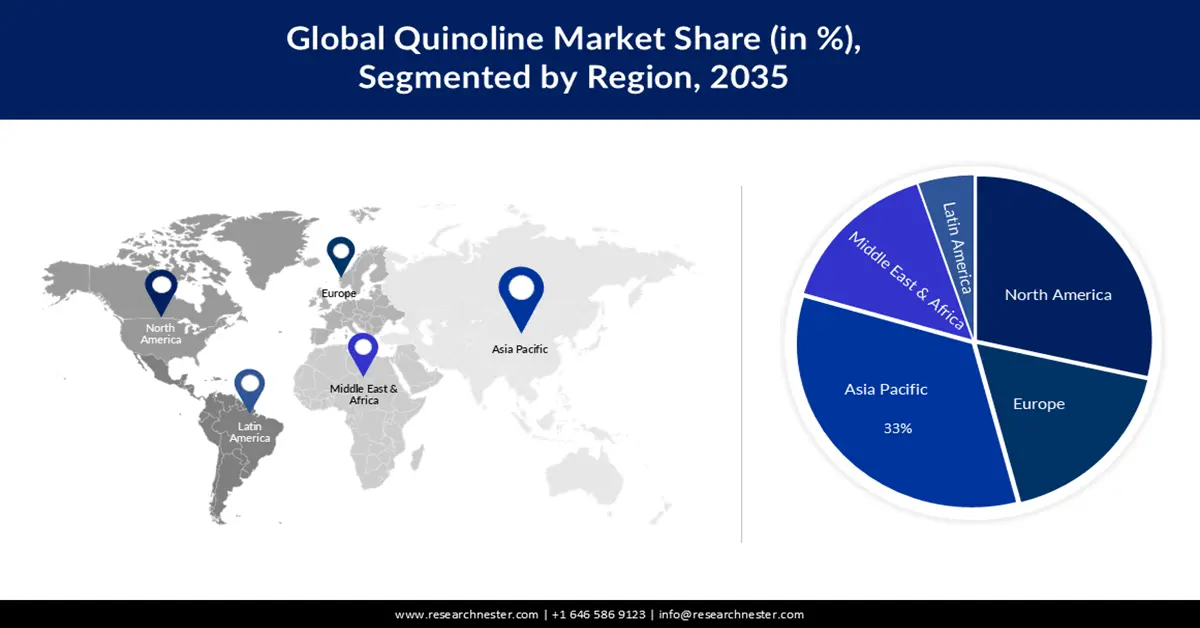

- By 2035, the Asia Pacific region is projected to command around 33% share of the quinoline market, propelled by the rising pesticide consumption amid expanding agricultural activities.

- By 2035, North America is anticipated to secure the next highest share, supported by the surging use of quinoline in cosmetic chemicals and nicotinic-acid synthesis.

Segment Insights:

- By 2035, the Purity Above 99% segment is expected to capture a substantial share of the quinoline market, stimulated by its growing adoption across pharmaceutical and food industries meeting regulatory quality standards.

- Over 2026–2035, the Metallurgical segment is set to attain a noteworthy share, strengthened by the increased use of quinoline derivatives as catalysts and corrosion inhibitors.

Key Growth Trends:

- Increasing Applications in the Pharmaceutical Industry

- Rising Usage in Cosmetics and Formulation of Cosmetic Vitamins

Major Challenges:

- Negative Effects of Quinoline on the Environment

- Side Effects on Over usage of Quinoline

Key Players: Salvi Chemical Industries, Vijay Chemical Industries, Kao Corporation, Merck KGaA, Xiaoyi JinJing Chemical Co., Ltd, ABC Compounding Company, Ansteel, Steris PLC, Ecolab, Henkel.

Global Quinoline Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 395.37 billion

- 2026 Market Size: USD 410.67 billion

- Projected Market Size: USD 602.35 billion by 2035

- Growth Forecasts: 4.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: United States, China, Germany, Japan, India

Last updated on : 24 November, 2025

Quinoline Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Applications in the Pharmaceutical Industry – There has been increasing concern among people about their health and raising awareness of early diagnostics. The growing number of applications of quinoline as antimalarial, antibacterial, antifungal, cardiotonic, anti-inflammatory, analgesic, anticonvulsant, and anthelmintic is anticipated to drive the demand for quinoline market growth in the coming years.

