Global Propylene Glycol Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How They Would Aid The Business?

- Competitive Landscape

- Dow

- BASF SE

- Temix Oleo

- INEOS Oxide

- Huntsman International

- Haike Chemical Group Co., Ltd

- Repsol

- Shell Plc

- ADEKA Corporation

- LyondellBasell Industries N.V.

- Metadynea LLC

- Technological Advancements

- Key Player in the Propylene Glycol

- Technology Analysis

- Propylene Glycol

- End User Analysis

- SWOT Analysis

- PESTLE Analysis

- Product Launch

- Recent Development

- PORTER Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Source, Value (USD Million),

- Petroleum Based

- Bio-Based

- Grade, Value (USD Million),

- Industrial Grade

- USP Grade

- End user, Value (USD Million),

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Source, Value (USD Million),

- Regional Synopsis, Value (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Source, Value (USD Million),

- Petroleum Based

- Bio-Based

- Grade, Value (USD Million),

- Industrial Grade

- USP Grade

- End user, Value (USD Million),

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Country Level Analysis Value (USD Million), 2024-2037

- U.S.

- Canada

- Source, Value (USD Million),

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Source, Value (USD Million),

- Petroleum Based

- Bio-Based

- Grade, Value (USD Million),

- Industrial Grade

- USP Grade

- End user, Value (USD Million),

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Country Level Analysis Value (USD Million), 2024-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Source, Value (USD Million),

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Source, Value (USD Million),

- Petroleum Based

- Bio-Based

- Grade, Value (USD Million),

- Industrial Grade

- USP Grade

- End user, Value (USD Million),

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Country Level Analysis Value (USD Million), 2024-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Source, Value (USD Million),

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Source, Value (USD Million),

- Petroleum Based

- Bio-Based

- Grade, Value (USD Million),

- Industrial Grade

- USP Grade

- End user, Value (USD Million),

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Country Level Analysis Value (USD Million), 2024-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Source, Value (USD Million),

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Source, Value (USD Million),

- Petroleum Based

- Bio-Based

- Grade, Value (USD Million),

- Industrial Grade

- USP Grade

- End user, Value (USD Million),

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Country Level Analysis Value (USD Million), 2024-2037

- Saudi Arabia

- UAE

- Oman

- South Africa

- Morocco

- Tunisia

- Algeria

- Rest of Middle East & Africa

- Source, Value (USD Million),

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

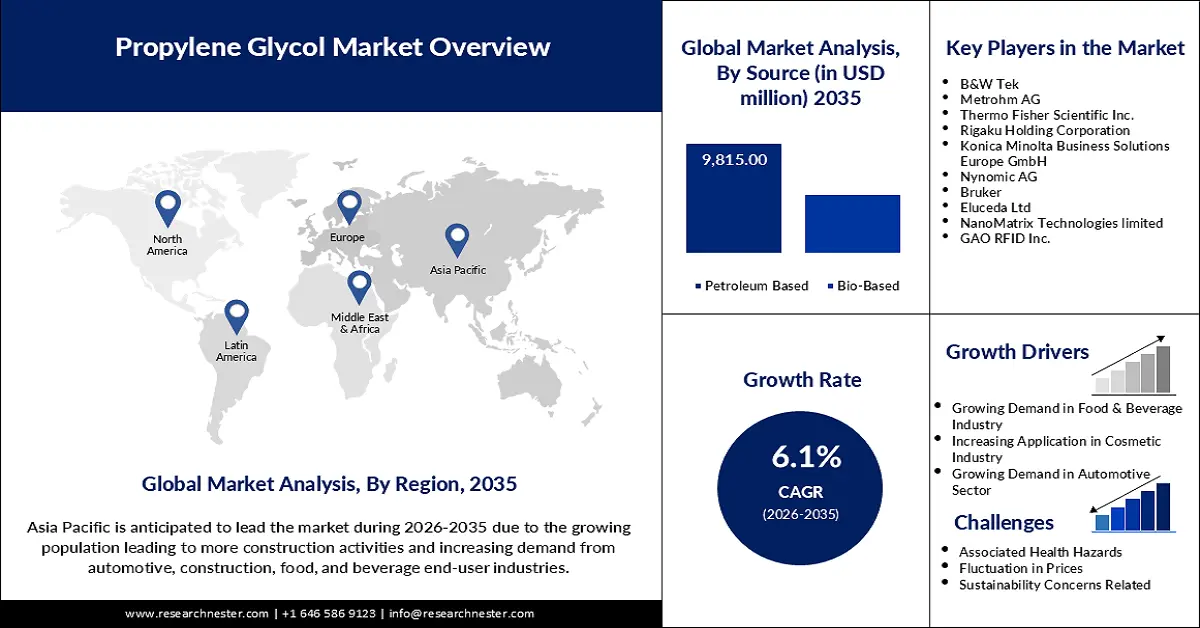

Propylene Glycol Market Outlook:

Propylene Glycol Market size was over USD 4.46 billion in 2025 and is projected to reach USD 8.06 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of propylene glycol is evaluated at USD 4.7 billion.

