Plant Sterol Esters Market Outlook:

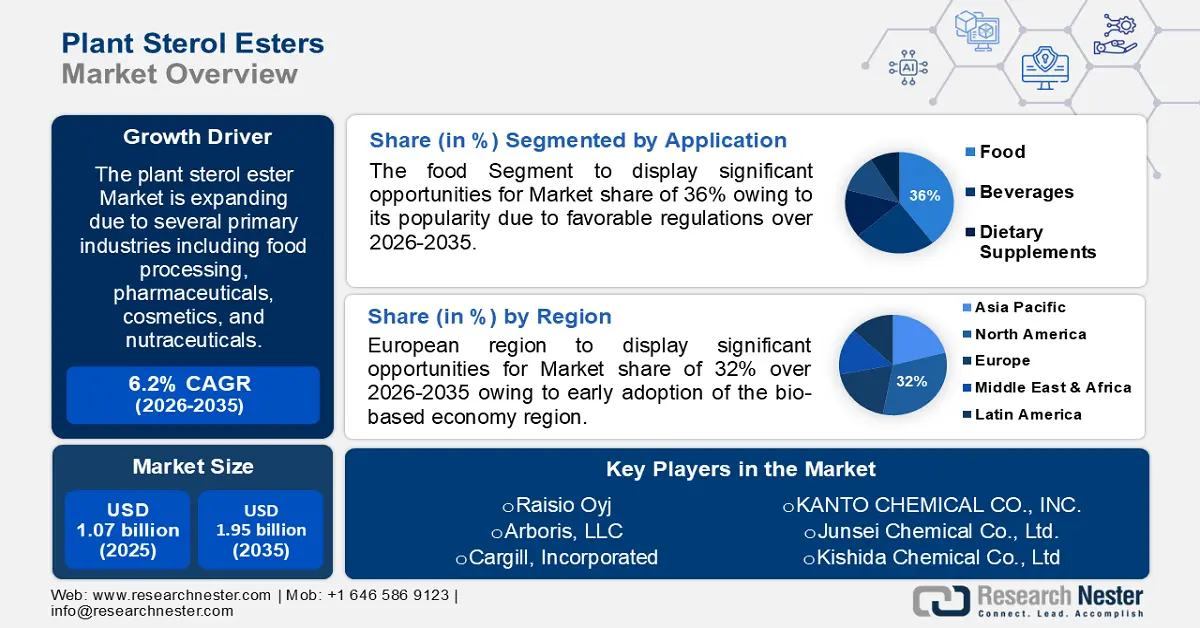

Plant Sterol Esters Market size was valued at USD 1.07 billion in 2025 and is expected to reach USD 1.95 billion by 2035, registering around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plant sterol esters is evaluated at USD 1.13 billion.

The plant sterol esters market is driven by several primary industries including food processing, pharmaceuticals, cosmetics, and nutraceuticals. These esters are in high demand in the food and pharmaceutical sectors because they are known to lower blood cholesterol levels. Plant sterol esters are used as a supplement in many foods, such as yogurt, cereals, and snack bars.

Due to the growing number of people with cardiovascular disorders, the pharmaceutical industry continues to demand plant sterol esters. With the increasing incidence of cardiovascular diseases globally, there is a greater emphasis on preventive healthcare measures. Globally, cardiovascular diseases is responsible for the death of almost 17.9 million people as reported by World Health Organization. Plant sterol esters offer a non-pharmacological approach to managing cholesterol levels, thereby reducing the risk of heart disease. Studies have also shown that plant sterols can stop the development of cancer cells.

Key Plant Sterol Esters Market Insights Summary:

Regional Highlights:

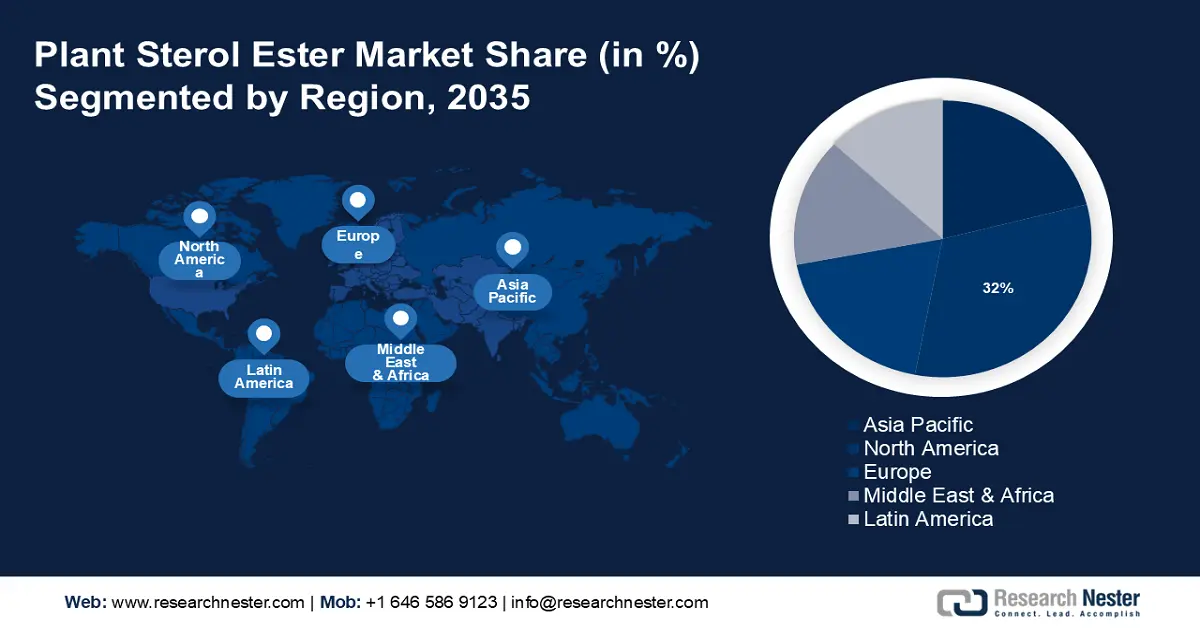

- Europe plant sterol esters market will hold more than 32% share by 2035, driven by early adoption of bio-based economy and cholesterol concerns.

- North America market will achieve huge CAGR during 2026-2035, driven by high prevalence of cardiovascular disease and demand for supplements.

Segment Insights:

- The powder segment segment in the plant sterol esters market is forecasted to achieve a 58% share by 2035, driven by its wide use in food, supplements, and pharmaceutical applications.

- The food segment segment in the plant sterol esters market is expected to hold a 36% share by 2035, influenced by favorable food regulations and cholesterol-lowering benefits of the product.

Key Growth Trends:

- Expansion of functional food industry

- Increasing health awareness among the aging population

Major Challenges:

- Limited consumer awareness

Key Players: and Frutarom Ltd., Raisio Oyj, Arboris, LLC, Cargill, Incorporated, Lambert's Health Care, Nutrartis, Blackmores, VITAE NATURALS, Xi'an Healthful Biotechnology Co., Ltd, FUJIFILM Wako Pure Chemical Corporation.

Global Plant Sterol Esters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.07 billion

- 2026 Market Size: USD 1.13 billion

- Projected Market Size: USD 1.95 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Plant Sterol Esters Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of functional food industry - The functional food industry is experiencing rapid growth as consumers seek out products that offer additional health benefits beyond basic nutrition. Plant sterol esters are increasingly being incorporated into functional food products such as spreads, dairy alternatives, and beverages, driving market expansion. The future of the functional food sector seems bright; global revenue for functional foods is expected to rise from about 300 billion US dollars in 2017 to more than 440 billion by 2022.

-

Increasing health awareness among the aging population - The aging population is more susceptible to health issues such as high cholesterol and cardiovascular diseases. As the elderly demographic expands, there is a higher demand for products that can address age-related health concerns, providing growth prospects for plant sterol esters market.

As reported by WHO, the share of old age population globally will be around 1.4 billion in 2030, up from 1 billion in 2020. Furthermore, as people become more health-conscious, there is a growing demand for natural ingredients that can help manage cholesterol levels, which in turn helps in chronic disease management. Plant sterol esters have been shown to effectively lower LDL cholesterol, making them popular among consumers looking for natural cholesterol-lowering solutions. -

Technological advancements in extraction and formulation - Ongoing research & development efforts have led to advancements in the extraction and formulation of plant sterol esters, improving their efficacy and versatility. Enhanced formulations make it easier for manufacturers to incorporate plant sterol esters into a wide range of food and beverage products, further driving plant sterol esters market growth.

Challenges

-

High cost of product - The plant sterol esters market expansion is anticipated to be hampered by the high cost of these products in the various developing countries and worries about the stringent regulatory requirements for the approval of phytosterol-based products and components. The market for plant sterol esters is anticipated to face challenges during the forecast period due to a lack of knowledge and awareness about the product's advantages in developing countries.

-

Limited consumer awareness - Despite their proven health benefits, many consumers remain unaware of plant sterol esters and their cholesterol-lowering properties. Lack of awareness hampers market growth as consumers may not actively seek out products containing plant sterol esters.

Plant Sterol Esters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 1.07 billion |

|

Forecast Year Market Size (2035) |

USD 1.95 billion |

|

Regional Scope |

|

Plant Sterol Esters Market Segmentation:

Application Segment Analysis

Food segment is set to account for around 36% plant sterol esters market share by 2035. Plant sterol esters are being used in a variety of food products and are gaining popularity due to favourable regulations in countries like China, Japan, Brazil, Germany, Finland, the U.K., the United States, and Turkey. They are also known to lower blood cholesterol levels, which further increases their use in the food industry.

