Portable Oxygen Concentrators Market Outlook:

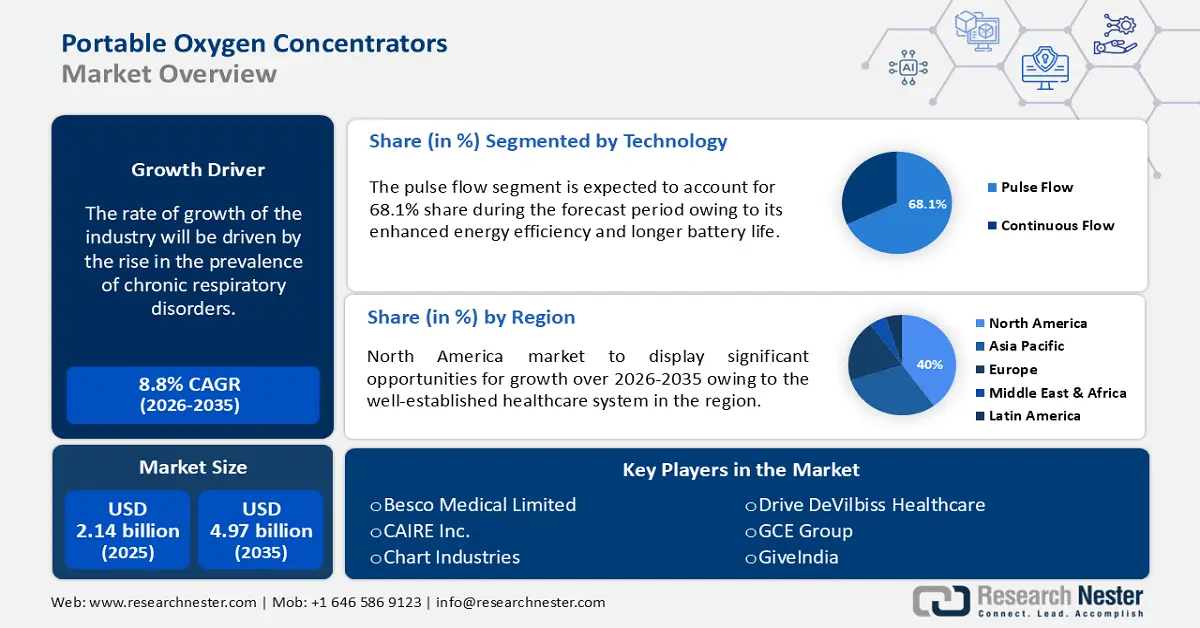

Portable Oxygen Concentrators Market size was valued at USD 2.14 billion in 2025 and is expected to reach USD 4.97 billion by 2035, expanding at around 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable oxygen concentrators is evaluated at USD 2.31 billion.

The rise in the prevalence of chronic respiratory disorders, such as asthma, chronic obstructive pulmonary diseases (COPD) and sleep apnea is a key factor boosting market growth. In 2020, the Centers for Disease Control and Prevention (CDC) published that, of U.S. adults, 27.2% had more than one chronic ailment, and more than half (51.8%) had at least one diagnostic chronic condition. Worldwide market prospects have been positively impacted by the increasing need for portable oxygen concentrators among patients with sleep apnea, owing to their convenient mobility.

Sales of portable oxygen concentrators are expected to grow as people with respiratory illnesses usually require additional oxygen to raise the oxygen content in their bloodstream and promote oxygen delivery to their tissues. Portable oxygen concentrators are used by non-pressurized airplanes, the glassblowing industry, and the skin care sector. The growth of the portable oxygen concentrators market is also expected to rise due to changing lifestyles, increasing affordability, and rising expenditure in healthcare systems.

Key Portable Oxygen Concentrators Market Insights Summary:

Regional Highlights:

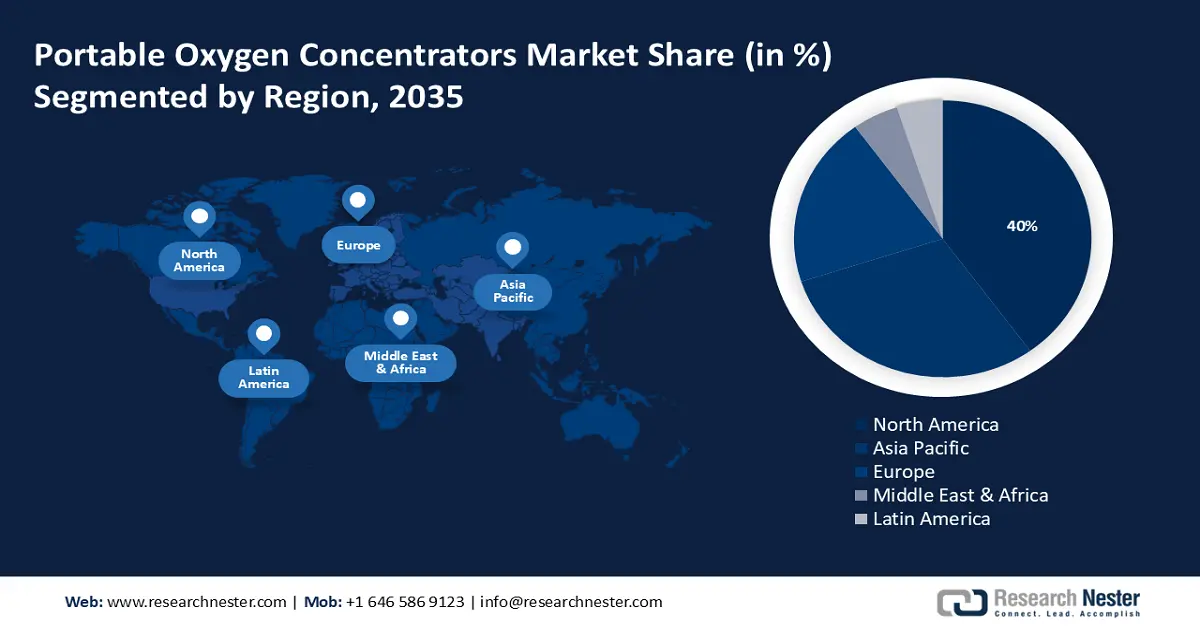

- The North America portable oxygen concentrators market will account for 40% share by 2035, driven by rising respiratory disorder rates and Medicare coverage for portable oxygen concentrators.

Segment Insights:

- The pulse flow segment in the portable oxygen concentrators market is expected to dominate by 2035, influenced by increased energy efficiency and longer battery life.

- The asthma segment in the portable oxygen concentrators market is forecasted to achieve a notable revenue share by 2035, driven by the rising prevalence of asthma and effective product availability.

Key Growth Trends:

- Increasing prevalence of chronic obstructive pulmonary diseases (COPD)

- Growing number of elderly people worldwide

Major Challenges:

- Strict government regulations and procedures for reimbursement

- Exorbitant price and scarcity of these devices

Key Players: Besco Medical Limited, CAIRE Inc., Chart Industries, Drive DeVilbiss Healthcare, Foshan Keyhub Electronic Industries Co. Ltd., GCE Group, GiveIndia, Inogen, Inc.

Global Portable Oxygen Concentrators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.14 billion

- 2026 Market Size: USD 2.31 billion

- Projected Market Size: USD 4.97 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Portable Oxygen Concentrators Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing prevalence of chronic obstructive pulmonary diseases (COPD): The need for portable oxygen concentrators is increasing owing to the rise in the prevalence of COPD, the quick development and accessibility of different types of concentrators, and the availability of simple-to-use oxygen concentrators for medical treatment. Patients with COPD typically use portable oxygen cylinders for everyday tasks including housework, work, and shopping. The World Health Organization (WHO) reported that COPD was the third most common cause of mortality worldwide, affecting over 65 million individuals and accounting for 3 million deaths in 2019.

-

Growing number of elderly people worldwide: The need for portable oxygen concentrators and the world's aging population is driving portable oxygen concentrators market expansion. For instance, according to data published in 2022 by WHO, the percentage of the elderly population in the world will almost triple from 12% to 22% between 2015 and 2050. Furthermore, growing urbanization and increased levels of disposable income are the drivers of the market expansion for portable oxygen concentrators.

- Continuous release of new products: Leading companies are investing more in developing portable pulse and continuous-flow oxygen concentrators to cater to the rising demand. One such example is the launch of medical-grade oxygen concentrators by Servotech Power Systems in 2021 to help IIT Jammu and IISER Bhopal develop oxygen concentrators in India. Servotech has also extended its network of strategic alliances by working with these institutions. Concentrators for hospitals, foundations, medical facilities, commercial establishments, and other important stakeholders in need of the product will be supplied by Servotech.

Challenges

-

Strict government regulations and procedures for reimbursement: Governments' strict guidelines and reimbursement practices may limit the general use of portable oxygen concentrators. Furthermore, modifications to the FDA's medical device approval procedure in numerous nations may limit portable oxygen concentrators market expansion to some degree throughout the projection period.

-

Exorbitant price and scarcity of these devices: One of the obstacles to the widespread usage of portable oxygen concentrators is their cost. POC acceptability is low in emerging economies due to low disposable income and a greater product price compared to developed countries. Another problem is that these devices are not as easily accessible in remote areas and countries with undeveloped healthcare systems.

