Protective Clothing Market Outlook:

Protective Clothing Market size was valued at USD 12.3 Billion in 2025 and is likely to cross USD 22.87 Billion by 2035, registering more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of protective clothing is assessed at USD 13.01 Billion.

The growth of the market can be attributed to the rapid boom of the textile industry across the world. Moreover, protective clothing is used in textile products in order to provide protection from environmental situations, and it is predicted to drive the market’s growth. The revenue generation of the global textile industry in 2018 was approximately USD 900 billion, which is further anticipated to reach USD 1,250 billion by 2024.

Protective clothing market trends, such as, the presence of large number of textile businesses in the world, are expected to bolster the production of protective clothing in the upcoming years. The total number of textile and cloth manufacturing companies in the European Union was calculated to be 143,000 in the year 2021. In recent years, concerns related to workplace safety has grown considerably in every sector. The increasing healthcare, chemical, construction, food processing, or manufacturing industries, the high number of mortalities and accidental injuries are expected to drive the protective clothing market in the recent years. Hence, these factors are expected to hike the growth of the market over the forecast period.

Key Protective Clothing Market Insights Summary:

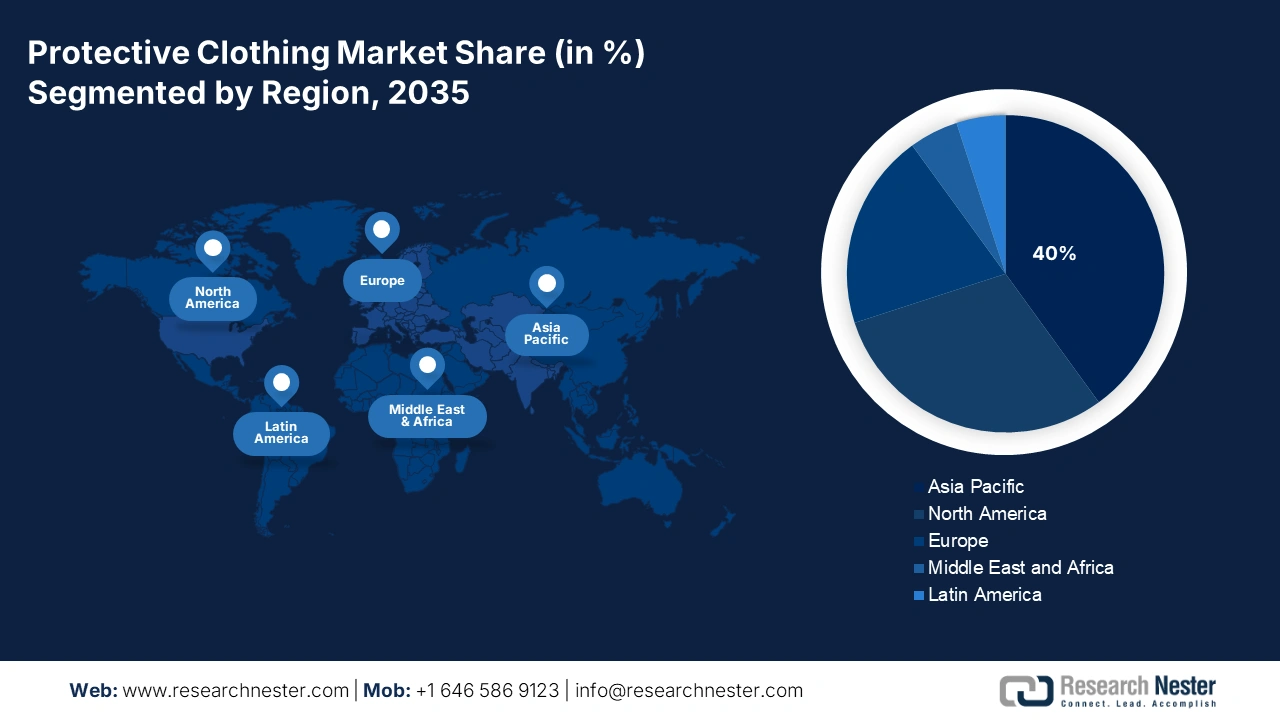

Regional Highlights:

- Asia Pacific protective clothing market, the largest share by 2035, is driven by high textile fiber production and strong workforce.

Segment Insights:

- The construction end-user segment in the protective clothing market is anticipated to achieve the largest share by 2035, driven by the expansion of the construction sector, rising demand for construction processes, and GDP growth.

- The aramid & blends segment in the protective clothing market is expected to hold a significant share by 2035, driven by high utilization in ballistic protection due to superior properties.

Key Growth Trends:

- Prevalence of Industrial Accidents

- Rise in Instances of Structure Fires

Major Challenges:

- Concerns Related to Wearability Issues

- Requirement for High Initial Investment

Key Players: Protective Industrial Products Inc,Honeywell International Inc., Lakeland Inc., 3M Company, DuPont de Nemours, Inc., ANSELL LTD, Clark Corporation, Teijin Aramid BV, Sioen Industries NV, Cintas Corporation.

