Pre-Workout Supplements Market Outlook:

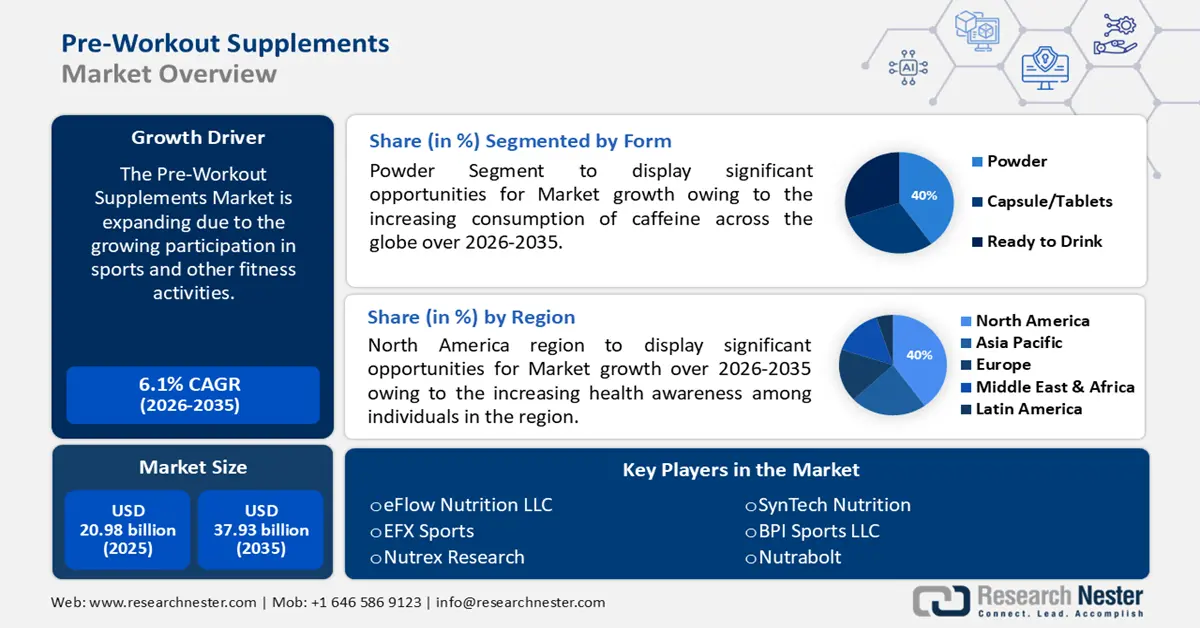

Pre-Workout Supplements Market size was valued at USD 20.98 billion in 2025 and is expected to reach USD 37.93 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pre-workout supplements is evaluated at USD 22.13 billion.

This market growth is assessed to be encouraged by the growing participation in sports and other fitness activities, leading to a higher demand for products that can enhance energy.

Pre-workout supplements are cutting-edge dietary compositions that have gained popularity among athletes and fitness enthusiasts in recent years to improve energy levels and athletic performance.

According to the World Economic Forum, across the 29 countries questioned, more than half of adults (58%) desire to play more sports.

Key Pre-Workout Supplements Market Insights Summary:

Regional Highlights:

