Polyester Film Market Outlook:

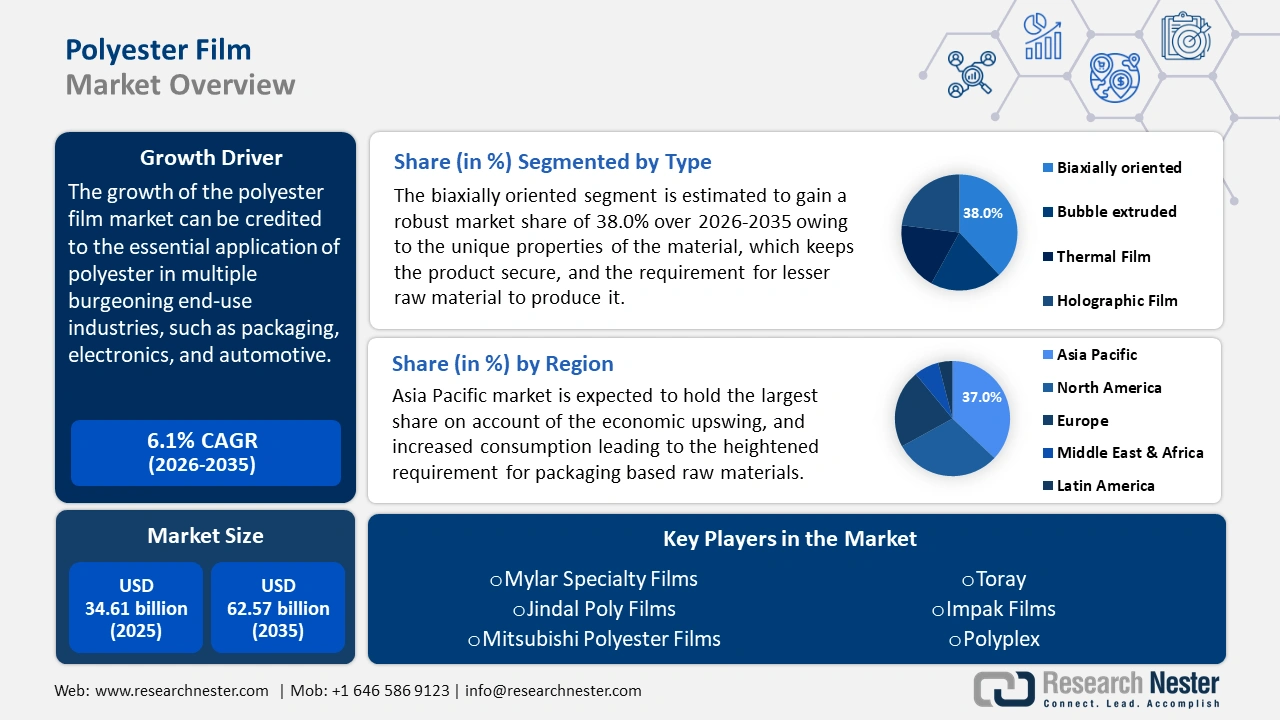

Polyester Film Market size was valued at USD 34.61 billion in 2025 and is set to exceed USD 62.57 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyester film is estimated at USD 36.51 billion.

The growth of the polyester film market can be credited to the essential application of polyester in multiple burgeoning end-use industries, such as packaging, electronics, and automotive. For instance, polyester (primarily polyethylene terephthalate-PET-but also polybutylene terephthalate-PBT-and polyethylene naphthalate-PEN) is the most common fiber used in the production of automotive textiles. It accounts for 42%, whereas polyamide 6.6 (PA 6.6) makes up 26%. These fibers are preferred because of their good physical qualities, strong mechanical performance, dyeability, and low cost.

Key Polyester Film Market Insights Summary:

Regional Highlights:

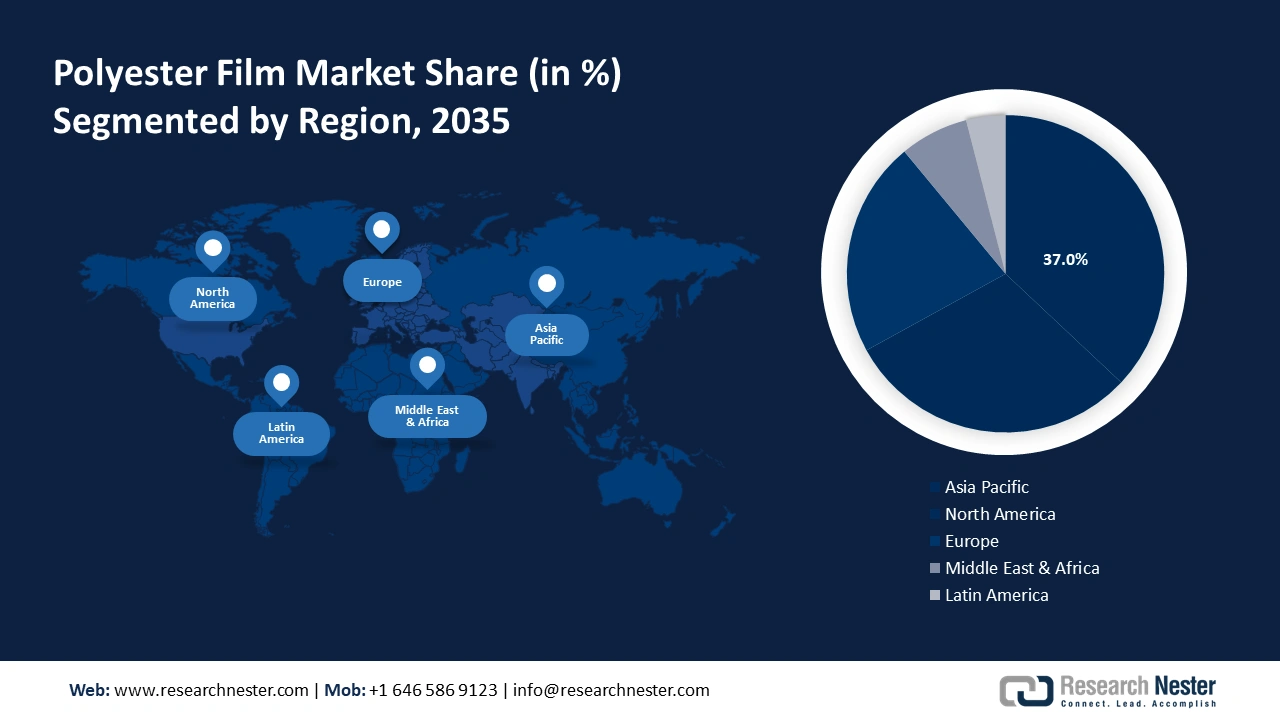

- Asia Pacific’s polyester film market will account for 37% share by 2035, driven by economic upswing and increased consumption leading to higher demand for packaging raw materials.

- North America market will capture a 30% share by 2035, driven by increased consumption of packaged food and beverages alongside industrialization and commercialization.

Segment Insights:

- The biaxially oriented segment in the polyester film market is expected to grow significantly by 2035, driven by its unique attributes like barrier to water vapor, dimensional stability, and recyclability.

- The <50 microns segment in the polyester film market is expected to secure a 30% share by 2035, driven by high mechanical strength, elasticity, and dimensional stability in lamination processes.

Key Growth Trends:

- Rising demand for flexible packaging

- Easier label printability

Major Challenges:

- Rising demand for flexible packaging

- Easier label printability

Key Players: Toray Industries, Inc., DuPont Teijin Films, Mitsubishi Chemical Corporation, Kolon Industries, Inc., SKC Inc., Polyplex Corporation Ltd., Jindal Poly Films Ltd., Ester Industries Limited, Garware Polyester Ltd., Terphane (Tredegar Corporation).

Global Polyester Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.61 billion

- 2026 Market Size: USD 36.51 billion

- Projected Market Size: USD 62.57 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 18 September, 2025

Polyester Film Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for flexible packaging: Polyester films are widely used in flexible packaging due to their high strength, clarity, and resistance to moisture and gases. These properties make them ideal for extending the shelf life of products, protecting contents, and providing aesthetic appeal. As consumer demand for convenient and longer-lasting packaging solutions increases, the need for polyester films in flexible packaging applications is also growing. This trend is expected to continue driving polyester film market expansion. The rising demand for flexible packaging materials in FMCG products is driving revenue growth of the market. According to Flexible Packaging Association (FPA), the flexible packaging industry had USD 41.5 billion in sales in the United States in 2022.

-

Easier label printability: Polyester film labels are preferred for their longevity and water-repellency, conveniently bonding to all kinds of materials like coarse surfaces, oily metals, or even low surface energy plastics. They are even immune to extreme temperatures, allowing the product descriptions to be legible throughout the shelf-life of the product, and more. The polyester film label components are categorized into face material, liner, and adhesive, each providing a peculiar resistance property. The smudge-resistant labels find their applications in various industries, particularly in, chemical labels, freezer labels, equipment, labels, warning labels, etc. According to a consumer survey, 77% of consumers are influenced by the labeling of the packaging when deciding to buy a product. This underscores the importance of a fitting label quality that polyester film fulfills.

- Superior insulation properties: Polyester film provides multiple dielectric properties, temperature resistance, flame retardance, and thermal stability. It is used extensively in cables, transformers, membrane touch switches, and wires, available in different thicknesses. Polyester film is also chemically treated to amplify their surface tension, to facilitate better adherence, thereby, increasing electrical insulation.

Challenges

-

Competitive environment: Polyester film, majorly utilized in packaging, finds its corrivals in paper, polyethylene, and polypropylene-based packaging, slightly limiting its market opportunities. Many of the mentioned materials provided cost-effective options, with finer properties, that may become the purchaser’s preference.

