Plasmid DNA Manufacturing Market Outlook:

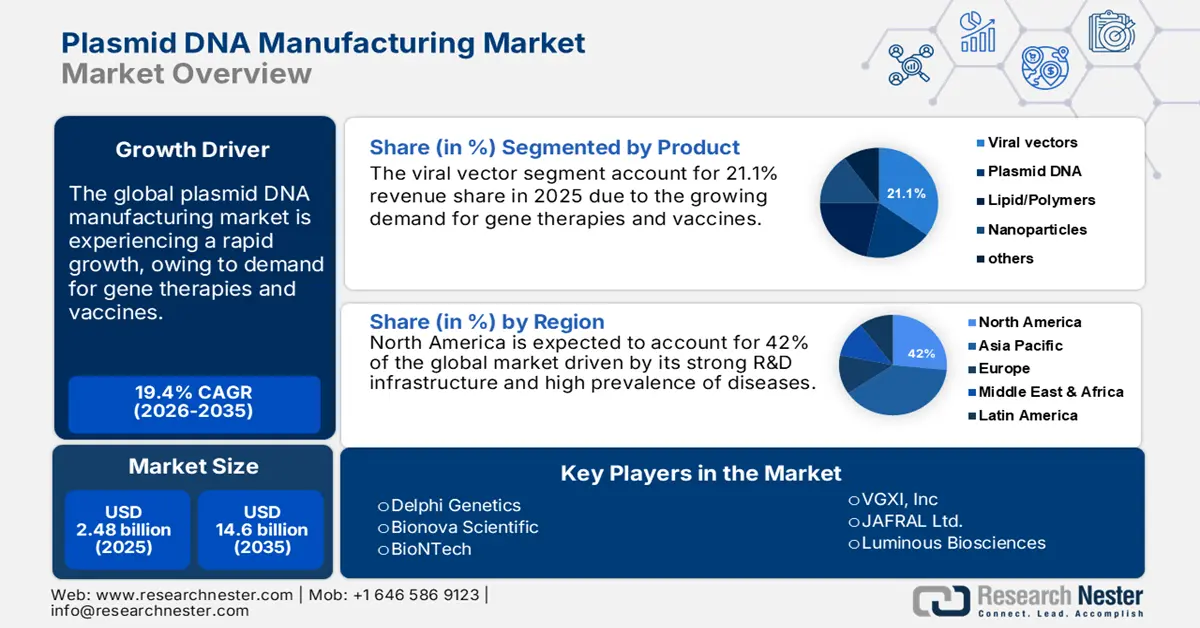

Plasmid DNA Manufacturing Market size was valued at USD 2.48 billion in 2025 and is expected to reach USD 14.6 billion by 2035, registering around 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plasmid DNA manufacturing is evaluated at USD 2.91 billion.

Plasmid DNA serves as a key starting material for transient transfection and can be utilized directly as therapeutic agents. The rising boons of Plasmid DNA in treating various ailments including gene therapy, genetic engineering, and producing vaccines reflects its high plasmid DNA manufacturing market demand in the healthcare industry. Plasmid DNA is essential for the development of vaccinations, innovative genes, and cell therapies. As a result of the ongoing development of novel plasmid DNA vaccines, production processes have become more efficient and precise.

Due to plasmid’s capacity to carry large numbers of DNAs with a low risk of oncogenesis or immunogenicity, they are preferred over recombinant viruses for the development of vaccines and gene therapy. Throughout the forecast period 2025-2037, it is anticipated that growing inorganic methodologies such as key competitors in the market striving together to expand their product portfolio will propel the plasmid DNA manufacturing market expansion. For instance, In September 2022, Touchlight and Lonza announced their partnership to support the genetic medical revolution. Through this partnership, Lonza will be able to render a comprehensive and end-to-end solution for creating messengers RNA vaccines, and treatments by incorporating a distinct source of DNA.