The global propylene glycol market is anticipated to expand at a robust rate in the coming years, due to the increasing demand for propylene glycol across various sectors like automotive, pharmaceuticals, personal care, and so on. Rising environmental consciousness and the move towards biopolymers are driving improvements in manufacturing methods. For example, in March 2023, Ethos Asset Management worked with GreenGlycols B.V. to invest in a biomass-based propylene glycol plant in the Netherlands to promote sustainable industrial practices. These trends reveal the industry’s focus on sustainable business practices that are consistent with international objectives for sustainability.

The growth of the propylene glycol market is also boosted by government policies as well as the rising need for renewable chemicals. In September 2022, Dow launched its first circular economy-inspired propylene glycol solutions in Europe. These new products were developed to reduce carbon footprint while increasing efficiency for the automotive, food processing, construction, and many other industries. Also, the increasing need for USP-grade propylene glycol in the food and pharmaceutical industries is opening new propylene glycol market prospects for manufacturers globally.

Key Propylene Glycol Market Insights Summary:

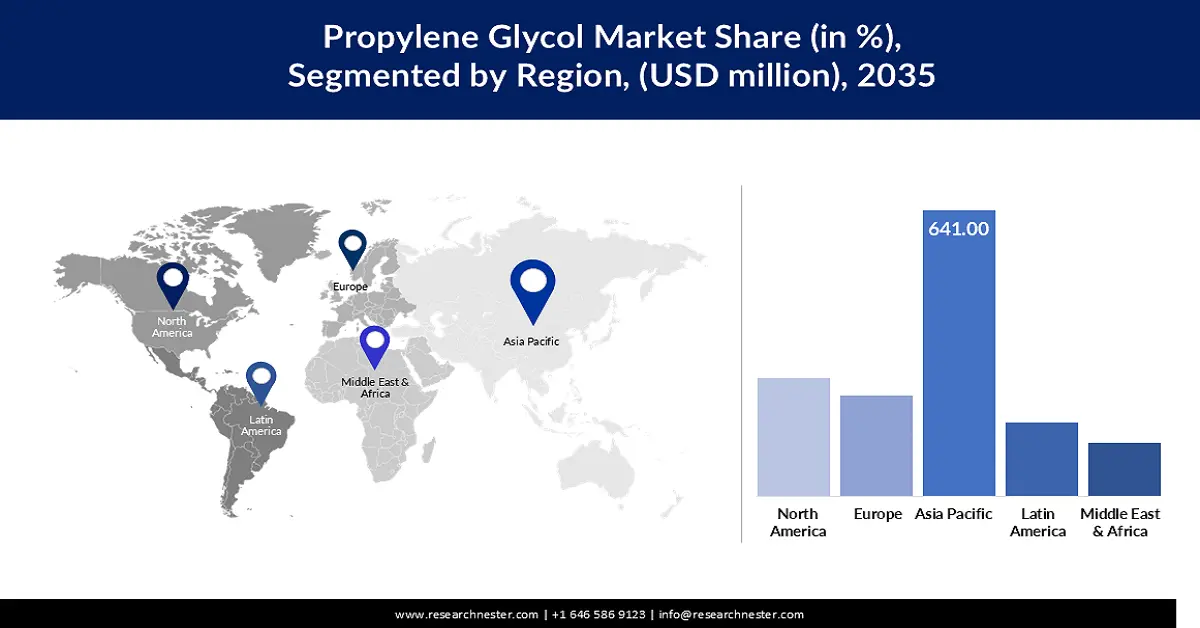

Regional Highlights:

- The Asia Pacific propylene glycol market is projected to capture a 42.50% share by 2035, fueled by industrialization and urbanization, especially in China and India.

- The North America market is expected to see substantial growth from 2026 to 2035, driven by the focus on renewable chemical production and new investments in bio-based manufacturing technologies.

Segment Insights:

- The petroleum-based segment in the propylene glycol market is expected to hold a 65% share by 2035, driven by its cost-effectiveness, established distribution channels, and accessibility.

