Pet Care Market Outlook:

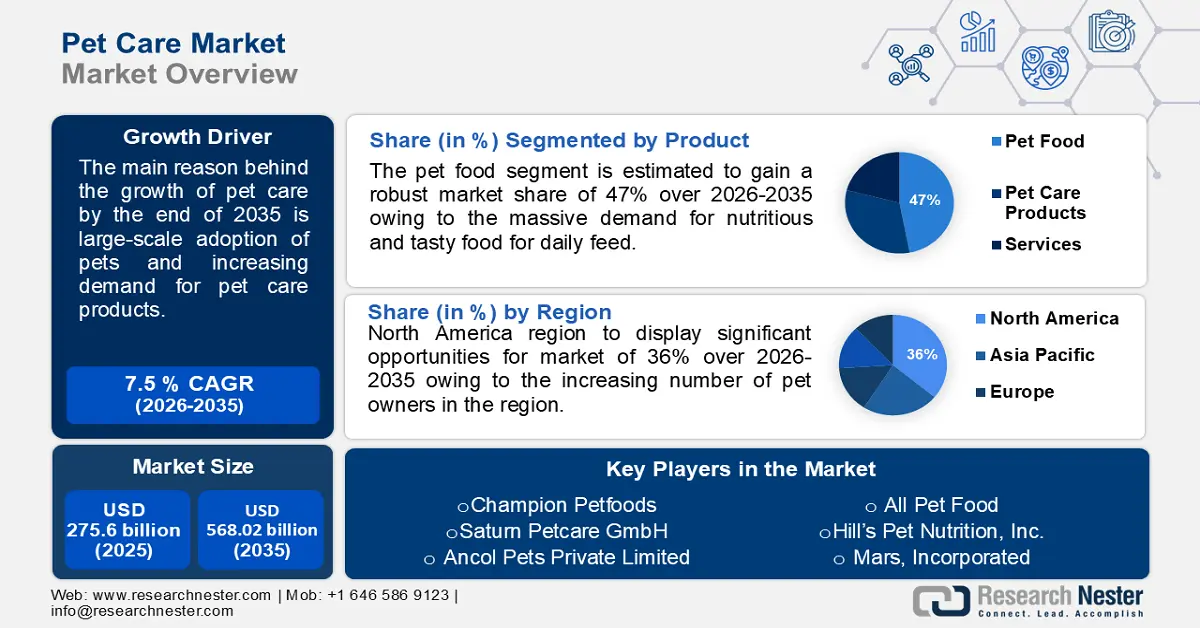

Pet Care Market size was valued at USD 275.6 billion in 2025 and is likely to cross USD 568.02 billion by 2035, expanding at more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pet care is assessed at USD 294.2 billion.

People started adopting pets on a large scale due to the love and companionship they offer to human beings. Pets help in reducing stress and feelings of loneliness, whereas, various studies show that pet owners tend to have lower blood pressure, reduced anxiety levels, and better mental health. They encourage regular exercise and outdoor activities which helps to maintain fitness. According to the World Animal Foundation report issued in 2024, around 4.8 million dogs and cats are adopted annually worldwide.

Key Pet Care Market Insights Summary:

Regional Highlights:

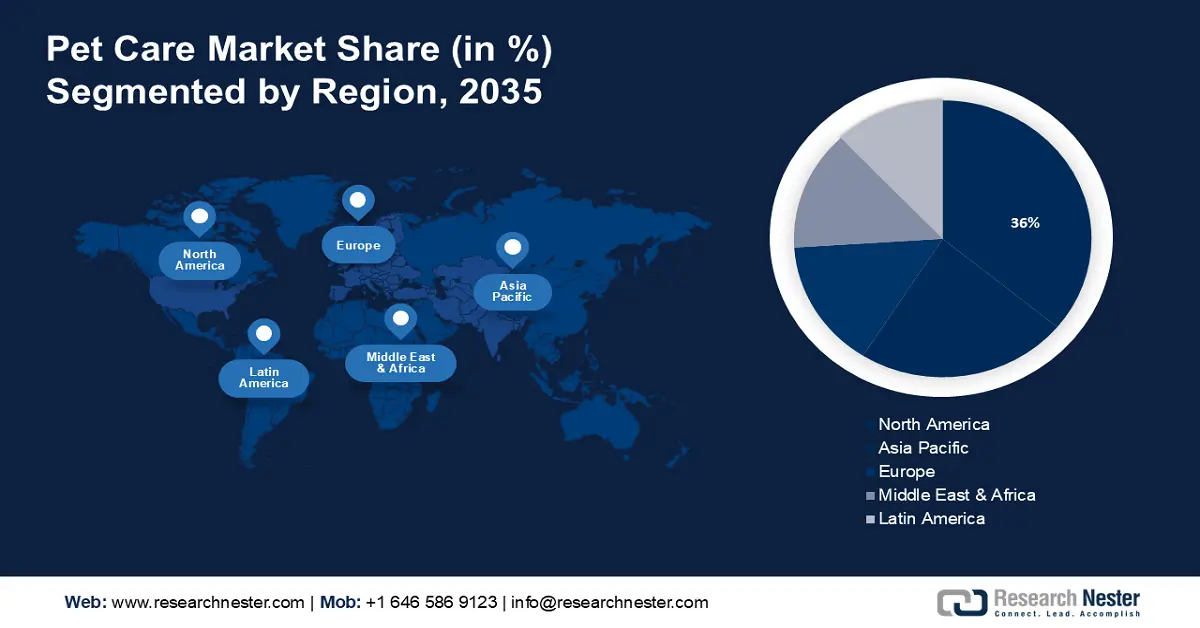

- North America pet care market is anticipated to capture 36% share by 2035, driven by the increasing number of pet owners and rising pet insurance adoption.

- Asia Pacific market will achieve huge CAGR during 2026-2035, driven by growth in pet food production and presence of key manufacturers.

Segment Insights:

- The offline segment in the pet care market is expected to achieve significant growth till 2035, fueled by wide product variety and personalized services in offline stores.

- The dog segment in the pet care market is expected to see substantial growth till 2035, driven by dogs providing comfort, protection, and health benefits.

Key Growth Trends:

- Increasing expenditure on pet care products

- Increasing cases of food-borne and zoonotic diseases in pets

Major Challenges:

- Congestion in animal shelters due to increasing abandonment

- High cost for pet care and services

Key Players: Blue Buffalo Company, Ltd, Champion Petfoods, Saturn Petcare GmbH, The Hartz Mountain Corporation, Petmate, Tail Blazers Pets, Hill’s Pet Nutrition, Mars, Inc.

Global Pet Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 275.6 billion

- 2026 Market Size: USD 294.2 billion

- Projected Market Size: USD 568.02 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Pet Care Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing expenditure on pet care products - People spending more on pet care products and services including food, animal health, grooming, and insurance is driving the market growth. The investor's inclination towards this sector is also growing at a fast pace. Additionally, the growing demand for pet care products motivates key players to modify the variety of products according to the customer’s needs.

The introduction of innovative options for pets attracts more people, resulting in pet care market growth. As per recent data published in 2024, the average total lifetime cost of owning a dog is between USD 19,893 and USD 55,132 including food, insurance, and healthcare if they have a 15-year lifespan. -

Increasing cases of food-borne and zoonotic diseases in pets - Zoonotic infections including viral and bacterial are majorly transmitted to humans through dogs. They are transferred by different mediums such as infected saliva, aerosols, contaminated urine/feces, and from direct contact with the dog. Rabies which is a commonly found disease in humans is caused by viral infection.

The increasing awareness and knowledge among dog owners and the general population regarding zoonotic infections could notably reduce zoonosis transmission and consequently their fatal complications. According to the World Health Organization (WHO), around 59,000 humans die every year in more than 150 countries due to rabies infection. Additionally, 95% of these cases are reported to be in Africa and Asia.

Challenges

-

Congestion in animal shelters due to increasing abandonment - Animal shelters are left with limited resources as they are getting overcrowded due to increased surrenders and abandoned animals. People who find it difficult to take care of their pets abandon them, resulting in an increasing number of stray animals.

-

High cost for pet care and services - Having a pet means investing financially in pet food, healthcare, grooming, and basic requirements. The high cost of owning a pet becomes a hurdle during pet adoption. Additionally, the majority of pet stores and breeders are facing a reduction in revenue due to decreasing demand for pets.