Key Plasmid DNA Manufacturing Market Market Insights Summary:

Regional Highlights:

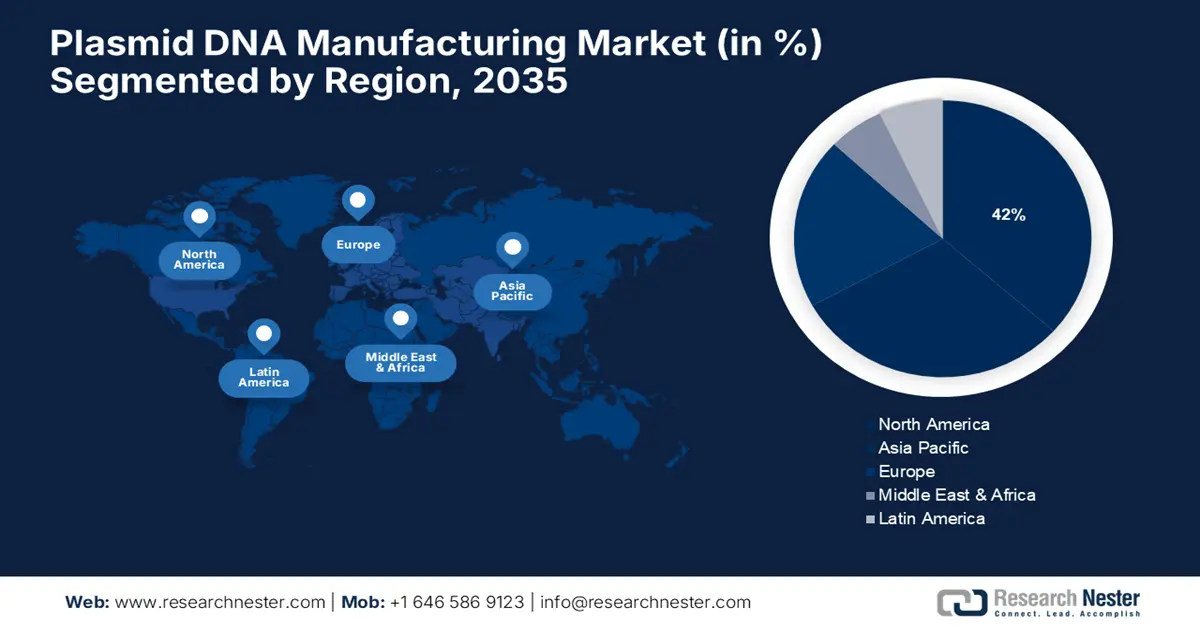

- The North America plasmid DNA manufacturing market will account for 42% share by 2035, driven by strong R&D infrastructure, government funding, and innovation in biotechnology.

- The Asia Pacific market will register significant expansion with a robust CAGR during 2026-2035, driven by rising demand for gene therapy, vaccines, and favorable regulatory environment.

Segment Insights:

- The clinical therapeutics segment in the plasmid dna manufacturing market is forecasted to capture a 55% share by 2035, driven by strong product pipelines and cutting-edge technologies in gene therapy and vaccines.

- The viral vector segment segment in the plasmid DNA manufacturing market is expected to secure a 21.10% share by 2035, driven by the growing demand for gene therapies and vaccines.

Key Growth Trends:

- Rise in research and development activities

- Increasing demand for gene therapies

Major Challenges:

- Plasmid designs and optimization

- Stringent regulatory norms

Key Players: JAFRAL, Ltd., Delphi Genetics, Aldevron, VGXI, Inc., and Akron Biotech are some prominent companies in the plasmid DNA manufacturing market.

Global Plasmid DNA Manufacturing Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.48 billion

- 2026 Market Size: USD 2.91 billion

- Projected Market Size: USD 14.6 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 18 September, 2025

Plasmid DNA Manufacturing Market Growth Drivers and Challenges:

Growth Factors:

- Rise in research and development activities: The rise in R&D activities is a crucial driving force in the plasmid DNA manufacturing market, fueled by the exploration of innovative applications such as Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR), gene editing, and RNA therapeutics, collaborations and partnerships between academia and industries, adherence to systematized and evolving regulatory standards, and optimization of manufacturing processes. These factors collectively are the reasons behind constant innovation, development, and discoveries leading to the uninterrupted growth of this field.