- The industrial grade segment in the propylene glycol market is projected to secure a 55.60% share by 2035, attributed to its wide applications in automotive coolants, de-icing solutions, and chemical manufacturing.

Key Growth Trends:

- Rising demand for sustainable products

- Expanding pharmaceutical and personal care applications

Major Challenges:

- Regulatory compliance and environmental concerns

- Supply Chain Disruptions

Key Players: The Dow Chemical Company, LyondellBasell Industries N.V., BASF SE, Archer Daniels Midland Company, Global Bio-chem Technology Group Company Limited, SKC Co., Ltd., Temix Oleo S.r.l., INEOS Group, Repsol S.A., Huntsman Corporation.

Global Propylene Glycol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.46 billion

- 2026 Market Size: USD 4.7 billion

- Projected Market Size: USD 8.06 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 11 September, 2025

Propylene Glycol Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for sustainable products: The increasing focus on the use of bio-based and renewable chemicals is the key factor fueling the growth of the propylene glycol market. In May 2023, the first operational year of the BioPG plant of ORLEN Poludnie, which was designed in partnership with BASF and Air Liquide, was completed. The plant turns bio-glycerol into renewable propylene glycol, underlining the trend towards more environmentally friendly production to satisfy the growing consumer demand for environmentally friendly products. Moreover, the enhancement of the regulatory pressure on cutting down carbon footprint enhances the shift to bio-based propylene glycol solutions.

- Expanding pharmaceutical and personal care applications: The rising application of propylene glycol in pharmaceuticals and personal care is the key driver of the market. In April 2023, Dow introduced a new line of propylene glycol products for personal care use, responding to the market’s need for innovative and sustainable products. These innovations show how propylene glycol is useful in formulations, which is why it is used in these fast-growing markets. Additionally, the enhanced demand for skincare and hygiene products after the pandemic has further emphasized the significance of propylene glycol in such sectors.

- Growth in aviation and automotive sectors: The application of propylene glycol in de-icing solutions and coolant systems is an essential factor for aviation and automobile sectors. Boeing’s 2023 Commercial Outlook estimates that the need for fuel-efficient commercial jets will increase, and this will spur demand for propylene glycol as a de-icing agent. Likewise, the improvement in automotive technologies is also accelerating the application of propylene glycol in antifreeze and lubricants, which in turn helps fuel the growth of the propylene glycol market. Global trends towards the use of electric vehicles also influence the development of new propylene glycol-based formulations for thermal management systems.

Challenges

- Regulatory compliance and environmental concerns: The increased stringent environmental laws force manufacturers to seek efficient and environmentally friendly ways of production. The effort to minimize carbon emissions and get rid of the dangerous by-products raises operational costs and calls for substantial capital expenditures in green technologies. Compliance is a real concern that companies need to consider when seeking to make a profit, particularly those that are relatively small in the industry.

- Supply Chain Disruptions: Geopolitical and natural calamities have affected the supply chain of raw materials and products, causing problems in the global supply chain. Glycerin and petroleum-based feedstock variability influences the prices and time of production. This makes manufacturers respond to transport cost changes and logistics challenges that affect their delivery prowess to clients. As a result, these factors are anticipated to limit propylene glycol market expansion during the forecast.

Propylene Glycol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 4.46 billion |

|

Forecast Year Market Size (2035) |

USD 8.06 billion |

|

Regional Scope |

|

Propylene Glycol Market Segmentation:

Source Segment Analysis

Petroleum-based segment is estimated to account for more than 65% propylene glycol market share by the end of 2035. Petroleum-based propylene glycol is still popular even though there is increasing consciousness about bio-based products as it is cost-effective, has well-established distribution channels, and is easily accessible. In March 2023, LyondellBasell revealed plans for an expansion of its facility in Texas, where it will boost the propylene glycol production capacity by 100,000 metric tons, proving the relevance of the segment in the global market. The use in construction, automotive, and personal care sectors supports the segment’s market standing even further.

Grade Segment Analysis

By 2035, industrial grade segment is set to capture over 55.6% propylene glycol market share, owing to its applications in automotive coolants, de-icing solutions, and chemical manufacturing. The industrial grade propylene has proved to be durable in its operations and can be used in almost any field, which has propelled companies to launch innovative derivates in various markets. For example, INEOS introduced propylene glycol derivatives for specialty chemical markets in September 2022, highlighting the role of industrial grade products in high-performance applications. This growth is consistent with the increased need for chemical intermediates with multiple applications in various industries, such as construction and energy storage.

