Polymer Emulsion Market Outlook:

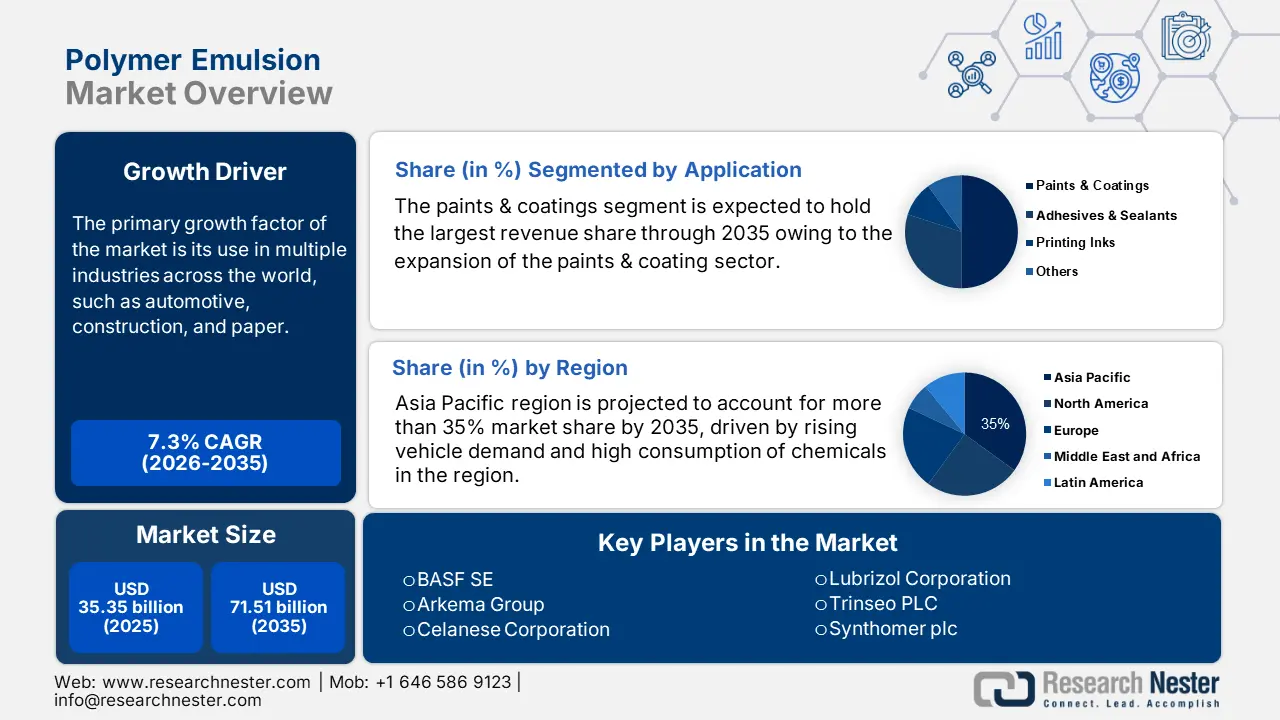

Polymer Emulsion Market size was valued at USD 35.35 Billion in 2025 and is expected to reach USD 71.51 Billion by 2035, expanding at around 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polymer emulsion is evaluated at USD 37.67 Billion.

The primary growth factor of the market is its use in multiple industries across the world, such as automotive, construction, and paper. The growth and revenue generated by these industries directly affect market growth. For instance, in 2019, the construction industry in the U.S. generated a revenue of approximately USD 2 trillion.

With the increasing rate of urbanization, the need for construction of the building has been emerging from the burgeoning populations of several countries. This trend is creating higher demands for labor thus, the high employment rate in the construction industry is expected to increase the adoption rate of polymer emulsion in the assessment period. As of 2021, there were almost 10 million construction workers in the United States, approximately 8% of the total working population. Besides this, higher sales of automobiles are expected to propel the growth of the market. In 2021, almost 3 million passenger automobiles were sold in the United States, while 56 million were sold in China. Furthermore, the growing paint industry and higher spending, and the research and development sector are expected to boost the market’s growth.