Phytosterols, which are found in plant sterol esters, can prevent cholesterol absorption in the gastrointestinal system, good for digestive health. Phytosterol esters can also be used as a fat replacement in some cases, making it a great food ingredient choice. All these factors are contributing to the growth of the market. functional foods dairy-based functional foods (e.g. with added probiotics, omega-3, phytosterols) account for 43% of a $16 billion market

Form Segment Analysis

By 2035, powder segment is estimated to account for around 58% plant sterol esters market share. Plant sterol esters in powder form find their primary application in the food industry, as nutritional supplements, and in the pharmaceutical sector.

In 2019, the Premier Protein brand was the leading nutrition liquid/powder in the United States with sales of about USD 415 million. The Ensure brand had sales of approximately USD 388 million that year. They are used in a variety of food and beverage products, including yellow fat spreads, milk, cheese, yogurt-based products, soy drinks, salad dressings, bread, spicy sauces (including mayonnaise), milk-based beverages with fruits or cereals, turkey, and sausages.

Type Segment Analysis

In plant sterol esters market, sitosterol segment is expected to dominate around 32% revenue share by the end of 2035. In pharmaceutical formulations, sitosterol is used as an anti-inflammatory, anti-apoptotic, and anticancer drug. It also raises antioxidant levels. Plant-based sitosterol is primarily used to treat benign prostatic hyperplasia, or BPH, which is an enlarged prostate, lowers cholesterol, and lowers the risk of cardiovascular disease.

The rising consciousness among consumers regarding health and nutrition has led to an increase in the demand for sitosterol. Campesterol is marketed as a dietary supplement and utilized as a food component due to its ability to decrease cholesterol. In light of this, the plant sterol esters market is estimated to witness growth in this segment.

Our in-depth analysis of the market includes the following segments:

|

Application |

|

|

Form |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plant Sterol Esters Market Regional Analysis:

European Market Insights

Europe industry is expected to hold largest revenue share of 32% by 2035. Europe is the market leader for phytosterols due to its early adoption of the bio-based economy. In the five largest European countries (Germany, France, Italy, Spain, and the United Kingdom), about 133.3 million people have excessive amounts of unhealthy cholesterol.

The plant sterol esters market is expanding due to the growing use of phytosterols as a functional component and the rise in personal care and cosmetics products, like anti-aging creams. As a result of increased R&D projects and increased demand Germany tends to be the dominant producer of plant sterol esters from a variety of end-user industries market in the European market.

North America Market Insights

The North American region will also encounter huge growth for the plant sterol esters market during the forecast period owing to rising use as food supplements in the food industry. Moreover, a primary factor driving the plant sterol esters market in North America is cardiovascular disease (CVD). About 127.9 million Americans (48.6%) who are 20 years of age or older are thought to have cardiovascular disease (CVD), which includes hypertension, heart failure, stroke, and coronary heart disease. About 28.6 million adults in America (9.9%) have a CVD, excluding hypertension.

In the USA, the National Cholesterol Education Program recommends that people with high cholesterol levels consume 2 grams of phytosterols every day. The organization has found strong evidence of the product’s effectiveness through research and development activities, which has generated a lucrative demand for phytosterol supplements in the USA.

Additionally, the USA Food and Drug Administration (FDA) has declared that foods containing 0.65 grams per serving of plant sterol esters may be taken twice per day with meals as part of a diet with a daily intake of a total of 1.3 grams. This is to maintain low cholesterol levels and saturated fat and to reduce the risks of heart disease.

Plant Sterol Esters Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Raisio Oyj

- Arboris, LLC

- Cargill, Incorporated

- Lambert's Health Care

- Nutrartis

- Blackmores

- VITAE NATURALS

- Xi'an Healthful Biotechnology Co., Ltd

- FUJIFILM Wako Pure Chemical Corporation

Recent Developments

- BASF joins the market for natural flavors and fragrances (F&F) ingredients by acquiring Isobionics, a biotechnology innovation leader that serves the worldwide F&F industry, and by entering into a cooperation agreement with Conagen, a biotechnology research leader. The company, which is well-known for being a top provider of artificial fragrance chemicals, is now expanding its line of products to include natural ingredients including valencene, nootkatone, and vanillin.

- Nutrartis, Cardiosmile is a plant sterol supplement business located in Chile, introduced to the American market in liquid sachet form. Water-dispersible plant sterols are designed to be an easy method to add flavor to food and drink as well as enhance cardiovascular health.

- Report ID: 6176

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plant Sterol Esters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.