Our in-depth analysis of the global market includes the following segments:

|

Source |

|

|

End user |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Propylene Glycol Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in propylene glycol market is expected to account for more than 42.5% revenue share by the end of 2035. Some of the factors include the industrialization and urbanization of the region, especially China and India. This is particularly true in China, which is expected to spend USD 13 trillion on infrastructure by 2030, making it the notable construction market globally and, therefore, the dominant market for propylene glycol in sealants and resins.

In India, the government’s housing schemes are to build 60 million new houses with USD 1.3 trillion investment in the next seven years. This significant housing construction drive is thereby creating a demand for propylene glycol in paints, adhesives, and construction materials. In addition, the India pharmaceutical industry, which was worth USD 42 billion in 2022, has been gradually integrating propylene glycol into its formulations as the material’s application in this rapidly expanding market.

The growth of the propylene glycol market is attributed to the expansion in the electronics and automotive industries in China. Due to the focus of the government on the sustainable development plan known as Made in China 2025, bio-based production of propylene glycol is becoming more popular. Furthermore, the government’s policies towards increasing the use of renewable energy storage systems, which use propylene glycol, have helped the country become the market leader.

North America Market Insights

North America region is anticipated to observe substantial growth through 2035. As a result of the abundance of manufacturing industries, especially the automotive industry, the region has been growing at a high rate. In March 2024, Dow unveiled two innovative propylene glycol (PG) solutions in North America, derived from bio-circular and circular feedstocks, marking a significant advancement in sustainable chemical production. This focus on renewable production is in line with the country’s environmental agenda and promotes sustainable development of the sector.

New investment in renewable chemicals and bio-based manufacturing technologies is driving the future of the propylene glycol market in the U.S. As per OICA, automotive production in the U.S. was 10.06 million units in 2022, which is 9% higher as compared to the previous year, increasing the usage of propylene glycol as a coolant and lubricant. In the same way, the pharmaceutical and personal care industries in the region have greatly depended on propylene glycol due to its wide application in drug formulation and skin care products, which in turn contributes to the growth of the market.

The propylene glycol market in Canada is also expanding due to the increasing need for green construction products. As one of the most common solvents in paints, coatings, and adhesives, propylene glycol has benefited from the Canadian government’s green building policies. Moreover, the production of pharmaceuticals in Canada is increasing, with a large number of new investments in drug production facilities, which will create new prospects for propylene glycol suppliers.

Propylene Glycol Market Players:

- Dow

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Temix Oleo

- INEOS Oxide

- Huntsman International

- Haike Chemical Group Co., Ltd

- Repsol

- Shell Plc

- ADEKA Corporation

- LyondellBasell Industries N.V.

- Metadynea LLC

The global propylene glycol market is highly competitive, with major players including Dow, BASF SE, INEOS Oxide, and Huntsman International dominating the market. These companies aim at innovation, capacity, and sustainability to sustain their competitiveness in the market. For instance, BASF’s bio-based projects and INEOS’s increase in production capacity demonstrate their focus on changing market requirements.

In January 2023, Braskem made a USD 40 million investment into a bio-based propylene glycol facility in Brazil, which is a major step in sustainable production. This plant started operations in 2024, marking a shift by the industry towards developing renewable chemical products. Such investments show how market leaders are looking to achieve corporate performance while at the same time taking into consideration their environmental footprint in order to support future growth.

Here are some leading companies in the propylene glycol market:

Recent Developments

- In May 2024, Shell Plc announced its decision to divest its refinery and petrochemical assets in Singapore. The sale, involving Indonesian chemicals firm Chandra Asri and Swiss commodities trader Glencore, underscores Shell's strategic move to streamline operations and focus on sustainable and high-value energy solutions, impacting the propylene glycol market indirectly through supply chain shifts.

- In September 2023, Dow Company introduced low-carbon, bio-based, and circular propylene glycol solutions in Europe. These solutions cater to various industries, including agriculture, pharmaceuticals, cosmetics, textiles, and food, offering versatile applications. This launch reinforces Dow’s commitment to sustainability and innovation in chemical manufacturing.

- In May 2023, ORLEN Poludnie completed the inaugural year of its BioPG plant, utilizing BASE technology for sustainable propylene glycol production. The facility converts bio-glycerol, a biodiesel by-product, into renewable propylene glycol (BioPG). This initiative underscores ORLEN Poludnie’s leadership in Poland’s biofuels sector and its commitment to green solutions.

- Report ID: 4907

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Propylene Glycol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.