Polypropylene Yarn Market Outlook:

Polypropylene Yarn Market size was over USD 19.18 billion in 2025 and is poised to exceed USD 32.15 billion by 2035, growing at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polypropylene yarn is evaluated at USD 20.09 billion.

The market’s growth is owed to the high demand for polypropylene yarn from the textile industry owing to favorable properties such as high tensile strength and cost-effectiveness boosting its application. The market is positioned to benefit from the versatility of polypropylene yarn and leverage demands from the industrial and packaging sectors to continue its growth curve.

A significant growth driver of the market is the cost advantage offered in comparison to other synthetic yarns. The sector witnesses increasing demand from the agricultural sector to make twines and crop covers due to the UV resistance features of polypropylene yarn. Additionally, the consumer shift towards sustainable products aligns with polypropylene’s recyclable characteristics, positioning it as an ideal choice in the burgeoning eco-friendly products market. For instance, in March 2024, U.S. Shell announced a partnership with Braskem for sustainable polypropylene. With surging advances in blends and finishes to improve the aesthetics of polypropylene yarn, the sector is positioned to experience increased adoption in home furnishings, fashion, and apparel.

Key Polypropylene Yarn Market Insights Summary:

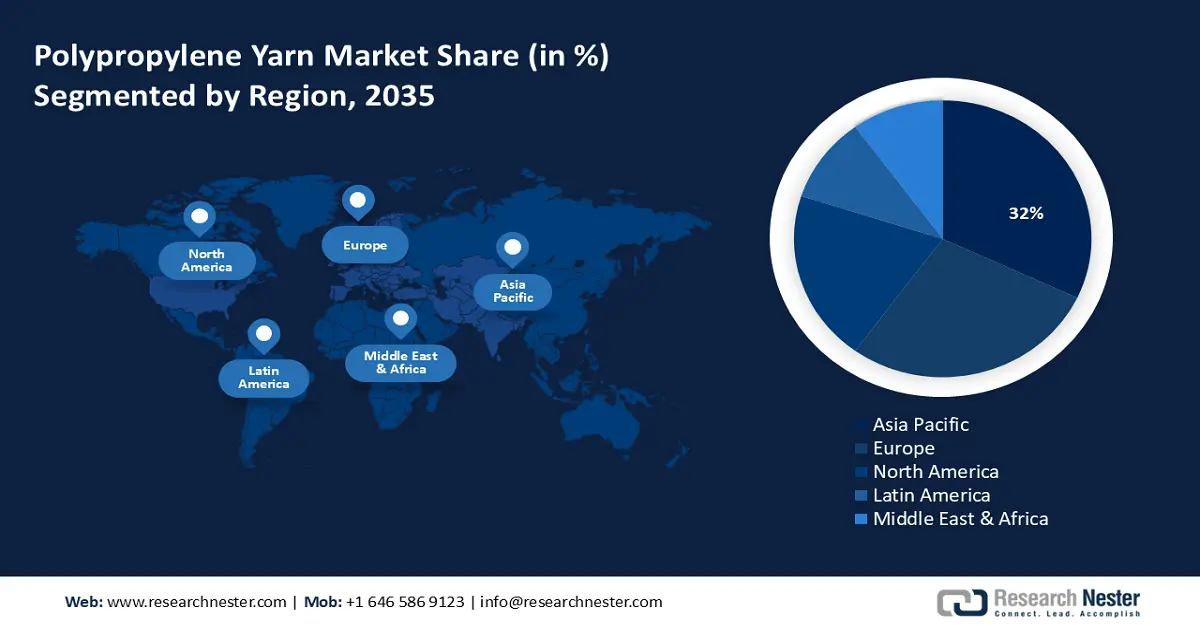

Regional Highlights:

- Asia Pacific leads the polypropylene yarn market with a 32% share, driven by the extensive manufacturing sector and rising demand in textile, automotive, and construction industries, fostering growth through 2026–2035.

- Europe is anticipated to achieve the fastest growth in the Polypropylene Yarn Market from 2026 to 2035, driven by the rising demand for bio-based polypropylene yarn to cater to eco-friendly consumer demands.

Segment Insights:

- The POY segment is anticipated to capture a significant market share by 2035, driven by its versatile applications in industrial and textile sectors.

- The Fully Drawn Polypropylene (FDY) segment is poised for substantial growth from 2026-2035, fueled by rising applications in durable materials like sportswear and industrial fabrics.