Portable Oxygen Concentrators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 2.14 billion |

|

Forecast Year Market Size (2035) |

USD 4.97 billion |

|

Regional Scope |

|

Portable Oxygen Concentrators Market Segmentation:

Technology Segment Analysis

The pulse flow segment is poised to capture about 68.1% portable oxygen concentrators market share during the forecast period. The segment is expanding due to the system's increased energy efficiency and longer battery life. Patients are also adopting pulse flow portable oxygen concentrators at a high rate since they are more convenient to carry, dependable, and provide oxygen just when needed. There are smaller portable oxygen concentrators with pulse flow that don't waste oxygen.

The segment is anticipated to expand quickly over the next several years due to its affordability and ease of use. The U.S. Census Bureau projects that by 2050, there will be 80 million older people living in the country. This can result in a strong demand for pulse-flow portable oxygen concentrators going ahead.

Indication Segment Analysis

The asthma segment in the portable oxygen concentrators market is set to garner a notable share during the forecast period due to the rising prevalence of asthma and the availability of highly effective portable oxygen concentrators. In 2020, the Global Initiative for Asthma (GINA) stated that 1-18% of populations in different countries suffer from asthma, and the prevalence has been increasing globally. To cater to this, many key players are developing and launching novel and more effective products for asthma patients.

In May 2023, Drive DeVilbiss announced the launch of an oxygen concentrator 1060 AW especially for rural and semi-urban areas. This is a 10-liter capacity oxygen concentrator designed to cater to the needs of challenging cases of asthma and other breathing issues.

Our in-depth analysis of the portable oxygen concentrators market includes the following segments:

|

Technology |

|

|

Indication |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Oxygen Concentrators Market Regional Analysis:

North America Market Insights

North America industry is predicted to account for largest revenue share of 40% by 2035. The market’s growth is due to a well-established healthcare system, rising awareness of cutting-edge treatment options, and increasing rates of respiratory disorders such as asthma and COPD. According to research published by the CDC (2021), 14.2 million (6.5%) adult Americans had COPD as diagnosed by physicians.

The portable oxygen concentrators market is expanding in the U.S. due to significant R&D spending and new product launches. Additionally, there has been a notable rise in the medicare coverage rate of portable oxygen concentrators (POCs) in the U.S. According to an analysis of Medicare claims data, the penetration rate of POCs was 22.0% in 2021 while that of stationary was 17%. This suggests that POCs are becoming more widely accepted than stationary oxygen concentrators, which is further fueling the market's expansion.

APAC Market Insights

Asia Pacific will also encounter huge growth in the portable oxygen concentrators market during the forecast period owing to rising COPD and asthma patients, improving healthcare infrastructure, and growing adoption of advanced devices including, portable oxygen concentrators. By 2030, healthcare spending in Asia-Pacific will be the fastest-growing globally, making up over 20% of total consumption.

Due to government infrastructure spending, urbanization, and economic growth, China is spending more on healthcare. Patients have easier access to concentrators and other medical devices in China owing to the increased healthcare spending and availability of advanced healthcare services. The amount spent on healthcare per person in 2022 was almost USD 6,044, up from roughly USD 5,440 in the year before.

The aging population, rising prevalence of respiratory diseases, and growing demand for in-home medical equipment are the main factors driving the portable oxygen concentrators market in Japan.

With their investment money and reasonable reimbursement guidelines, the government and private sector are encouraging market expansion in South Korea. Strategic moves like company mergers or acquisitions serve as platforms and foster the emergence of new market players.

Portable Oxygen Concentrators Market Players:

- OxyGo LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Besco Medical Limited

- CAIRE Inc.

- Chart Industries

- Drive DeVilbiss Healthcare

- Foshan Keyhub Electronic Industries Co. Ltd.

- GCE Group

- GiveIndia

- Inogen, Inc.

The portable oxygen concentrators market competitive environment is defined by the existence of multiple major competitors competing for market share. These businesses work hard to create cutting-edge goods, widen their networks of distribution, and offer thorough after-sales service. These companies are adopting several strategies such as mergers and acquisitions, partnerships, joint ventures, and product launches to enhance their product base and maintain their market position.

Here are some key players operating in the portable oxygen concentrators market:

Recent Developments

- In July 2023, VARON, a leading supplier of oxygen concentrators announced the addition of VP2 in its portable oxygen concentrator series. This device incorporates innovate technology and is equipped with advanced features to provide efficient and reliable oxygen supply to patients.

- In March 2022, GRS India with support from the North East Centre for Technology Application and Reach (NECTAR) announced the launch of a field-portable small bag pack emergency oxygen concentrator, Oxygen Plus. The product is most suitable for easy transportation in hilly regions of North East India.

- Report ID: 6349

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.