Global Protective Clothing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.3 Billion

- 2026 Market Size: USD 13.01 Billion

- Projected Market Size: USD 22.87 Billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Protective Clothing Market Growth Drivers and Challenges:

Growth Drivers

-

Prevalence of Industrial Accidents – Recent industrialization has propelled the expansion of numerous industries. On the other hand, the number of fatalities and accidents has also increased considerably. To protect the employees, the demand for protective clothing is expected to increase rapidly. The total number of fatal work injuries in the United States was calculated to be around 5,000 in 2020.

-

Rise in Instances of Structure Fires – Protective clothing is required in emergencies such as fires and is worn by personnel such as firefighters and first responders. Moreover, the flame-resistant fabrics are used for the manufacture of protective clothes in order to protect the employees from the fire work. Therefore, it is projected to increase the growth of the global protective clothing market. The recent statistics reported that in 2020, there were almost 500,000 structure fires in the United States, an increment of 2 percent from 2019.

- High Investments by Companies in R&D Activities – The development of new technologies and improvements in protective fabrics are undoubtedly a very important factor, that is expected to spur the growth of the global protective clothing market. The World Bank showed the data on Research and Development expenditure to be 2.63% of total GDP in 2020, up from 2.13% of total GDP in 2017.

- Rapid Industrialization and Urbanization – People working in industries such as construction and manufacturing often need to wear protective garments to help mitigate the risks associated in their lie of work. According to the United Nations Organization released the data stating that about 55% of the global population was living in urban areas in 2018, which is forecasted to increase to 68% by 2050.

Challenges

-

Concerns Related to Wearability Issues

-

Requirement for High Initial Investment

- Constant Fluctuation in Costs of Raw Materials – With global economic instability and volatile changes in the prices of crude oil, which indirectly or directly affects the prices for synthetic fibers, such as nylon or rayon. These factors affect the costs incurred in the manufacture of protective clothing. Hence, it is expected to restrain the growth of the global protective clothing market.

Protective Clothing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 12.3 Billion |

|

Forecast Year Market Size (2035) |

USD 22.87 Billion |

|

Regional Scope |

|

Protective Clothing Market Segmentation:

End-user Segment Analysis

The construction segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing expansion of the construction sector, backed by the rising demand for the construction processes across various industries along with the growth in Gross Domestic Product (GDP) and industrialization is expected to bolster the growth of the construction segment in the market in the assessment period.

Material Type Segment Analysis

The aramid & blends segment is expected to garner a significant share. The growth of the segment can be accounted to the higher utilization of aramid & blends in ballistic protection, which makes it suitable to be used in clothing, armor, and others. Aramid fiber properties include high resistance to strength, organic solvents, and abrasion, as these fibers are non-conductive and have low flammability.

Our in-depth analysis of the global market includes the following segments:

|

By Material Type |

|

|

By Application |

|

|

By End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protective Clothing Market Regional Analysis:

APAC Market Insights

The Asia Pacific protective clothing market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the increasing demand and manufacturing of textile fibers, along with dyes and pigments, in the region, backed by the growing population resulting in the availability of a robust workforce for production. It was expected that China was the top-ranked global textile exporter in 2021 with a value of approximately USD 120 billion, almost 52% of the total textile export industry in Asia. Also, the employment rate in the clothing industry, along with rapid urbanization and rising industries are expected to bring lucrative growth opportunities for the growth of the Asia Pacific protective clothing market during the forecast period. According to the International Labor Organization, around 65 million people were employed in the garment sector in Asia-Pacific, which accounts for 75% of all garment workers worldwide. Asia Pacific is known to have a robust textile industry, which is attributed to the lower cost of production & cheap labor. For instance, Japan is one of the leading exporters of textile which China comprises approximately 42% of the global textile industry with nearly 30 years of dominance in the textile & garment industry. All of this has been possible owing to the presence of good infrastructure, a robust supply-chain, and expertise in apparel products.

Protective Clothing Market Players:

- Protective Industrial Products Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Lakeland Inc.

- 3M Company

- DuPont de Nemours, Inc.

- ANSELL LTD

- Clark Corporation

- Teijin Aramid BV

- Sioen Industries NV

- Cintas Corporation

Recent Developments

-

Protective Industrial Products Inc. has acquired Industrial Starter, S.p.A. This acquisition is expected to enable the company to expand its operations in southern and eastern Europe to be a part of PIP global familiy. Protective Industrial Products Inc. is a renowned company in the field of protection and PPE for mining, construction, retail, and other markets.

-

Honeywell International Inc. has acquired Rocky Research. This acquisition expands the company’s existing portfolio, which includes power generation systems, energy storage, and power and thermal management systems. Rocky Research is a leading company in power management and thermal energy solution.

- Report ID: 4499

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protective Clothing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.