-

Regulatory challenges: A dynamic statutory regulation environment may pose a hurdle to the growth of the polyester film market. Adapting to the mercurial compliance requirements might prove to be expensive in the long run. The possibility of a retrenched economy and heightened focus on sustainability is also expected to hamper the prospects of this polyester film market.

Polyester Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 34.61 billion |

|

Forecast Year Market Size (2035) |

USD 62.57 billion |

|

Regional Scope |

|

Polyester Film Market Segmentation:

Type Segment Analysis

Biaxially Oriented segment is projected to account for around 38% polyester film market share by 2035. The segment growth can be connected to the wide applications of biaxially oriented polyester film due to its unique attributes such as favorable barrier to water vapor, different surface textures, dimensional stability, and high resistance to oil, grease, pollution, harmful chemicals, and recyclability. The biaxially oriented polyester film is the ideal choice for packaging when transporting goods due to their ability to keep the product secure, and resistant to elements. It’s also extensively used in printing, laminations, electrical appliances, adhesives, wrapping, and others. The primacy of this particular segment of polyester film is due to the fact that much lesser material is required to produce it, thereby leading to lesser wastage. Many innovations are still underway to produce even thinner films, all while preserving the distinguishable properties of the biaxially oriented polyester film. The low density of 900 kg/m3 with a width of 12–25 μm, allows its application even as a battery separator.

Product Segment Analysis

By 2035, <50 microns segment is expected to capture over 30% polyester film market share. The factors responsible for the growth of this segment are the high mechanical strength and elasticity. It also offers a greater operation temperature, upwards of 100°C, and offers top-notch dimensional stability. It is extensively used in lamination processes, providing stiffness, and adequate adhesion. These films are also utilized in electrical device production, with the support of the high stability of their loss tangent, and the dielectric constant over a broad frequency range. Polyester film is the most used substructure for apparel.

Application Segment Analysis

The pharmaceuticals segment in the polyester film market is estimated to gain the largest revenue share of 29% by the end of 2035. The segment growth can be credited to the uniform surface attributes, and opacity or transparency that is vital in the packaging of the medicines. The non-reactibility of the polyester films with the chemical components of the medicines makes them appropriate for use in the pharmaceutical industry. Additionally, they are also used in medical labeling, plastic face shields, and medical adhesives. The importance of polyester films has been underscored By the National Center for Biotechnology Information, which notes that 25-50% of polyester films are utilized in medical packaging as of 2022.

Our in-depth analysis of the polyester film market includes the following segments

|

Type |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyester Film Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 37% by 2035. The market growth in the region is expected on account of the economic upswing, and increased consumption leading to the heightened requirement for packaging based raw materials. The rising industrialization in the region is another aspect that is driving the demand for polyester film.

In China, urbanization has been observed in full swing, necessitating construction projects, and more demand for automobiles, wherein polyester films find their important use. The prevailing robust pharmaceutical industry in China has grown by 22% between 2018 and 2020. This determines that the polyester film market is expected to be at a progressive increase since it has a crucial application in various pharmaceutical end-products. The market for polyester film is expanding in South Korea as well since it is a crucial component in the production of flat panel displays.

North America Market Insights

The North America will witness a boost for the polyester film market during the forecast period, with a share of 30.0%, owing to the increased consumption of packaged food and beverages, alongside a solid industrialization, and commercialization in the region.

The U.S., particularly, will observe a jump in the demand for the polyester film due to the weightage given to the packaging of various goods, especially from the FMCG sector. The country is also home to multiple well-established firms that are thoroughly into research and development of more efficient packaging products utilizing polyester film. The reusability factor of the polyester film provides an eco-friendly option by employing it to manufacture other end-products, even after its use and putting its remarkable properties to use. Canada is also expected to generate revenue in the forecast period in the polyester film sector, as a result of its expansive application in the augmenting packaging-focused cosmetic industry.

Polyester Film Market Players:

- Mylar Specialty Films

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jindal Poly Films

- Mitsubishi Polyester Film

- Toray

- Polyplex

- Impak Films

- SRF Limited

- Kolon Industries

- Terphane

- Uflex

Multiple companies are investing heavily in R&D to further enhance the properties of the polyester film, and generate more areas of its applications. The diverse applications of polyester films are propelling its demands, and these companies are collaborating to produce a quality product.

Recent Developments

- In April 2024, UFlex, India's largest multinational flexible packaging and solutions company, has announced an important milestone in its journey of growth and innovation. On March 31, 2024, the company began commercializing poly-condensed polyester chips at its manufacturing site in Panipat, India.

- In October 2021, Mitsubishi Chemical Corporation announced plans to expand its HOSTAPHAN polyester film production capacity in Europe, including the installation of a new production line. The investment totals around 110 million euros and is projected to be finished by the end of 2024.

- Report ID: 6385

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyester Film Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.