- Rising Usage in Cosmetics and Formulation of Cosmetic Vitamins – Quinoline is used in the production of conditioners, shampoos, bath soaps, toothpaste, hair gels, lotions, and other skincare products.

- Increasing Usage in Food & Beverages Sector – The food and beverages industry include quinoline as a food additive or dye to add yellow color to food products.

Challenges

-

Negative Effects of Quinoline on the Environment – Quinoline is released into the environment by industries owing to its vast applications in various end-user sectors. The presence of quinoline is harmful to the environment as it enters the air, water, soil, and atmosphere causing adverse effects. High exposure to quinoline leads to headache, nausea, dizziness, and vomiting and may damage the liver of humans. When released into the groundwater will affect the aquatic life. All these factors together account for the hindering of quinoline market growth.

- Side Effects on Over usage of Quinoline

- Increasing Preference for Bio-Based Dyes and Additives

Quinoline Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 395.37 billion |

|

Forecast Year Market Size (2035) |

USD 602.35 billion |

|

Regional Scope |

|

Quinoline Market Segmentation:

Type Segment Analysis

Purity Above 99% is the segment predicted to have a significant market demand in the coming years owing to the increasing application in the end-user industries. Quinoline with a purity above 99% is of high grade and can be used in the preparation of consumable goods. Further, the pharmaceutical and food industry prefers high-quality quinoline to qualify for the standards of government regulatory bodies which increases the use of 99% pure quinoline and thereby fuelling the market segment growth.

Application Segment Analysis

The metallurgical segment is poised to surpass the quinoline market share during the forecast timeframe. Quinoline and its derivatives are used in the metallurgy process as catalysts and corrosion inhibitors and are estimated to drive the market segment growth. Utilization of quinoline as a catalyst helps to prevent further reduction of alkynes to alkanes in the reaction process. Quinoline is included in the lindlar catalysts that are used in the synthesis of vitamins A, and K.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Application |

|

|

Synthesis |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Quinoline Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 33% by 2035. The increasing pesticide consumption in the region with growing agricultural activities is projected to augment the market growth. Quinoline is the precursor for crop protection chemicals such as pesticide and herbicide manufacturing. Escalating usage of quinoline dyes in the leather industry owing to the increasing demand for leather products in the Asia Pacific region is driving the market expansion.

North American Quinoline Market Insights

North America registered the next highest market value after the Asia Pacific region owing to the high number of cosmetic users in the region. The population of the United States spends USD 240 to USD 300 on cosmetic chemicals each month. Increasing use of quinoline in the synthesis of nicotinic acid with the increase of niacin prescriptions in the U.S. Moreover, there has been surging use of quinoline is utilized as a precursor in cyanine dyes, and in the production of specialty chemicals in the region.

European Market Insights

The quinoline market in the European region crossed a noteworthy market share between 2026-2035. Respiratory disorders in Europe are treated using quinoline and its derivatives such as levofloxacin, norfloxacin, moxifloxacin, and ciprofloxacin. Quinoline is the fastest-growing antibiotic class in the region which is stated to have a positive impact on market growth.

Quinoline Market Players:

- Salvi Chemical Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vijay Chemical Industries

- Kao Corporation

- Merck KGaA

- Xiaoyi JinJing Chemical Co., Ltd

- ABC Compounding Company

- Ansteel

- Steris PLC

- Ecolab

- Henkel

Recent Developments

- Kao Corporation launched the sales of dry shampoo named Space Shampoo Sheet which is sold in limited quantities on Rakuten Ichiba, the largest e-commerce platform in Japan.

- Ecolab reported a net sale in 2022 increased by 9% with a 15% rise in fixed currency sales compared to 2021. The net income attributed to Ecolab in 2022 raised by 12% from 2021 i.e., increasing from 301 in 2021 to 264.4 in 2022.

- Report ID: 4995

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Quinoline Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.