Pet Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 275.6 billion |

|

Forecast Year Market Size (2035) |

USD 568.02 billion |

|

Regional Scope |

|

Pet Care Market Segmentation:

Product Segment Analysis

Pet food segment is anticipated to dominate pet care market share of over 47% by 2035. The segment growth is due to the massive demand for nutritious and tasty food for daily feed. Pet food comprises meat, meat byproducts, grains, cereals, vitamins, and minerals. Pet owners are concerned about the health of their pets is results in a high demand for quality pet food. As per a recent report issued in 2023, pet food production has been growing at a fast pace reaching 35.27 million metric tons in 2022.

Animals Segment Analysis

In pet care market, dog segment is projected to dominate revenue share of over 52% by 2035. The segment growth can be attributed to the comfort and protection given by dogs. They also help to keep the body fit by promoting exercise, which prevents cardiovascular diseases. All these factors drive the segment growth.

Additionally, people living alone prefer to have at least one pet as a companion contributing to the market growth in developed countries. As per the World Population Review report issued in 2024, around 30% of households worldwide have a dog, totaling between 700 million to 1 billion dogs in 2024.

Distribution Channel Segment Analysis

By 2035, offline segment is set to dominate pet care market share of over 76%. In offline mode, pet store consists of a wide variety of food and pet care products. Moreover, these stores provide personalized services, advice, and immediate access to products and healthcare facilities like canine arthritis treatment and infections. According to the Health for Animals report published in 2022 (Global Animal Health Association), more than 1 billion people have pets at home worldwide.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Animals |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pet Care Market Regional Analysis:

North American Market Insights

North America industry is set to account for largest revenue share of 36% by 2035. The market growth in the region is expected on account of the increasing number of pet owners in the region. With high incomes, people can afford pets and provide them best healthcare facilities, and nutritious food. According to a recent report published in 2023, around 66% of U.S. households, or about 86.9 million families have pets in their homes.

The market for pet care is growing in the US as the region started offering pet health insurance to the owners which includes accidents and illness. According to the Insurance Information Institute report issued in 2023, around 5.7 million pets were insured in the U.S. at the end of 2023 showing a 17% increase over 2022. The average accident and illness premium for dogs was USD 676 a year or USD 56 a month.

In Canada, the growing demand for superior quality pet food is driving the market growth leading to a notable revenue generation from such products. As per a recent report data issued in 2024, the pet population in the region was 27.9 million in 2020. In the same year, Canadians spent nearly USD 2 billion on premium quality dry dog food and around USD 841 million on dry cat food.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the pet care market during the forecast period and will hold the second position owing to the presence of key players in manufacturing facilities in the region. Due to the presence of leading companies, it becomes easy to access premium pet products fueling the economy of the region. For instance, a report issued in 2022 states that pet food production increased by 17.1% from 3.26 million metric tons to 3.81 million metric tons in the Asia-Pacific region in 2021.

China's pet care business has undergone tremendous growth due to growth in the country’s GDP (gross domestic product) per capita and the growing need for companionship. According to the World Population Review report issued in 2024, China is home to over 54.29 million dogs. Popular breeds including Pekingese, Chow Chow, Shar Pei, and Tibetan Mastiff are found there in the pet category.

The market for pet care is growing in Indonesia due to the higher adoption of cats as Indonesia is a predominantly Muslim country that considers cats as sacred animals. As per the data issued in 2022, 69% population owned cats and 13% owned dogs in 2022. Number of cats is 654.8% higher than that of dogs in 2021.

Pet Care Market Players:

- Blue Buffalo Company, Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Champion Petfoods

- Saturn Petcare GmbH

- The Hartz Mountain Corporation

- Petmate

- Tail Blazers Pets

- Ancol Pets Private Limited

- Hill’s Pet Nutrition, Inc.

- All Pet Food

- Mars, Incorporated

The major key players present in the market focus on the production of premium quality food products and providing the best medical healthcare facilities.

Recent Developments

- Champion Petfoods has received approval from the U.S. Food and Drug Administration (FDA) for a grain-free diet as there is no evidence found that it causes canine dilated cardiomyopathy (DCM). The agency said that there is nothing inherently unsafe about a grain-free diet which is good news for pet lovers who have seen their dogs thrive on grain-free diets for healthy and wholesome nutrition.

- Petmate announced that it has launched its newest WonderSnaXX product offering, NutterZ, to deliver a creamy peanut butter experience that dogs love while eliminating the mess for pet parents. The butter treats combine the WonderSnaXX proprietary SAFE-HIDE® manufacturing process with a unique, real peanut butter formulation that has never been seen before in pet treats.

- Report ID: 6200

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pet Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.