In February 2023, BioNTech SE announced the infrastructure completion of its new Plasmid DNA manufacturing unit in Marburg, Germany, to produce plasmid DNA for clinical and commercial products at cost-effective prices. - Increasing demand for gene therapies: The plasmid DNA manufacturing market is significantly influenced by the growing need for gene therapy since these developments depend mostly on premium pDNA as vectors for genes. Gene therapies are proven to have the potential to cure genetic disorders. Moreover, some pioneering breakthroughs during the clinical trials and regulatory approvals by gene therapy have fostered a push towards this driving force and have gained investments. Consequently, there is a need for efficient, scalable, and high-purity pDNA synthesis, which is driving advancements in technologies and production processes.

- Rising prevalence of cancer and other rare diseases: According to the World Health Organization (WHO), cancer has become a leading cause of death worldwide. Plasmid DNA is gaining importance as it has become a promising tool for cancer treatment, offering a targeted and flexible approach to combat different types of cancers. Additionally, plasmid DNA-based treatments exhibit evident outcomes in combination with other therapies such as chemotherapy and radiation to enhance the effectiveness and increase the cure rate.

Challenges

- Plasmid designs and optimization: Plasmid designing and its optimization are critical steps in the production process of Plasmid DNA. It involves a careful monitoring of the plasmid’s instruction to be right, stable, and well-stated. These loopholes can lead to poor yields, impaired gene expression, and increased production costs.

- Stringent regulatory norms: Abiding by the norms and regulations have a great influence on the plasmid DNA market. Although they assure safety and effectiveness, organizations such as the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) can create trouble. Products made from plasmid DNA, for instance, have strict requirements for their potency, purity, and quality. Manufacturers are deemed and bound to go through a lot of paperwork to submit, complicated approval procedures, and frequent inspections to endure.

Plasmid DNA Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 2.48 billion |

|

Forecast Year Market Size (2035) |

USD 14.6 billion |

|

Regional Scope |

|

Plasmid DNA Manufacturing Market Segmentation:

By Product Segment Analysis

The viral vector segment in the plasmid DNA manufacturing market will emerge as the dominant segment with a revenue share of 21.1% by 2035, owing to the growing demand for gene therapies and vaccines. Viral vectors are utilized as a tool which is involved in delivering genetic materials into the cell, and their usage has revolutionized the field of gene therapy and vaccine development.

There are also advancements in vector designing and manufacturing that have contributed to the growth of the plasmid DNA market by making it more efficient, reliable, and effective. Persistent innovation and discoveries have been spurred, collaborations between industry and academia, and government assistance in funding initiatives have fueled the propelled exploration.

In April 2024, Charles River Laboratories announced a collaboration with Axovia Therapeutics to produce high-quality gene of interest plasmids and extend its assistance in the development of procedure of gene therapies for ciliopathies, including Bardet-Biedl Syndrome (BBS).

By Development Phase Segment Analysis

Clinical therapeutics segment will account for 55% of the plasmid DNA manufacturing market share by 2035. As the demand for gene therapy and vaccines continues to soar, this sector of market has capitalized on the trend, solidifying its position. With its strong pipeline of products and cutting-edge technologies, the clinical therapeutics sector is poised to drive growth and shape the future of plasmid DNA manufacturing market. For example, In December 2021, Plasmid DNA-based cancer immunotherapies, such as VGX-3100, have shown promising results in clinical trials.

By Disease Segment Analysis

The oncology segment in the plasmid DNA manufacturing market is expected to account for the largest revenue share during the forecast period. This segment is expanding as a result of the increased use of DNA plasmids in cancer treatments. Numerous gene therapy approaches, inclusive of oncolytic virotherapy, immune modulation based on gene therapy, and genetic modification of apoptotic cells, are used to treat cancer. Thus, there's a greater need for plasmid DNA, the driving force behind segment growth. Rare genetic disorders, such as sickle cell anemia and muscular dystrophy are also being targeted for expected results.