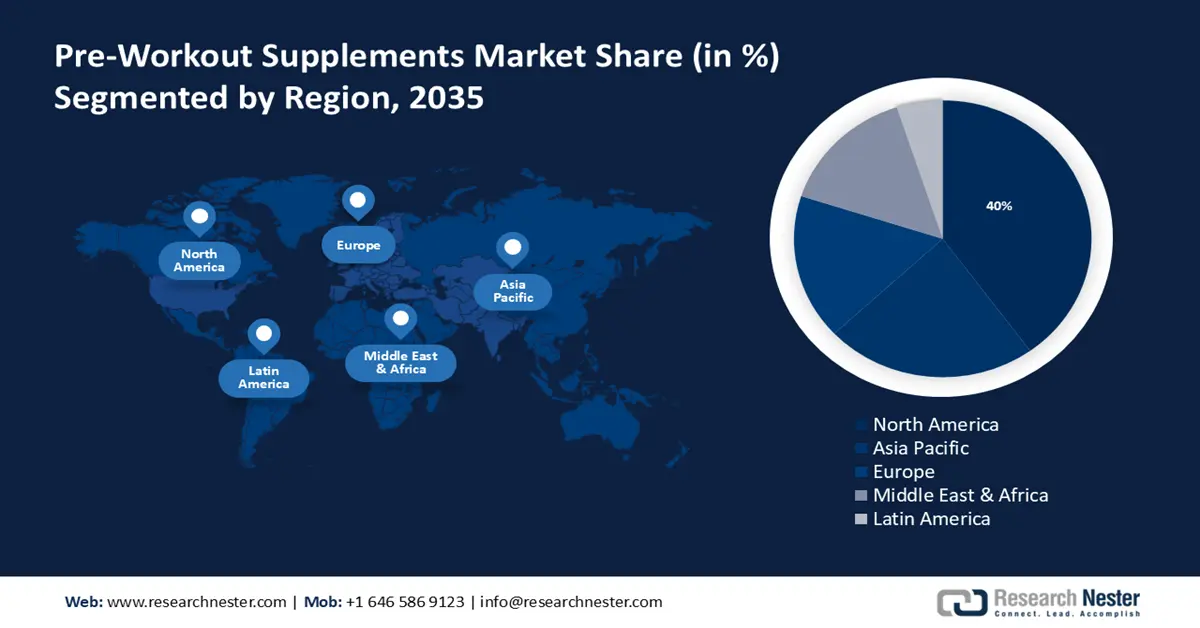

- North America pre-workout supplements market will hold more than 40% share by 2035, driven by increasing health awareness and growing knowledge of pre-workout supplements.

- Asia Pacific market will achieve massive market revenue share by 2035, attributed to rising personal disposable income increasing demand for pre-workout supplements.

Segment Insights:

- The powder segment in the pre-workout supplements market is projected to hold a 40% share by 2035, attributed to the increasing consumption of caffeine across the globe.

- The offline segment in the pre-workout supplements market is expected to achieve the highest CAGR through 2035, driven by the rising number of gym memberships.

Key Growth Trends:

- Rising burden of micronutrient deficiencies

- Increasing popularity of social media

Major Challenges:

- Absence of regulatory protocols

- Potential health concerns

Key Players: Finaflex, Bio-Engineered Supplements and Nutrition, Inc., EFX Sports, Nutrex Research, SynTech Nutrition, BPI Sports LLC, Nutrabolt, JNX Sports, eFlow Nutrition LLC.

Global Pre-Workout Supplements Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.98 billion

- 2026 Market Size: USD 22.13 billion

- Projected Market Size: USD 37.93 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Pre-Workout Supplements Market Growth Drivers and Challenges:

Growth Drivers

-

Rising burden of micronutrient deficiencies - Low dietary intake results in costly social and public expenses as well as decreased productivity therefore, multi-ingredient pre-workout supplements (MIPS) are a specific class of nutritional supplements that are meant to be taken before working out and contain a combination of compounds that are said to support the muscles as a buffer during strenuous exercise.

The World Health Organization (WHO) believes that over 2 billion individuals worldwide suffer from deficiencies in important vitamins and minerals, specifically iron, zinc, iodine, and vitamin A. -

Increasing popularity of social media - Social media influencers are heavily promoting pre-workout supplements as fitness firms have teamed up with fitness influencers, who frequently use social media sites like Instagram and TikTok as their main distribution methods.

For instance, globally, there were more than 5 billion social media users as of January 2024, up from 4 billion in January 2023. -

Surging number of product launches - For instance, GNC an American multinational retail and nutritional manufacturing company introduced a new pre-workout formula, AMP Tri-Phase, which includes several unique components that are intended to enhance the generation of nitric oxide, and is positioned for brain stimulation, muscular energetics, and sustained workout performance.

Challenges

-

Absence of regulatory protocols - The pre-workout formula is not standardized since supplements are subject to different regulatory requirements than prescription drugs or other controlled medications, and are subject to less regulation by the FDA.

Unfortunately, there are no strict manufacturing or marketing standards applied to these supplements, which can render a pre-workout supplement harmful, affecting users' finances, and health, and might have other negative consequences. -

Potential health concerns - Pre-workout supplements contain a lot of caffeine, which is linked to negative effects such as trembling, palpitations, anxiety, chest pain, and convulsions.

Pre-workouts carry certain possible hazards, such as toxicity and the potential for dehydration, and can raise the chance of hypertension, cardiac arrhythmias, and possibly a heart attack in individuals with severe coronary disease.

