Point-of-Entry Water Treatment Systems Market Outlook:

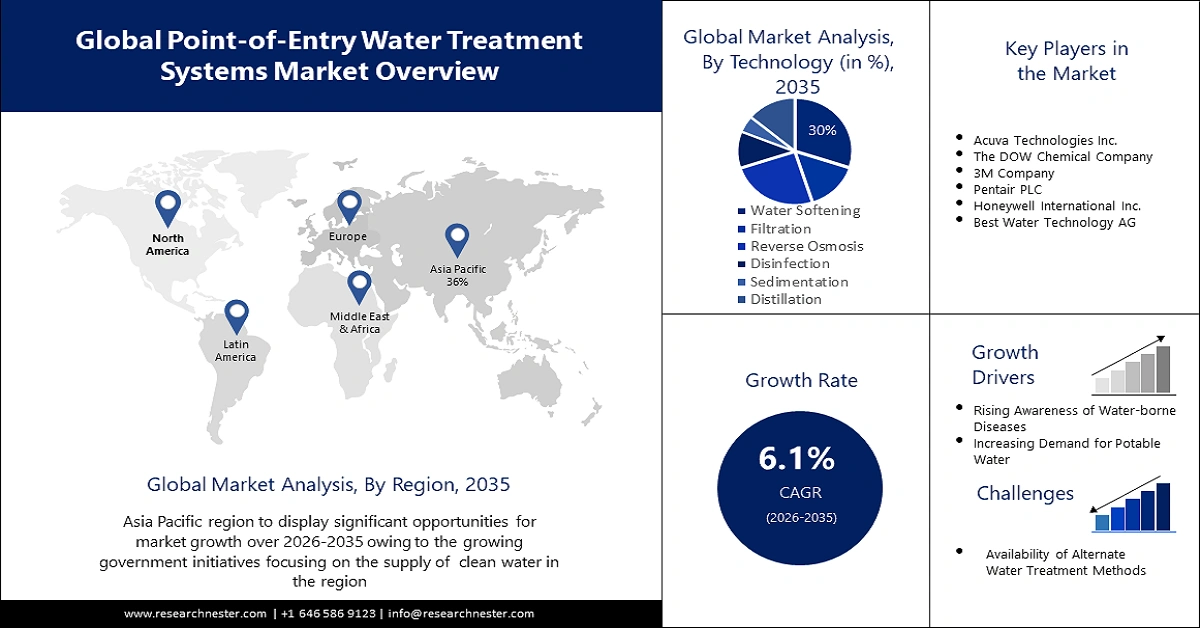

Point-of-Entry Water Treatment Systems Market size was over USD 11.01 billion in 2025 and is anticipated to cross USD 19.9 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of point-of-entry water treatment systems is assessed at USD 11.61 billion.

The growing global population and the increasing demand for potable and safe drinking water are major driving factors expected to propel industry growth.

The augmenting need for water purification processes globally with the rising demand for usable water owing to widespread waterborne diseases worldwide is predicted to create numerous revenue sources for the key players in the POE water treatment system. According to data found, around 2 billion people worldwide consume unsafe/contaminated water.

As point-of-entry water treatment systems employ softening systems, and large carbon filters, with other technologies that treat chemicals, and neutralize water by removal of dirt and sediment, its adoption is increasing to prevent the spread of water-related diseases.

Key Point-of-Entry Water Treatment Systems Market Insights Summary:

Regional Highlights:

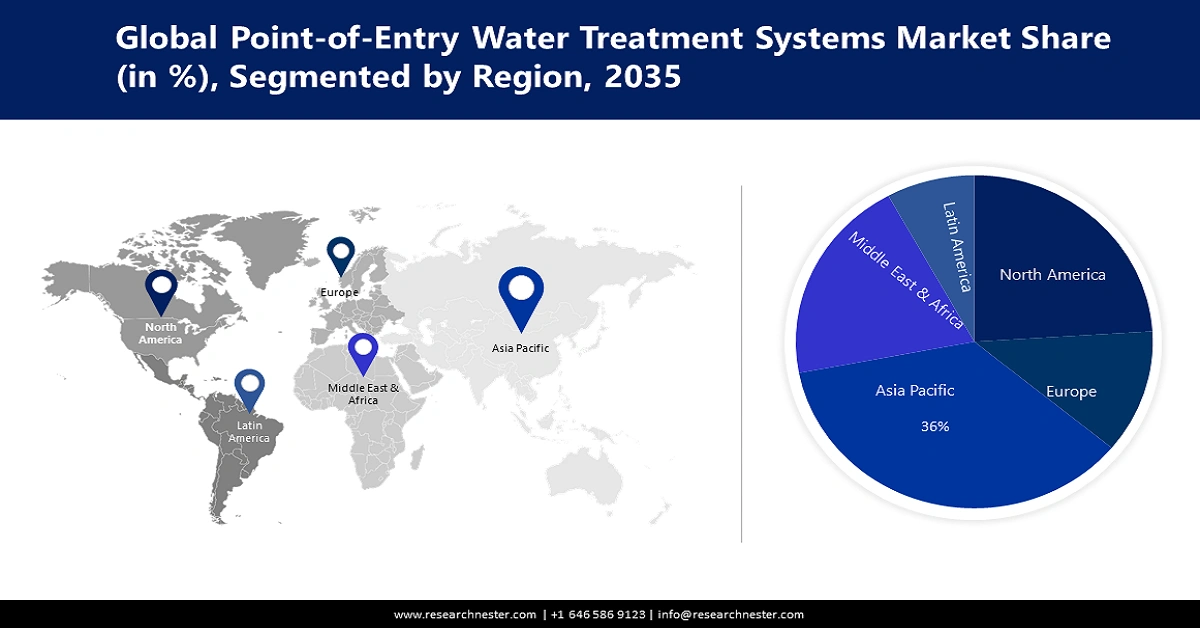

- Asia Pacific point-of-entry (POE) water treatment systems market will secure around 36% share by 2035, driven by government emphasis on safe drinking water and adoption of ultrafiltration and reverse osmosis technologies.