Key Growth Trends:

- Rising demand in automotive and industrial sectors

- Growing demand for sustainable and recyclable applications

Major Challenges:

- Competition from alternative fibers

- Environmental concerns and regulatory pressure

- Key Players: Barnet, Shanghai Yishi Industrial Co., Ltd., Lankhorst Yarns, Antex, Agropoli, Cordex, Dostlar, Filatex India Co, Ltd., and Chemosvit Fibrochem.

Global Polypropylene Yarn Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.18 billion

- 2026 Market Size: USD 20.09 billion

- Projected Market Size: USD 32.15 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Polypropylene Yarn Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand in automotive and industrial sectors: The high tensile strength of polypropylene yarn has made it a key product in industrial and automotive applications. Manufacturers are seeking to improve the aesthetics of the yarn to increase adoption in the automotive sector. For instance, in July 2024, Borealis announced the launch of glass fiber-reinforced polypropylene compounding with 65% post-consumer recycled polymer content which will be used in the interiors of automotives. The industrial sector is fueling demands for polypropylene yarn to manufacture safety nets and webbings that can withstand high temperatures. The global polypropylene yarn sector is poised to leverage steady demands from the automotive and industrial sectors.

-

Growing demand for sustainable and recyclable applications: Globally, there is a sustained push for eco-friendly materials propelled by changing consumer trends seeking recyclable products. Polypropylene yarn is the only fiber that is classified within the Higgs index as one of the most sustainable fibers offering consumers and manufacturers a certification of sustainability for the supply chain. The shift to a circular economy is poised to boost demands for polypropylene yarns. The United Nations Economic Commission for Europe (UNECE) highlighted the member states decisions at the 69th commission session to implement digital and green transformations for sustainable development to harness trade for transition to circular economy. For instance, in November 2021, Sulzer announced new recycling opportunities for ocean-bound plastic waste and will process polypropylene to turn it into yarn and filament.

- Advancements in yarn manufacturing: The global polypropylene yarn market is poised to benefit from advancements in texturizing, extrusion, and finishing processes that enhance the quality, texture, and functionality of polypropylene yarn boosting its adoption. Smart fabrics combine functionality with user comfort necessitating yarns that can support frequent washing. Polypropylene yarn fulfils the demand owing to low moisture absorption features positioning them as ideal for textiles in applications such as conductive fabric and embedded sensors in clothing.

Additionally, advancements allow manufacturers to produce high-performance polypropylene yarn to meet specific demands of the industries, boosting a competitive edge in the global market.

Challenges

-

Competition from alternative fibers: The market’s growth can be slowed owing to increased competition from other natural and synthetic fibers, such as cotton, nylon, polyester, etc. Polypropylene yarn can face disadvantages due to the durability of alternative fibers. The competitive market experiences continued innovations while keeping prices competitive, which can prove to be a challenge in a saturated market for the adoption of polypropylene yarns

-

Environmental concerns and regulatory pressure: The global polypropylene yarn sector can face challenges to its growth due to growing pressure on manufacturers for sustainable production practices that can drive the cost of production. With a surge in the popularity of biodegradable alternatives, the polypropylene yarn market can have its share reduced curtailing its growth. With rising concerns about the environmental impact of synthetic materials placing an onus on manufacturers, the sector has to navigate the challenges. The market is positioned to leverage the use of polypropylene in yarns to address environmental concerns.

Polypropylene Yarn Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 19.18 billion |

|

Forecast Year Market Size (2035) |

USD 32.15 billion |

|

Regional Scope |

|

Polypropylene Yarn Market Segmentation:

Process Type (Partially Oriented Polypropylene (POY), Fully Drawn Polypropylene (FDY), Draw Textured Yarn)

Partially Oriented Polypropylene (POY) segment is anticipated to capture over 47.7%. polypropylene yarn market share by 2035. The segment’s growth is due to its versatile applications in the industrial and textile sectors. POY is positioned as an essential component as a precursor for fully drawn yarn (FDY) and textured yarn boosting demands in the production of fabrics of varying degrees of elasticity and durability. Manufacturers implement POYs' customizable properties to create end-products that meet specific requirements boosting the segment’s growth. For instance, in June 2024, Dow announced the development of REVOLOOP recycled plastic resins to advance the circularity initiative.

The fully drawn polypropylene (FDY) segment of the market is poised to increase its revenue share during the forecast period. The growth of the segment is attributed to rising applications that require robust, durable materials, such as sportswear, upholstery, industrial fabrics, etc. Technological advancements in spinning processes have improved yarn quality benefiting the segment’s growth curve. The heightened resistance to wear and tear has positioned FDY to answer demands for durable fabrics. For instance, in January 2024, Celanese and Underamour announced the development of innovative new neolast fiber for use in performance stretch fabrics.