Key Polymer Emulsion Market Insights Summary:

Regional Highlights:

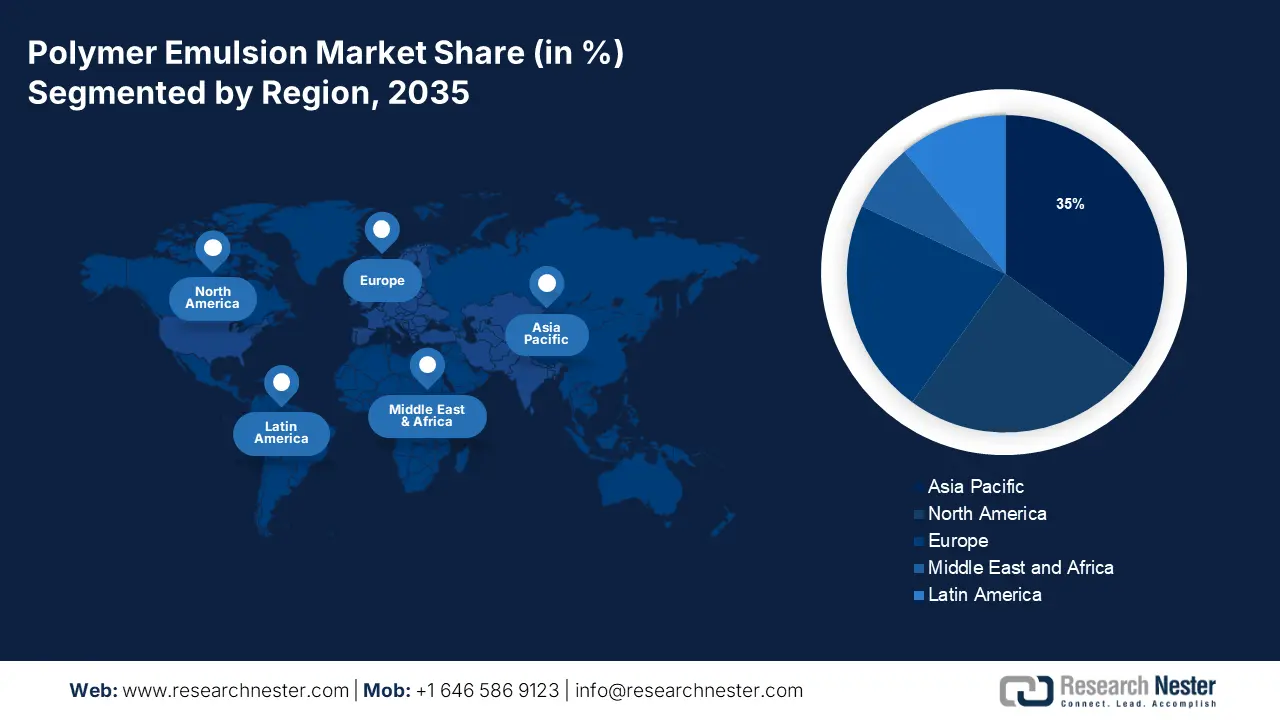

- Asia Pacific polymer emulsion market will hold over 35% share by 2035, driven by rising vehicle demand and high consumption of chemicals in the region.

Segment Insights:

- The paints and coatings segment in the polymer emulsion market is expected to achieve the highest market share by 2035, driven by expansion in the paints & coatings industry and increasing construction demand.

- The pulp & paper segment in the polymer emulsion market is expected to hold the highest market share by 2035, fueled by growing global paper usage and performance needs in papermaking.

Key Growth Trends:

- Boom in the Paints & Coatings Industry

- Development in Chemical Industry

Major Challenges:

- Fluctuation in Costs of Raw Materials

- Long Production Cycles

Key Players: DIC Corporation, BASF SE, Arkema Group, Celanese Corporation, Wacker Chemie AG, OMNOVA Solutions Inc., Momentive Performance Materials Inc., Lubrizol Corporation, Trinseo PLC, Synthomer plc.

Global Polymer Emulsion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.35 Billion

- 2026 Market Size: USD 37.67 Billion

- Projected Market Size: USD 71.51 Billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Polymer Emulsion Market Growth Drivers and Challenges:

Growth Drivers

- Boom in the Paints & Coatings Industry – Owing to their distinct advantages and capacity to enhance the finishing of the final product, polymer emulsions are extensively employed in the paint and coatings industry. Indoor and outdoor paints, structural coatings, and protective coatings are just a few of the paint and coating kinds that can employ polymer emulsions. The growing construction rate has propelled the utilization of paints and adhesives in various processes. Thus, the growing need for paints & adhesives is expected to attract growth opportunities for the polymer emulsion market. In 2020, the global paint and coatings industry was estimated to be valued at USD 160 billion globally.