Pre-Workout Supplements Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 20.98 billion |

|

Forecast Year Market Size (2035) |

USD 37.93 billion |

|

Regional Scope |

|

Pre-Workout Supplements Market Segmentation:

Form Segment Analysis

Powder segment is expected to dominate pre-workout supplements market share of over 40% by 2035. The segment growth can be attributed to the increasing consumption of caffeine across the globe. For instance, caffeine is the most commonly taken mental stimulant in the world, with over 65% of people consuming it.

Pre-workout supplements are performance-enhancing and are typically sold as powders that can be combined with water to drink before working out.

Caffeine is the primary ingredient in pre-workout supplements which is readily available in pill or powder form, providing an excellent value for those on a tight budget looking for a simple way to acquire more energy before working out, or whenever it is most convenient.

Distribution Channel (Online, Offline)

The offline segment in the pre-workout supplements market is likely to register the highest CAGR during the forecast timeframe. The rising number of gym memberships is the primary driver of the segment's growth. Worldwide, there are more than 204,180 fitness centers., and around 184 million subscriptions in gyms.

Pre-workout supplements are widely available through health stores and gyms since the great majority of gyms have partnerships with nutrition vendors given the obvious demand for nutrition products.

One great approach to add a revenue stream to any fitness center is to sell workout supplements by informing the clients on the advantages and proper use of dietary supplements and providing loyalty programs, discounts, and promotions.

Our in-depth analysis of the market includes the following segments:

|

Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pre-Workout Supplements Market Regional Analysis:

North American Market Insights

North America region in pre-workout supplements market is expected to dominate revenue share of over 40% by 2035. The market growth in the region is also expected on account of increasing health awareness among individuals. As a consequence, there is a growing knowledge of pre-workout supplements among athletes and working people in the region to preserve their bodies' nutritional balance.

According to a survey, following the COVID outbreak, more than 65% of Americans are more aware of their physical health.

Over the past ten years, the number of enterprises in the fitness industry in the United States has generally climbed year over year led by an increase in diabetes and obesity cases, along with the growing emphasis on mindfulness, self-care, and general wellbeing.

For instance, as of 2023, there were more than 113,320 Gym, Health & Fitness Clubs operating in the US, around a 2% rise from 2022.

The gym business in Canada has grown, which has led to an increasing number of fitness centers, ranging from inexpensive to expensive gyms in the nation.

Particularly, in Canada, over 15% of people own a gym membership.

APAC Market Insights

The Asia Pacific region will also encounter massive market revenue for the pre-workout supplements market during the forecast period and will hold the second position owing to the increasing personal disposable income in this region. This has contributed to increased purchasing power which may augment the demand for pre-workout supplements for all age groups.

Compared to around 31% in 2022, Asia Pacific is predicted to provide over 35% of the world's disposable income in 2040.

In Japan, a large number of high school students participate in after-school organizations, particularly those focused on sports since sports are considered an important aspect of Japanese culture, leading to a higher need for alternative protein and fitness equipment targeted at athletes and fitness fanatics.

Moreover, exercise and sports participation are widespread in Japan, where over 45% of adults and the majority of children play sports every week.

Supplements for health and nutrition are currently seeing strong market trends in China because they are so readily available and simple to use, therefore, more people are accepting them.

Simultaneously, the demand from consumers for Korean red ginseng as a natural pre-workout supplement has surged significantly since it aids in the recovery from repetitive anaerobic exercise's anti-fatigue effects, and can enhance cognitive function, making it a strong nootropic option for increasing concentration.

Pre-Workout Supplements Market Players:

- Finaflex

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Engineered Supplements and Nutrition, Inc.

- EFX Sports

- Nutrex Research

- SynTech Nutrition

- BPI Sports LLC

- Nutrabolt

- JNX Sports

- eFlow Nutrition LLC

The market for pre-workout supplements is fragmented worldwide, with several domestic and international competitors. The leading companies in the pre-workout supplements market are pursuing tactics such as product innovation, collaborations, geographic expansions, mergers and acquisitions, and product innovation in order to build a solid customer base and, consequently, a respected position in the industry.

Recent Developments

- Finaflex announced a partnership with Branch Warren for the creation of potent pre-workout supplement WRN, for individuals who thrive in the gym and push their boundaries to the maximum.

- JNX Sports introduced a new size of its best-selling pre-workout formula: The Curse! Pre-Workout 30 Serves for those who are new to taking pre-workout. The product works in concert to increase energy levels, postpone exhaustion, and sharpen mental focus, all of which let individuals exercise harder and longer between sessions.

- Report ID: 6056

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pre-Workout Supplements Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.