Product Type (Multifilament Yarn, Monofilament Yarn, Spun Yarn, Textured Yarn, Dyed Yarn, Fibrillated Yarn, Tape Yarn, Air Textured Yarn)

By product type of the global polypropylene yarn market, the multifilament yarn segment is poised to register the largest revenue share. The growth of the segment is owed to the cost-effectiveness of multifilament yarns and is positioned to increase its revenue share in emerging economies where demand for affordable and high-quality textiles is rising. The application of multifilament yarn is poised to increase in activewear, medical products, and home textiles owing to its durability. Businesses are investing in advancements in multifilament yarn that are projected to maintain the segment’s robust growth curve. For instance, in September 2024, the Filament Factory (TFF) launched a high-performance PA12 high-strength multifilament yarn leveraging a partnership with Evonik.

Our in-depth analysis of the global market includes the following segments:

|

Process Type |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polypropylene Yarn Market Regional Analysis:

APAC Market Forecast

Asia Pacific industry is predicted to dominate majority revenue share of 32% by 2035. The market’s growth in the region is owed to an extensive manufacturing sector and rising demands in the textile, automotive, and construction industries. The market in APAC is led by China, India, Japan, and South Korea. The rapid urbanization in emerging economies in APAC has fueled market opportunities. A significant driver in the region is the low production costs coupled with a skilled workforce providing the framework to create a robust production and supply chain. For instance, in May 2021, Hanwha Total based in South Korea announced an investment of USD 1.3 billion to develop a new polypropylene line at the Daesan complex to boost production capacity.

China registered the largest market share in the market of APAC. The dominant revenue share of China is attributed to its position as the largest textile exporter globally. China accounts for USD 148 billion worth of exports of textiles as of 2022. The market benefits from the steady demand for polypropylene yarn in domestic textile manufacturing. Additionally, the polypropylene exports of China are estimated to double in 2024 benefiting from capacity expansion and the trends are favorable for the continued profitable growth of the polypropylene market in China.

India is poised to increase its revenue share in the polypropylene market. The growth is owed to a thriving textile sector and rising demands in packaging and agriculture. India has a burgeoning textile sector. For instance, Invest India estimates the domestic textile market in the country at USD 165 billion in 2022, out of which 40 billion was from exports. India is positioned to benefit from the rising demand for textiles globally and U.S. sanctions on China to fill the supply chain gaps. Additionally, the rising disposable income of the middle class in the country has boosted the demand for high-quality home textiles, where polypropylene yarn is utilized in the manufacturing process.

Europe Market Analysis

The Europe market is poised to register the fastest revenue share in the global polypropylene yarn market. The market’s growth is owed to a rising commitment to circular economy principles. A key growth driver is the rising demand for bio-based polypropylene yarn to cater to domestic consumer demands for eco-friendly products. The World Integrated Trade Solution estimated the trade value of European value in polypropylene was USD 1.7 billion in 2022.

Germany is projected to register the largest revenue share in the market in Europe. The growth is fueled by rising demands by manufacturers for applications in seat covers, trunk fabrics, interior linings, etc. Rising investments in automation and research and development to improve the resilience of polypropylene yarn are poised to continue the sector’s growth curve in the country. For instance, in April 2024, Filidea Technical Yarns presented sustainability and technology for recycling fibers.

France is poised to increase its revenue share in the polypropylene yarn market. The growth of the market in France is attributed to demands in the production of non-woven medical textiles. Additionally, the growth of green buildings in the nation is leading to a surge in demand for geotextiles in sustainable infrastructure projects. For instance, in July 2024, Carbios and Nouvelles announced a partnership to develop the French polyester recycling industry.

Key Polypropylene Yarn Market Players:

- Barnet

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shanghai Yishi Industrial Co., Ltd.

- Lankhorst Yarns

- Antex

- Agropoli

- Cordex

- Dostlar

- Filatex India Co, Ltd.

- Chemosvit Fibrochem

The global polypropylene yarn market is poised to register a profitable growth during the forecast period. Key players in the market are investing in increasing production capabilities and partnerships to increase the revenue share.

Here are some key players in the market:

Recent Developments

- In October 2024, trinamix GmbH announced that they will join the inaugural Plastic Recycling Show Asia in 2024, Singapore to showcase their versatile plastics and textile identification technology to the Southeast-Asian market.

- In July 2024, PureCycle, MiniFIBERS, Beverly Knits announced the production of several high-quality product samples. MiniFIBERS used PureCycle resin produced from post-consumer recycled (PCR) waste to create fiber packages.

- Report ID: 6661

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polypropylene Yarn Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.