- Expansion of the Automotive Industry - Polymer emulsions are largely employed in the manufacture of vehicle coatings in the automotive sector. They can be utilized to enhance the coating's water resistance, flexibility, and other crucial attributes for automobile coatings. Additionally, they can be employed to improve the coating's adherence to the surface and improve the look in general. Additionally, they may be utilized in the creation of sealants and adhesives for vehicles, which are employed to assemble various components. Recent calculations stated that revenue generated worldwide by the global automotive industry by 2030 is projected to reach USD 9 trillion.

- Development in Chemical Industry – Polymer emulsions are used in the chemical industry for a variety of purposes, including lubricants, and as a starting point for the synthesis of additional polymers. Additionally, they can be employed as a dispersing agent to assist maintain the suspensions of insoluble compounds in liquids. The latest reports stated that the revenue garnered by the global chemical industry in the year 2021 was approximately 4 trillion dollars, a considerable increment from the previous year with 3 trillion dollars.

- Increased Research and Development Expenditure – As per the World Bank, the statistics revealed that the expenditure on research and development activities accounted to be 2.63% of the total GDP in 2020, a considerable rise from the year 2017 with 2.13% of the total GDP.

Challenges

- Fluctuation in Costs of Raw Materials

- Stringent Government Rules - Polymer emulsion involves the secretion of lots of harmful chemicals into the environment, which impacts both human and ecological health. Therefore, governments worldwide mandate strict rules and regulations to prevent the exploitation of the environment.

- Long Production Cycles

Polymer Emulsion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 35.35 Billion |

|

Forecast Year Market Size (2035) |

USD 71.51 Billion |

|

Regional Scope |

|

Polymer Emulsion Market Segmentation:

Application Segment Analysis

The global polymer emulsion market is segmented and analyzed for demand and supply by application into paints & coatings, adhesives & sealants, printing inks, and others. Out of these, the paints and coatings segment is anticipated to garner the highest revenue by 2035, owing to the expansion of the paints & coating sector. As per recent estimates, the volume of the paints & coatings industry stood at around 10 billion gallons in 2019 in the United States. Further, the high demand for paints from the construction sector is another growth factor in the segment. In 2020, the consumption of architectural paint in the U.S. amounted to around 860 million gallons.

End-user Segment Analysis

The global polymer emulsion market is also segmented and analyzed for demand and supply by end-users into automotive, pulp & paper, construction, textile, industrial, and others. Out of these, the pulp & paper segment is anticipated to garner the highest revenue by 2035. This can be owed to the growing use of paper across the world. Moreover, there are various kinds of emulsion polymers that are employed during the different phases of papermaking. They are employed to add durability, tear resistance, and strength. Furthermore, the specialized paper applications call for exacting performance standards. For instance, over 400 tons of paper are produced every year globally.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Emulsion Market Regional Analysis:

Asia Pacific region is projected to account for more than 35% market share by 2035, driven by rising vehicle demand and high consumption of chemicals in the region. As per the International Organization of Motor Vehicles, the total production of vehicles in the region was approximately 46 million units in 2021, a rise from around 44 million units in 2020. Similarly, the total sales in the region were nearly 42 million units in 2021, a rise from around 40 million in 2020. Further, the high consumption and sales of chemicals in the region are also projected to drive market in the forecast period. The domestic sales of chemicals in the Asia Pacific region were worth around USD 3 trillion in 2021.

Polymer Emulsion Market Players:

- DIC Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Arkema Group

- Celanese Corporation

- Wacker Chemie AG

- OMNOVA Solutions Inc.

- Momentive Performance Materials Inc.

- Lubrizol Corporation

- Trinseo PLC

- Synthomer plc

Recent Developments

-

BASF SE has joined hands with SIBUR to develop innovative polymer solutions at SIBUR’s PolyLab Research and Development Center located in Moscow, Russia.

-

DIC Corporation announced acquire BASF’s global pigments business, known as BASF Colors & Effects (BCE), which is expected to broaden the company’s portfolio as a global manufacturer of pigments, including those for electronic displays, cosmetics, coatings, plastics, inks, and specialty applications

- Report ID: 4549

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Emulsion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.