- North America market will account for 24% share by 2035, attributed to urbanization and increasing demand for clean water driven by awareness of waterborne diseases.

Segment Insights:

- The water-softening segment in the point-of-entry water treatment systems market is expected to capture a 30% share by 2035, driven by the rising need to utilize hard water with the escalating demand for water.

- The industrial segment in the point-of-entry water treatment systems market is projected to maintain a remarkable share by 2035, fueled by growing adoption of industrial water treatment systems for clean water compliance.

Key Growth Trends:

- Increasing Demand for Drinking Water

- Rising Government Emphasis on Clean Water

Major Challenges:

- High Cost of Operation & Maintenance

- Availability of Alternate Water Treatment Methods

Key Players: Canature Environmental Products Co., Ltd., Acuva Technologies Inc., The DOW Chemical Company, 3M Company, Pentair PLC, Honeywell International Inc., Best Water Technology AG, Calgon Carbon Corporation, Culligan International, Danaher Corporation.

Global Point-of-Entry Water Treatment Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.01 billion

- 2026 Market Size: USD 11.61 billion

- Projected Market Size: USD 19.9 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Point-of-Entry Water Treatment Systems Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Drinking Water – The rapidly growing need for clean and safe drinking water to prevent the transmission of diseases such as cholera, diarrhea, dysentery, and others is forwarding the need to install water purification systems, promoting market growth.

Moreover, the widespread of urban settlements and the rise in efforts to eliminate the supply of contaminated water together with surging installations of water and wastewater treatment plants are further projected to contribute numerous growth opportunities to the market.

- Rising Government Emphasis on Clean Water – The increasing implementation of several national and global initiatives in adherence with Sustainable Development Goal 6 that advocate "clean water and sanitation for all" is augmenting the installations of large water treatment plants to distribute clean water to the masses.

The increasing efforts to strengthen the water treatment infrastructure at several levels, including municipal water plants, individual buildings, and households are projected to drive point-of-entry water treatment systems market expansion.

Challenges

- High Cost of Operation & Maintenance – POE water treatment systems are most efficient for large projects and such adoption elevates the overall cost of operation and maintenance, hampering the market growth.

- Availability of Alternate Water Treatment Methods

- Lower Adoption Rate by Smaller Projects & Properties

Point-of-Entry Water Treatment Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 11.01 billion |

|

Forecast Year Market Size (2035) |

USD 19.9 billion |

|

Regional Scope |

|

Point-of-Entry Water Treatment Systems Market Segmentation:

Technology Segment Analysis

The water-softening segment in the point-of-entry water treatment systems market is anticipated to account for 30% share in the upcoming years, owing to the rising need to utilize hard water with the escalating demand for water. The softening system averts the build-up of minerals in water pipelines and fixtures and provides long life for some appliances. Water softeners are installed in buildings to treat the water entering the building.

Additionally, the disinfection segment is anticipated to garner the most revenue share, owing to the rapid setup of large water treatment plants to ensure the supply of water that has low levels of chemical disinfectant.

End-User Segment Analysis

Industrial segment is expected to capture remarkable revenue share by the end of 2035, accredited to the growing adoption of an industrial water treatment system that treats water and makes it usable for the required application. The growth in strict government regulations regarding the use of clean water in specific industries and the surging technological advancements is influencing the POE water treatment system installations depending on the facility's needs.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Point-of-Entry Water Treatment Systems Market Regional Analysis:

APAC Market Insights

The point-of-entry water treatment systems market in Asia Pacific is projected to be the largest with a share of about 36% by the end of 2035. The increasing government emphasis in emerging economies like India to provide safe drinking water is counted to expand the usage of water treatment technologies like ultrafiltration and reverse osmosis solutions, ultimately resulting in regional market expansion. The Government of India has taken an initiative to implement Jal Jeevan Mission (JJM) – Har Ghar Jal in partnership with States/UTs. This mission is developed to provide a potable tap water supply to each rural household by 2024.

Moreover, the existence of a vast pool population in the region and the scarcity of potable water in the middle and low-income countries is further expected to boost the market growth.

North American Market Insights

The North America point-of-entry water treatment systems market is estimated to be the second largest market with a share of about 24% by the end of 2035 owing to the growing urbanization along with elevating demand for clean water for consumption and usage.

The rising awareness about water-borne diseases in countries such as the United States is responsible for the endorsement of water treatment systems in the region. As per a projection by the Centers for Disease Control and Prevention on waterborne disease in the US, it was stated that waterborne pathogens result in 7,000 deaths, 120,000 hospitalizations, 7 million illnesses, and USD 3 billion in healthcare costs annually.

Point-of-Entry Water Treatment Systems Market Players:

- Canature Environmental Products Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acuva Technologies Inc.

- The DOW Chemical Company

- 3M Company

- Pentair PLC

- Honeywell International Inc.

- Best Water Technology AG

- Calgon Carbon Corporation

- Culligan International

- Danaher Corporation

Recent Developments

- Acuva Technologies Inc. launched a new Point-of-Entry (PoE) UV-LED water disinfection system, which offers flow rates from 8 to 20 GPM with minimal maintenance.

- Canature Environmental Products Co., Ltd. to join hands with Acuva, to develop UV-LED water treatment technology solutions in China.

- Report ID: 3819

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Point-of-Entry Water Treatment Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.