Our in-depth analysis of the plasmid DNA manufacturing market includes the following segments

|

By Product |

|

|

By Application

|

|

|

By Disease |

|

|

By Developmental Phase |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plasmid DNA Manufacturing Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 42% by 2035. Government initiatives and funding have strengthened the region's position, making it an undisputed leader. The region sustains the dominant position, based on its world-class research institutes such as the Food and Drug Administration (FDA), the National Institute on Health (NIH), advanced technologies, and innovative biotechnology and pharmaceutical companies. The region's robust infrastructure including state-of-art manufacturing facilities and highly skilled workforce, enables rapid development and production of premium quality plasmid DNA products.

Additionally, the favorable business environment, characterized by strong intellectual property protections, government funding for research and development, and streamlined regulatory processes, fosters a culture of innovation and entrepreneurship. As a result, the region is home to a number of industry leaders, including Inovio Pharmaceuticals, BioNTech, and Modern Therapeutics, which are pioneers of plasmid DNA–based gene therapies, vaccines, and other therapeutics.

Some major areas in North America are California, which is a hub for the biotechnology and pharmaceutical industry with many industry leaders based in the San Francisco Bay Area and San Diego such as Biogen, Genentech, and Mexico City, a growing hub for biotechnology and pharmaceuticals companies, many of which are based in and around Mexico City. For example, Progenika Biopharma, and Bioclones. These areas provide a combination of factors such as resources, talent, and funding that support the growth of plasmid DNA manufacturing. Moreover, supportive government legislation and favorable regulatory scenarios for gene therapy in the country are expected to boost the demand for plasmid DNA.

In October 2021, the FDA, NIH, and 15 other pharmaceutical companies partnered to develop groundbreaking gene therapies for rare genetic diseases. Such initiatives are likely to accelerate the demand for plasmid DNA as it plays a vital role in advanced treatments.

Asia Pacific Market Insights

The plasmid DNA manufacturing market in the Asia Pacific is expected to witness a significant expansion in the coming years driven by rising demand for gene therapy and vaccines, along with government support and funding which creates a favorable environment for growth.

In addition, the region offers skilled workforce, and a highly developed biotechnological infrastructure with high profitability, making it an attractive location for global companies. With a growing focus on regenerative medicines, particularly in Japan and South Korea, a growing number of collaborations and partnerships, the region is well-positioned for rapid expansion. Moreover, a favorable regulatory framework is streamlining the approval process for new products, paving the way for the Asia-Pacific region to become a major player in the pharmaceutical DNA manufacturing market.

Plasmid DNA Manufacturing Market Players:

- VGXI, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JAFRAL Ltd.

- Luminous Biosciences

- Delphi Genetics

- Akron Biotech

- Plasmidfactory GmbH

- Cobra Biologics & Pharmaceutical Services

- Vigene Biosciences

- Aldevron

- Nature Technology Corporation

The plasmid DNA manufacturing market has a strong competitive landscape globally with a dynamic and diverse eco-system comprising well-established players such as GenScript ProBio, Samsung Biologics, and emerging players, including WuXi Biologics, Fujifilm Diosynth Biotechnologies, and Hanmi Fine Chemical. The National Institute of Advanced Industrial Science and Technology and A*STAR Bioprocessing Technology are two research institutes that are substantially contributing to the advancements within the market. Start-ups, such as GeneTech and PlasmidFactory, are introducing novel solutions to the market.

Furthermore, the market is enhanced by the regional presence of global businesses, including Lonza and Thermo Fisher Scientific. The plasmid DNA manufacturing market is growing and innovation in this eco-system, is propelled by partnerships, rise in the focus on regenerative medicine, and investments in advanced technologies.

Some of the major players are:

Recent Developments

- In March 2024, Novel Bio, a leader in biomanufacturing technologies in plasmid DNA, and Culture Biosciences, a digital biomanufacturing company, announced an agreement to develop plasmid DNA. Through this agreement, Novel Bio will assist Culture Biosciences to fasten its development processes for scalable fermentation processes.

- In June 2023, INADcure Foundation signed an agreement with Charles River Laboratories for phase I/II clinical studies of gene therapy targeting infantile neuroaxonal dystrophy to produce high-quality pDNA.

- Report ID: 6369

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.